Texas Sample Letter regarding Application for Employer Identification Number

Description

How to fill out Sample Letter Regarding Application For Employer Identification Number?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Texas Sample Letter for Application for Employer Identification Number in moments.

If you currently hold a monthly subscription, Log In and download the Texas Sample Letter for Application for Employer Identification Number from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved forms in the My documents section of your account.

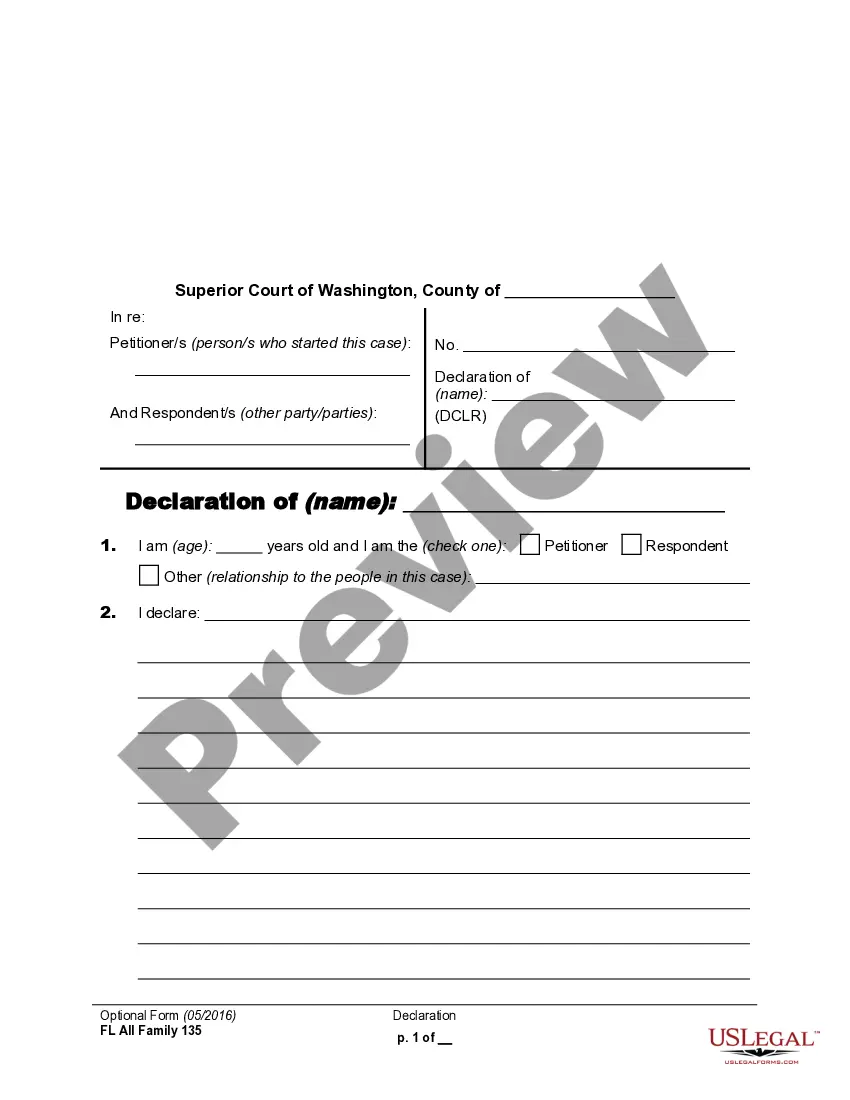

If you are looking to use US Legal Forms for the first time, here are simple instructions to get you started: Ensure you have selected the correct form for your city/county. Click on the Preview button to examine the form's content. Check the form summary to confirm you have chosen the correct document. If the form does not meet your needs, utilize the Search box at the top of the screen to find the one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your details to register for an account. Process the transaction. Use your Visa or Mastercard or PayPal account to complete the purchase. Choose the format and download the document to your device. Make modifications. Fill out, edit and print and sign the saved Texas Sample Letter for Application for Employer Identification Number. Every template you added to your account does not have an expiration date and is yours permanently. Therefore, to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Texas Sample Letter for Application for Employer Identification Number with US Legal Forms, the most extensive collection of legal document templates.

- Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

The Texas Taxpayer Number is the 11-digit number assigned by the Comptroller of Public Accounts. The Texas taxpayer number is not the same as the Federal Employer Identification Number or the Texas Secretary of State (SOS) File Number.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service.

To obtain an EIN for your Texas business, you must file a Form SS-4. There is no fee for applying for an EIN.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

Most businesses operating in Texas will require both a federal tax ID and a Texas state tax ID number. Fortunately, despite the fact that these two numbers are distinct, the process for applying to them is highly similar and easy to follow.

Step by Step: How to Apply for an EIN Go to the IRS website. ... Identify the legal and tax structure of your business entity. ... If your business is an LLC, provide information about the members. ... State why you are requesting an EIN. ... Identify and describe a contact person for the business. ... Provide the business' location.

You can contact the IRS directly and request a replacement confirmation letter called a 147C letter. Start by calling the IRS Business & Specialty Tax Line toll free at 1-800-829-4933 (or if you are calling outside the United States at 267-941-1099) between AM and PM EST.