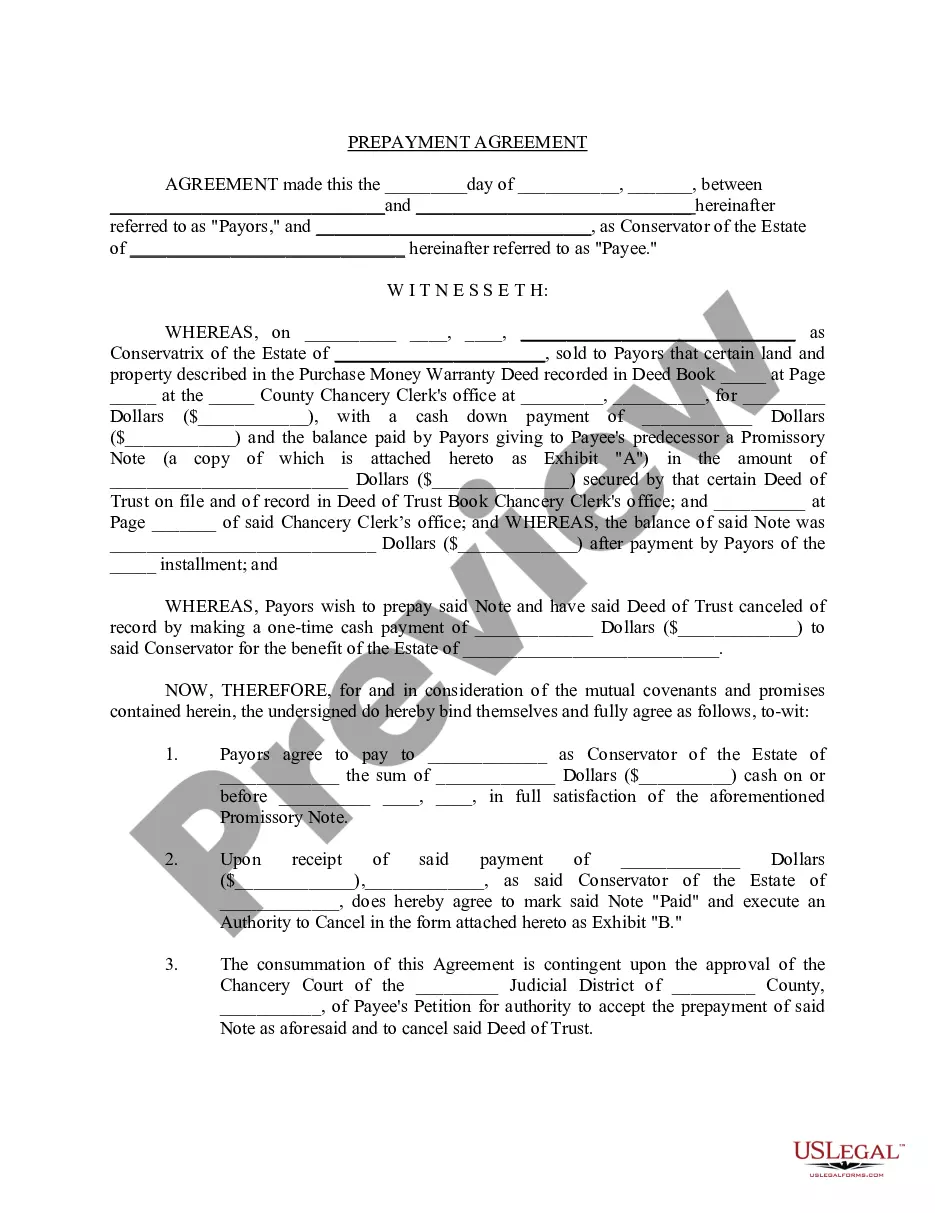

Texas Prepayment Agreement

Description

How to fill out Prepayment Agreement?

It is possible to commit time on-line attempting to find the legal document template that meets the state and federal requirements you want. US Legal Forms provides 1000s of legal types that happen to be examined by specialists. You can actually download or produce the Texas Prepayment Agreement from our services.

If you already have a US Legal Forms accounts, you may log in and click the Download key. After that, you may total, change, produce, or indicator the Texas Prepayment Agreement. Every single legal document template you purchase is your own property for a long time. To have another version for any obtained develop, go to the My Forms tab and click the related key.

If you work with the US Legal Forms site the very first time, keep to the easy recommendations below:

- Very first, make certain you have chosen the right document template for your state/town of your liking. Read the develop description to make sure you have selected the appropriate develop. If offered, use the Preview key to search throughout the document template as well.

- If you want to get another version of the develop, use the Research discipline to find the template that suits you and requirements.

- After you have found the template you want, click Purchase now to carry on.

- Find the rates program you want, type your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You should use your Visa or Mastercard or PayPal accounts to pay for the legal develop.

- Find the format of the document and download it in your gadget.

- Make adjustments in your document if possible. It is possible to total, change and indicator and produce Texas Prepayment Agreement.

Download and produce 1000s of document templates using the US Legal Forms Internet site, which offers the most important collection of legal types. Use skilled and state-distinct templates to handle your business or specific requirements.

Form popularity

FAQ

Discounts, Penalties, Interest and Refunds Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying.

The prepayment report and tax prepayment for a quarterly filer are due on or before the 15th day of the second month of each quarter. For example, for the first quarter return filing period that is due on April 20, the prepayment report and tax prepayment are due on Feb. 15.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption ? Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Texas offers a variety of partial or total (absolute) exemp- tions from property appraised values used to determine local property taxes. A partial exemption removes a percentage or a fixed dollar amount of a property?s value from taxation. A total (absolute) exemption excludes the entire property from taxation.

Some customers are exempt from paying sales tax under Texas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Common Texas sales tax exemptions include those for necessities of life, including most food and health-related items. In addition, goods for resale, such as wholesale items, are exempt from sales tax, as well as newspapers, containers, previously taxed items, and certain goods used for manufacturing.

Make a Payment ? Payments and prepayments can be submitted via the Webfile system for the current report period without filing a report. You can also submit a payment for a period with an open liability. Make a Prepayment: This will allow you to make a prepayment.