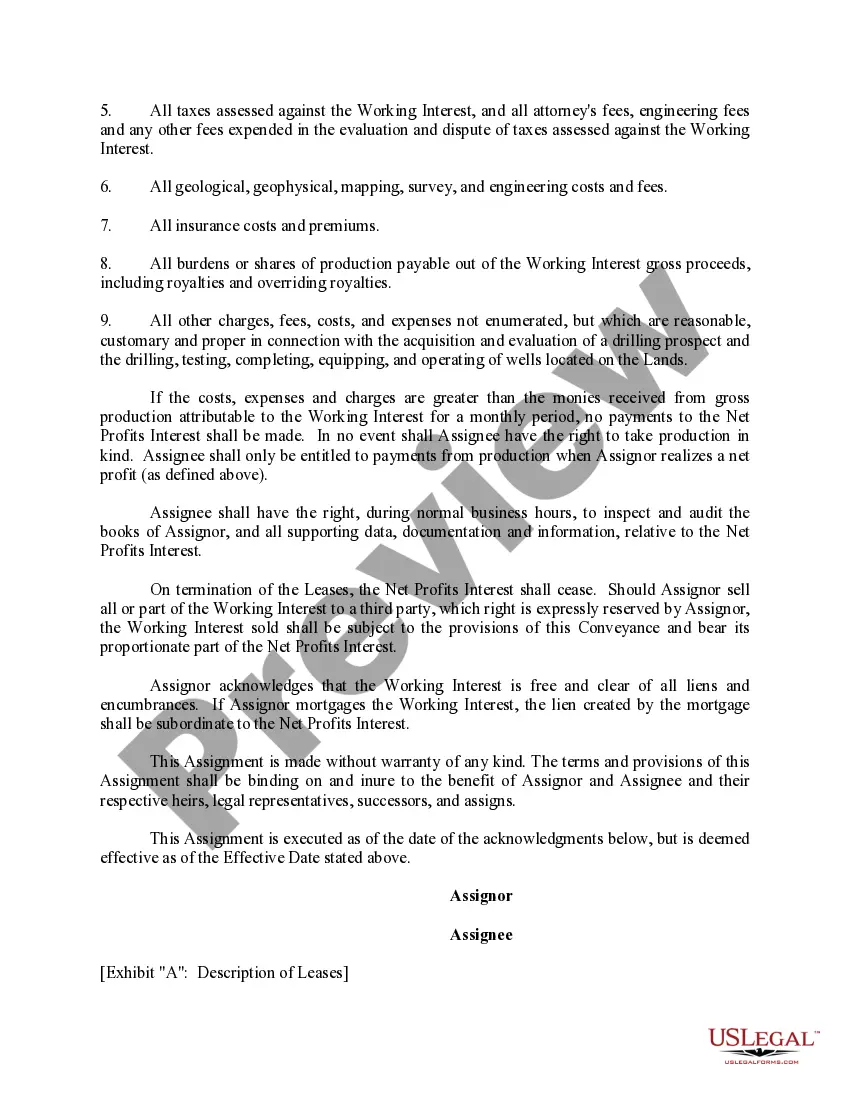

This form is used when Assignor grants, assigns, and conveys to Assignee a percentage of the net profit interest in the Working Interest. The Net Profits Interest is the stated percentage interest in the share of monies payable for gross production attributable to the Working Interest less the costs and expenses attributable to the Working Interest.

Tennessee Assignment of Net Profits Interest

Description

How to fill out Assignment Of Net Profits Interest?

You are able to invest time online searching for the lawful document design which fits the state and federal specifications you will need. US Legal Forms gives 1000s of lawful forms which are examined by professionals. It is simple to download or produce the Tennessee Assignment of Net Profits Interest from the service.

If you already possess a US Legal Forms profile, it is possible to log in and click on the Down load button. Following that, it is possible to full, edit, produce, or indicator the Tennessee Assignment of Net Profits Interest. Every single lawful document design you buy is yours forever. To acquire one more version of the acquired kind, visit the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms website the very first time, keep to the straightforward guidelines listed below:

- Initially, be sure that you have selected the proper document design for your state/town of your liking. Look at the kind explanation to ensure you have picked the appropriate kind. If accessible, utilize the Preview button to check from the document design at the same time.

- If you wish to locate one more version in the kind, utilize the Research field to find the design that suits you and specifications.

- When you have located the design you desire, click Acquire now to continue.

- Pick the prices strategy you desire, type in your credentials, and register for an account on US Legal Forms.

- Complete the deal. You may use your charge card or PayPal profile to fund the lawful kind.

- Pick the format in the document and download it in your system.

- Make alterations in your document if required. You are able to full, edit and indicator and produce Tennessee Assignment of Net Profits Interest.

Down load and produce 1000s of document layouts making use of the US Legal Forms site, which provides the greatest selection of lawful forms. Use skilled and state-particular layouts to deal with your organization or person demands.

Form popularity

FAQ

A profits interest serves as an incentive for partners to become more proactive in pursuing greater profitability, thus contributing to the companies' growth. It also provides a tax benefit to recipients, as all appreciation in value is taxed as long-term capital gains rather than as ordinary income. Profits Interest: Definition and Comparison to Capital Interest Investopedia ? ... ? Investing Basics Investopedia ? ... ? Investing Basics

A profits interest is an equity-like form of compensation that limited liability companies (LLCs) can offer to employees and other service providers. The value of a profits interest is based on the growing value of the LLC, which allows employees (or ?partners?) to benefit from the LLC's appreciation in value. Profits Interests for LLCs: What to Know - Carta Carta ? blog ? llcs-what-to-know-about-pr... Carta ? blog ? llcs-what-to-know-about-pr...

Example 1: Profits interest ? Let's say that the company is worth $1,000,000 and has $50,000 in annual profits. A worker with a 10% interest grant doesn't have any interest in the company's current market value, but they do have a 10% interest in annual profits, which equates to $5,000. The Complete Guide to Profits Interest - insightsoftware insightsoftware ? blog ? the-complete-guid... insightsoftware ? blog ? the-complete-guid...

Profits Interest. A partnership interest that gives the owner the right to receive a percentage of future profits (but not existing capital) from the partnership. A profits interest is commonly granted to a ?service partner? in exchange for his or her services.

The grant of the profits interest should not result in any taxable income to the recipient. A profits interest may be initially granted as a fully vested or may vest based on continued service or the achievement of business benchmarks related to the partnership's operations. Profits interest grants ? basics - DLA Piper Accelerate DLA Piper Accelerate ? knowledge ? pr... DLA Piper Accelerate ? knowledge ? pr...

A private non-profit institution (NPI) is defined as a legal or social entity acting for the purpose of producing goods and services whose status does not permit them to be a source of income, profit or other financial gains for the units that establish, control or finance them.

A net profits interest is an agreement that provides a payout of an operation's net profits to the parties of the agreement. It is a non-operating interest that may be created when the owner of a property, typically an oil and gas property, leases it out to another party for development and production.