No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Texas Acceptance of Claim and Report of Past Experience with Debtor

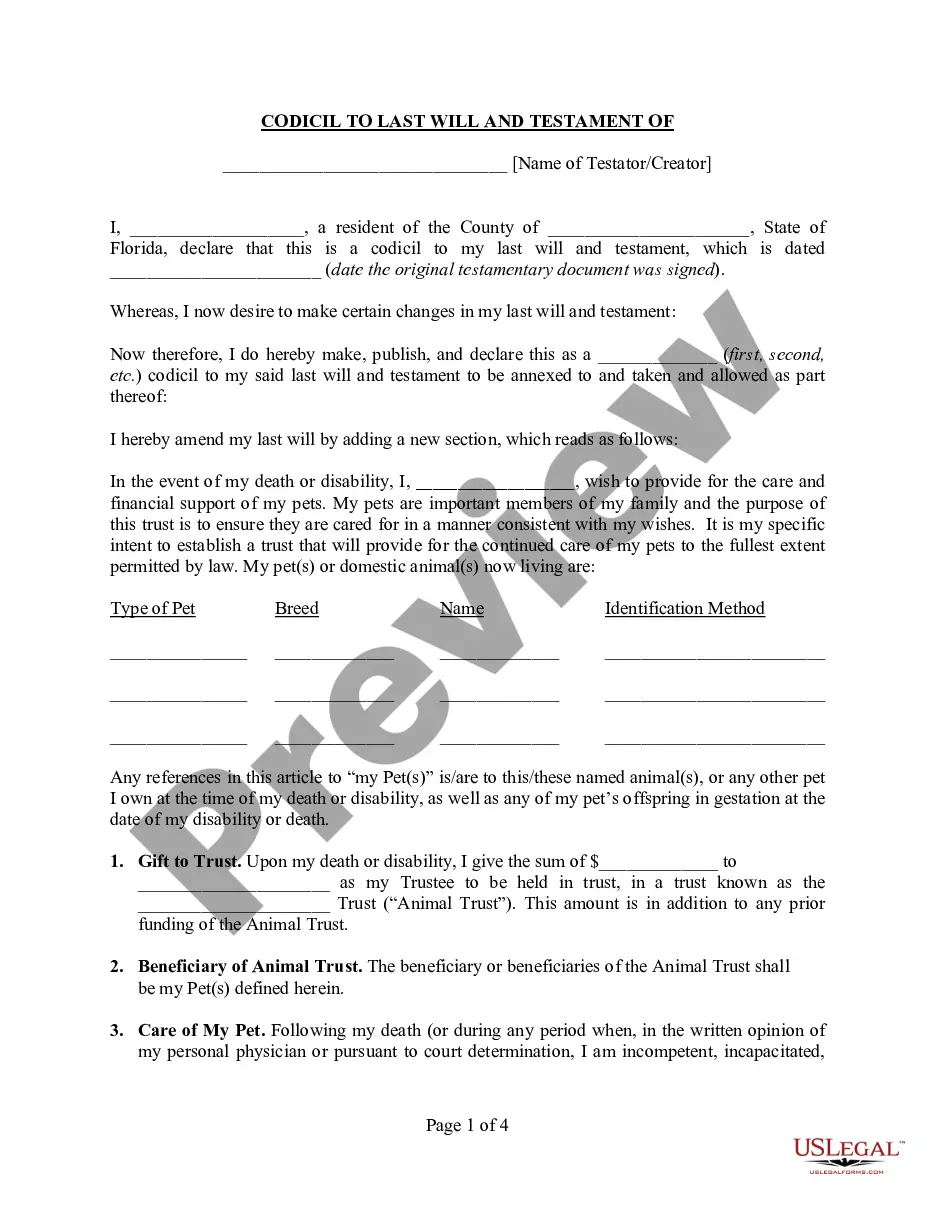

Description

How to fill out Acceptance Of Claim And Report Of Past Experience With Debtor?

Have you ever been in a situation where you require documents for occasional professional or personal use.

