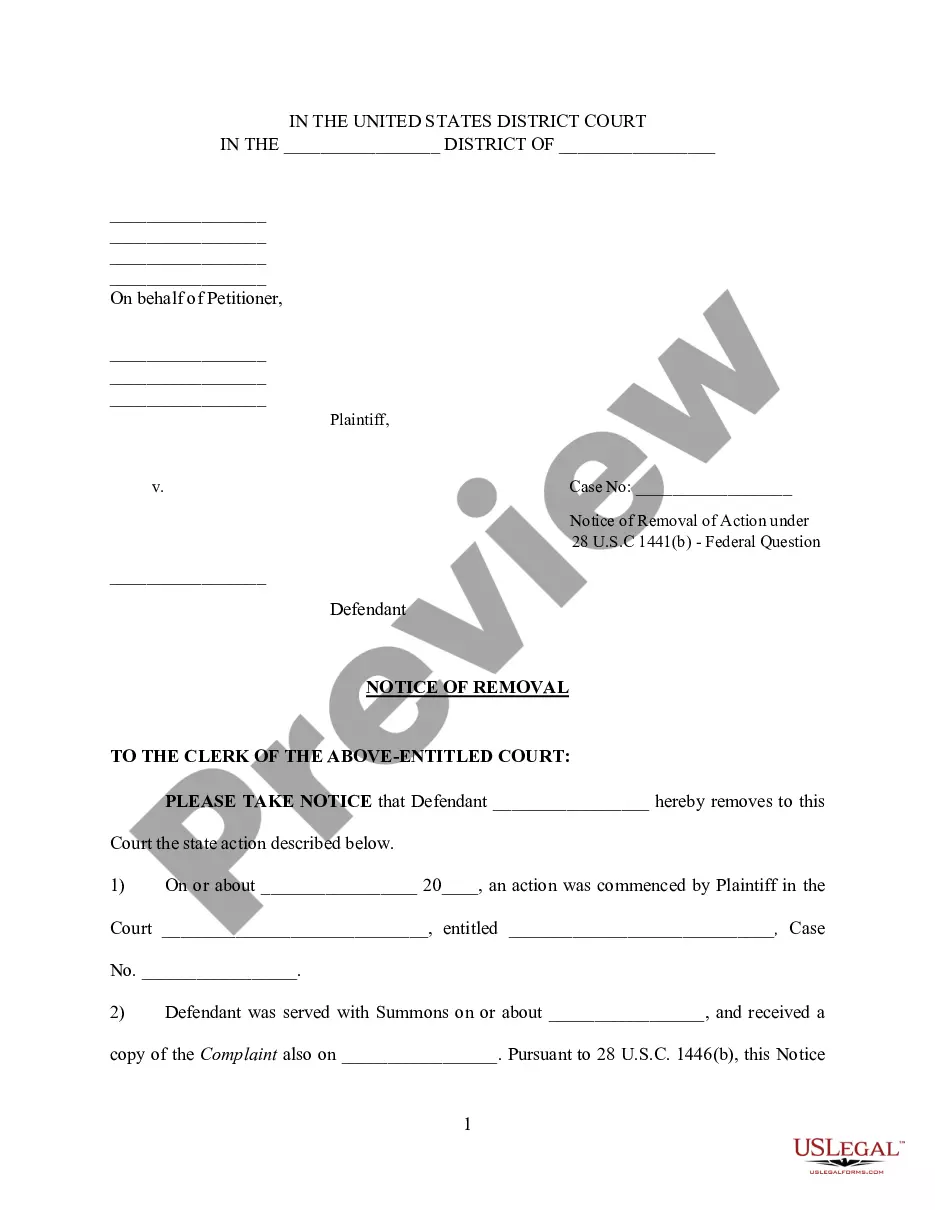

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Texas Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

Are you currently in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, such as the Texas Release by Trustee to Beneficiary and Receipt from Beneficiary, which are designed to meet state and federal requirements.

Once you obtain the appropriate form, click Purchase now.

Choose the pricing plan you desire, enter the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Texas Release by Trustee to Beneficiary and Receipt from Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Get the form you need and ensure it is for the correct city/area.

- Use the Preview button to view the form.

- Read the details to confirm that you have selected the correct document.

- If the document is not what you need, utilize the Search field to find the form that fits your requirements.

Form popularity

FAQ

To write a trust distribution letter, start by clearly stating the purpose of the letter and identifying the beneficiaries. Include a Texas Release by Trustee to Beneficiary and Receipt from Beneficiary to ensure all parties acknowledge the distribution. Be sure to outline the specific assets being distributed, any necessary actions from the beneficiaries, and relevant deadlines. For a template and guidance, USLegalForms offers valuable resources tailored to help you structure this letter effectively.

An example of a letter to beneficiaries includes a clear outline of what assets they are receiving and the steps they need to take. This letter often contains a Texas Release by Trustee to Beneficiary and Receipt from Beneficiary to confirm their acceptance of the inheritance. Including details about the trust and any distribution timelines helps beneficiaries understand their rights and obligations. Using platforms such as USLegalForms can simplify creating this important document.

A letter of release of inheritance serves as a formal document that affirms the distribution of assets from a deceased person's estate. It acts as a Texas Release by Trustee to Beneficiary and Receipt from Beneficiary, ensuring that beneficiaries formally accept their inheritance. This document helps clarify that the trustee has fulfilled their duties in distributing the assets. For a seamless process, consider using online resources like USLegalForms.

Yes, distributions from a trust can be taxable to beneficiaries, depending on the type of trust and the nature of the assets. In many cases, the taxes are based on the income generated by the trust prior to distribution. Understanding this aspect can help beneficiaries prepare for their financial responsibilities related to the Texas Release by Trustee to Beneficiary and Receipt from Beneficiary.

The purpose of a receipt and release is to confirm that a beneficiary has received their inheritance and to protect the trustee from future legal disputes. This document provides both parties with peace of mind, as it clearly outlines the transaction completed. It's an important step in the process of a Texas Release by Trustee to Beneficiary and Receipt from Beneficiary.

A receipt and release form PDF is a document that beneficiaries sign after receiving their shares from a trust. This form acts as proof that the beneficiary has received the assets and releases the trustee from future claims regarding those assets. In a Texas Release by Trustee to Beneficiary, the receipt and release form is often crucial to finalize the transfer.

To transfer assets from a trust to a beneficiary, the trustee must prepare a formal transfer document, typically a Texas Release by Trustee to Beneficiary. This document outlines the specific assets being transferred and provides legal proof of the transaction. Utilizing a reliable platform like uslegalforms can simplify this process, ensuring accuracy and compliance.

A trustee release is a legal document that allows a trustee to transfer assets held in a trust to a beneficiary. It signifies the completion of the trustee's duties regarding those assets. This Texas Release by Trustee to Beneficiary can be crucial in ensuring that beneficiaries receive their entitled inheritances without unnecessary delays.

Yes, beneficiaries in Texas are entitled to a copy of the will once it has been filed for probate. This transparency helps beneficiaries understand their rights and interests regarding the estate. Utilizing a Texas Release by Trustee to Beneficiary and Receipt from Beneficiary serves as an essential document in clarifying beneficiary interests. You can rely on US Legal Forms for reliable resources and templates to streamline this process.

In Texas, a trustee cannot disregard a beneficiary's rights. The trustee has a fiduciary duty to act in the best interests of the beneficiaries. If a beneficiary feels ignored, they can request a Texas Release by Trustee to Beneficiary and Receipt from Beneficiary to assert their rights. This helps ensure beneficiaries receive their entitled benefits and maintain transparent communication.