Tennessee Coaching Services Contract - Self-Employed

Description

How to fill out Coaching Services Contract - Self-Employed?

It is feasible to invest multiple hours online trying to locate the authentic document template that meets the state and federal requirements you will need.

US Legal Forms offers an extensive collection of legitimate forms that are reviewed by experts.

You can easily download or print the Tennessee Coaching Services Contract - Self-Employed from our service.

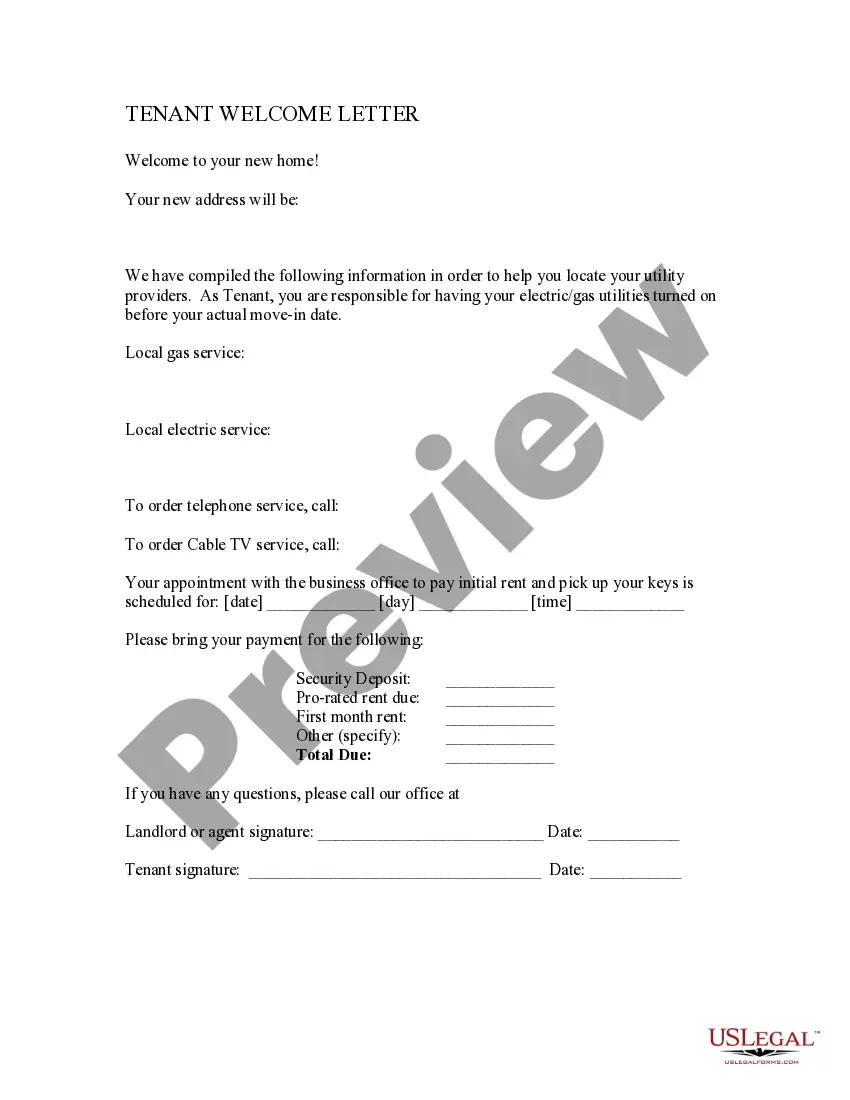

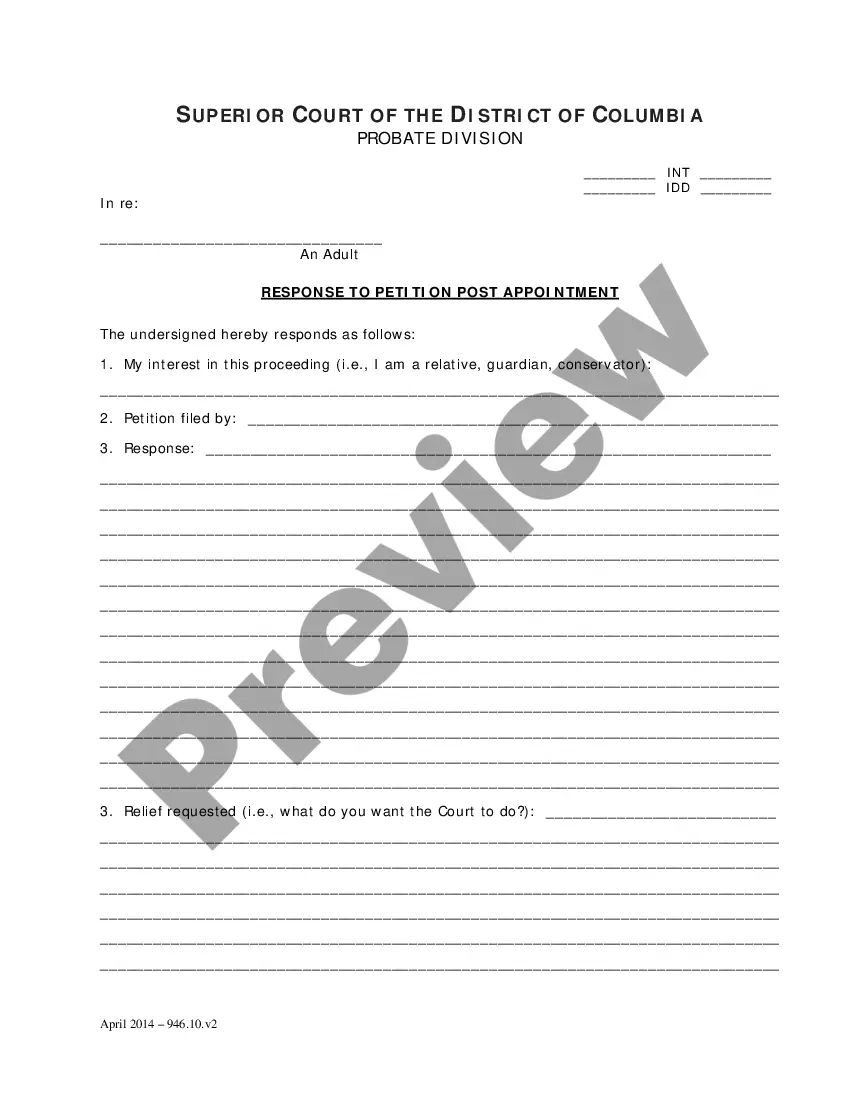

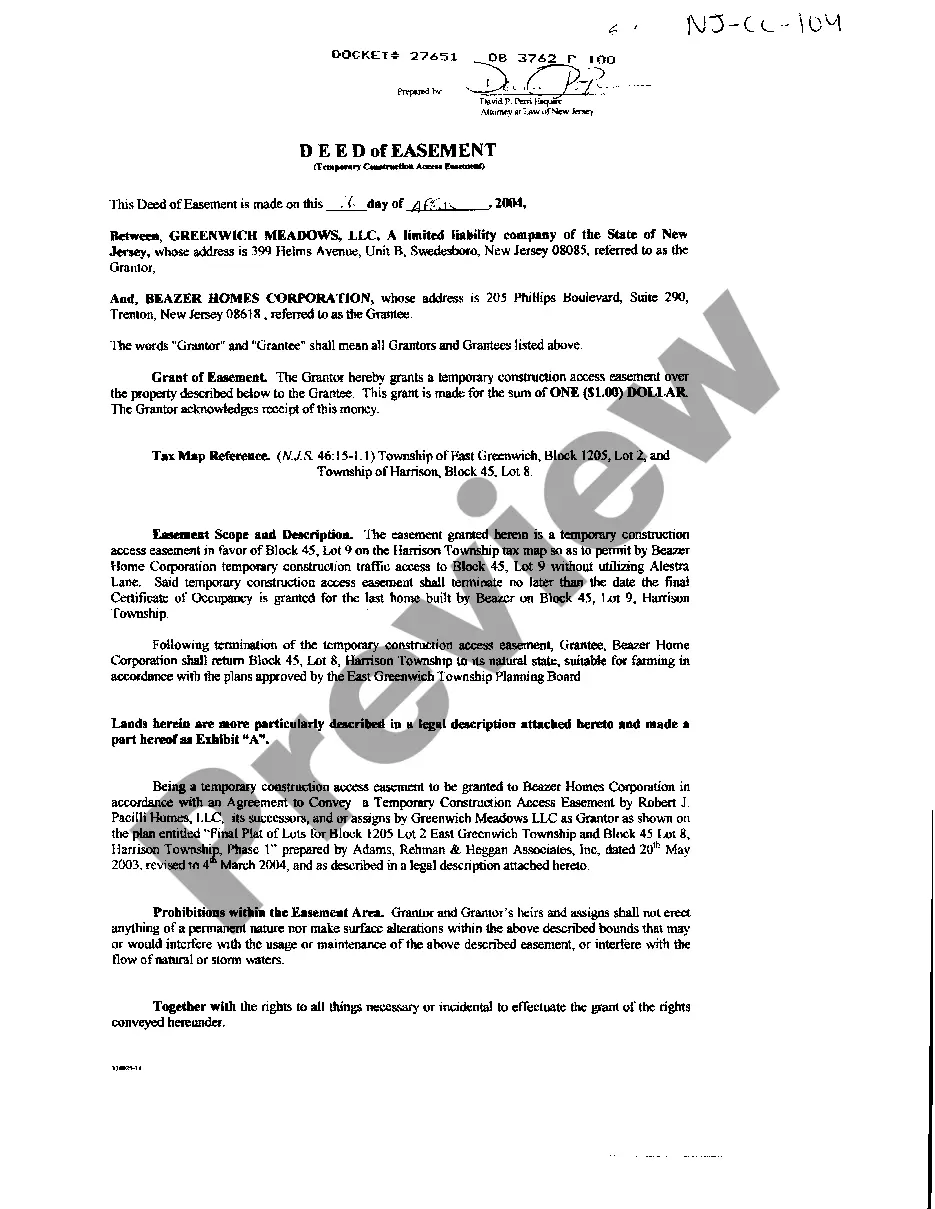

If available, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Tennessee Coaching Services Contract - Self-Employed.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/city of choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

Yes, employment contracts are enforceable in Tennessee as long as they meet certain legal requirements. When you enter a Tennessee Coaching Services Contract - Self-Employed, it creates a binding agreement between parties, provided that both agree to the terms. It's important to ensure that the contract is written clearly and includes all necessary components, such as payment terms and duties. If you're uncertain about the specifics, USLegalForms offers resources to help you draft a solid contract that protects your rights.

To become an independent contractor in Tennessee, first establish your business identity, which may include obtaining the necessary licenses and permits. Next, outline your services and create a clear Tennessee Coaching Services Contract - Self-Employed to govern your relationships with clients. Stay informed about state regulations to ensure compliance as you build your independent contracting career.

