An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Texas Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage

Description

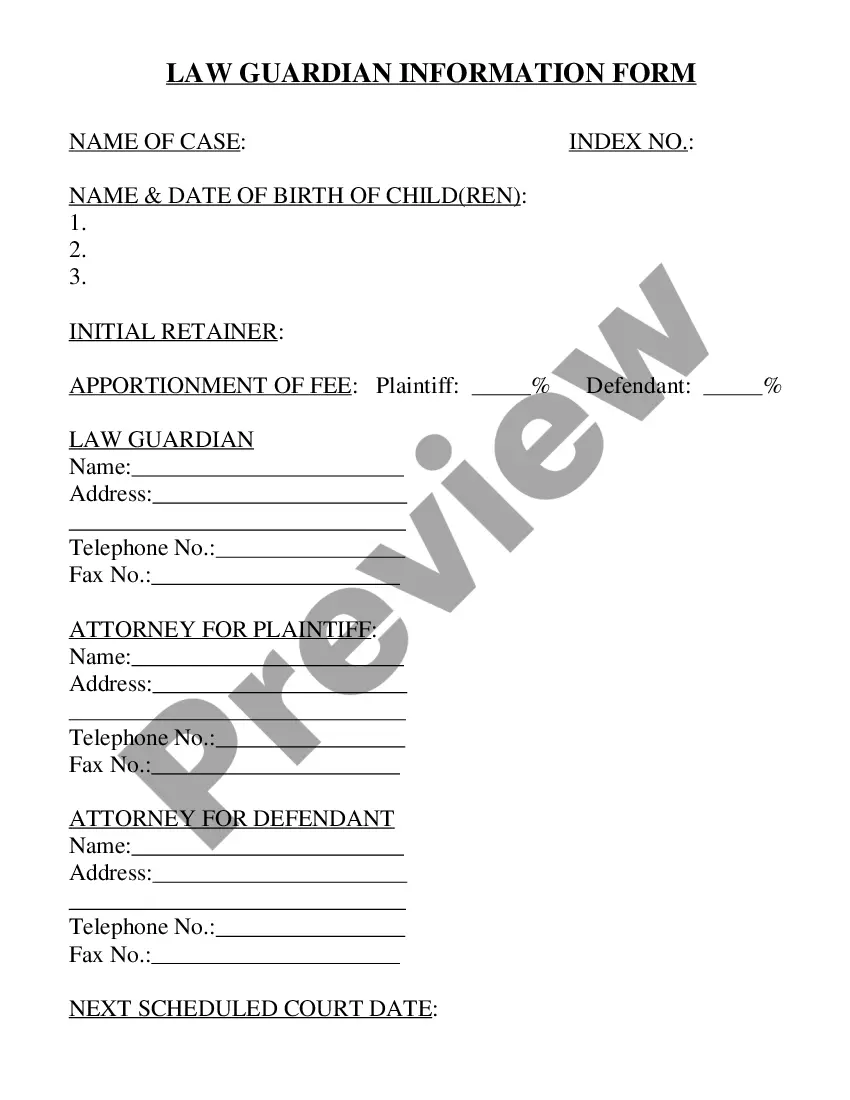

How to fill out Agreement To Modify Interest Rate On Promissory Note Secured By A Mortgage?

You are able to spend several hours on the Internet looking for the lawful document format that meets the federal and state specifications you require. US Legal Forms provides thousands of lawful varieties which can be reviewed by experts. It is possible to download or print the Texas Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage from the support.

If you currently have a US Legal Forms account, it is possible to log in and click the Download key. Afterward, it is possible to comprehensive, modify, print, or signal the Texas Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage. Every lawful document format you buy is yours forever. To obtain another version of any acquired develop, check out the My Forms tab and click the related key.

If you are using the US Legal Forms web site for the first time, follow the basic recommendations below:

- Very first, ensure that you have chosen the proper document format for your state/city of your liking. See the develop explanation to ensure you have selected the appropriate develop. If accessible, utilize the Review key to check throughout the document format too.

- In order to discover another variation from the develop, utilize the Lookup industry to find the format that meets your requirements and specifications.

- After you have discovered the format you want, click Buy now to carry on.

- Pick the prices plan you want, type in your accreditations, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You may use your credit card or PayPal account to cover the lawful develop.

- Pick the format from the document and download it to your system.

- Make changes to your document if needed. You are able to comprehensive, modify and signal and print Texas Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage.

Download and print thousands of document web templates using the US Legal Forms Internet site, which offers the greatest selection of lawful varieties. Use professional and express-specific web templates to deal with your small business or individual requirements.

Form popularity

FAQ

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

The promissory note could be declared invalid if it doesn't reveal the amount that the borrower owes the lender, or what installments are due. If there are multiple installments, then include each installment's due date.

A promissory note is a legal, financial tool declared by a party, promising another party to pay the debt on a particular day. It is a written agreement signed by drawer with a promise to pay the money on a specific date or whenever demanded.

An amendment to a promissory note is a legal document that makes changes to the original promissory note in a legal manner. The original contract may be restated in order to include the new changes that were made by the amendment to the promissory note.

The Promissory Note is the promise to pay for the property. The Deed of Trust puts a lien on the property to secure the promise. The Warranty Deed transfers the property to the Buyer.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A secured promissory note is an agreement where the borrower puts something of value up as collateral to safeguard the value of the loan. In the event the borrower is unable to make payments and defaults on the loan, a secured promissory note empowers the lender to take possession of the collateral in lieu of payment.

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.