Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments

What this document covers

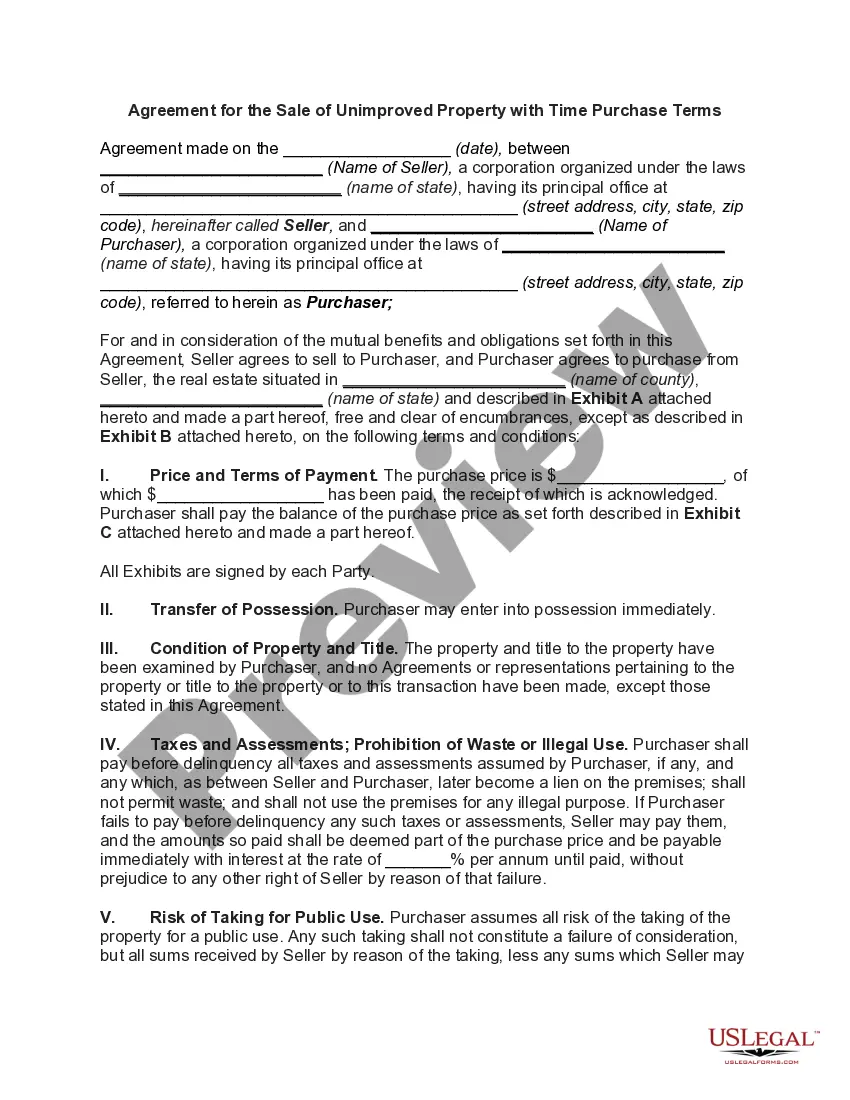

The Contract for Deed Notice of Default by Seller to Purchaser is a critical legal document in Texas that formally notifies a purchaser who has either paid forty percent of the property price or made forty-eight payments that they are not complying with the terms of their contract. This notice outlines the specific defaults and actions required by the purchaser to avoid potential foreclosure, helping both sellers and buyers understand their obligations and rights under Texas law.

