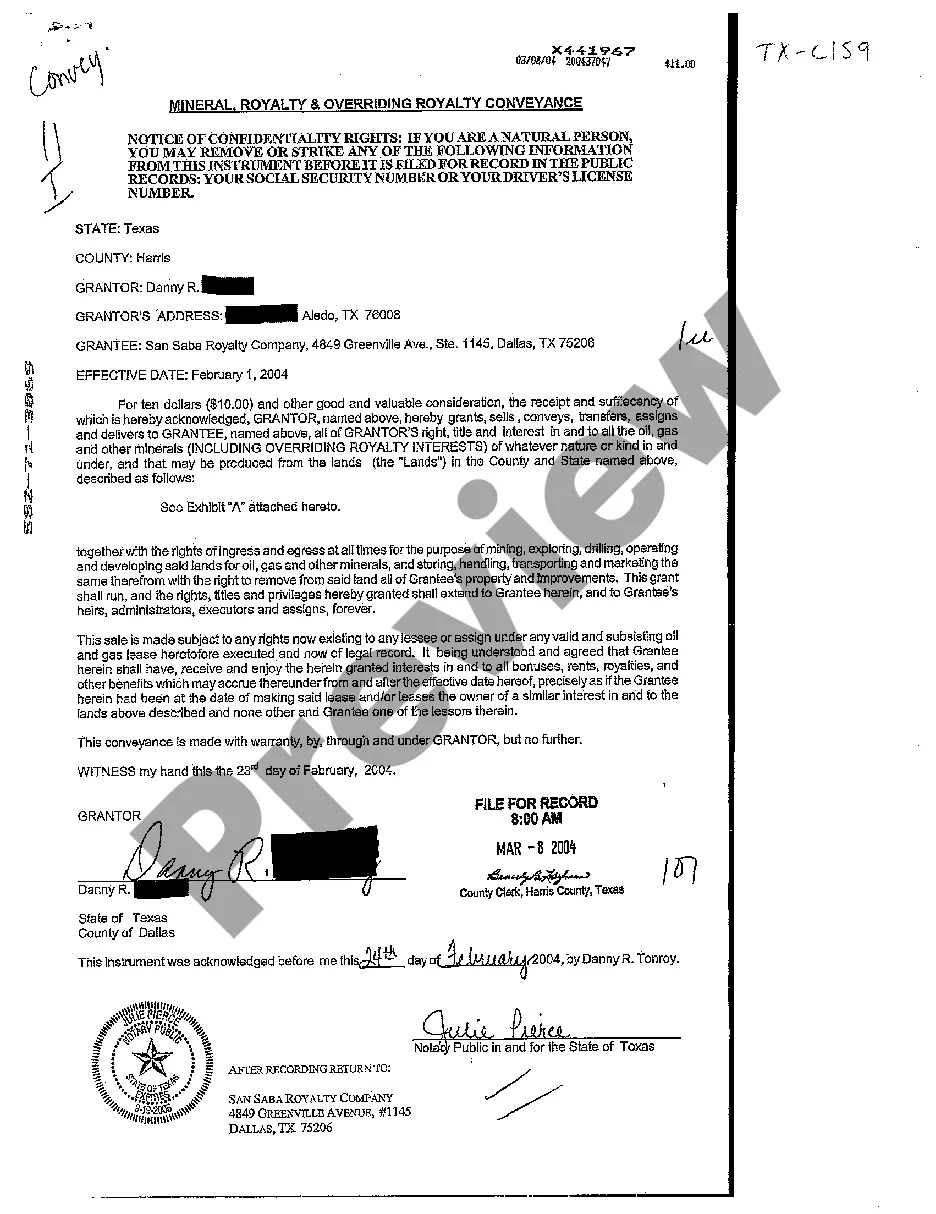

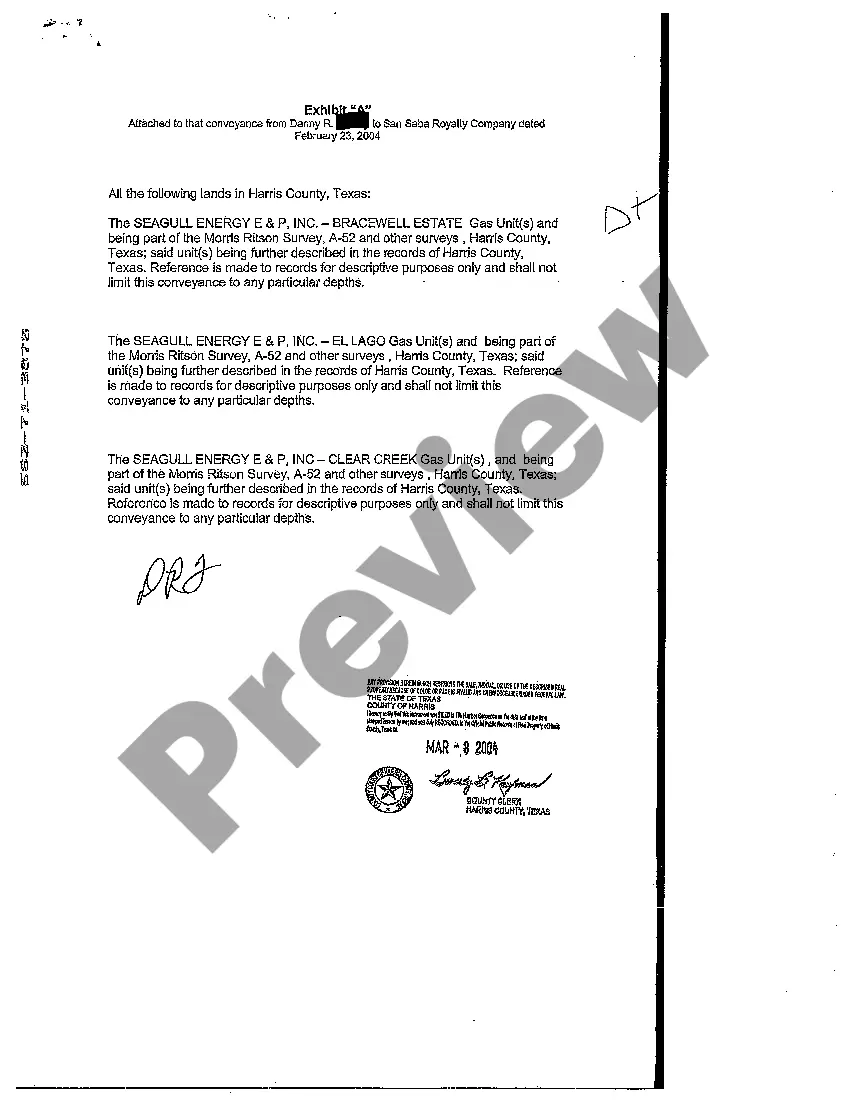

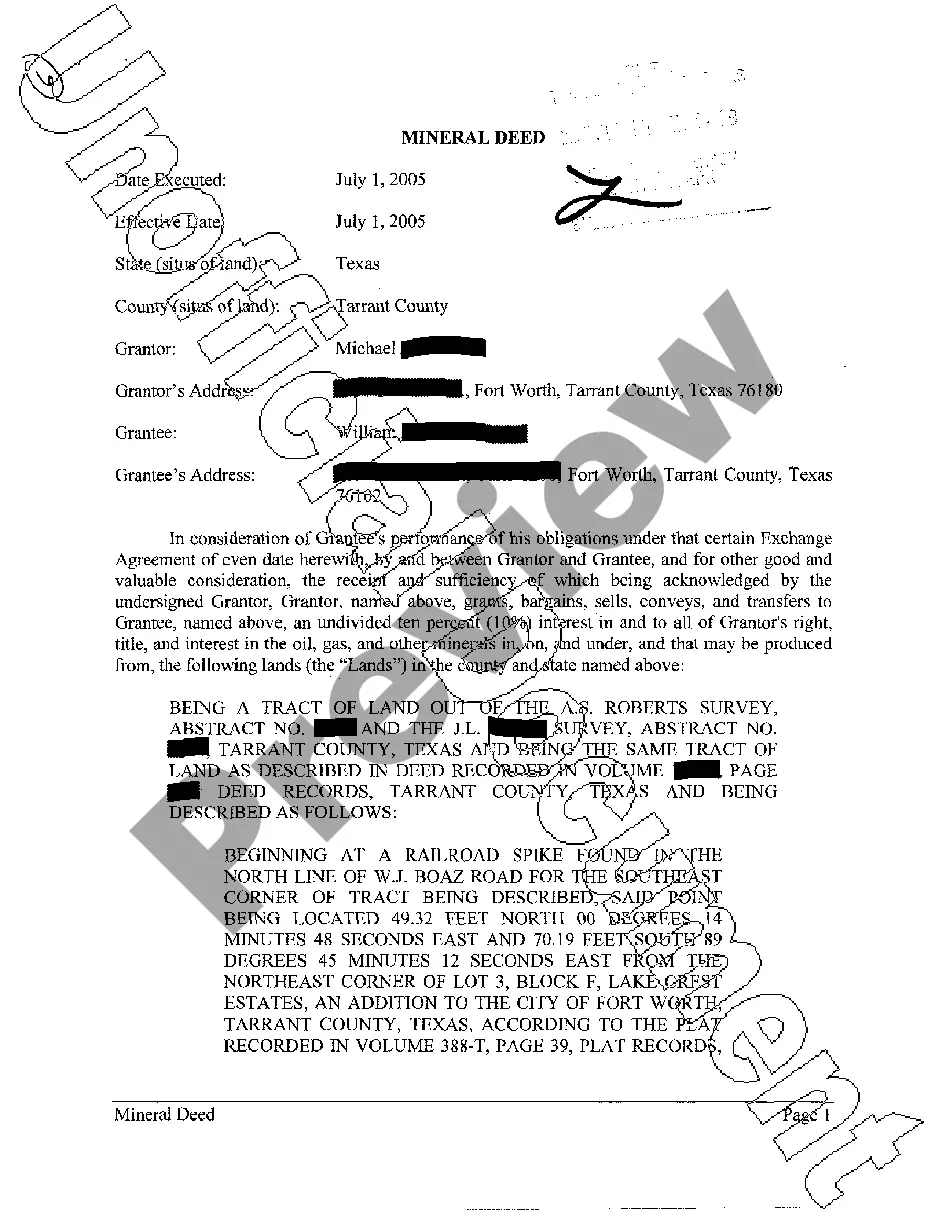

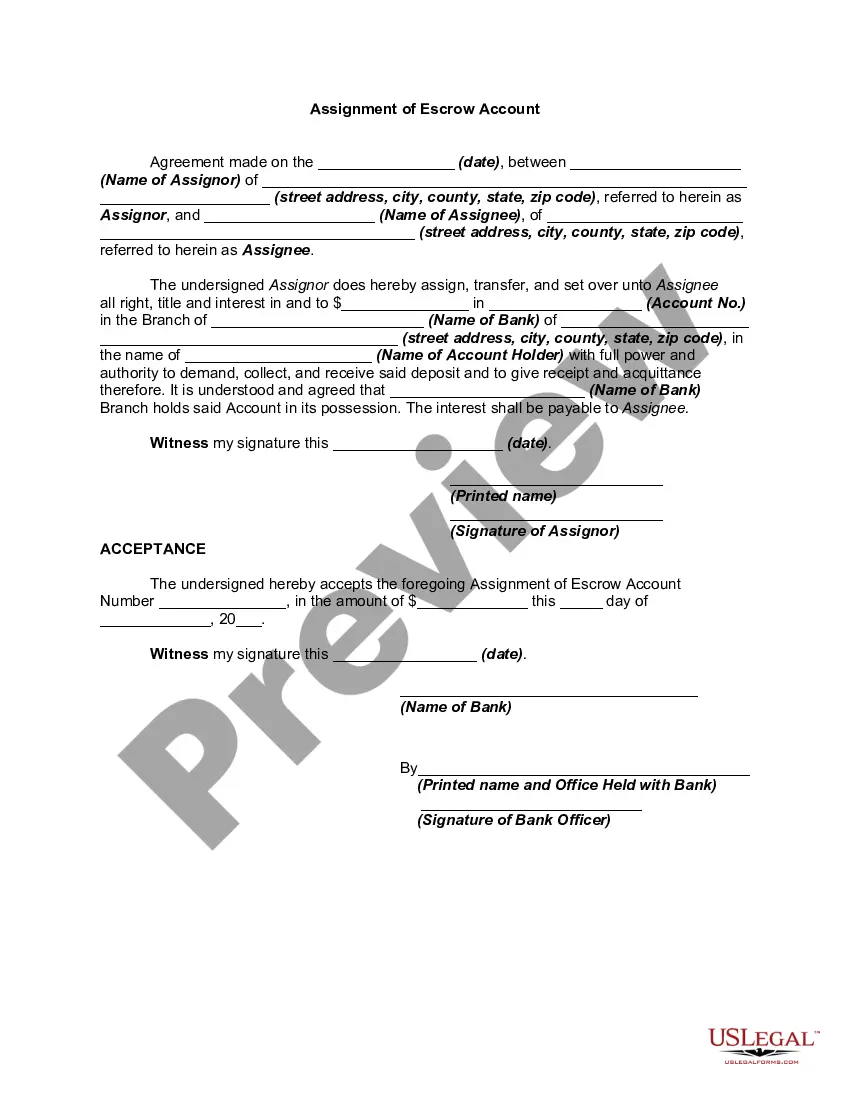

