Tennessee Self-Employed Route Sales Contractor Agreement

Description

How to fill out Self-Employed Route Sales Contractor Agreement?

Have you ever been in a situation where you need documentation for various business or personal reasons nearly every day.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

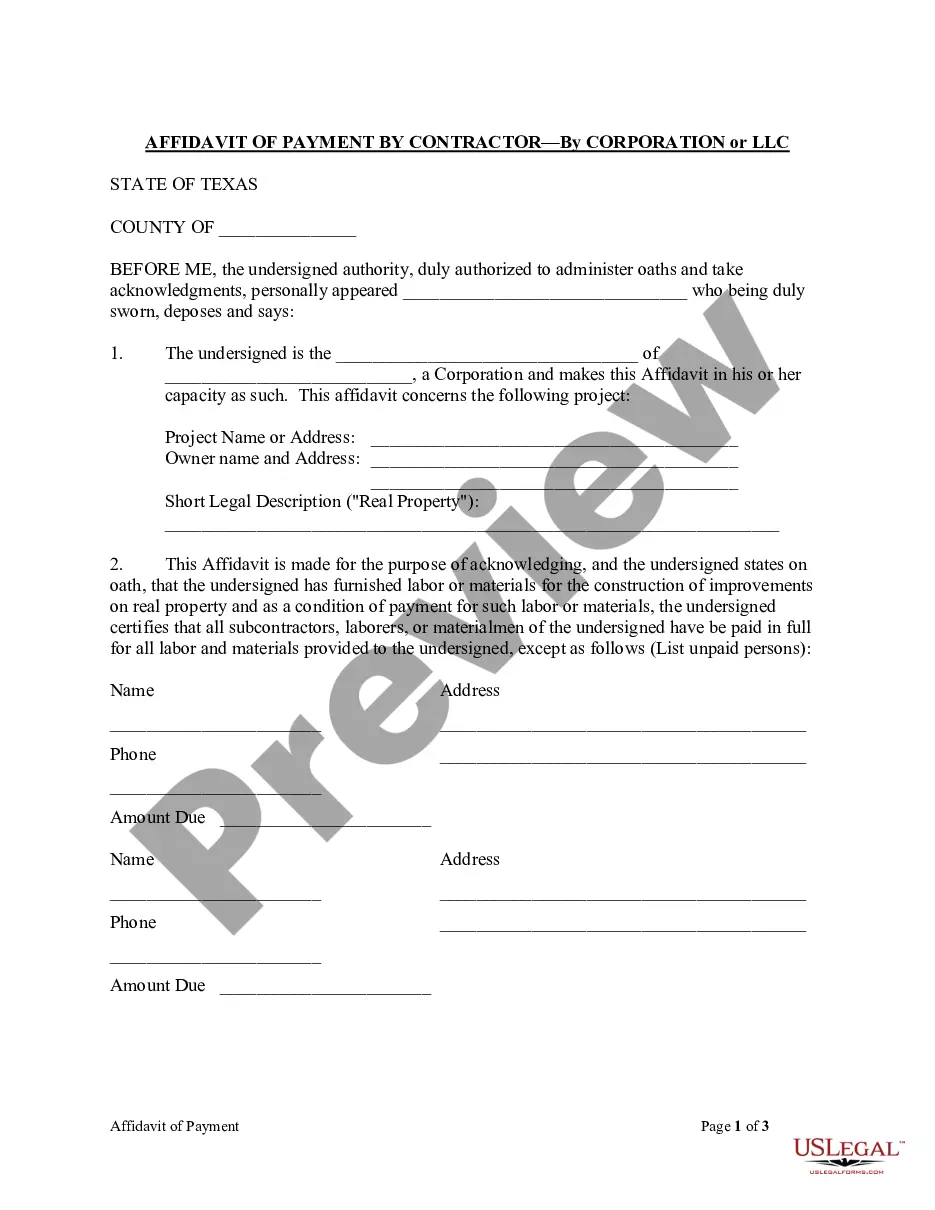

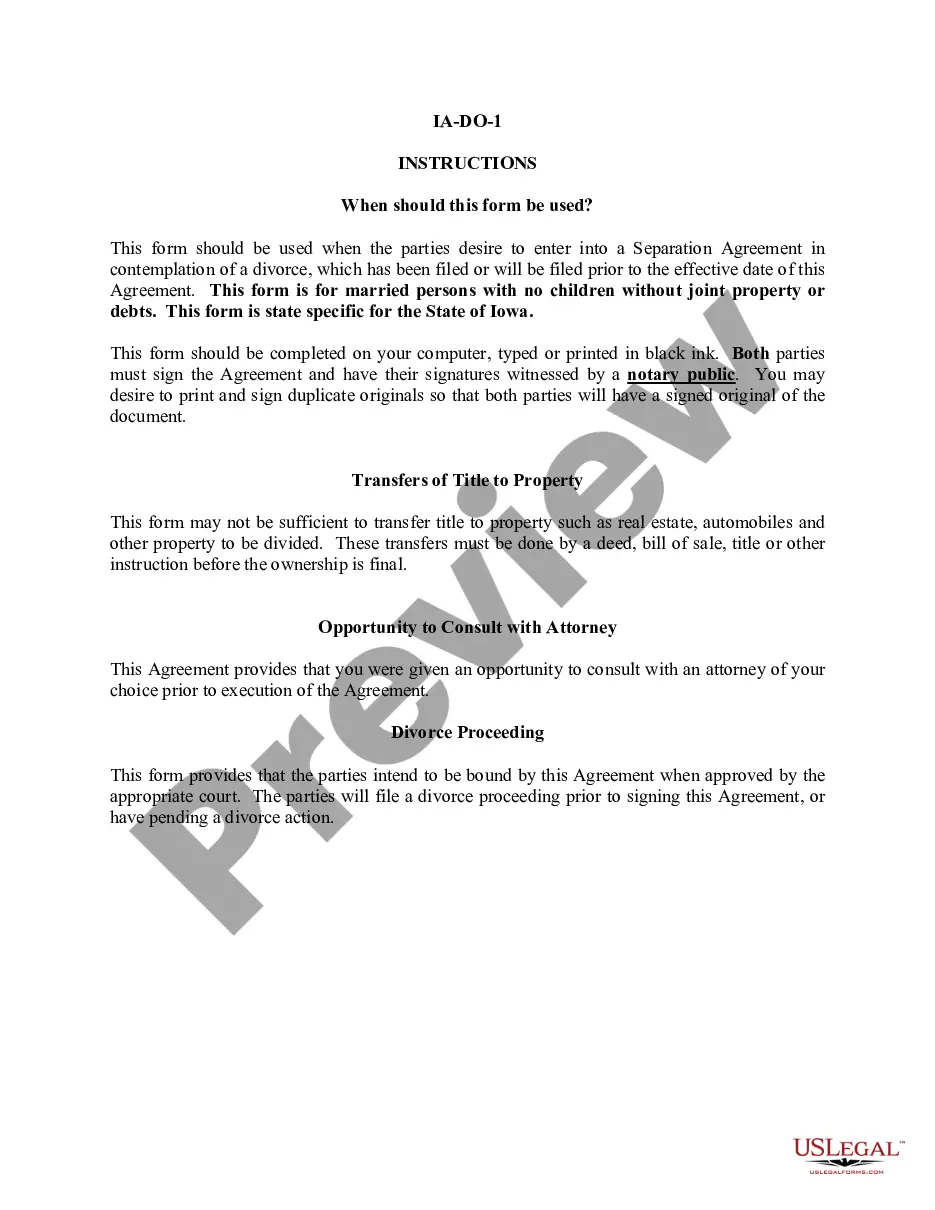

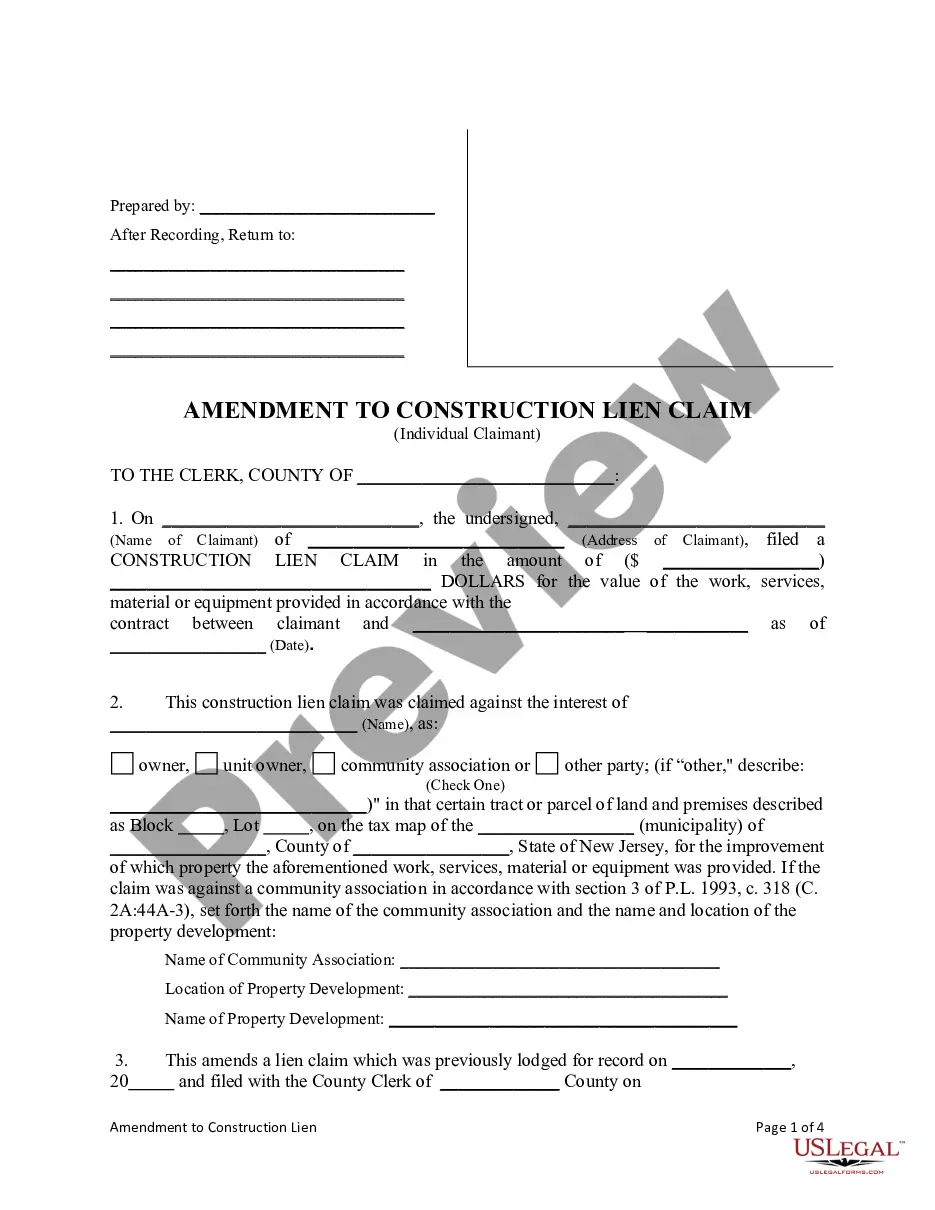

US Legal Forms offers thousands of template documents, such as the Tennessee Self-Employed Route Sales Contractor Agreement, designed to meet federal and state regulations.

Once you locate the appropriate document, simply click Acquire now.

Choose the payment plan you prefer, complete the required details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Self-Employed Route Sales Contractor Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct city/state.

- Use the Preview button to review the document.

- Check the description to confirm that you have selected the correct form.

- If the document is not what you are looking for, utilize the Search field to find the template that meets your needs.

Form popularity

FAQ

An independent contractor agreement in Tennessee is a legal document that outlines the working relationship between a contractor and a client. It details the services provided, payment terms, and the rights and obligations of each party. The Tennessee Self-Employed Route Sales Contractor Agreement is tailored for those in specific sales roles, ensuring compliance with state regulations.

