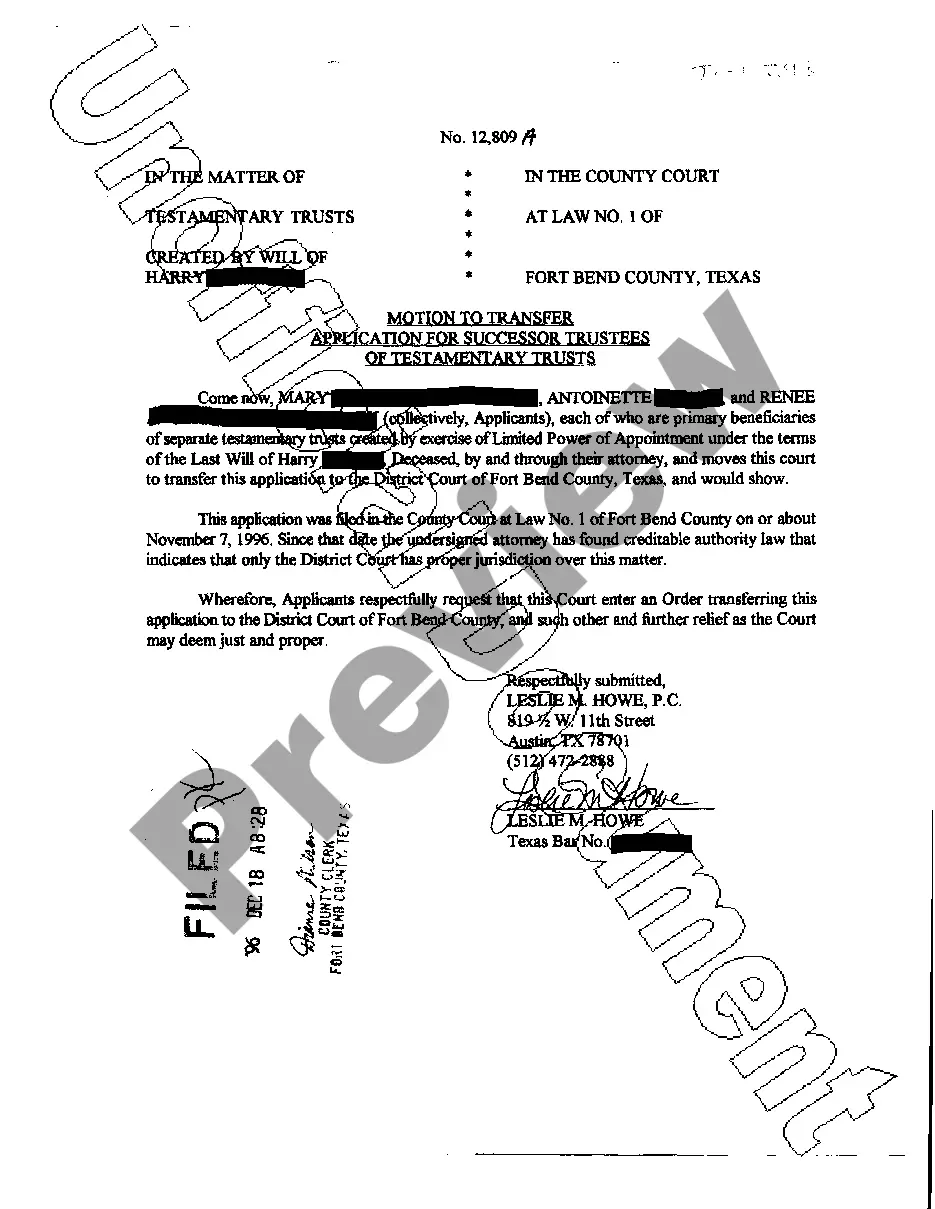

Texas Application for Successor Trustees

Description

Get your form ready online

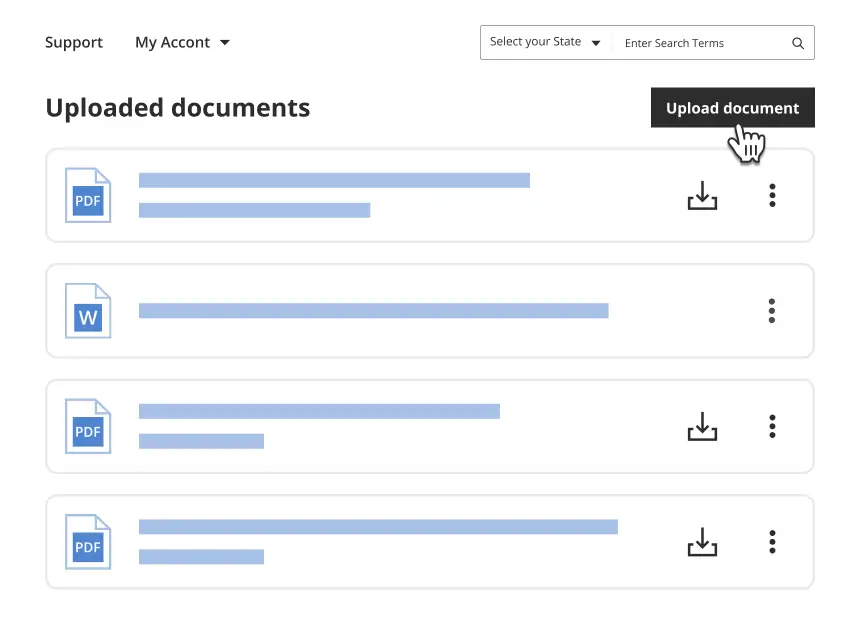

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

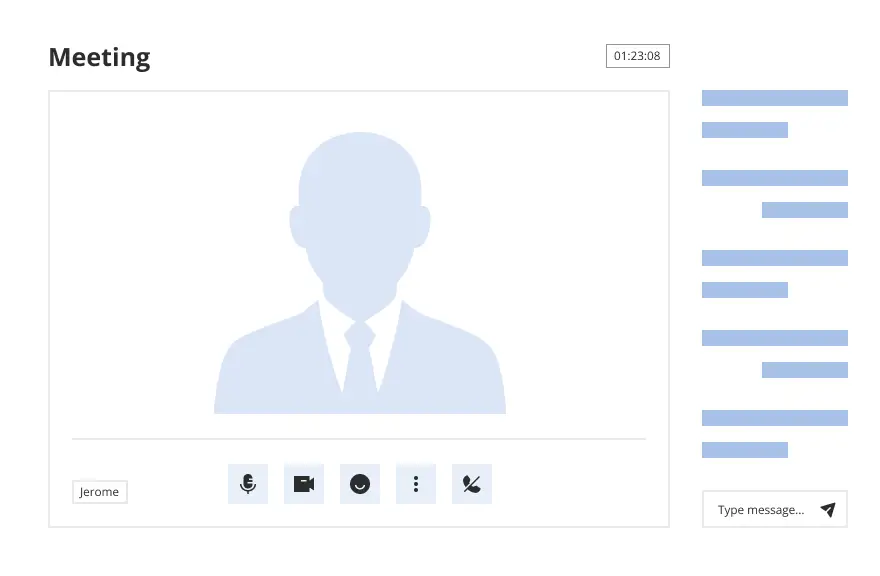

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Application For Successor Trustees?

Access to high quality Texas Application for Successor Trustees forms online with US Legal Forms. Steer clear of hours of misused time searching the internet and lost money on forms that aren’t up-to-date. US Legal Forms gives you a solution to just that. Find around 85,000 state-specific authorized and tax forms that you can save and submit in clicks in the Forms library.

To find the sample, log in to your account and click on Download button. The document is going to be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- Find out if the Texas Application for Successor Trustees you’re considering is suitable for your state.

- See the form using the Preview option and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to register.

- Pay out by credit card or PayPal to complete making an account.

- Pick a favored file format to download the file (.pdf or .docx).

You can now open the Texas Application for Successor Trustees example and fill it out online or print it and do it yourself. Think about mailing the papers to your legal counsel to make sure things are filled out appropriately. If you make a mistake, print out and fill application once again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and get access to more templates.

Form popularity

FAQ

The amendment prevents the need to write a whole new trust. At the top of the page, state the date and that this is an amendment to name a successor trustee. State the successor's information and note that this person becomes he effective trustee upon the death of you and any other co-trustee and grantor.