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed

Description

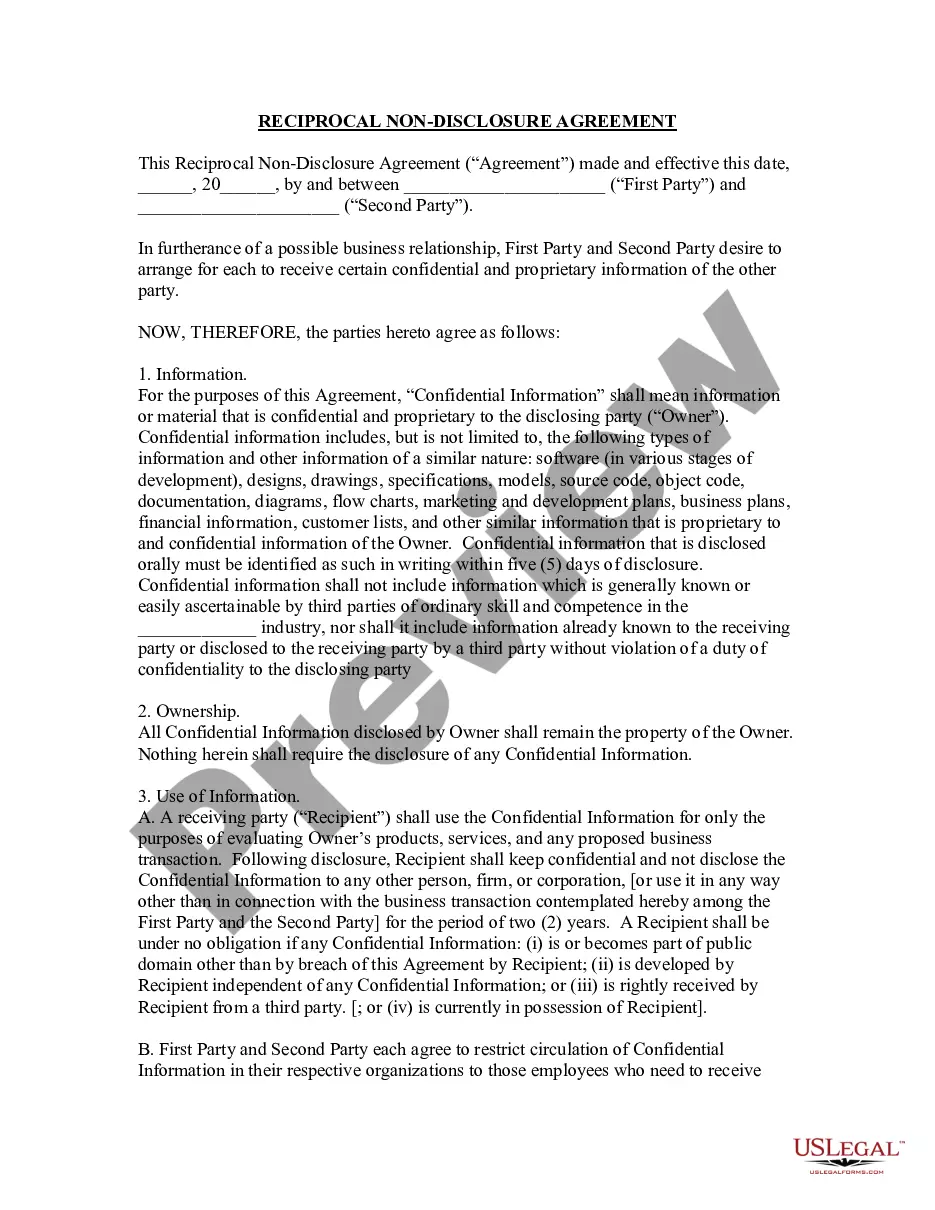

Key Concepts & Definitions

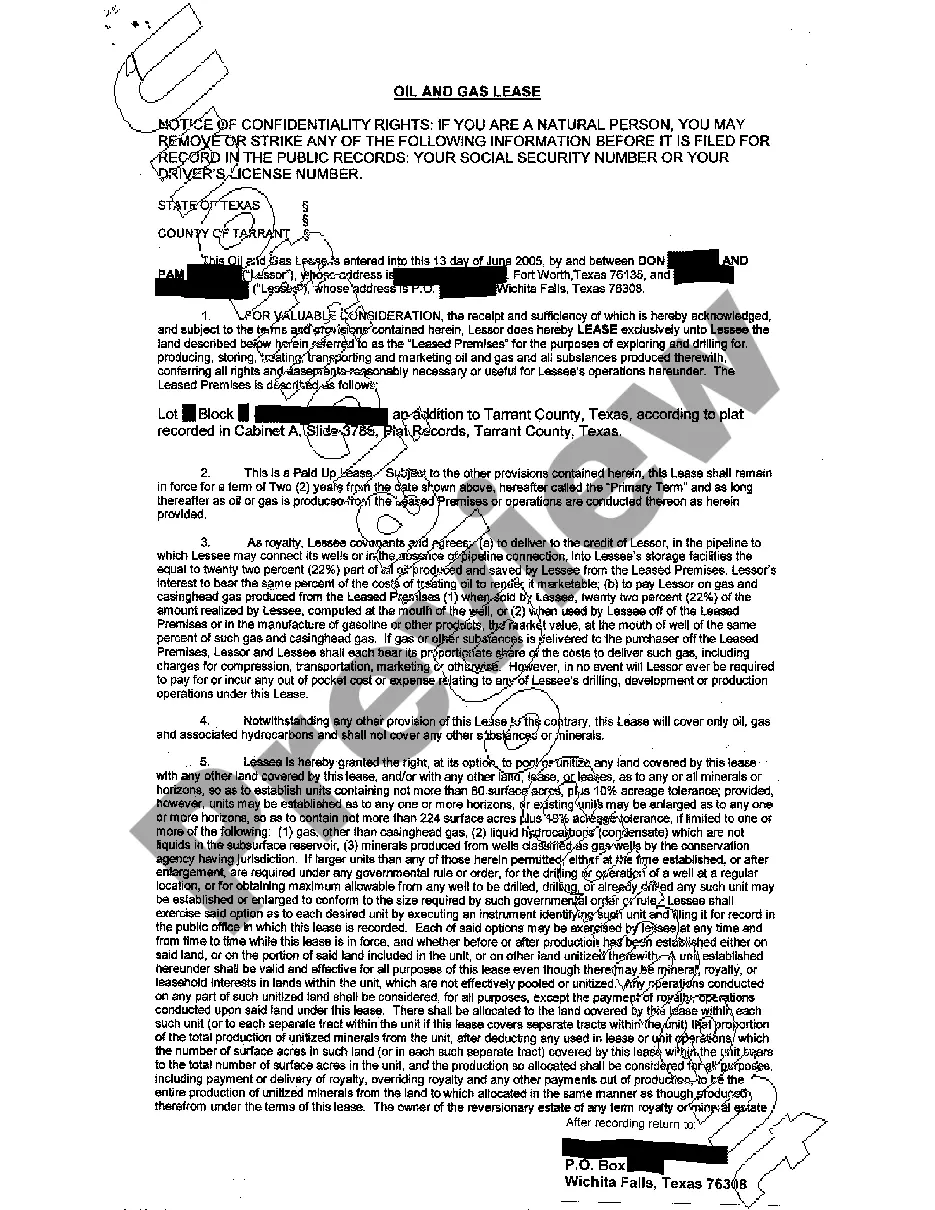

Mineral Royalties and Overriding Royalties are financial agreements common in the U.S. mining and oil industries. A mineral royalty is a payment to the mineral rights holder based on the volume or value of minerals produced, such as oil or natural gas. An overriding royalty is a fraction of the production revenue, granted by the leaseholder, which is not tied to mineral ownership but rather, the lease agreement's terms.

