Texas Security Agreement for Promissory Note

Description

How to fill out Security Agreement For Promissory Note?

Locating the appropriate legitimate document template can be challenging.

Naturally, there are numerous designs accessible on the web, but how can you acquire the valid version you seek.

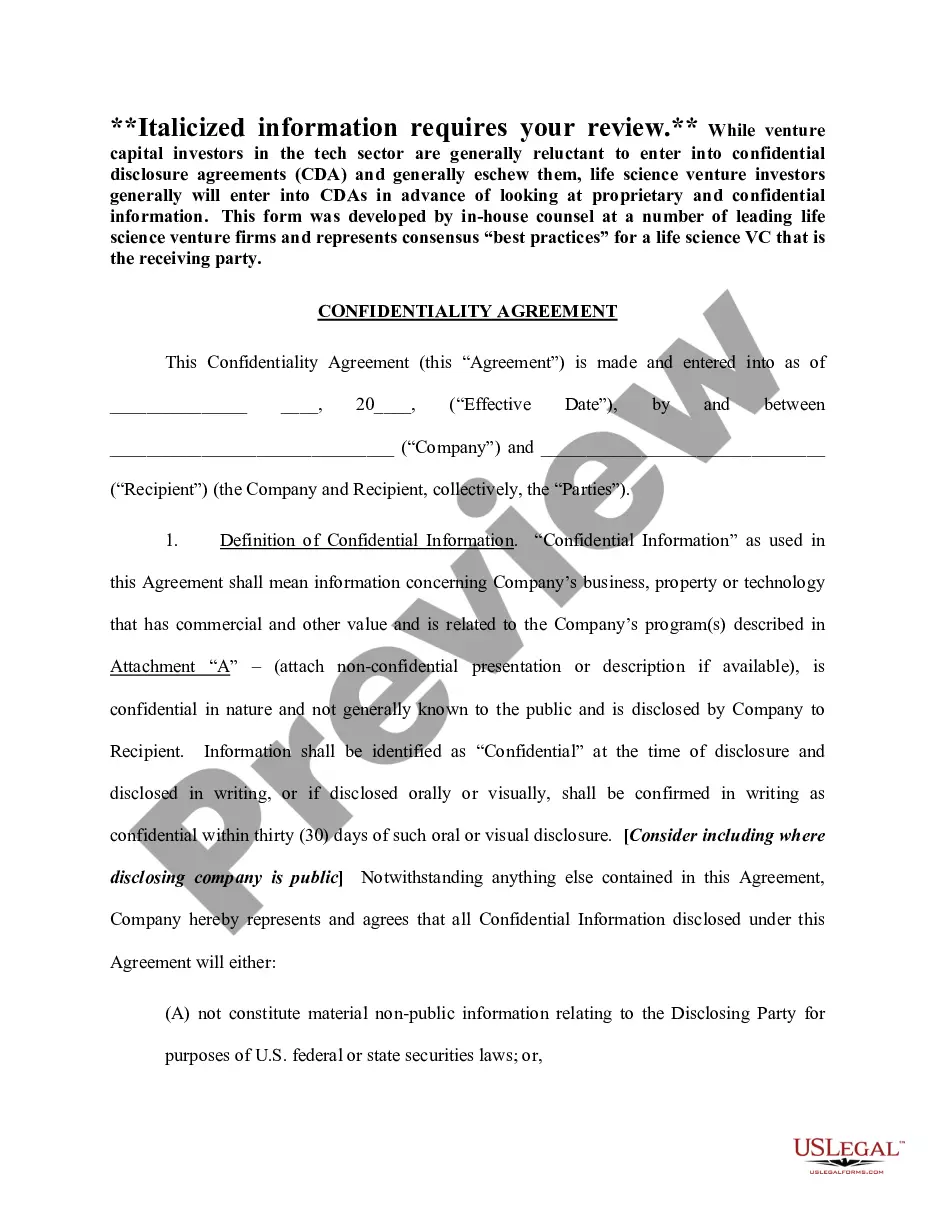

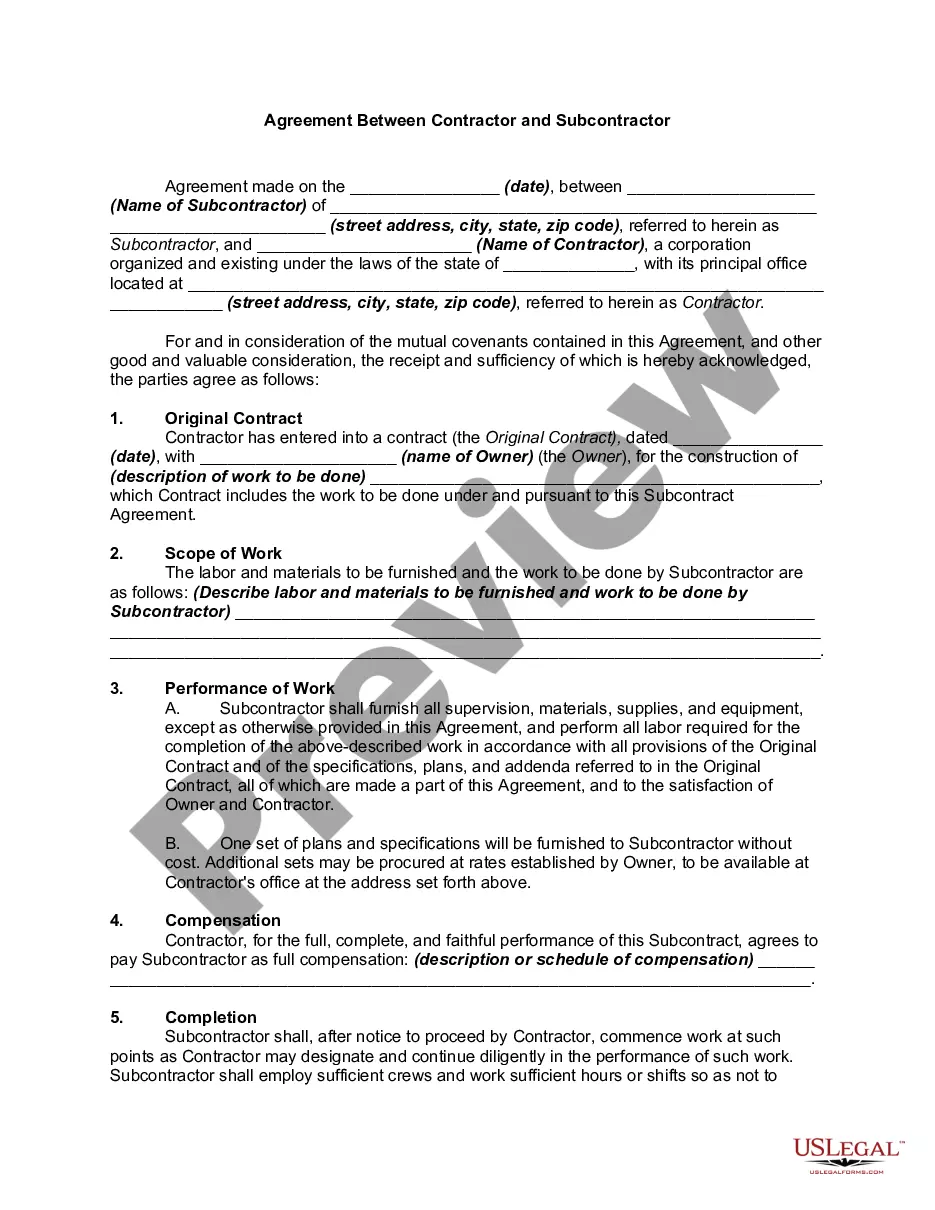

Utilize the US Legal Forms website. This service offers thousands of templates, including the Texas Security Agreement for Promissory Note, which you can use for both business and personal purposes.

