Tennessee Collections Agreement - Self-Employed Independent Contractor

Description

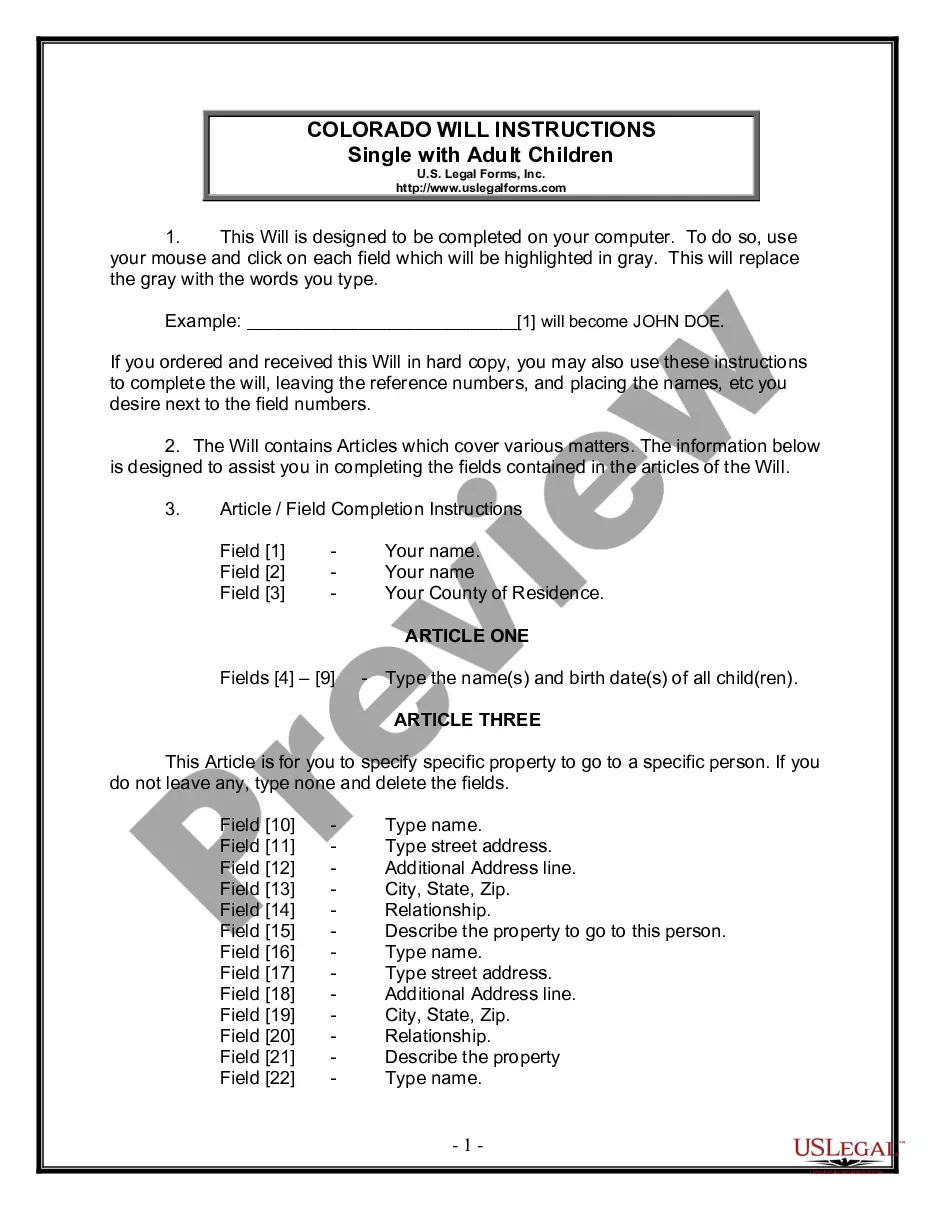

How to fill out Collections Agreement - Self-Employed Independent Contractor?