Step-by-Step Guide

- Understanding the Terms: Familiarize yourself with specific terms like 'royalty interest' and 'lease agreement'.

- Assess the Property: Evaluate the mineral-producing potential of the property.

- Legal Consultation: Hire an attorney specialized in mineral rights and royalties to navigate legal complexities.

- Negotiating Agreements: Effective negotiation tactics to ensure the agreement is beneficial.

- Monitoring and Managing: Regularly monitor your royalties and overriding interests for compliance with the terms of the contract.

Risk Analysis

Market Volatility: Prices of minerals and oils fluctuate, affecting royalty amounts. Legal Disputes: Misunderstandings or disputes over contract terms can lead to lengthy and costly legal battles. Environmental Regulations: Changes in environmental laws may influence mining or drilling operations, impacting royalties.

Best Practices

- Transparent Accounting: Ensure all payments and deductions are clearly documented.

- Regular Reviews: Regularly reviewing the terms of the royalty agreements to adapt to any legal or market changes.

- Strengthen Relationships: Maintain good relationships with lessees to ensure timely and complete royalty payments.

Common Mistakes & How to Avoid Them

Insufficient Due Diligence: Always perform comprehensive due diligence before entering any agreements. Poor Negotiation: Engage skilled negotiators or legal aid to ensure favorable terms. Lack of Regular Monitoring: Implement systematic checks to ensure compliance with the agreement terms.

FAQ

- What is the difference between mineral royalty and overriding royalty? Mineral royalty is tied to ownership, whereas overriding royalty is tied to production revenue from a lease.

- How do changes in market prices affect royalties? Royalties based on revenue will fluctuate with market prices, impacting your earnings.

- Can overriding royalties be negotiated after a lease agreement? Typically, terms should be negotiated at the start; however, terms can occasionally be renegotiated during lease renewals.

Summary

Understanding and managing mineral royalties and overriding royalties are crucial for those involved in the U.S. mining and hydrocarbon industries. It involves not just knowing the basic terms but also actively managing and negotiating the terms effectively to ensure a profitable return from mineral properties.