First, ensure you have chosen the correct document for your city/county. You can view the document using the Preview button and check the document description to confirm it is suitable for you.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Acquire button to find the Texas Security Agreement for Promissory Note.

- Use your account to review the legal documents you may have previously obtained.

- Navigate to the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps for you to follow.

Form popularity

FAQ

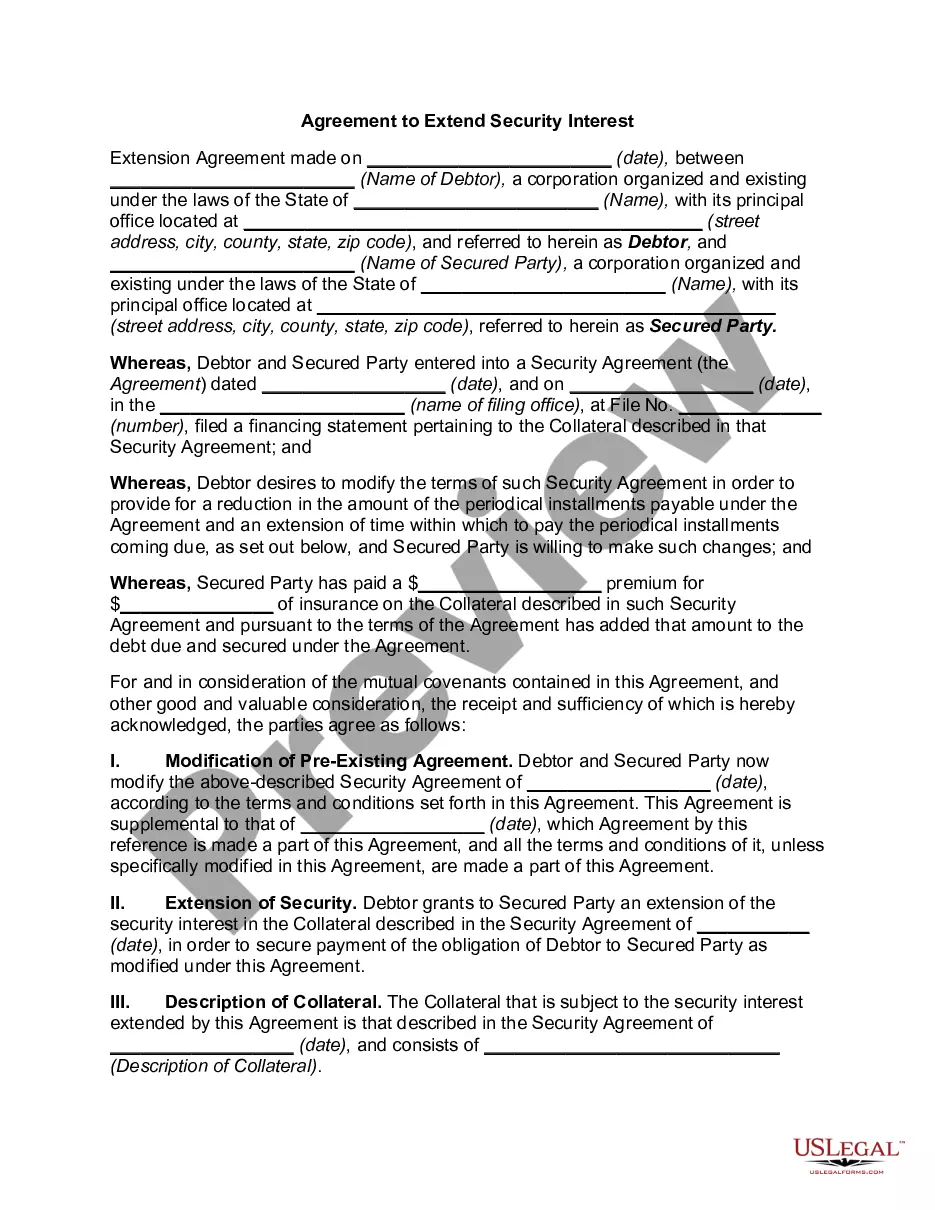

A security interest arising out of a sale of a promissory note (i.e., an instrument) is perfected automatically, without additional action, when it attaches. See Section 9-304(4) of the Uniform Commercial Code.

