Tennessee Fence Contractor Agreement - Self-Employed

Description

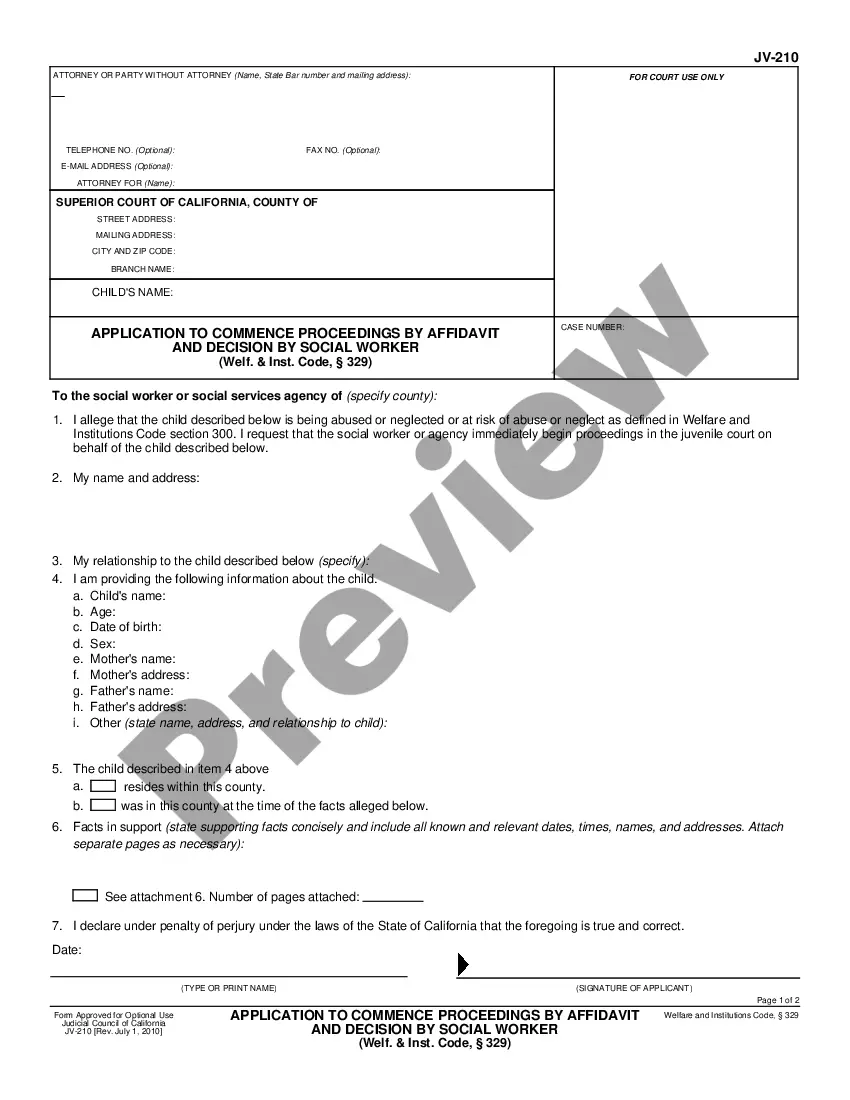

How to fill out Fence Contractor Agreement - Self-Employed?

You can spend hours online trying to locate the authentic document template that meets the federal and state standards you need.

US Legal Forms offers thousands of authentic forms that are reviewed by specialists.

You can actually download or print the Tennessee Fence Contractor Agreement - Self-Employed from my service.

If available, use the Review button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Next, you can fill out, modify, print, or sign the Tennessee Fence Contractor Agreement - Self-Employed.

- Every authentic document template you obtain is yours permanently.

- To get another copy of the purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/city of choice.

- Check the form description to confirm you have chosen the right one.

Form popularity

FAQ

To create an independent contractor agreement, begin by clearly defining the scope of work and the duties expected from the contractor. Include essential details such as payment terms, timelines, and any necessary legal clauses. Using a template, like the Tennessee Fence Contractor Agreement - Self-Employed available on USLegalForms, can streamline this process and ensure you cover all critical points. This approach not only protects the interests of both parties but also helps you establish a professional relationship.

To protect yourself as an independent contractor, consider drafting a comprehensive agreement that outlines your rights and responsibilities. Be clear about project expectations, payment timelines, and dispute resolution mechanisms. Additionally, using the Tennessee Fence Contractor Agreement - Self-Employed from US Legal Forms can provide you with the legal framework needed to safeguard your interests and maintain professionalism.

Independent contractors must meet specific legal requirements in Tennessee, such as obtaining necessary permits and adhering to tax regulations. It is critical to understand the distinction between an employee and an independent contractor, as this affects your legal obligations. Having a well-drafted Tennessee Fence Contractor Agreement - Self-Employed can ensure you meet these requirements effectively.

A basic independent contractor agreement outlines the terms between a contractor and their client. It typically includes details such as project scope, payment terms, and deadlines. This agreement is essential as it protects both parties and clarifies their responsibilities. Using a Tennessee Fence Contractor Agreement - Self-Employed can simplify this process for fence contractors.

The independent contractor agreement in Tennessee is a legally binding document that sets the terms between a client and an independent contractor. This agreement outlines the scope of services, payment terms, duration, and rights of both parties. For those in the fencing industry, utilizing a well-crafted Tennessee Fence Contractor Agreement - Self-Employed ensures clear expectations and helps avoid disputes. Platforms like uslegalforms can provide templates to simplify the creation of such agreements.

Writing an independent contractor agreement requires you to outline the foundational elements clearly. Begin with a header that states it is an independent contractor agreement, followed by the parties’ names. Next, describe the services, payment terms, and durations of the engagement. Incorporating specifics relevant to the Tennessee Fence Contractor Agreement - Self-Employed makes the contract more robust and useful for both parties.

To fill out an independent contractor agreement, start by listing your name and the client's name, followed by service details and project scope. Clearly state payment terms, including rates and milestones, as well as deadlines for completion. Don't forget to include important provisions that address confidentiality and termination to ensure a solid understanding as outlined in the Tennessee Fence Contractor Agreement - Self-Employed.

Filling out an independent contractor form involves providing accurate personal and business information. Begin by entering your name, address, and taxpayer identification number on the form. Next, specify the type of services you will provide, including details about the Tennessee Fence Contractor Agreement - Self-Employed you will use. Finally, review the document for completeness before submitting it to your client.

An independent contractor needs to complete several key documents to initiate their work. First, a W-9 form is crucial for tax purposes, providing your taxpayer identification information. Additionally, a Tennessee Fence Contractor Agreement - Self-Employed should outline the terms of your work, expectations, and payment arrangements. This paperwork helps ensure clarity and protects both parties involved.