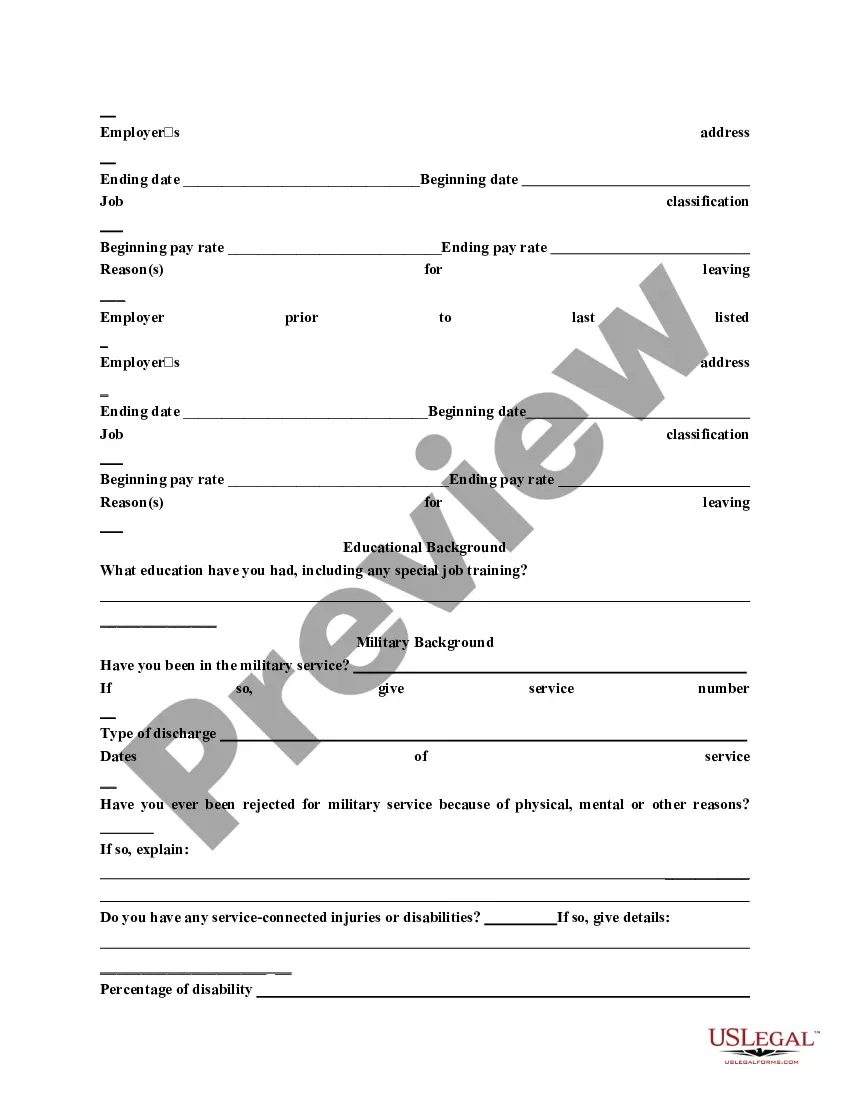

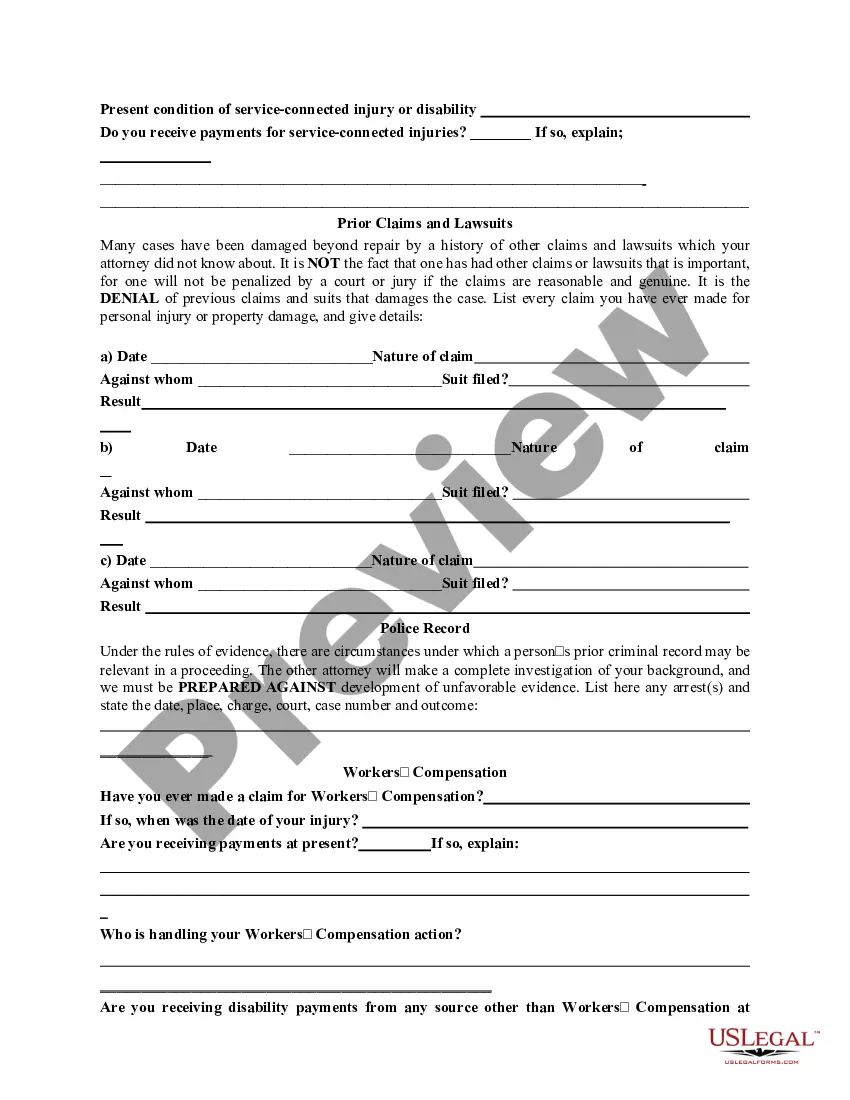

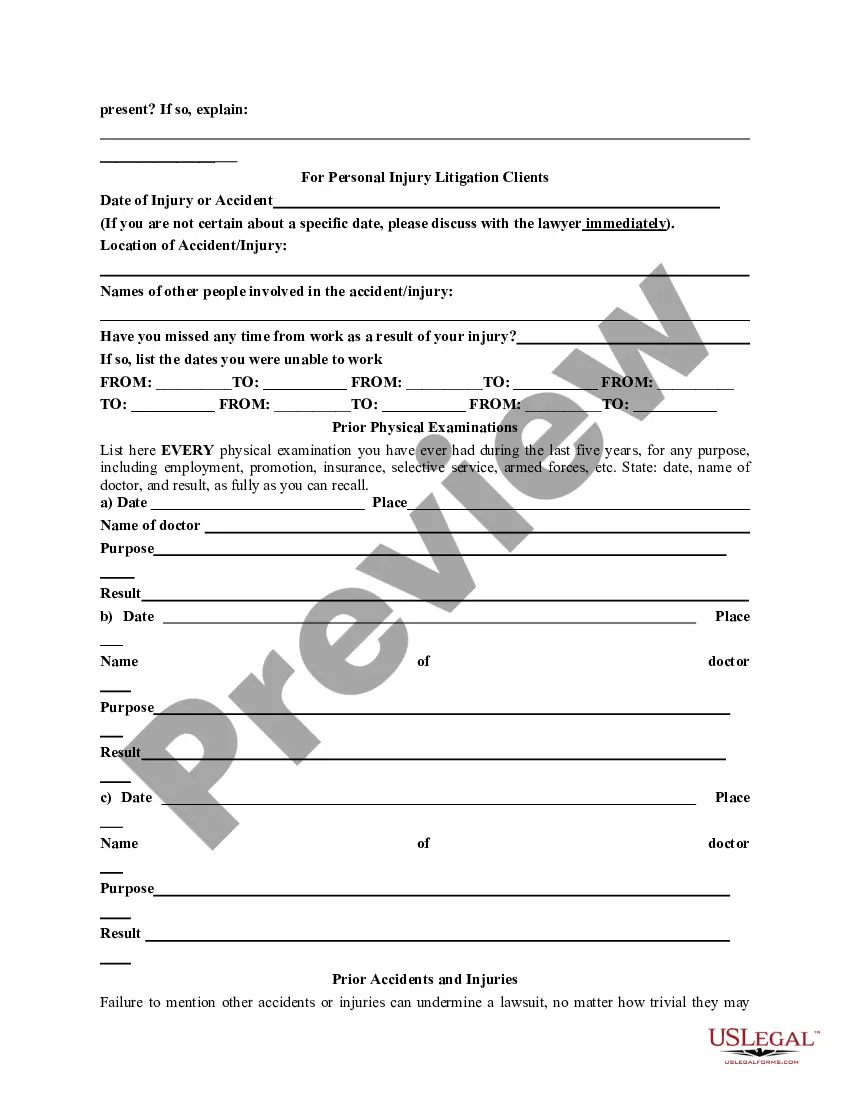

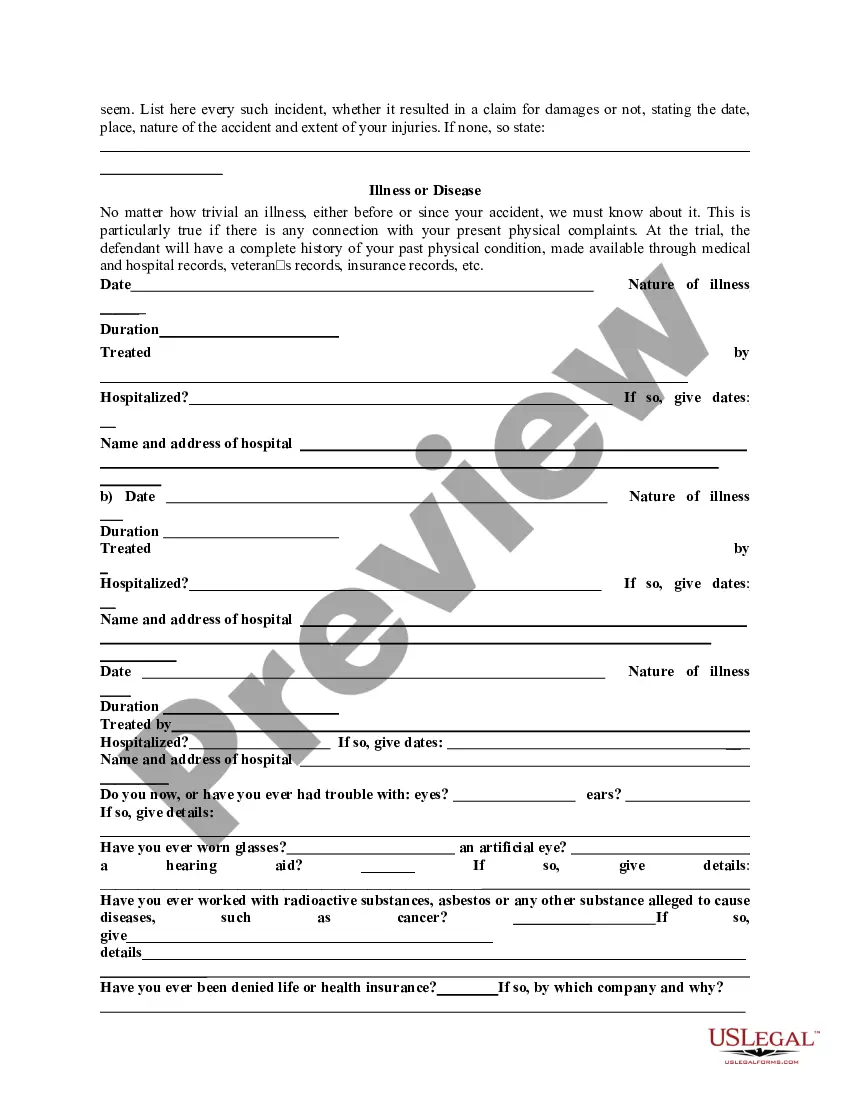

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Texas General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Locating the correct official document template can be challenging.

Of course, there are numerous templates accessible on the internet, but how can you acquire the official form you need.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your city/county. You can preview the form using the Preview option and review the form details to confirm it is the right one for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is correct, click on the Get now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Texas General Information Questionnaire. US Legal Forms is the largest repository of legal forms where you can find various document templates. Take advantage of the service to download properly crafted documents that comply with state requirements.

