Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

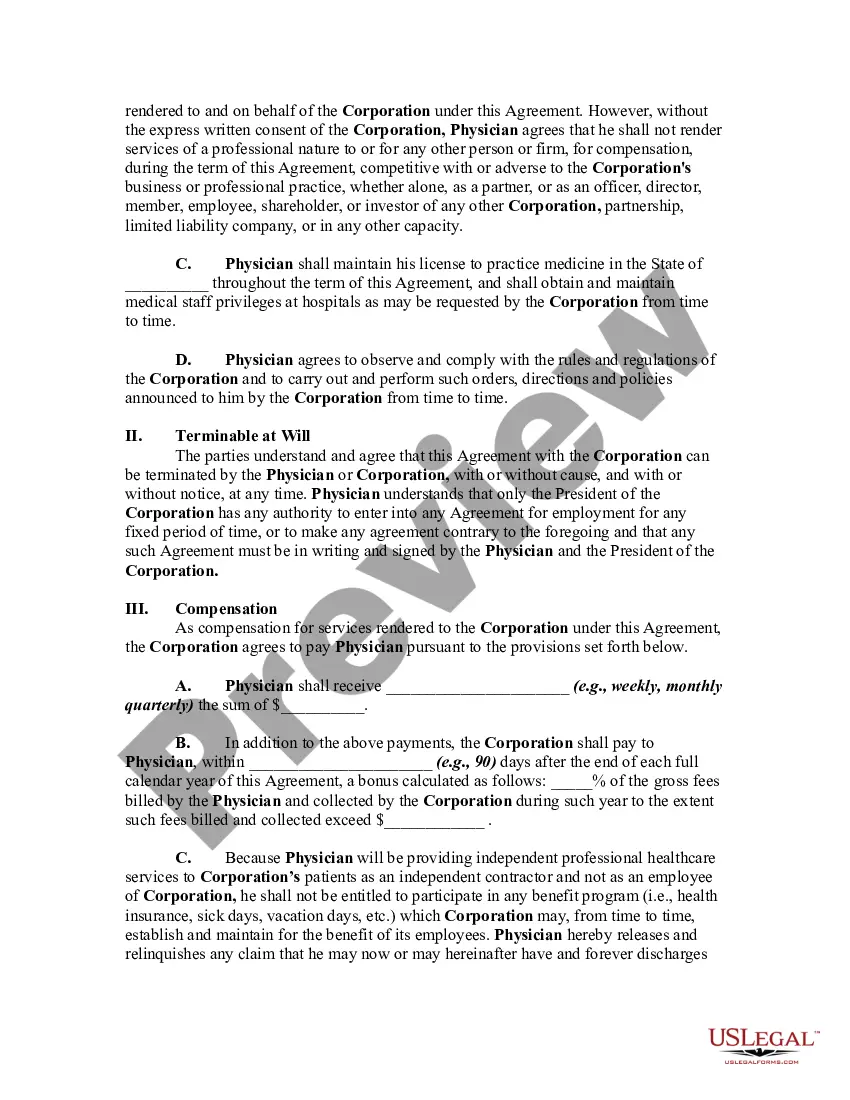

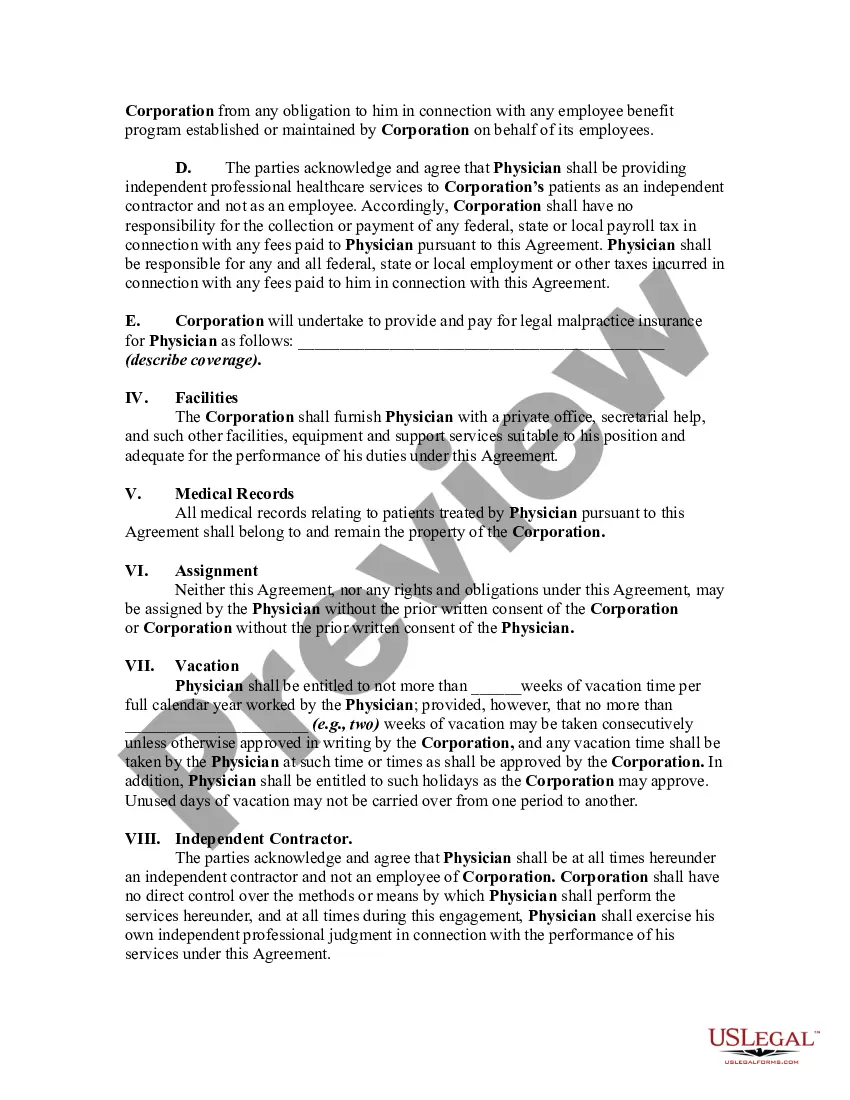

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

How to fill out Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

Are you presently in a circumstance where you frequently require documents for either business or personal purposes almost every working day.

There are numerous official document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of template documents, including the Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, designed to meet both state and federal requirements.

Access all of the document templates you have purchased via the My documents section.

You can obtain an additional copy of the Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation at any time if needed. Just click on the required form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and confirm it is for the correct city/county.

- 2. Utilize the Review button to inspect the form.

- 3. Verify the details to ensure you have selected the right form.

- 4. If the form is not what you're looking for, use the Search field to find one that fits your needs and requirements.

- 5. Once you find the correct form, click Get now.

- 6. Choose your pricing plan, input the necessary information to set up your account, and complete the purchase using PayPal or credit card.

- 7. Select a convenient document format and download your copy.

Form popularity

FAQ

Non-compete agreements can be enforceable against independent contractors in Texas, but they must meet specific legal criteria. Such agreements must be reasonable in scope, geography, and duration. It is advisable to outline these conditions in a Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation to ensure clarity and compliance with state laws.

To become an independent contractor in Texas, you need to have a clear business structure, register your business if required, and acquire any necessary licenses. A Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation will be essential to formalize your relationship with clients or employers. Additionally, you may want to invest in accounting resources to manage your finances effectively.

When writing an independent contractor agreement in Texas, start by clearly identifying both parties involved. Include essential details such as the scope of work, payment terms, and the duration of the agreement. Make sure to address specific elements relevant to a Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, ensuring both parties understand their commitments and rights.