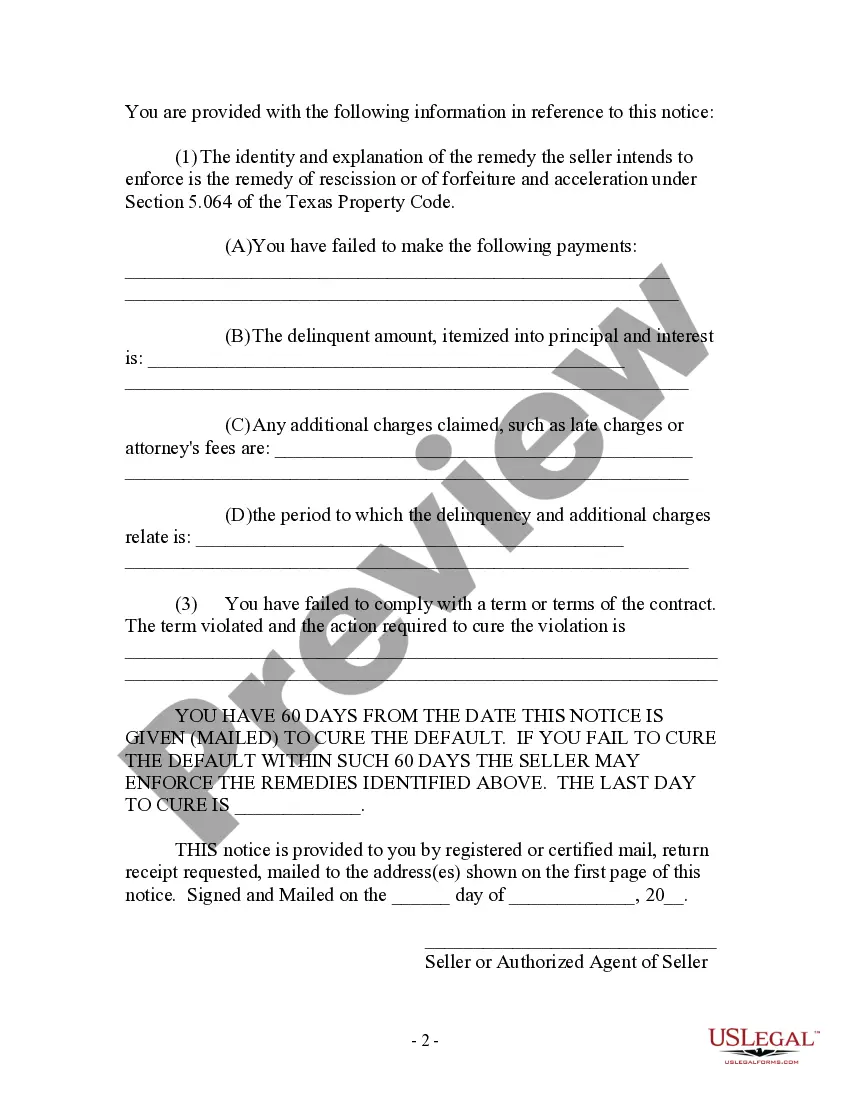

Key parts of this document

- Identification of the seller and purchaser.

- Notification of default and failure to comply with the contract.

- Specification of overdue payments, including principal and interest.

- Details regarding additional charges, such as late fees.

- Instruction for the purchaser to cure the default within sixty days.

- Signing and mailing information for legal delivery.

Situations where this form applies

This form should be used when a seller needs to officially notify a purchaser of a default under a contract for deed. Common scenarios include when the purchaser has missed payments or failed to fulfill other contractual obligations. It is important for sellers to provide this notice to preserve their rights to initiate foreclosure proceedings if the purchaser does not cure the default within the specified timeframe.

Intended users of this form

- Sellers who have entered into a contract for deed with a purchaser.

- Purchasers who have made significant payments but have fallen behind on their obligations.

- Legal representatives of sellers needing to ensure compliance with tenant rights and notification laws.

Completing this form step by step

- Identify the parties involved by entering their names and addresses.

- Specify the terms of the default, including missed payments and any additional charges.

- Enter the deadline for curing the default, ensuring it aligns with the sixty-day requirement.

- Sign the notice, ensuring it is sent via registered or certified mail for legal compliance.

- Keep a copy of the notice for your records.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Failing to accurately list the amounts due, including principal and interest.

- Not providing the correct deadline for curing the default.

- Omitting required signatures or mailing details.

- Sending the notice through non-traceable methods.

Why use this form online

- Instant access to a legally vetted notice template prepared by licensed attorneys.

- Convenient download option allows for quick and easy use.

- Editable fields make it easy to customize the form to suit specific situations.

- Reduces the risk of errors compared to handwritten forms.

