Utah Buy Sell Agreement Between Shareholders and a Corporation

Description

How to fill out Buy Sell Agreement Between Shareholders And A Corporation?

Are you currently in a situation where you require documents for both business or personal reasons every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, including the Utah Buy Sell Agreement Between Shareholders and a Corporation, which are crafted to comply with federal and state regulations.

Choose a preferred file format and download your copy.

Locate all the document templates you have purchased in the My documents list. You can obtain another copy of the Utah Buy Sell Agreement Between Shareholders and a Corporation anytime if necessary. Just click the desired form to download or print the document.

Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service provides well-prepared legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you may download the Utah Buy Sell Agreement Between Shareholders and a Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/state.

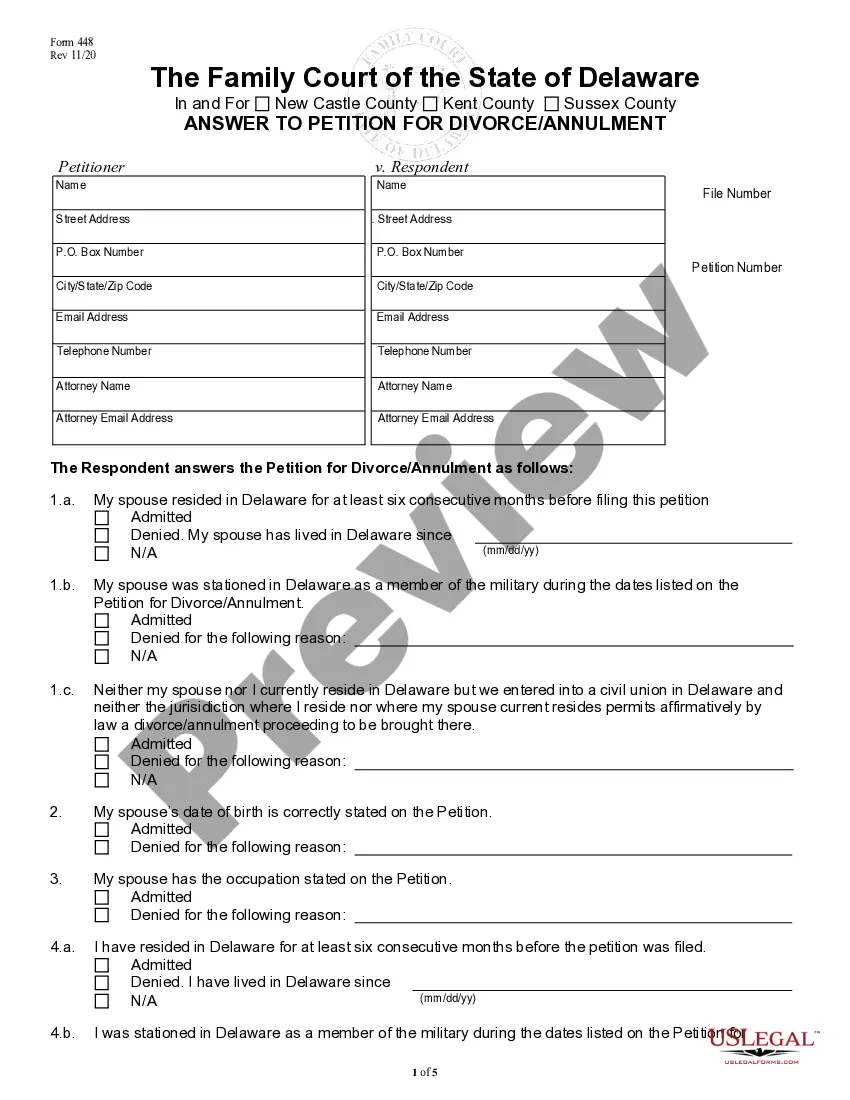

- Use the Review option to assess the document.

- Check the description to ensure you have selected the appropriate form.

- If the form is not what you're seeking, use the Lookup field to find the form that meets your needs and requirements.

- Once you have the right form, click on Buy now.

- Select the pricing plan you want, fill out the necessary details to create your account, and purchase your order using your PayPal or credit card.

Form popularity

FAQ

sell agreement is usually created by an attorney or a corporate service provider experienced in drafting Utah Buy Sell Agreements Between Shareholders and a Corporation. These experts understand the complexities involved and help ensure that all necessary provisions are included. Choosing the right professional can make the process smoother and more efficient for all parties involved.

To obtain a Shareholders Agreement, you can consult legal professionals or access reliable online platforms, like US Legal Forms, that specialize in corporate documents. They offer customizable templates tailored to the Utah Buy Sell Agreement Between Shareholders and a Corporation. With such resources, you can create an agreement that meets your specific needs and complies with local regulations.

Sales agreements are usually written by attorneys or experienced business professionals familiar with the Utah Buy Sell Agreement Between Shareholders and a Corporation. They help ensure that all terms are clearly defined and legally binding. Having a well-drafted sales agreement is crucial to avoid disputes and misunderstandings during share transactions.

Typically, attorneys with experience in corporate law draft Utah Buy Sell Agreements Between Shareholders and a Corporation. These legal professionals ensure that the document complies with state laws and adequately represents the intentions of the parties involved. Engaging an attorney helps safeguard your interests and provides guidance tailored to your specific situation.

A Utah Buy Sell Agreement Between Shareholders and a Corporation is a legal document that outlines the rights and obligations of shareholders when it comes to buying and selling shares of the corporation. It provides clarity on how shares can be transferred and under what circumstances. This agreement protects both the shareholders and the corporation, ensuring a smooth process during ownership changes.

sell agreement is not the same as a shareholder agreement, but they often complement each other. The buysell agreement specifically addresses the terms under which shares can be bought or sold, particularly upon events such as death or departure of a shareholder. In contrast, a shareholder agreement covers a broader range of topics relating to ownership and management. For a clear understanding of these documents, consider the Utah Buy Sell Agreement Between Shareholders and a Corporation for your needs.

Setting up a shareholder agreement involves several key steps, starting with identifying all shareholders and defining their ownership stakes. Next, clearly outline operational procedures, rights, and responsibilities, as well as provisions related to share transfers and dispute resolution. Finally, seek legal advice to ensure compliance with state laws and to draft a comprehensive document. Platforms like ours can assist in creating a tailored Utah Buy Sell Agreement Between Shareholders and a Corporation.

One common pitfall of a shareholder agreement is the lack of clarity in its terms, which can lead to disputes among shareholders. Additionally, if not adequately updated, the agreement may not reflect the current operational reality of the corporation. Underestimating the importance of including buy-sell provisions can also create complications during ownership transitions. To address these issues, refer to the Utah Buy Sell Agreement Between Shareholders and a Corporation for comprehensive guidance.

While not legally required, a shareholder agreement is highly beneficial for any corporation with multiple shareholders. It clarifies expectations and responsibilities, helping to mitigate conflicts and misunderstandings. This agreement also provides a clear process for addressing issues, such as the exit of a shareholder or the entry of a new one. Consider using the Utah Buy Sell Agreement Between Shareholders and a Corporation to support your legal framework.

The primary purpose of a shareholder agreement is to outline the rights and responsibilities of shareholders in a corporation. This document governs key topics, such as voting rights, profit distribution, and the process for transferring shares. By establishing clear rules, a shareholder agreement can prevent disputes and ensure smooth operations. When considering such agreements, the Utah Buy Sell Agreement Between Shareholders and a Corporation can be a valuable resource.