- The service offers thousands of templates, such as the Texas General Information Questionnaire, suitable for both business and personal purposes.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Texas General Information Questionnaire.

- Use your account to browse through the legal forms you have purchased previously.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

An out-of-state entity has an economic nexus in Texas if gross receipts from business done in Texas are $500,000 or more. This is even without a physical presence in the state. Furthermore, an entity's treatment for federal income tax purposes does not determine its responsibility for Texas franchise tax.

If you fail to file a report, pay taxes, or post a security bond, the Comptroller's office may suspend any permit or license issued by this agency after conducting a hearing. You can avoid this hearing simply by filing and paying the past due period(s) and/or posting the required security bond.

Texas Franchise reports may be submitted electronically with approved tax preparation provider software.

Taxpayers who have questions about Texas taxes can receive help from the Comptroller's office through either a general information letter or a private letter ruling. General information letters answer most questions, but taxpayers can request a private letter ruling.

Discounts, Penalties, Interest and Refunds A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

As the state's cashier, the Comptroller's office receives, disburses, counts, safeguards, records, allocates, manages and reports on the state's cash. In addition, the Texas Comptroller chairs the state's Treasury Safekeeping Trust, which invests, manages and oversees more than $50 billion in assets.

What is the Franchise Tax Accountability Questionnaire? The Comptroller sets up a franchise tax account for your business based on information provided from the Texas Secretary of State and other sources. The Franchise Tax Accountability Questionnaire allows you to update your entity's information with us online.

Tax Clearance letters will be issued, upon request, by the Comptroller's office after all franchise tax reports and the appropriate signed information reports due through the date of reinstatement are filed, all franchise tax, penalty, interest and late filing penalties are paid.