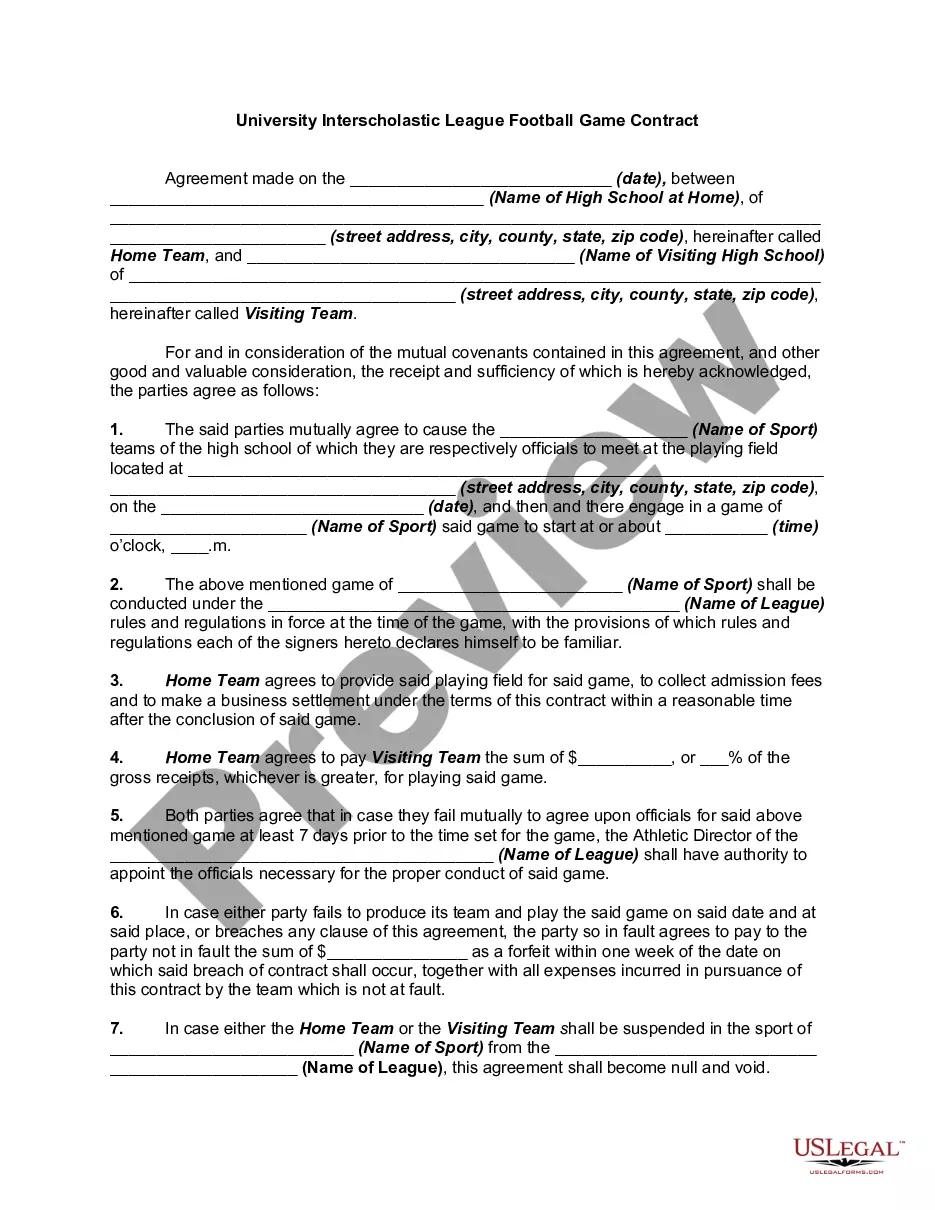

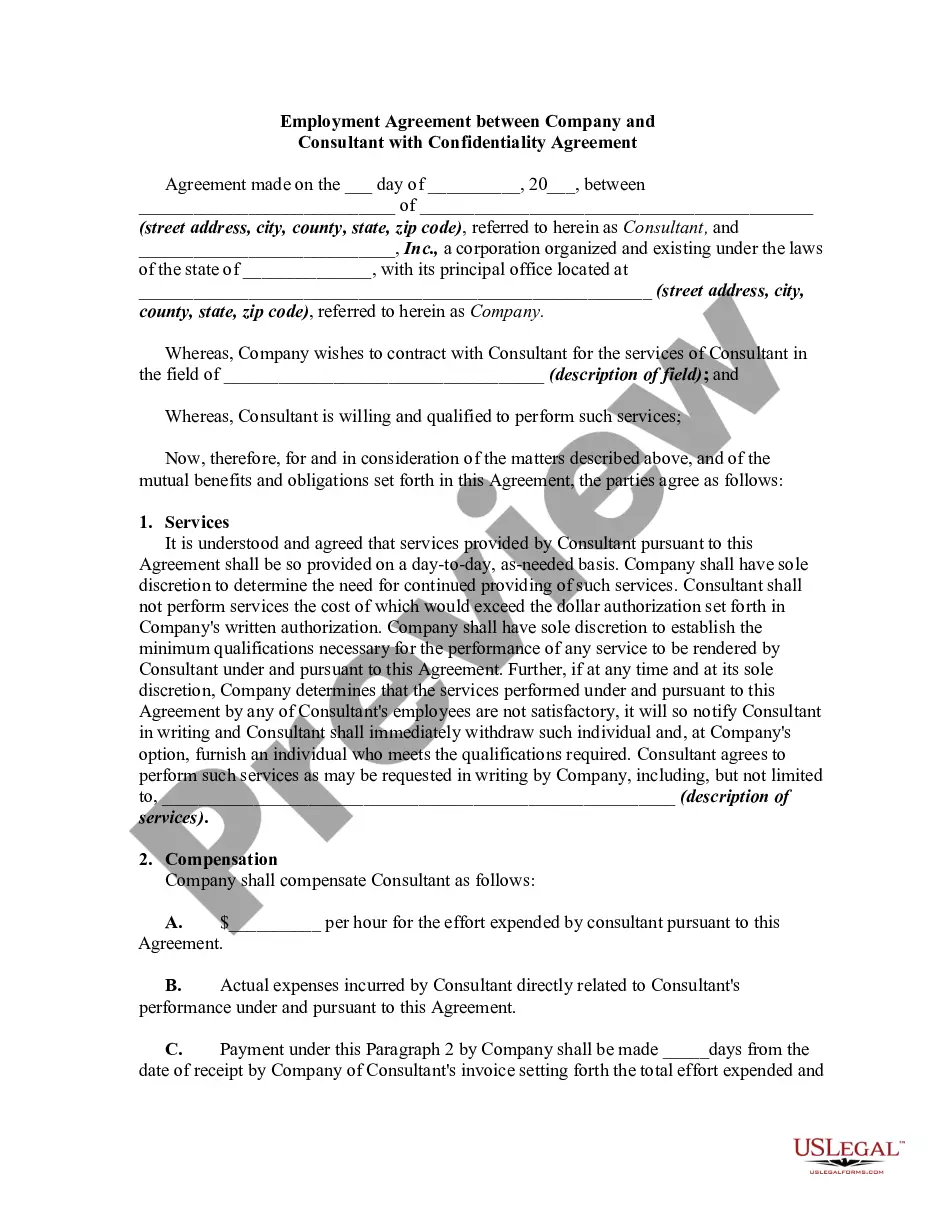

How to fill out Texas Mineral, Royalty, And Overriding Royalty Conveyance Deed?

Get access to high quality Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed samples online with US Legal Forms. Avoid hours of wasted time seeking the internet and lost money on documents that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find over 85,000 state-specific authorized and tax templates that you can save and fill out in clicks within the Forms library.

To get the sample, log in to your account and click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- Check if the Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed you’re looking at is appropriate for your state.

- Look at the sample making use of the Preview option and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Pick a favored file format to download the document (.pdf or .docx).

You can now open up the Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed template and fill it out online or print it out and do it yourself. Think about sending the file to your legal counsel to be certain things are completed correctly. If you make a error, print and complete application once again (once you’ve registered an account every document you save is reusable). Make your US Legal Forms account now and get more forms.

