Tennessee Option and Site Lease (Telecommunication Facilities)

Description

How to fill out Option And Site Lease (Telecommunication Facilities)?

Are you within a situation where you require papers for either enterprise or specific reasons virtually every day? There are plenty of legitimate papers web templates accessible on the Internet, but getting types you can rely on is not simple. US Legal Forms offers 1000s of kind web templates, much like the Tennessee Option and Site Lease (Telecommunication Facilities), that happen to be published to meet federal and state requirements.

When you are already acquainted with US Legal Forms internet site and get your account, simply log in. After that, you may down load the Tennessee Option and Site Lease (Telecommunication Facilities) template.

If you do not come with an profile and want to begin to use US Legal Forms, follow these steps:

- Obtain the kind you want and ensure it is for the proper town/area.

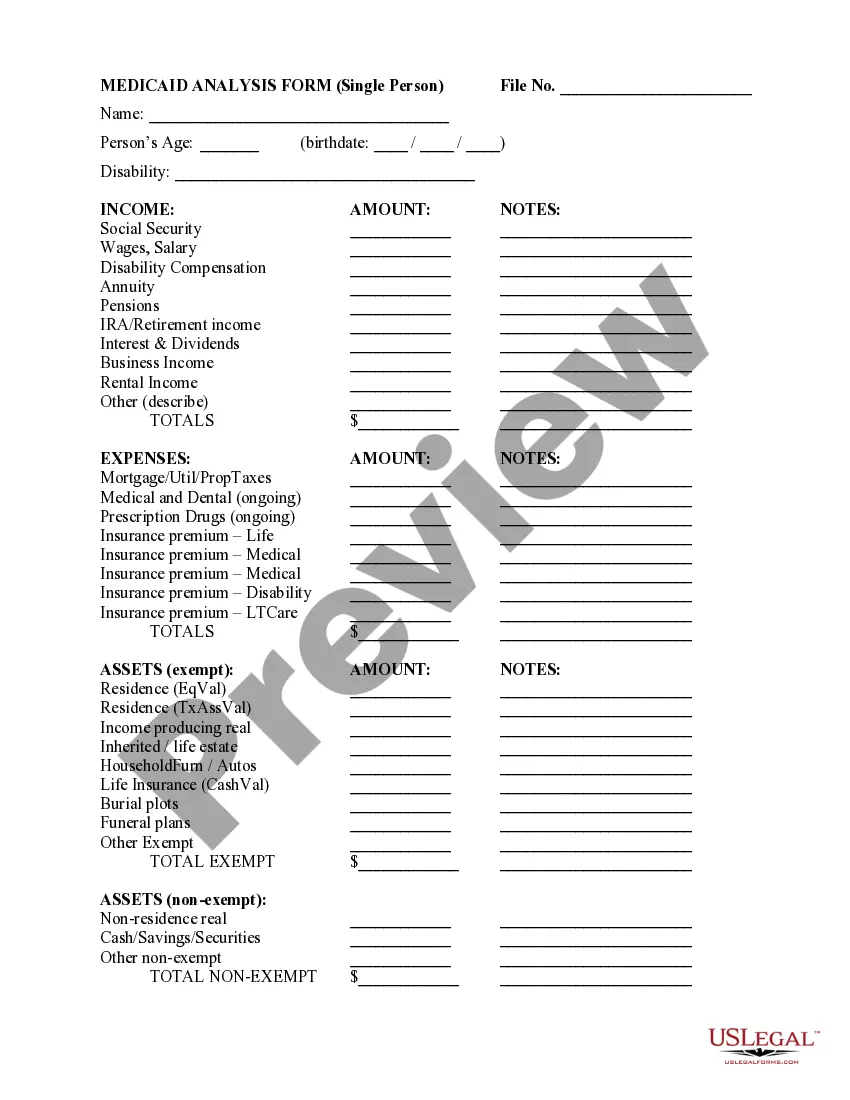

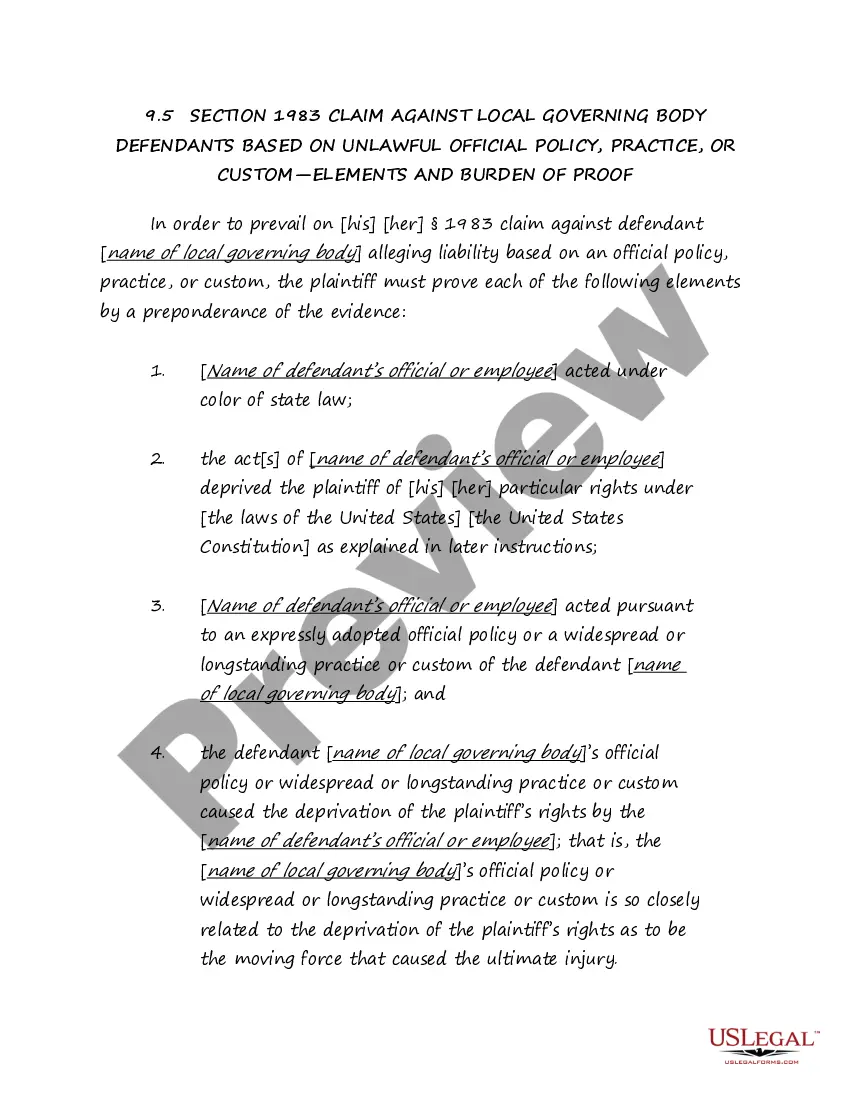

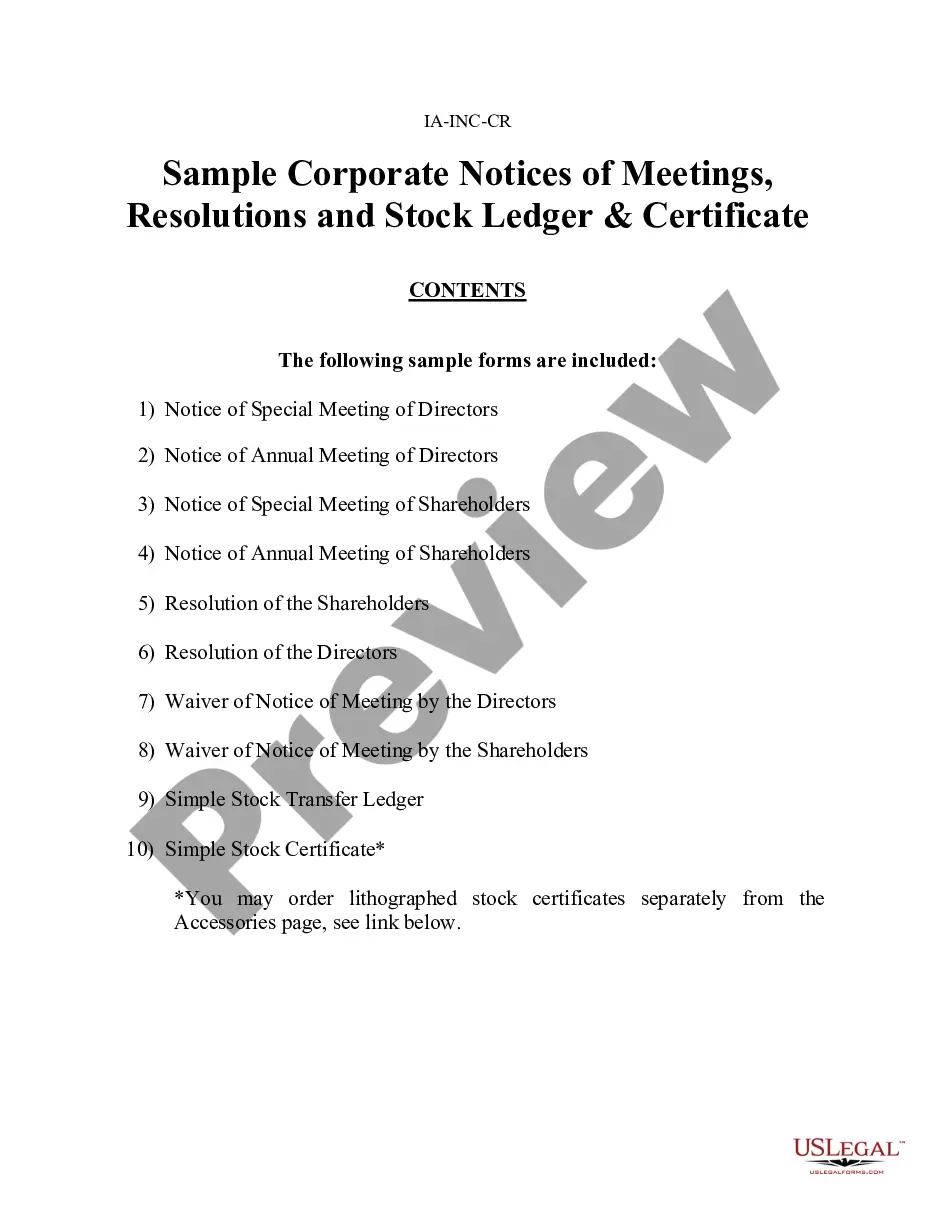

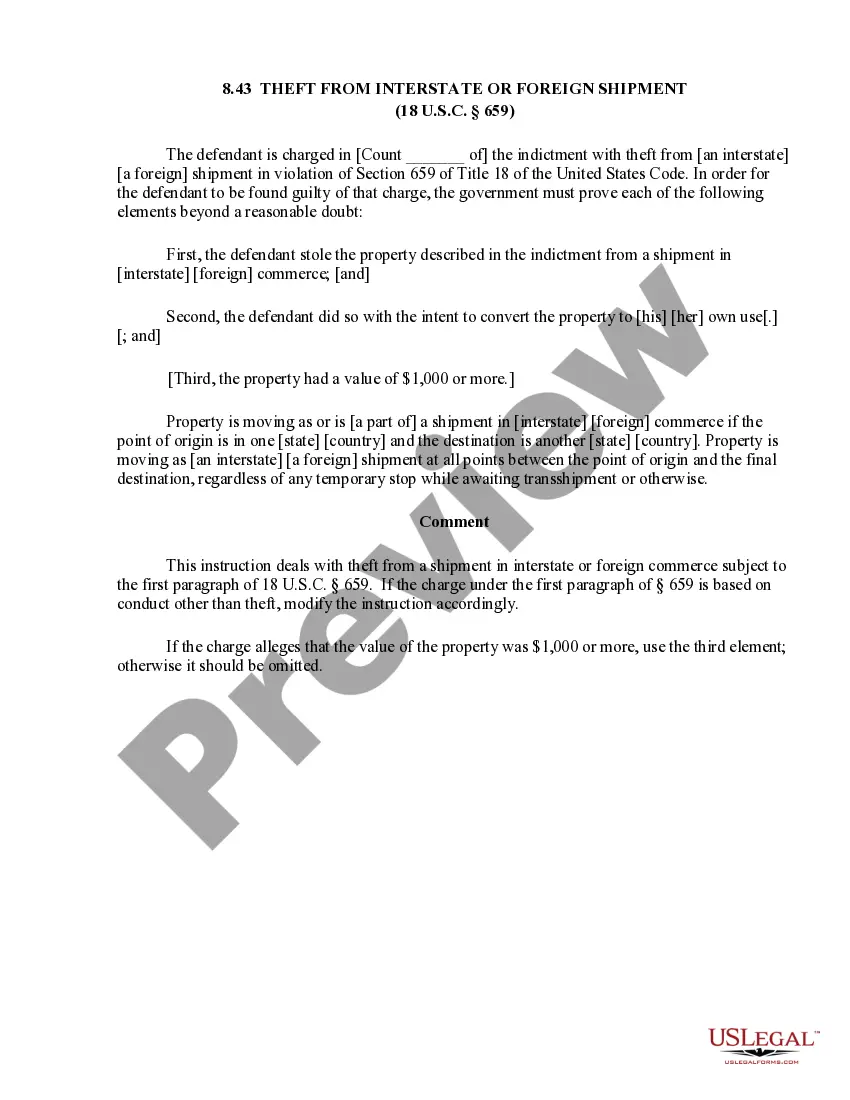

- Make use of the Preview button to review the form.