An independent contractor in Texas typically works under a contract rather than as an employee. Key qualifications include having the freedom to control how tasks are completed and being responsible for paying taxes on earnings. When establishing a Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, it’s crucial to clearly define the working relationship to maintain this independent status.

In Texas, a 1099 employee, or independent contractor, can work as many hours as needed to complete their projects. There is no cap on hours; however, it is essential to establish a clear Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation to outline expectations and responsibilities. This agreement helps both parties understand their roles and limits within the working relationship.

Certain information is exempt from the Texas Public Information Act, including confidential information related to patient privacy and attorney-client communications. These exemptions help protect sensitive data from public disclosure. To ensure adherence to legal frameworks when creating medical agreements, consider the benefits of a Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

The exceptions to the corporate practice of medicine (CPOM) in Texas include specific circumstances, like certain non-profit organizations or unique healthcare arrangements. These situations provide avenues for collaborative approaches in medical setups. Utilizing a Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can clarify these exceptions and facilitate compliance.

The anti indemnity statute in Texas generally prevents indemnifying a party for its own negligence. However, exceptions may apply, especially in construction contracts or other specified situations. To navigate these complexities effectively, consider using a Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation for clarity.

In Texas, the corporate practice of medicine generally prohibits corporations from employing physicians. However, there are exceptions, such as certain types of healthcare organizations, including non-profit hospitals and some group practices. Understanding these nuances is crucial, and a Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can provide tailored solutions.

The Texas heartbeat law has specific exceptions allowing for abortions under certain conditions. These exceptions include cases of medical emergencies, situations that threaten the mother's life, and when the fetus has a severe medical condition. For comprehensive guidance, obtaining a Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can help clarify the legal implications.