This Formula System for Distribution of Earnings to Partners provides a list of provisions to conside when making partner distribution recommendations. Some of the factors to consider are: Collections on each partner's matters, acquisition and development of new clients, profitablity of matters worked on, training of associates and paralegals, contributions to the firm's marketing practices, and others.

Tennessee Formula System for Distribution of Earnings to Partners

Description

How to fill out Formula System For Distribution Of Earnings To Partners?

US Legal Forms - one of the biggest libraries of legitimate kinds in the USA - delivers a variety of legitimate record layouts it is possible to down load or print. Utilizing the site, you can find a large number of kinds for enterprise and specific reasons, categorized by types, says, or search phrases.You can get the latest models of kinds much like the Tennessee Formula System for Distribution of Earnings to Partners in seconds.

If you already have a subscription, log in and down load Tennessee Formula System for Distribution of Earnings to Partners through the US Legal Forms local library. The Acquire switch can look on each kind you perspective. You have accessibility to all formerly saved kinds inside the My Forms tab of the profile.

In order to use US Legal Forms the very first time, here are basic instructions to help you get started off:

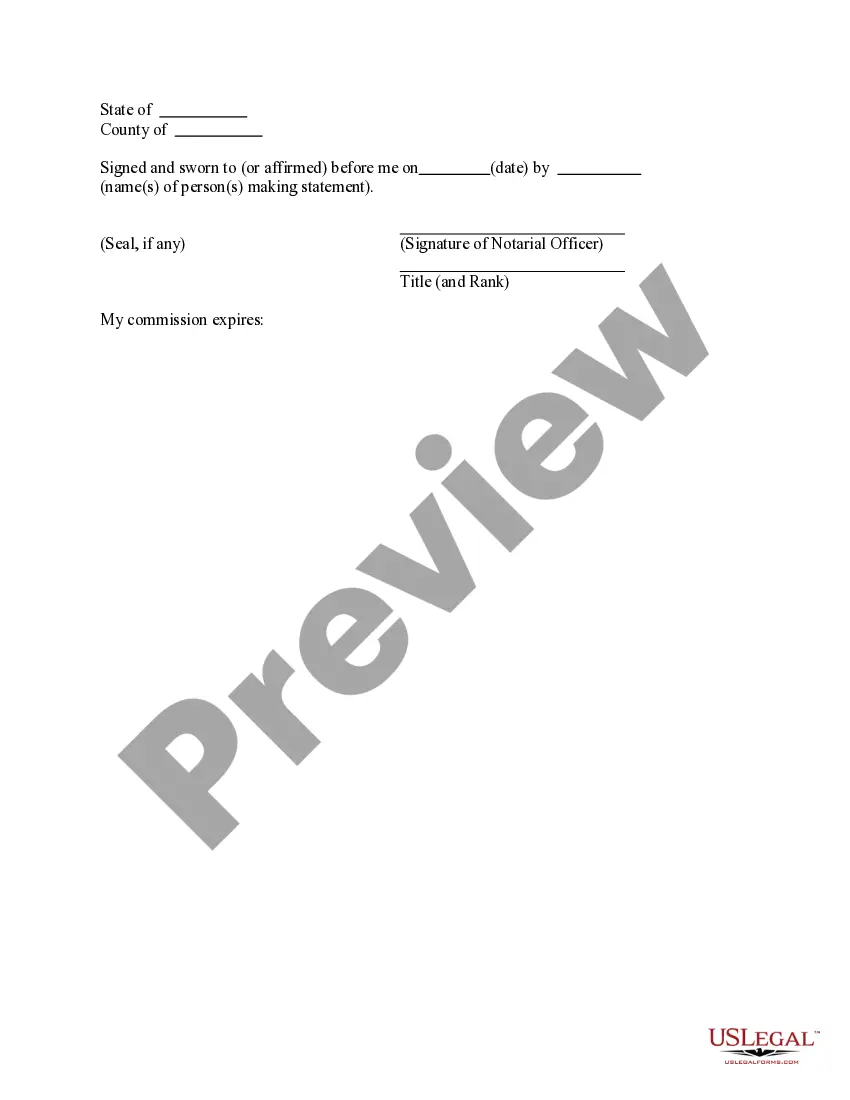

- Make sure you have chosen the best kind for your personal metropolis/state. Click the Preview switch to review the form`s content material. Read the kind explanation to actually have selected the appropriate kind.

- When the kind doesn`t fit your specifications, take advantage of the Search area on top of the display to discover the one who does.

- If you are satisfied with the form, confirm your option by clicking on the Acquire now switch. Then, opt for the prices plan you prefer and offer your credentials to sign up on an profile.

- Approach the transaction. Use your credit card or PayPal profile to accomplish the transaction.

- Choose the format and down load the form in your device.

- Make alterations. Load, revise and print and signal the saved Tennessee Formula System for Distribution of Earnings to Partners.

Every format you included with your account lacks an expiry day and is also your own property for a long time. So, if you wish to down load or print another copy, just visit the My Forms portion and click around the kind you want.

Obtain access to the Tennessee Formula System for Distribution of Earnings to Partners with US Legal Forms, one of the most comprehensive local library of legitimate record layouts. Use a large number of specialist and state-specific layouts that fulfill your business or specific requirements and specifications.

Form popularity

FAQ

The franchise tax is based on the greater of: 1) net worth or the book value of real property or 2) tangible personal property owned or used in Tennessee. The rate is 0.25 percent of the greater figure, and the minimum tax is $100, regardless of whether the business is active or inactive.

To close a Franchise and Excise Tax Account: Log in to TNTAP. Select the File Now link for the current Franchise and Excise return. Select Yes to ?Is this a final return for termination or withdrawal?? File your final return for termination or withdrawal.

There are some exemptions to filing franchise and excise tax. For example, certain limited liability companies, limited partnerships and limited liability partnerships whose activities are at least 66% farming or holding personal residences where one or more of its partners or members reside are exempt.

A taxpayer whose principal business in Tennessee is manufacturing may elect to apportion net earnings to this state by multiplying the earnings by a fraction, the numerator of which is the total receipts of the taxpayer in Tennessee during the taxable year and the denominator of which is the total receipts of the ...

Tennessee LLC Taxes The minimum payment for the state franchise tax is $100. Another tax requirement is the excise tax, which is 6.5 percent of the net taxable income that is generated in the state.

For individual filers, calculating federal taxable income starts by taking all income minus ?above the line? deductions and exemptions, like certain retirement plan contributions, higher education expenses and student loan interest, and alimony payments, among others.

Computation of income is a systematic presentation of all gains, exemptions, rebates, reliefs, deductions, and the computation of taxes in connection with the calculation of taxes. Although there is no standard format for this, the following elements are generally considered in the computation of income.

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. The excise tax is based on net earnings or income for the tax year.