When filling out an independent contractor agreement, begin by entering the names and addresses of both parties. Next, specify the work to be done, payment details, and deadlines. The Tennessee Self-Employed Route Sales Contractor Agreement available on US Legal Forms provides a clear layout, which helps you ensure all critical elements are included.

Filling out an independent contractor form involves providing accurate information about your business and the services offered. Be sure to include your name, contact details, and any relevant tax identification numbers. Using the Tennessee Self-Employed Route Sales Contractor Agreement form from US Legal Forms will guide you through the necessary sections, making the process straightforward.

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and duration of the contract. Include any specific responsibilities and rights for both parties. Utilizing the Tennessee Self-Employed Route Sales Contractor Agreement template from US Legal Forms can simplify this process, ensuring you cover all necessary legal aspects.

Creating an independent contractor agreement involves outlining key terms such as scope of work, payment details, and confidentiality clauses. It’s important to ensure that the agreement meets both federal and state laws. Using a platform like USLegalForms can simplify this process by providing templates for a Tennessee Self-Employed Route Sales Contractor Agreement that you can customize to fit your specific needs.

In Tennessee, a contract is legally binding when it involves an offer, acceptance, and consideration. Additionally, both parties must have the legal capacity to enter into the agreement, and the contract must serve a lawful purpose. Utilizing a Tennessee Self-Employed Route Sales Contractor Agreement helps ensure that all these elements are properly addressed.

Legal requirements for independent contractors vary by state but typically include the need for a written agreement and compliance with tax obligations. In Tennessee, a well-crafted Tennessee Self-Employed Route Sales Contractor Agreement can help clarify these requirements and ensure both parties adhere to the law. It’s vital to consult legal resources to ensure full compliance.

In the United States, an independent contractor must earn at least $600 in a calendar year from a single client to receive a 1099 form. This form is essential for reporting income to the IRS. If you are drafting a Tennessee Self-Employed Route Sales Contractor Agreement, be sure to account for this income threshold in your payment terms.

The new federal rule aims to clarify the classification of independent contractors versus employees. It emphasizes the importance of the degree of control a business has over the worker and their tasks. Understanding this rule is crucial for ensuring compliance, especially for those using a Tennessee Self-Employed Route Sales Contractor Agreement.

An independent contractor agreement serves as a formal contract between a business and an individual who provides services. This document clearly outlines the terms of engagement, responsibilities, and payment details. By having a Tennessee Self-Employed Route Sales Contractor Agreement, both parties can establish expectations, reduce misunderstandings, and protect their interests.