- Read the explanation to ensure that you have chosen the right kind.

- In case the kind is not what you are trying to find, use the Research industry to discover the kind that meets your requirements and requirements.

- If you find the proper kind, click on Get now.

- Opt for the costs program you desire, complete the necessary information to produce your money, and purchase an order utilizing your PayPal or bank card.

- Choose a practical data file formatting and down load your copy.

Locate every one of the papers web templates you may have bought in the My Forms food selection. You can obtain a extra copy of Tennessee Option and Site Lease (Telecommunication Facilities) any time, if necessary. Just go through the required kind to down load or printing the papers template.

Use US Legal Forms, one of the most substantial selection of legitimate varieties, in order to save time and stay away from faults. The service offers expertly created legitimate papers web templates which can be used for an array of reasons. Make your account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

In Tennessee, services that are generally not subjected to either sales or use taxes include data processing, information services, and management consulting services. Businesses that offer management consulting or management services are required to pay a local gross receipts tax. Are Services Taxable in Tennessee - UpCounsel upcounsel.com ? are-services-taxable-in-ten... upcounsel.com ? are-services-taxable-in-ten...

Generally sales or use tax is imposed on all leases and rentals of tangible personal property; however, if an owner of property maintains continuous supervision over the item being leased and furnishes an operator or crew to operate it, the owner is rendering a service which is not subject to sales or use tax. (Tenn. Leasing of Tangible Personal Property - TN.gov tn.gov ? documents ? notices ? sales ? lease tn.gov ? documents ? notices ? sales ? lease

The taxes apply to corporations, limited partnerships, limited liability companies (LLCs), and business trusts that are chartered, qualified, or registered in Tennessee or are doing business in the state. Sole proprietors and general partnerships aren't subject to either tax.

LLCs taxed as C-corp C-corps will pay the 21% federal corporate income tax as well as Tennessee's 6.5% corporate income tax.

Certain entities under specific circumstances are exempt from paying the business tax. These may include, but are not limited to, people acting as employees, manufacturers, religious and charitable entities selling donated items, direct-to-home satellite providers, and movie theaters.

Classification 3 is for service businesses. Some businesses that provide services are listed in this section as exempt and are not required to have a business license. Classifications - TN.gov tn.gov ? revenue ? taxes ? business-tax ? cla... tn.gov ? revenue ? taxes ? business-tax ? cla...

Obtain a Business License The licenses vary based upon gross sales thresholds, which are as follows: No business license: Under $3,000 in gross sales. Minimum activity license: Between $3,000 and $100,000* in gross sales. A business tax account and filing are not required with a minimum activity license.

Remote sellers who meet the economic nexus threshold in TN must register and remit sales and use tax. ? Economic nexus sales threshold: $100,000 within 12-month period, after July 31,2020. Local tax is collected at the local jurisdictional rate* where the sale is shipped or delivered. Out-of-State Businesses and Nexus in TN tn.gov ? revenue ? misc ? nexuswebinar2022 tn.gov ? revenue ? misc ? nexuswebinar2022