This Formula System for Distribution of Earnings to Partners provides a list of provisions to conside when making partner distribution recommendations. Some of the factors to consider are: Collections on each partner's matters, acquisition and development of new clients, profitablity of matters worked on, training of associates and paralegals, contributions to the firm's marketing practices, and others.

Texas Formula System for Distribution of Earnings to Partners

Description

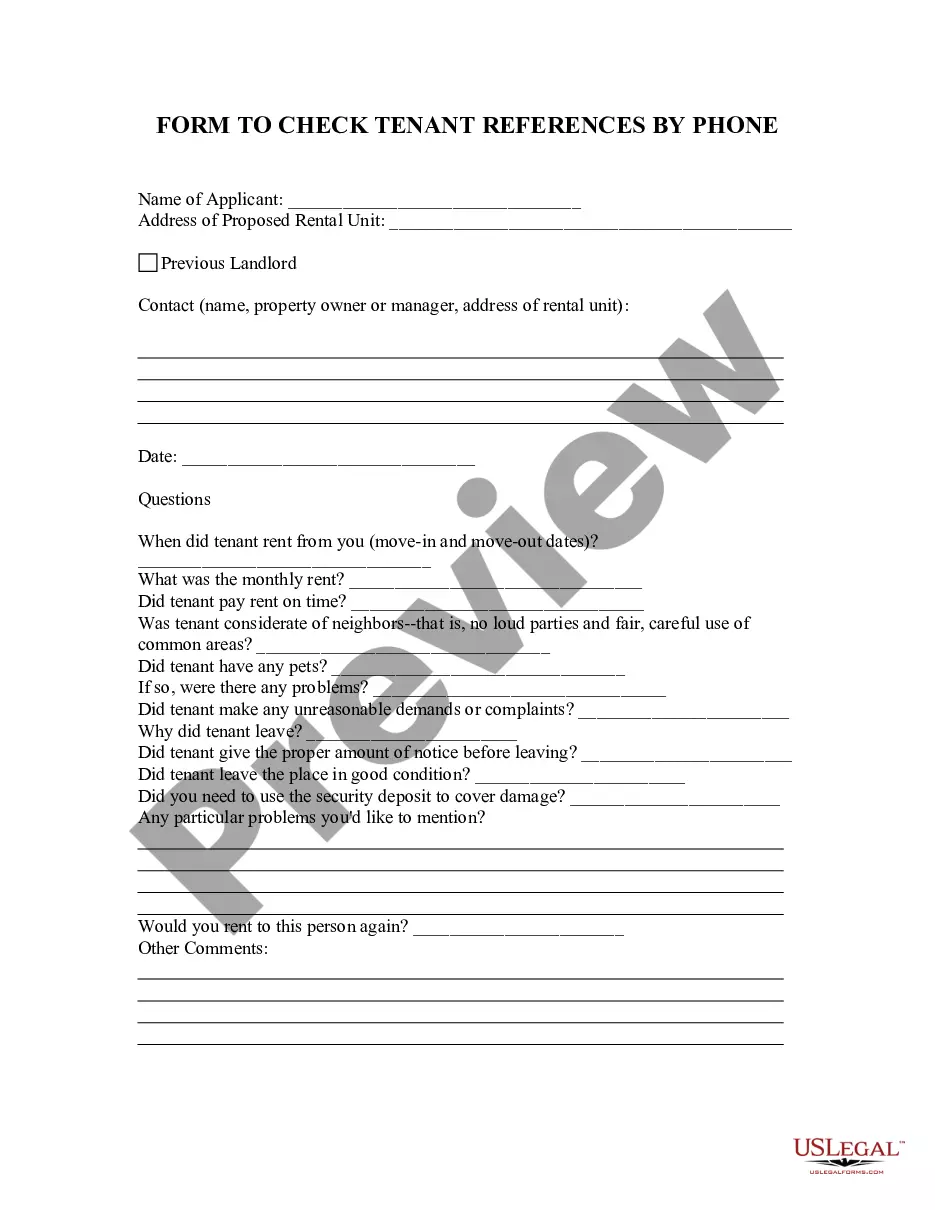

How to fill out Formula System For Distribution Of Earnings To Partners?

US Legal Forms - one of several most significant libraries of legitimate kinds in the States - delivers a variety of legitimate record layouts you are able to acquire or printing. Making use of the website, you will get thousands of kinds for enterprise and specific uses, sorted by groups, suggests, or key phrases.You can get the latest variations of kinds such as the Texas Formula System for Distribution of Earnings to Partners within minutes.

If you already have a subscription, log in and acquire Texas Formula System for Distribution of Earnings to Partners from your US Legal Forms catalogue. The Download key will show up on every type you see. You gain access to all earlier delivered electronically kinds within the My Forms tab of your respective bank account.

In order to use US Legal Forms the very first time, listed below are simple recommendations to help you started out:

- Make sure you have picked the correct type for your personal city/region. Select the Preview key to check the form`s articles. See the type description to ensure that you have chosen the appropriate type.

- In the event the type does not fit your demands, take advantage of the Search industry on top of the screen to find the one that does.

- When you are content with the shape, validate your option by clicking on the Purchase now key. Then, pick the costs program you favor and give your accreditations to register for the bank account.

- Approach the deal. Utilize your bank card or PayPal bank account to complete the deal.

- Choose the formatting and acquire the shape on the device.

- Make modifications. Fill up, edit and printing and sign the delivered electronically Texas Formula System for Distribution of Earnings to Partners.

Every single design you included with your account does not have an expiry particular date and is also your own forever. So, if you want to acquire or printing another copy, just go to the My Forms portion and click on in the type you will need.

Obtain access to the Texas Formula System for Distribution of Earnings to Partners with US Legal Forms, by far the most comprehensive catalogue of legitimate record layouts. Use thousands of skilled and express-particular layouts that satisfy your company or specific demands and demands.

Form popularity

FAQ

Total revenue is determined from revenue amounts reported for federal income tax minus statutory exclusions.

Reports and Payments For franchise tax reports originally due?The no tax due threshold is?on or after Jan. 1, 2022, and before Jan. 1, 2024$1,230,000on or after Jan. 1, 2020, and before Jan. 1, 2022$1,180,000on or after Jan. 1, 2018, and before Jan. 1, 2020$1,130,0005 more rows

For the 2023 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the ...

How is it computed? Net Distributive Income or NDI, for a pass-through entity, is the net amount of income, gain, deduction or loss reportable to the owners on an IRS Form K-1 for the entity's tax year. (Actual distribution is not required.) Guaranteed payments to partners are included when computing NDI.

The wage and cash compensation deduction for each 12-month period are as follows: $400,000 per person for reports originally due in 2022 and 2023. $390,000 per person for reports originally due in 2020 and 2021.

Disregarded Entities An entity's treatment for federal income tax purposes does not determine its responsibility for Texas franchise tax. Therefore, partnerships, LLCs and other entities that are disregarded for federal income tax purposes are considered separate legal entities for franchise tax reporting purposes.

There is no minimum tax requirement under the franchise tax provisions. An entity that calculates an amount of tax due that is less than $1,000 or that has annualized total revenue less than or equal to $1,230,000 is not required 3 Page 4 to pay any tax.

Franchise tax is based on a taxable entity's margin. Unless a taxable entity qualifies and chooses to file using the EZ computation, the tax base is the taxable entity's margin and is computed in one of the following ways: total revenue times 70 percent; total revenue minus cost of goods sold (COGS);