Jurisdiction-specific notes

This form is designed to meet the legal standards and requirements specified under Texas law, particularly regarding contracts for deed. It reflects the unique provisions of the Texas Property Code, ensuring that both parties are adequately informed of their rights and obligations.

Form popularity

FAQ

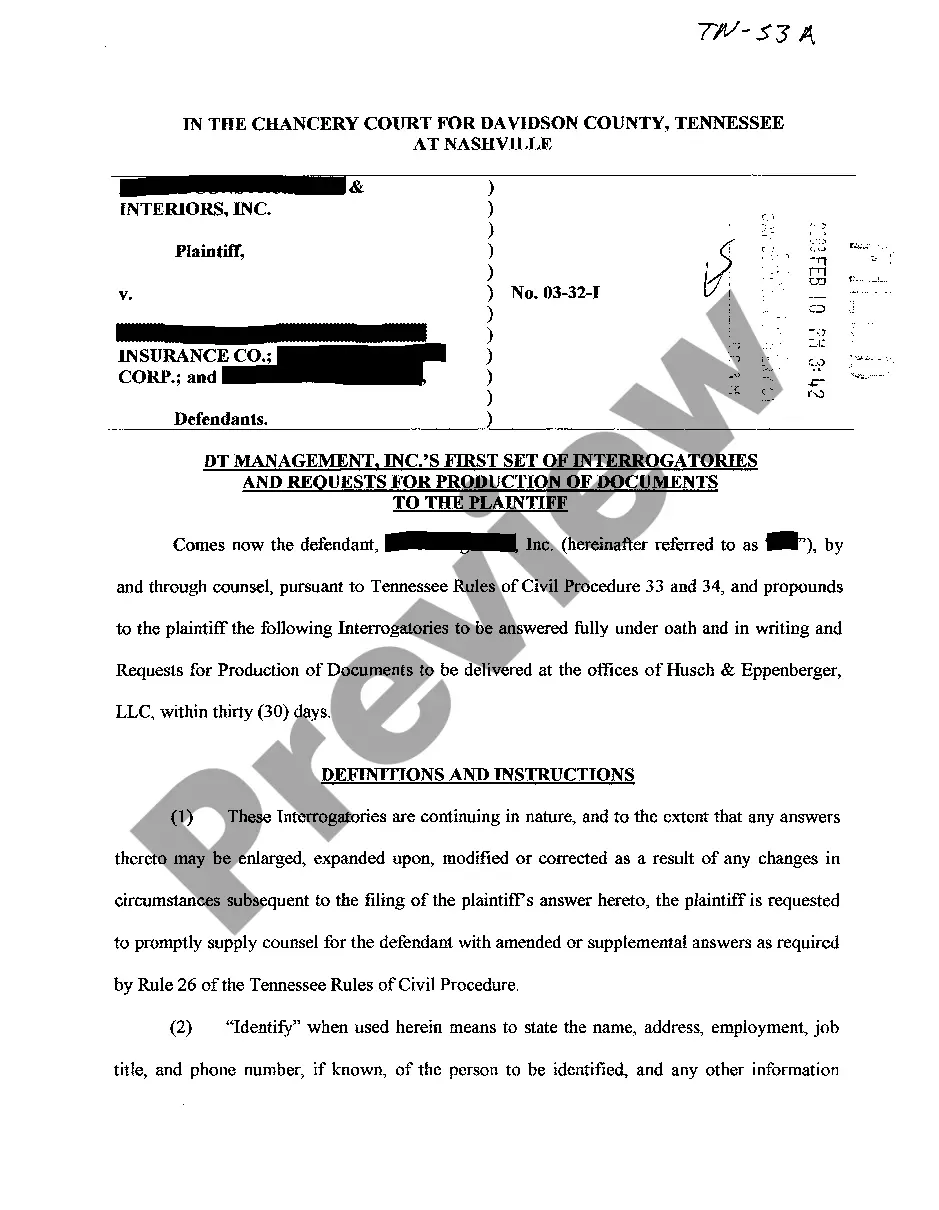

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

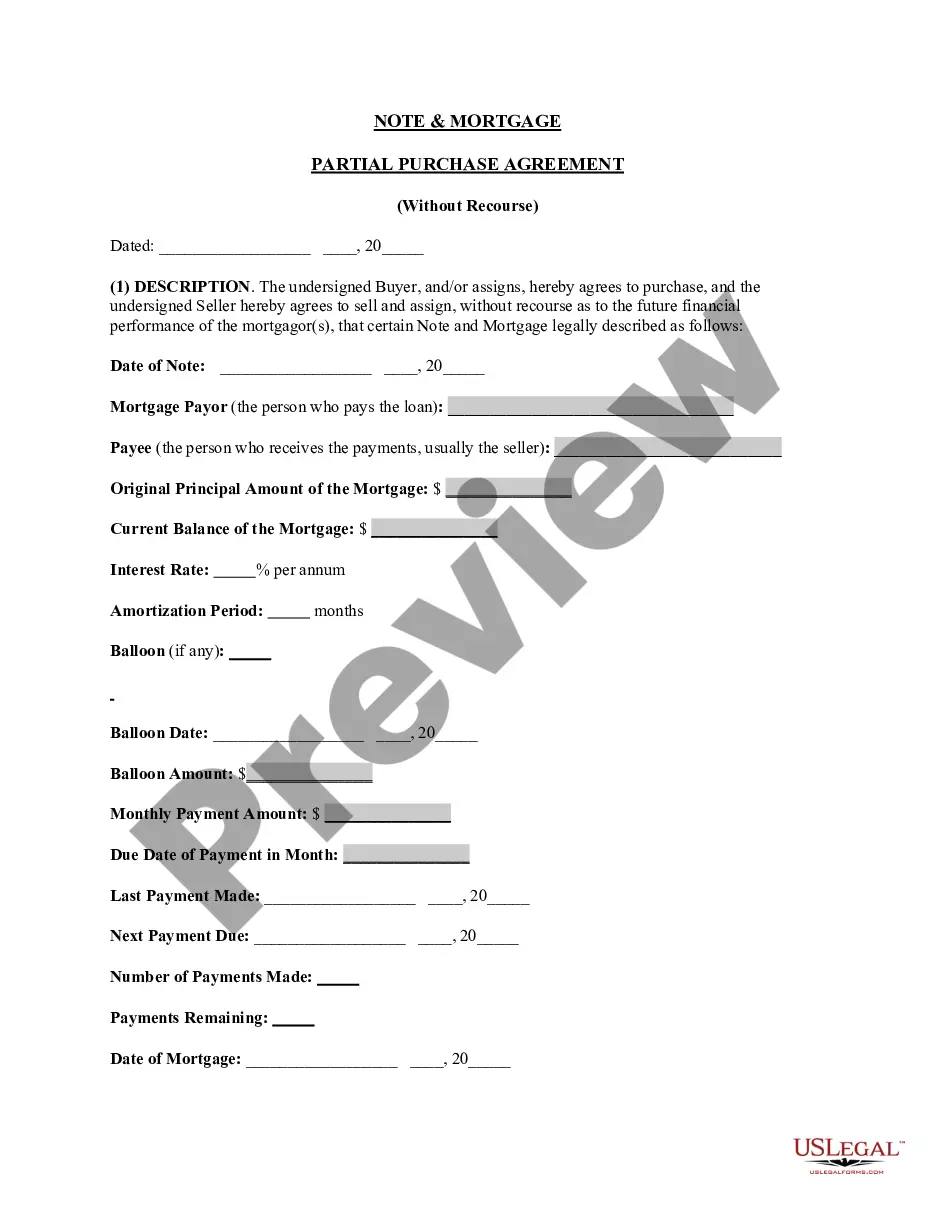

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.

If a seller defaults, he must return all deposits, plus added reasonable expenses, to the buyer. The other party may also seek to compel the erring party to complete the deal under specific performance. From a buyer's point of view, it is advisable to get the sale agreement registered.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

A contract for deed is a different form of seller-finance. In a contract for deed, the seller keeps the title to the property and the buyer does not receive a deed to the property.In Texas, contracts for deed on residential property are considered potentially predatory and subject to strict consumer-protection laws.