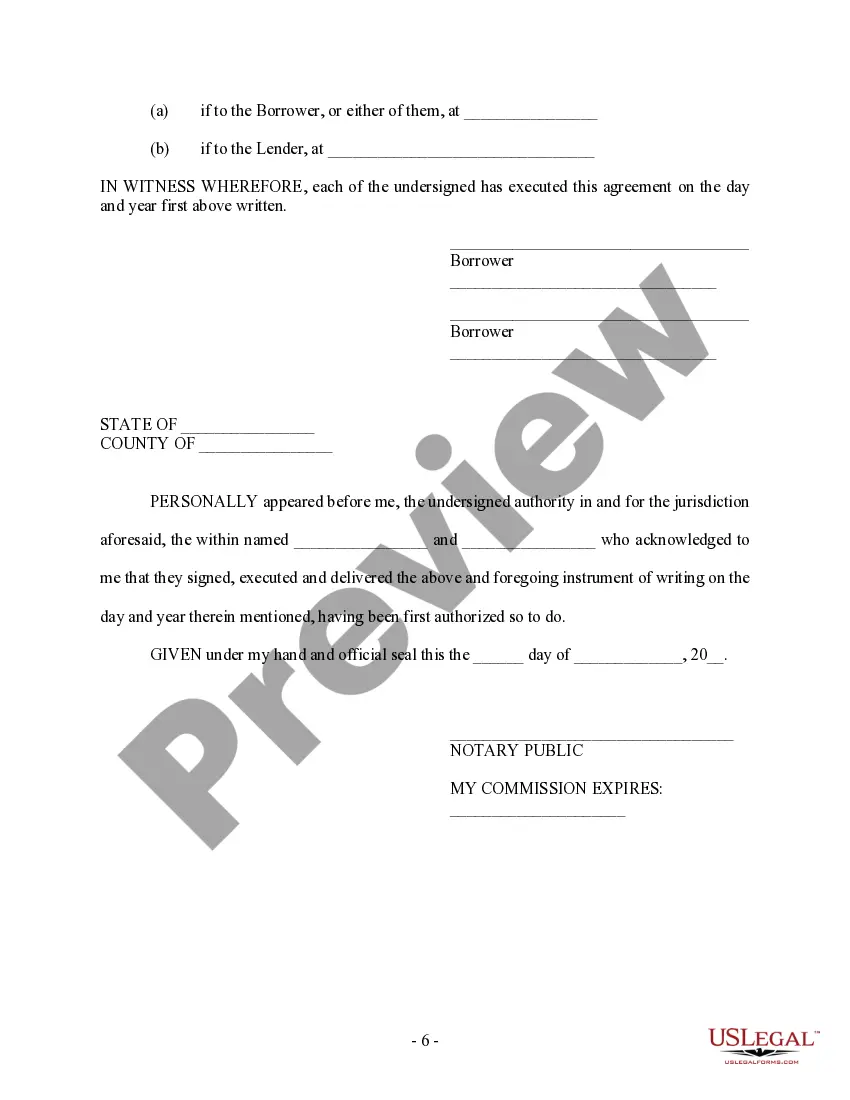

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust. If the collateral is personal property, there will be a security agreement.

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

Dated Signature: In Texas, both unsecured and secured promissory notes must be signed and dated by the borrower and any co-signer; the lender need not sign. There is no legal requirement for promissory notes to be witnessed or notarized in Texas.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A secured promissory note may include a security agreement as part of its terms. If a security agreement lists a business property as collateral, the lender might file a UCC-1 statement to serve as a lien on the property. A security agreement mitigates the default risk faced by the lender.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.