Form popularity

FAQ

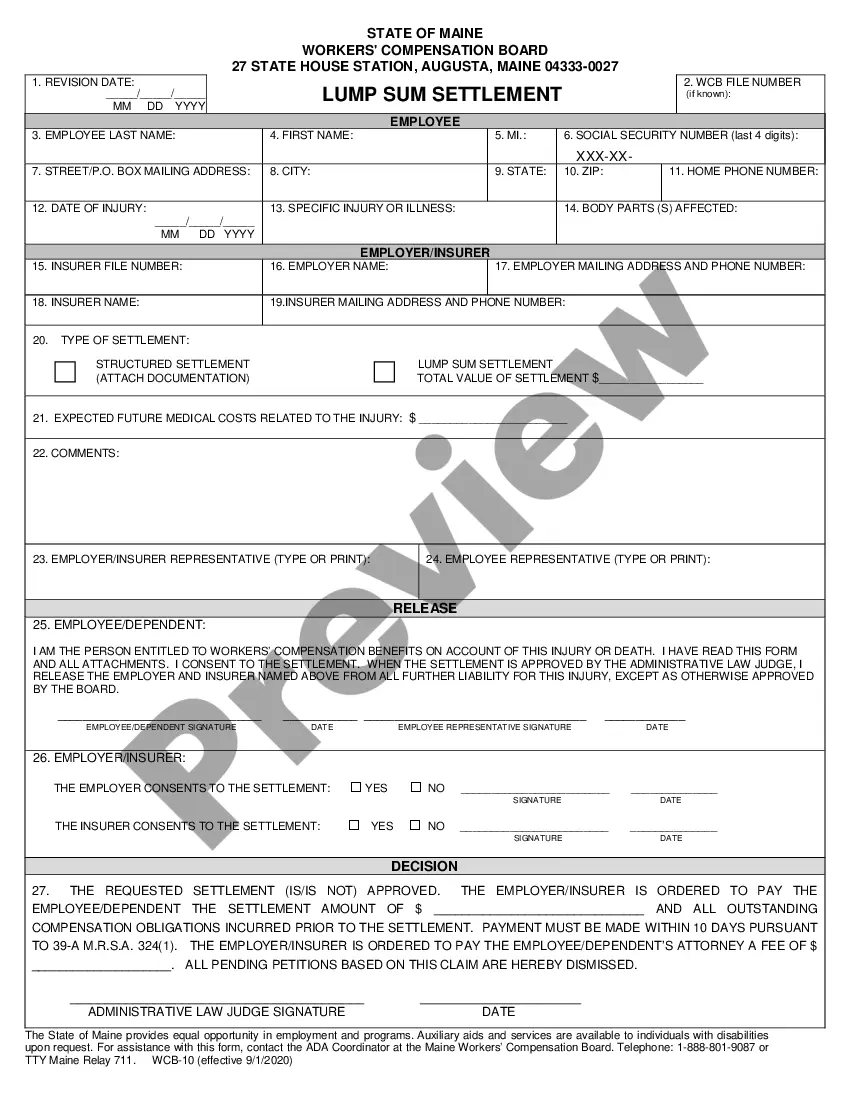

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

Under Texas law, ownership of land includes ownership of minerals under the surface of the land.Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate.