There are numerous genuine document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms provides thousands of template documents, such as the Texas Acceptance of Claim and Report of Past Experience with Debtor, which can be tailored to comply with federal and state regulations.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you may download the Texas Acceptance of Claim and Report of Past Experience with Debtor template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/county.

- Use the Preview button to review the template.

- Read the description to ensure you have correctly selected the appropriate document.

- If the document is not what you are looking for, utilize the Lookup field to find the document that meets your needs and requirements.

- Once you locate the correct document, click Acquire now.

Form popularity

FAQ

Responding to a lawsuit from a debt collector in Texas requires timely action. You should file a written response to the court within the deadline stated in the summons. Deny any claims you believe are false and request validation of the debt. Utilizing the Texas Acceptance of Claim and Report of Past Experience with Debtor through our platform can help you draft an appropriate response and ensure you are following proper legal procedures.

In Texas, debt collectors generally cannot take you to court after 7 years for most debts. The statute of limitations for collecting a debt is typically four years, but some cases may vary. If a debt collector tries to pursue action after this period, it may be invalid. Refer to the Texas Acceptance of Claim and Report of Past Experience with Debtor to understand your rights and use our platform for guidance.

Disputing a debt does not automatically restart the statute of limitations. In Texas, the clock on the statute runs from the last activity on the debt, such as a payment or communication. While disputing can show you are taking action, it is crucial to understand that it does not negate the original timeline. If you need clarity about your rights under the Texas Acceptance of Claim and Report of Past Experience with Debtor, consider using our legal forms.

Form 410 is the official proof of claim form used in bankruptcy proceedings to establish the validity of a creditor's claim. This form allows creditors to detail the amounts owed to them by the debtor. For those involved with the Texas Acceptance of Claim and Report of Past Experience with Debtor, filling out Form 410 accurately is crucial for protecting your rights and ensuring that you receive the payments owed to you.

Yes, a debtor can file a proof of claim, especially if they feel that they may have valid claims against other parties. This allows them to inform the court about any debts owed to them, which may be relevant during the bankruptcy process. It is essential for debtors to be knowledgeable about the Texas Acceptance of Claim and Report of Past Experience with Debtor to ensure they can effectively advocate for their claims.

The proof of claim is usually filed by creditors who are seeking to collect debts owed to them by a debtor undergoing bankruptcy proceedings. It can be filed by individuals, businesses, or financial institutions that hold a valid claim. Understanding the nuances of the Texas Acceptance of Claim and Report of Past Experience with Debtor can help ensure that you, as a creditor, correctly file your proof of claim.

To obtain proof of claim in the Northern District of Texas, you can visit the court's official website or contact the clerk’s office for guidance. Typically, the proof of claim form is available online for downloading and printing. Utilizing resources like uslegalforms can streamline this process, making it easier for you to submit the necessary documentation in relation to the Texas Acceptance of Claim and Report of Past Experience with Debtor.

If a creditor does not file a proof of claim in a timely manner, they may lose their right to collect debts from the debtor. This means that the debts may be discharged during the bankruptcy process, effectively freeing the debtor from financial obligations. In cases related to Texas Acceptance of Claim and Report of Past Experience with Debtor, it is crucial for creditors to adhere to these filing requirements to protect their interests.

In Texas, a debt collector can legally pursue old debt for a period of four years from the date of the last payment or acknowledgment. After this time, the debt becomes time-barred, meaning collectors cannot sue you for it. Understanding this timeline is crucial for managing your finances, especially in the context of the Texas Acceptance of Claim and Report of Past Experience with Debtor. Always keep exploration of your legal options in mind, as you may have beneficial solutions available.

To answer a debt claim citation in Texas, start by writing a formal response to the court. Include key details such as your name, address, and the case number, followed by your defenses against the claims. Make sure you refer to the Texas Acceptance of Claim and Report of Past Experience with Debtor for clarity regarding your position. Consulting with US Legal Forms can streamline this process and ensure you meet all necessary legal requirements.