Have you found yourself in a situation where you need documents for both professional or personal purposes every single day? There are numerous legal document templates available online, but locating ones you can rely on isn't easy. US Legal Forms provides a vast array of form templates, such as the Tennessee Collections Agreement - Self-Employed Independent Contractor, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Tennessee Collections Agreement - Self-Employed Independent Contractor template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Get the form you need and ensure it is for the correct city/county. Use the Review button to evaluate the form. Check the details to confirm you have selected the right form. If the form isn’t what you are looking for, use the Lookup field to find the form that suits your needs and requirements. Once you find the correct form, click Buy now. Choose the pricing plan you want, enter the necessary information to create your account, and complete the purchase using your PayPal or credit card. Select a convenient document format and download your copy.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Find all the document templates you have purchased in the My documents section.

- You can obtain another copy of the Tennessee Collections Agreement - Self-Employed Independent Contractor at any time if needed.

- Just click on the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

- The service offers professionally crafted legal document templates that can be used for various purposes.

- Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

The legal requirements for independent contractors in Tennessee include properly completing and submitting their taxes, maintaining necessary licenses, and following labor laws. Also, having a clearly defined Tennessee Collections Agreement - Self-Employed Independent Contractor can outline expectations and compliance for all parties involved. It’s wise to keep updated on any changes in state regulations to ensure ongoing compliance.

In Tennessee, the amount of work you can perform without a contractor's license depends on the project's scope. Generally, if your project costs less than $25,000, you do not need a license. However, if your work exceeds this threshold, you must obtain the necessary licensing. Being aware of these regulations can help you avoid potential legal issues in your independent contractor career.

A basic independent contractor agreement outlines the essential terms of the working relationship between the contractor and the client. It includes key details such as job description, payment structure, deadlines, and confidentiality agreements. You can enhance your agreement by incorporating elements specific to your field, which can be easily done with a Tennessee Collections Agreement - Self-Employed Independent Contractor template from USLegalForms.

An independent contractor agreement in Tennessee is a legal document that defines the working relationship between a contractor and a client. It typically includes details about the work to be performed, payment terms, and the rights and responsibilities of both parties. This agreement is crucial for clearly establishing your status as a self-employed individual, which is why using a proper template can be beneficial.

As an independent contractor in Tennessee, receiving payments can be achieved through various methods. You can invoice your clients directly, use online payment platforms, or even set up direct bank transfers. Keep in mind that having a structured payment schedule outlined in your Tennessee Collections Agreement - Self-Employed Independent Contractor can help clarify payment expectations and reduce misunderstandings.

Creating an independent contractor agreement in Tennessee is straightforward. Start by outlining the scope of work, payment terms, and the timeline for project completion. Make sure to include clauses for confidentiality, termination, and dispute resolution. Using a template, like those available on USLegalForms, can simplify the process and ensure you cover all essential components.

Writing an independent contractor agreement involves outlining the key terms of your working relationship. Begin with a clear introduction that identifies both parties and summarizes the scope of work. Include payment details, duration of the project, and dispute resolution methods to protect both sides. A Tennessee Collections Agreement - Self-Employed Independent Contractor template can serve as a helpful starting point to ensure all necessary elements are included.

To fill out an independent contractor form, gather all necessary information like your business name, address, and tax identification number. Clearly describe the services you will provide, alongside the agreed payment terms. Don't forget to review the form for completeness, as accuracy is key in a Tennessee Collections Agreement - Self-Employed Independent Contractor. Additionally, using a reliable platform can help simplify the process.

Filling out an independent contractor agreement requires careful attention to detail. Start with your personal information and that of your client, and then include the scope of work you will perform. Be sure to specify payment terms, deadlines, and any confidentiality agreements. Utilizing a Tennessee Collections Agreement - Self-Employed Independent Contractor template can streamline the process and ensure you don’t miss critical details.

As a self-employed independent contractor in Tennessee, you'll typically need to complete essential paperwork such as a Tennessee Collections Agreement - Self-Employed Independent Contractor. This document outlines the terms of your work, payment structure, and obligations. It's also advisable to maintain records of invoices and any other agreements related to your projects. By organizing your paperwork upfront, you ensure a smoother workflow and clearer communication with clients.