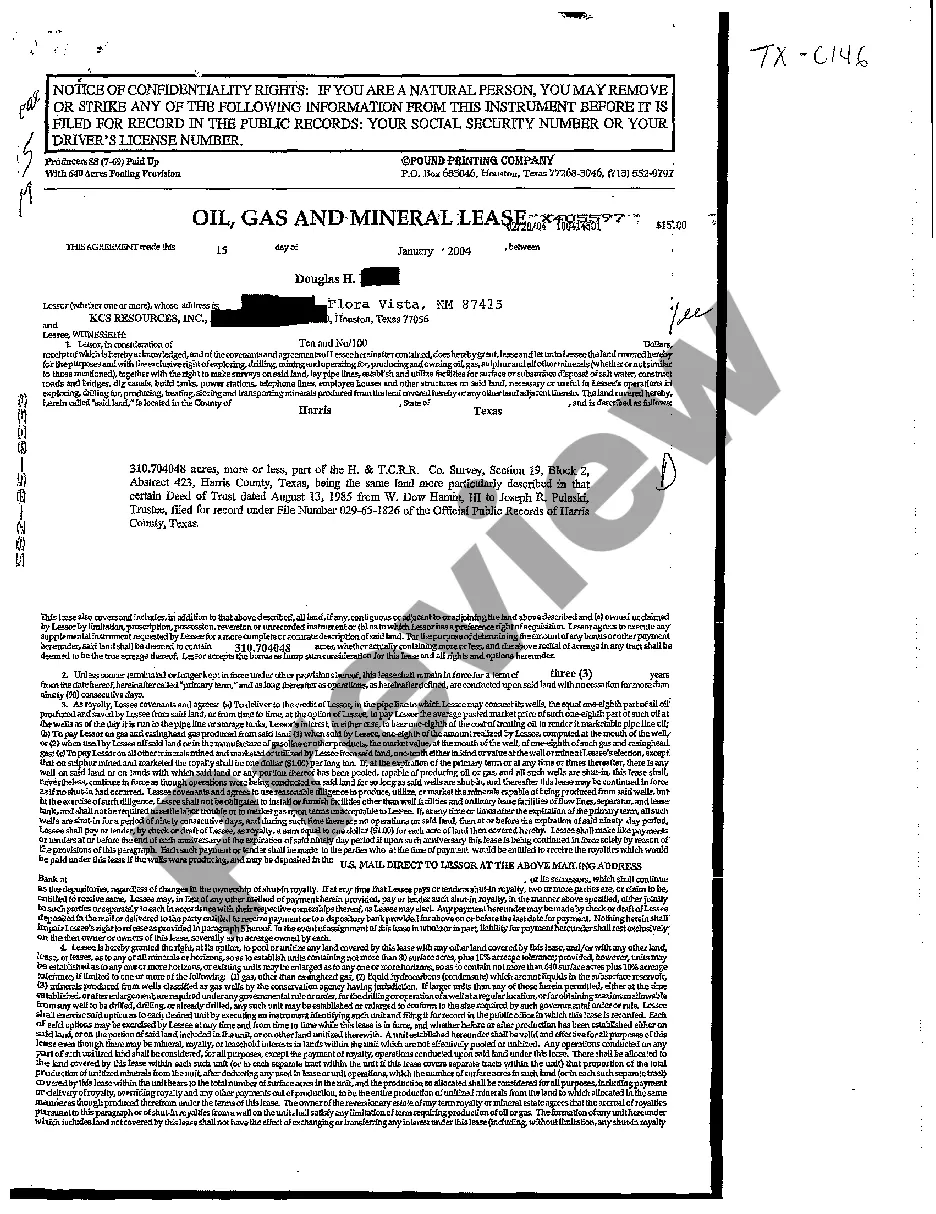

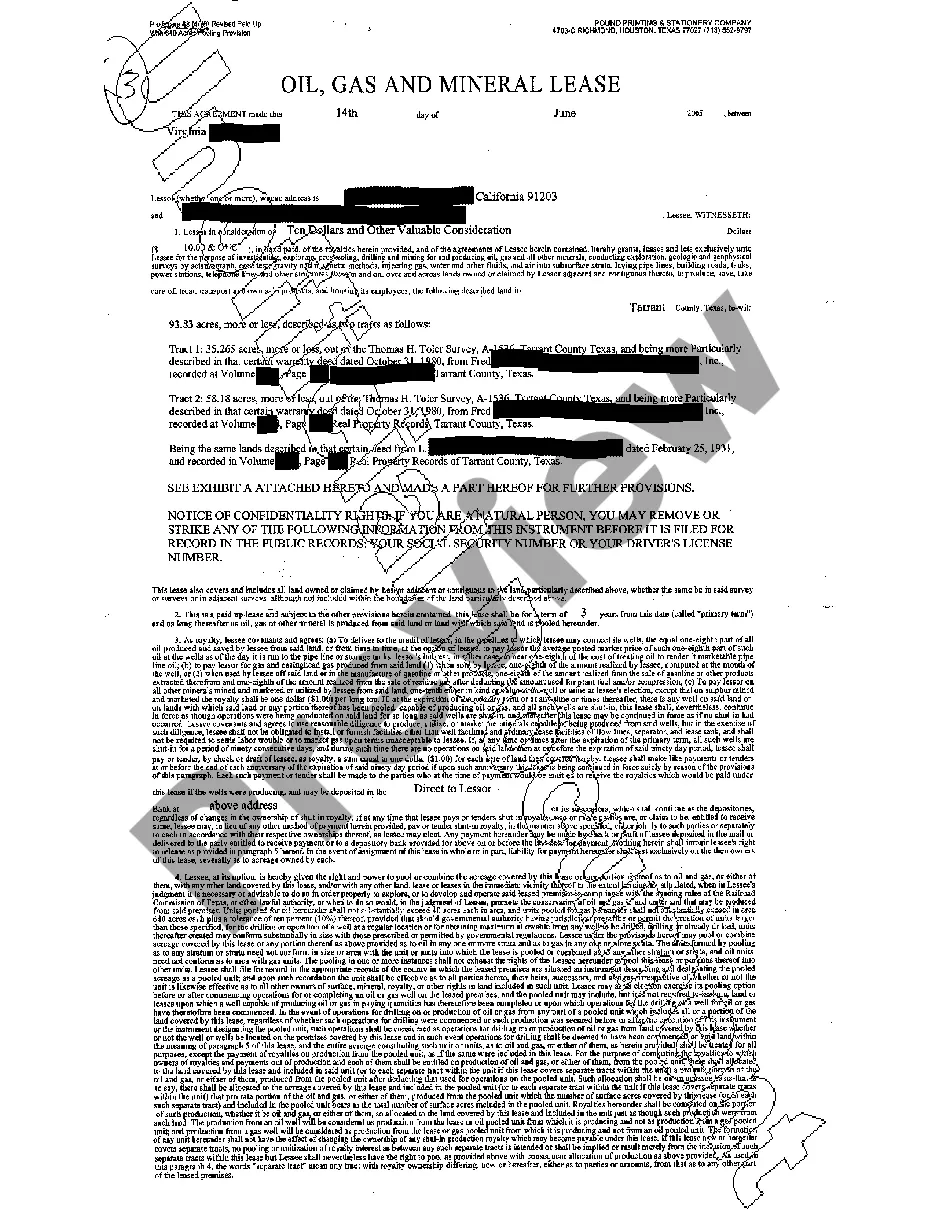

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller.Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

The royalty mineral owner retains ownership of the interest after production stops. Holders of overriding royalty interests have no ownership rights to the minerals under the ground but a non-possessory undivided interest.

A deed that names the seller/donor and the purchaser/donee. It states and describes the rights being sold or given. Filing of the notarized conveyance in the county government office which is generally the county clerk's office.

1. n. Oil and Gas Business A percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.