Texas Complex Guaranty Agreement to Lender

Description

How to fill out Complex Guaranty Agreement To Lender?

Discovering the right legal papers template could be a have difficulties. Needless to say, there are a lot of web templates available online, but how will you discover the legal form you want? Utilize the US Legal Forms internet site. The support delivers a huge number of web templates, like the Texas Complex Guaranty Agreement to Lender, that you can use for organization and personal demands. Every one of the forms are checked by experts and fulfill federal and state requirements.

If you are previously registered, log in to the account and then click the Acquire switch to find the Texas Complex Guaranty Agreement to Lender. Use your account to search through the legal forms you might have bought previously. Proceed to the My Forms tab of your respective account and acquire yet another duplicate in the papers you want.

If you are a whole new customer of US Legal Forms, listed below are basic directions that you can stick to:

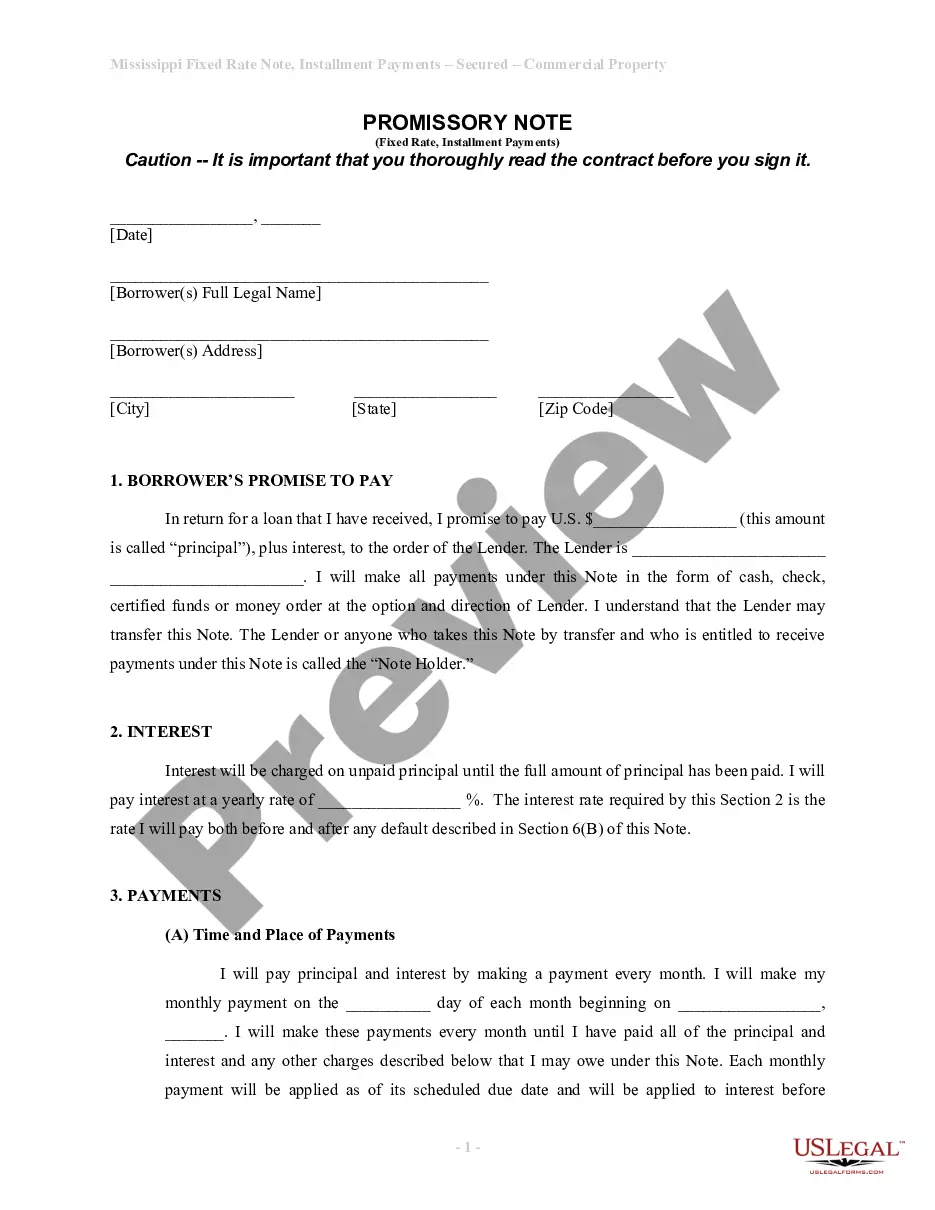

- Very first, make certain you have selected the correct form for your metropolis/area. You can look over the shape utilizing the Review switch and look at the shape outline to make certain this is the right one for you.

- When the form fails to fulfill your needs, make use of the Seach discipline to discover the correct form.

- When you are sure that the shape is proper, go through the Acquire now switch to find the form.

- Opt for the pricing prepare you desire and enter in the necessary information. Build your account and buy the order using your PayPal account or bank card.

- Choose the data file structure and obtain the legal papers template to the device.

- Comprehensive, modify and print and sign the received Texas Complex Guaranty Agreement to Lender.

US Legal Forms is definitely the biggest catalogue of legal forms in which you will find different papers web templates. Utilize the service to obtain expertly-made papers that stick to status requirements.

Form popularity

FAQ

A guarantee is presumed not to be enforceable unless all the named guarantors sign the guarantee (or the terms of the guarantee provide that the guarantee is enforceable on a signed party irrespective of whether other named parties sign).

Section 4 of the Statute of Frauds (1677) requires a guarantee to be in writing and signed by the guarantor (or some other person lawfully authorised to sign on the guarantor's behalf). If a guarantee does not comply with Statute of Frauds (1677), s 4, it will be unenforceable.

The "guarantor" is the person guarantying the debt while the party who originally incurred the debt is the "principle" and the creditor is the "guaranteed party." Under California law, if properly drafted, a guaranty is a fully enforceable obligation which allows the guaranteed party to proceed directly against the ...

Guarantor agrees to the provisions of this Guaranty, and hereby waives notice of (a) any loans or advances made by Lender to Borrower, (b) acceptance of this Guaranty, (c) any amendment or extension of the Note, the Loan Agreement or of any other Loan Documents, (d) the execution and delivery by Borrower and Lender of ...

A Deed of Guarantee & Indemnity is a document signed by parties in order to confirm that one of the parties to a contract will guarantee the performance of one of the other parties.

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

IN WRITING Oral guaranties are almost never enforceable in California though many creditors have attempted to enforce them claiming that they only extended credit predicated on various oral assurances from the owners of the debtor.

In order for a guaranty agreement to be enforceable, it has to be in writing, the writing has to be signed by the guarantor, and the writing has to contain each of the following essential elements: 1. the identity of the lender; 2. the identity of the primary obligor; 3.