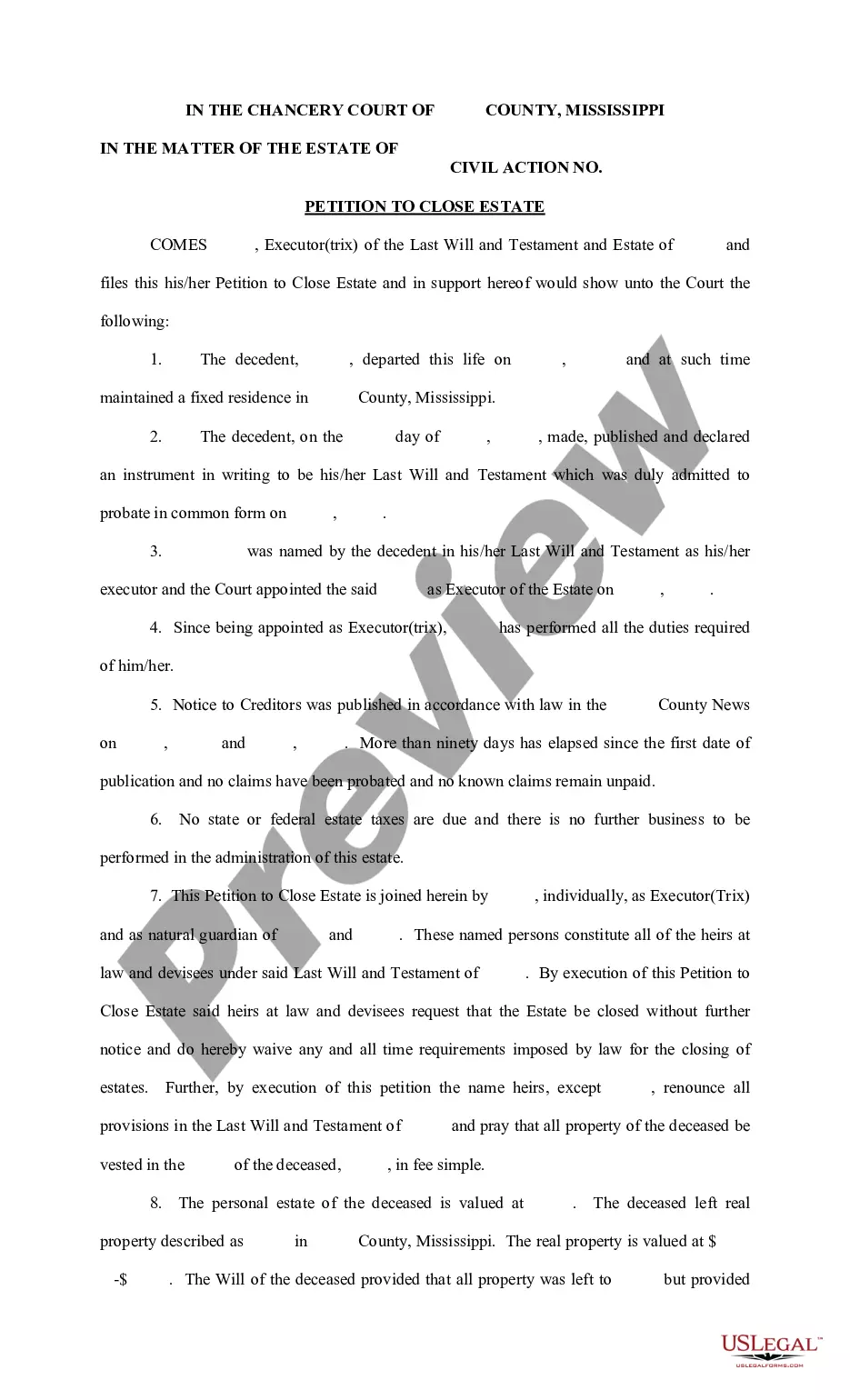

A Conversion of Reserved Overriding Royalty Interest to Working Interest form. The assignee shall be entitled to recover, out of the total proceeds derived from the sale of oil and gas produced from each well drilled and completed as a well capable of producing oil or gas in paying quantities on the Land, the total cost of drilling, completing, and equipping such well together with the cost of operating such well until the time of such recovery.

Tennessee Conversion of Reserved Overriding Royalty Interest to Working Interest

Description

How to fill out Conversion Of Reserved Overriding Royalty Interest To Working Interest?

If you want to comprehensive, download, or produce lawful papers layouts, use US Legal Forms, the greatest variety of lawful varieties, which can be found online. Make use of the site`s simple and easy convenient search to get the files you require. A variety of layouts for enterprise and personal uses are sorted by classes and suggests, or key phrases. Use US Legal Forms to get the Tennessee Conversion of Reserved Overriding Royalty Interest to Working Interest with a few clicks.

Should you be presently a US Legal Forms client, log in in your bank account and click on the Obtain switch to find the Tennessee Conversion of Reserved Overriding Royalty Interest to Working Interest. You may also accessibility varieties you earlier acquired within the My Forms tab of the bank account.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for that appropriate area/country.

- Step 2. Make use of the Review option to look through the form`s articles. Don`t forget about to learn the information.

- Step 3. Should you be not satisfied together with the type, utilize the Search discipline on top of the screen to discover other models from the lawful type design.

- Step 4. When you have found the shape you require, click on the Buy now switch. Opt for the costs strategy you like and add your qualifications to register for the bank account.

- Step 5. Process the transaction. You can utilize your charge card or PayPal bank account to perform the transaction.

- Step 6. Pick the structure from the lawful type and download it on your product.

- Step 7. Comprehensive, modify and produce or indicator the Tennessee Conversion of Reserved Overriding Royalty Interest to Working Interest.

Every lawful papers design you buy is the one you have forever. You may have acces to every single type you acquired with your acccount. Click the My Forms portion and pick a type to produce or download again.

Compete and download, and produce the Tennessee Conversion of Reserved Overriding Royalty Interest to Working Interest with US Legal Forms. There are millions of professional and express-certain varieties you may use for the enterprise or personal requirements.

Form popularity

FAQ

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

The value of a royalty interest is derived from expected future revenues generated by leasing and/or production, which are largely determined by oil and gas market prices and the current drilling environment.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty is ?carved out of? the working interest. If ABC Oil Company acquires an oil and gas lease covering Blackacre that reserves a 25% royalty, ABC has a 75% net revenue interest. ABC can convey a share of that net revenue interest as a royalty.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.