Tennessee Catering Services Contract - Self-Employed Independent Contractor

Description

How to fill out Catering Services Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a diverse selection of legal templates that you can download or create.

By utilizing the website, you can obtain thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Tennessee Catering Services Contract - Self-Employed Independent Contractor in moments.

If you already have a subscription, Log In and download the Tennessee Catering Services Contract - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will appear on every document you view. You have access to all of the previously saved forms from the My documents tab of your account.

Process the purchase. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the document to your device. Make modifications. Fill out, edit, print, and sign the saved Tennessee Catering Services Contract - Self-Employed Independent Contractor. Every template you add to your account has no expiration date and is yours permanently. Thus, if you need to download or create another copy, simply go to the My documents section and click on the form you need. Access the Tennessee Catering Services Contract - Self-Employed Independent Contractor with US Legal Forms, the most vast collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- To start using US Legal Forms for the first time, here are some practical tips.

- Ensure you have selected the correct form for your area/region.

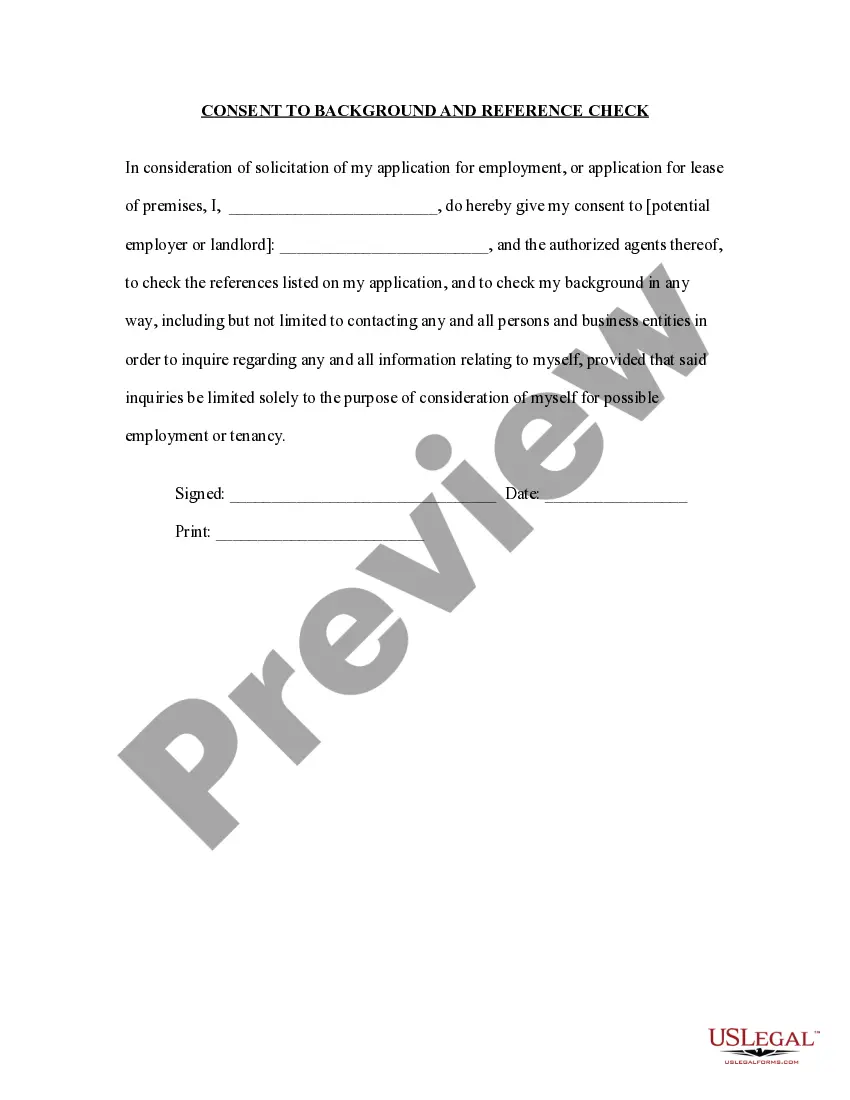

- Click the Review button to examine the contents of the form.

- Review the form outline to confirm you have chosen the appropriate form.

- If the form does not meet your needs, utilize the Lookup field at the top of the screen to find one that does.

- If you are satisfied with the form, finalize your choice by clicking on the Buy now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Yes, a self-employed person can certainly have a contract. This contract helps define the relationship with clients and sets expectations in a clear manner. It's essential to have these agreements in place to protect both parties involved. A well-structured Tennessee Catering Services Contract - Self-Employed Independent Contractor reinforces your professionalism and commitment.

Creating an independent contractor contract involves outlining key details such as services, payment, timelines, and obligations. You can start with a template and tailor it to fit your specific needs. Ensure it complies with Tennessee regulations and addresses all essential points. For added ease, consider using a Tennessee Catering Services Contract - Self-Employed Independent Contractor available on our platform.

If you break an independent contractor agreement, you may face consequences such as financial penalties or legal action. This breach could harm your reputation and future business opportunities. It's essential to communicate with your client if issues arise. Utilizing a Tennessee Catering Services Contract - Self-Employed Independent Contractor can help you avoid potential conflicts by setting clear rules from the start.

A basic independent contractor agreement outlines essential terms between you and your client. This includes payment terms, scope of work, deadlines, and confidentiality clauses. Having a solid agreement helps protect your rights and ensures clear expectations. For catering services, a Tennessee Catering Services Contract - Self-Employed Independent Contractor can serve as a comprehensive template.

The new federal rule simplifies how independent contractors are classified under labor laws. It emphasizes the importance of economic realities over technicalities. This change aims to protect workers while providing clarity for businesses. When considering a Tennessee Catering Services Contract - Self-Employed Independent Contractor, it’s crucial to understand how these regulations may impact your work.

Yes, as a self-employed independent contractor in Tennessee, obtaining a business license is usually necessary. This license validates your operation and ensures compliance with local regulations. You should check specific requirements in your county or city. Using a Tennessee Catering Services Contract - Self-Employed Independent Contractor can help you clearly outline your business activities.

To fill out an independent contractor agreement, begin by providing your contact information and the client's details. Clearly describe the services you will provide, including timelines and payment structure. Make sure to include your Tennessee Catering Services Contract - Self-Employed Independent Contractor terms, as this will serve to protect your rights as a self-employed independent contractor.

Filling out an independent contractor form requires you to provide your personal information, such as your name, address, and Social Security number. Next, detail the nature of work you will perform and the agreed compensation. Ensure that you reference your Tennessee Catering Services Contract - Self-Employed Independent Contractor for accurate job specifications and payment terms.

Writing an independent contractor agreement involves specifying the scope of work, payment details, and the duration of the engagement. You should also address any confidentiality or non-compete clauses that apply. Using templates from platforms like uslegalforms can simplify this process and ensure your Tennessee Catering Services Contract - Self-Employed Independent Contractor meets legal standards.

The independent contractor agreement in Tennessee is a legal document that outlines the relationship between a contractor and a client. This agreement clarifies duties, compensation, and the terms of the working relationship. For professionals operating under a Tennessee Catering Services Contract - Self-Employed Independent Contractor, this document can help prevent misunderstandings and protect both parties.