Nolo's Living Trust does not currently allow you to name an institution as successor trustee. If you want to do so, you will need help from an attorney. Normally, your first choice as successor trustee should be a flesh-and-blood person, not the trust department of a bank or other institution.

For a revocable living trust, that Trustee is usually the person that created the trust.The successor trustee usually takes power when the person that created the trust either becomes incapacitated or has died. The Trustee only manages the assets that are owned by the trust, not assets outside the trust.

Generally, if you are a trustee you should identify yourself as the trustee on all trust-related paperwork by signing your name followed by the words as trustee." As an alternative, you can also state your name followed by as trustee and not individually." Doing so will help ensure separation between you in your

Can the Successor Trustee Be a Beneficiary of the Trust? It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common.When Mildred dies, Allison uses her authority as trustee to transfer the trust property to herself.

Typically, the named successor trustee to a trust does not take over until the existing trustee stops serving, whether due to his or her resignation, removal, or death.First, the trustee can use the trust funds to fight the court case. Second, the court will first seek to advance the trust grantor's intent.

2 attorney answers Just the grantors. They are usually also the trustees. If they are not the trustees still no need to sign. However, that is why you want successor trustees listed in case trustee does not or cannot serve.

A successor trustee is named to step in and manage the trust when the trustee is no longer able to continue (usually due to incapacity or death).The beneficiaries are the persons or organizations who will receive the trust assets after the grantor dies.

It depends on the terms of the trust. If the trust designates that the trustees are to act together, and not independently, then yes, a signature by both trustees are required in order to transfer property out of the trust.