In TN, the limit for work done without a contractor's license stands at $25,000 for any single job. This amount covers labor and materials, so keep this in mind when estimating project costs. For better clarity and legal protection, consider a Tennessee Coaching Services Contract - Self-Employed to outline the terms of your work.

You can perform minor renovations, repairs, and maintenance tasks without a contractor's license. This typically includes small-scale work, such as painting or landscaping, as long as you stay within the specified dollar amount limits. Again, consider integrating a Tennessee Coaching Services Contract - Self-Employed to define your scope clearly.

Contracting without a license in Tennessee can lead to significant penalties, including fines and potential legal action. If caught, you may also be required to cease work or obtain the necessary licenses. To avoid these issues, formalizing your agreements with a Tennessee Coaching Services Contract - Self-Employed is an effective strategy.

You can perform up to $25,000 worth of work without a contractor license in Tennessee per project. However, it's essential to adhere to the specific requirements that define this threshold. Utilizing a Tennessee Coaching Services Contract - Self-Employed can also help clarify the boundaries of your work to both you and your clients.

To qualify as an independent contractor in Tennessee, you need to demonstrate that you operate your own business, manage your own financial risks, and control how you complete your work. Maintaining the necessary licenses, if applicable, is also crucial. Additionally, establishing a Tennessee Coaching Services Contract - Self-Employed can solidify your status and outline your relationship with clients.

Yes, many coaches operate as independent contractors, providing expertise and training on a contractual basis. Typically, a Tennessee Coaching Services Contract - Self-Employed can clearly define the coach's role and the services they offer. This arrangement gives them the flexibility to manage their own business and clients. Understanding your status as an independent contractor empowers you to grow and develop your coaching practice.

Yes, a self-employed individual can and should have a contract. A Tennessee Coaching Services Contract - Self-Employed formalizes the agreement between you and your clients, outlining expectations and responsibilities. This contract creates a secure framework for your business relationship. Therefore, it is an important tool for any self-employed person to utilize.

In Tennessee, whether you require a business license as an independent contractor can depend on your location and specific services. Often, local municipalities might have their own licensing requirements, so it's crucial to check those. Utilizing a Tennessee Coaching Services Contract - Self-Employed can guide you through legal requirements and keep your operations compliant. Always verify with local business authorities for precise information.