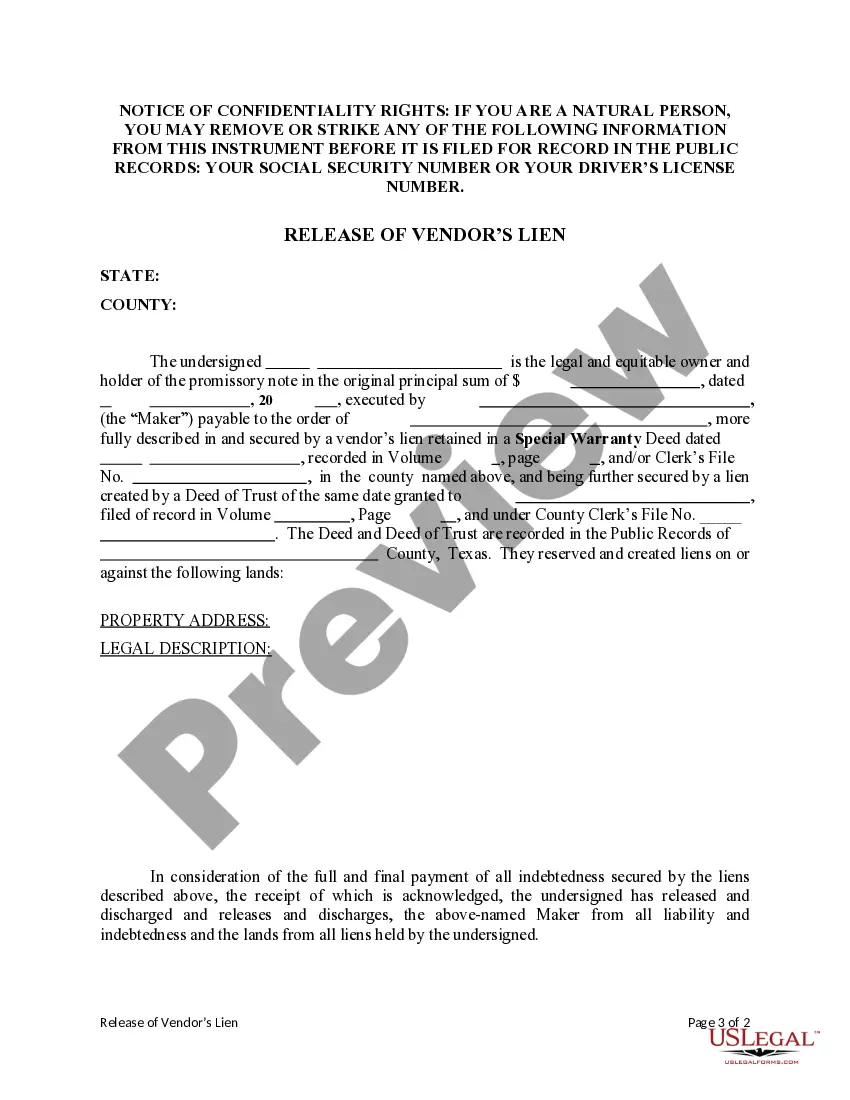

This form is a release of a retained vendor's lien. The lienholder has agreed to release the property from the lien of the deed of trust and discharge all right and title to the property.

Texas Release of Vendor's Lien

Description

Key Concepts & Definitions

Release of Vendor's Lien: This legal process removes a vendor's lien from the title of real property, ensuring the property can be transferred without any claims from the vendor. Real Property relates to land and any structures on it. A vendor's lien is often used in the context of real estate transactions, commonly in states like Texas, and can be integrated into a deed of trust or warranty deed for additional legal clarity and security against financial disputes.

Step-by-Step Guide

- Determine the Type of Lien: Understand whether the lien is a judgment lien, a vendor's lien, or another type. Each type has different release processes.

- Review the Deed: Check the warranty deed or deed of trust for any clauses related to lien releases.

- Obtain Legal Assistance: Consult with a lawyer to ensure that all legal procedures are followed accurately for your state, particularly if the property is in Texas where specific rules about lien texas and real estate apply.

- File a Release: Prepare and file the appropriate release of lien form with the local county office, ensuring that all information is correct and complete.

- Verify Release: Follow up to ensure that the lien release has been properly recorded against the real property, restoring clear title.

Risk Analysis

Financial Risk: Failure to properly release a lien could lead to financial disputes or complications in selling the property. Legal Risks: Incorrect filing of the release or not adhering to state-specific laws (such as those in Texas) can result in legal challenges or invalidation of the release.

Key Takeaways

- Ensuring the release of vendors lien is crucial for clear property title transfer.

- Legal clarity in the form of correct documentation and adherence to state laws, especially in lien-intensive states like Texas, is essential.

- Consultation with legal professionals is recommended for effective handling of the lien release.

FAQ

What is a vendor's lien? A vendor's lien is a right retained by the seller for unpaid purchase money by the buyer, secured against the property sold.

How can I remove a judgment lien from real property? Removing a judgment lien typically requires satisfying the lien through payment or negotiation with the lienholder, followed by filing a release document with the appropriate local authority.

How to fill out Texas Release Of Vendor's Lien?

Get access to quality Texas Release of Vendor's Lien templates online with US Legal Forms. Avoid hours of misused time browsing the internet and dropped money on files that aren’t updated. US Legal Forms provides you with a solution to just that. Find above 85,000 state-specific authorized and tax samples you can save and fill out in clicks in the Forms library.

To get the example, log in to your account and click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started easier:

- See if the Texas Release of Vendor's Lien you’re looking at is appropriate for your state.

- Look at the sample making use of the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to finish creating an account.

- Pick a favored file format to save the document (.pdf or .docx).

Now you can open the Texas Release of Vendor's Lien example and fill it out online or print it out and get it done yourself. Take into account mailing the file to your legal counsel to be certain things are filled out correctly. If you make a error, print and fill sample again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and get access to far more forms.

Form popularity

FAQ

A vendor's lien is a lien in favor of the "vendor" or the seller of real estate. When a warranty deed contains a vendor's lien, the buyer agrees to allow the seller to seize the property until the property is paid for in full.

The subcontractor would file a lien waiver before a lien is filed. By doing so, the subcontractor is giving up his or her right to a lien against the property. In comparison, a lien release (also known as release of lien, cancellation of lien, or a lien cancellation) would come into play after the filing of a lien.

A Lien Release (also considered a Lien Cancellation or Release of Lien) is a legally binding document that is sent by the current lien holder, the individual who has leased the property or provided payment to secure the property, that informs any debt in relation to that property has been fulfilled and they relinquish

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

Add or Remove a Lien on a Vehicle To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.