Tennessee License Agreement regarding the inclusion of software product as a component

Description

How to fill out License Agreement Regarding The Inclusion Of Software Product As A Component?

You can invest hours on the Internet searching for the legitimate document web template that fits the federal and state needs you need. US Legal Forms provides 1000s of legitimate kinds which are examined by professionals. You can easily obtain or produce the Tennessee License Agreement regarding the inclusion of software product as a component from our support.

If you have a US Legal Forms profile, you are able to log in and then click the Acquire switch. After that, you are able to comprehensive, revise, produce, or indication the Tennessee License Agreement regarding the inclusion of software product as a component. Each legitimate document web template you get is yours eternally. To have yet another duplicate associated with a obtained develop, visit the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms web site the first time, stick to the easy directions under:

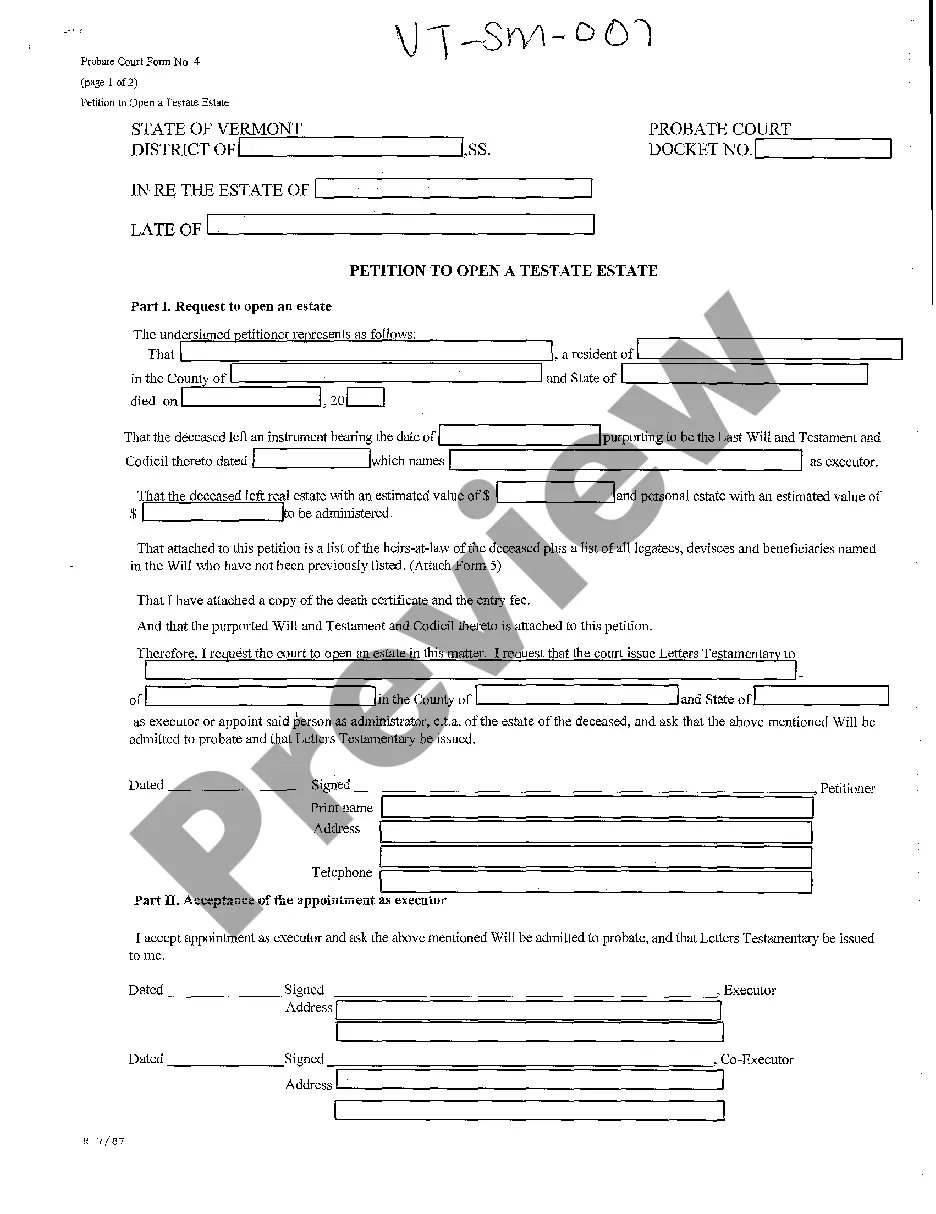

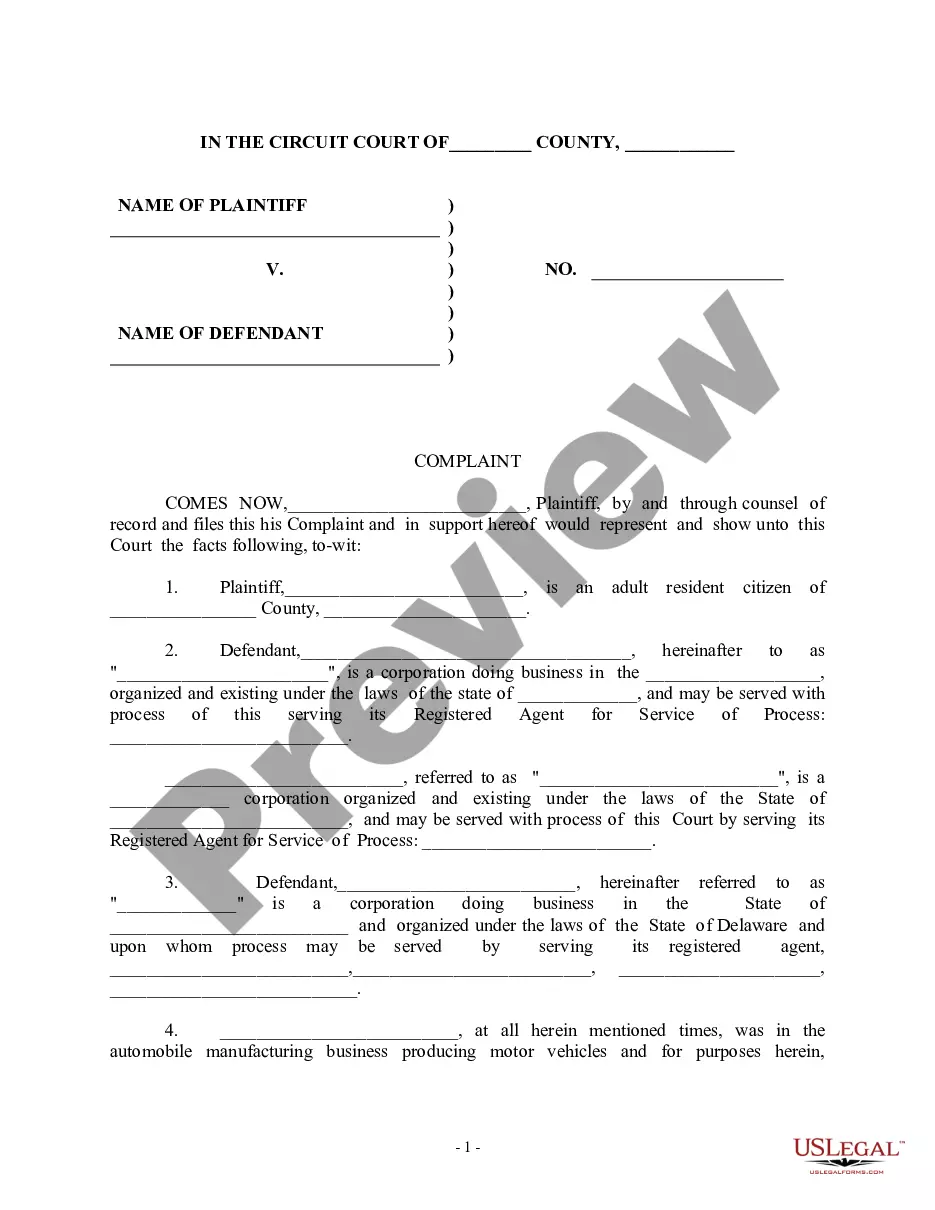

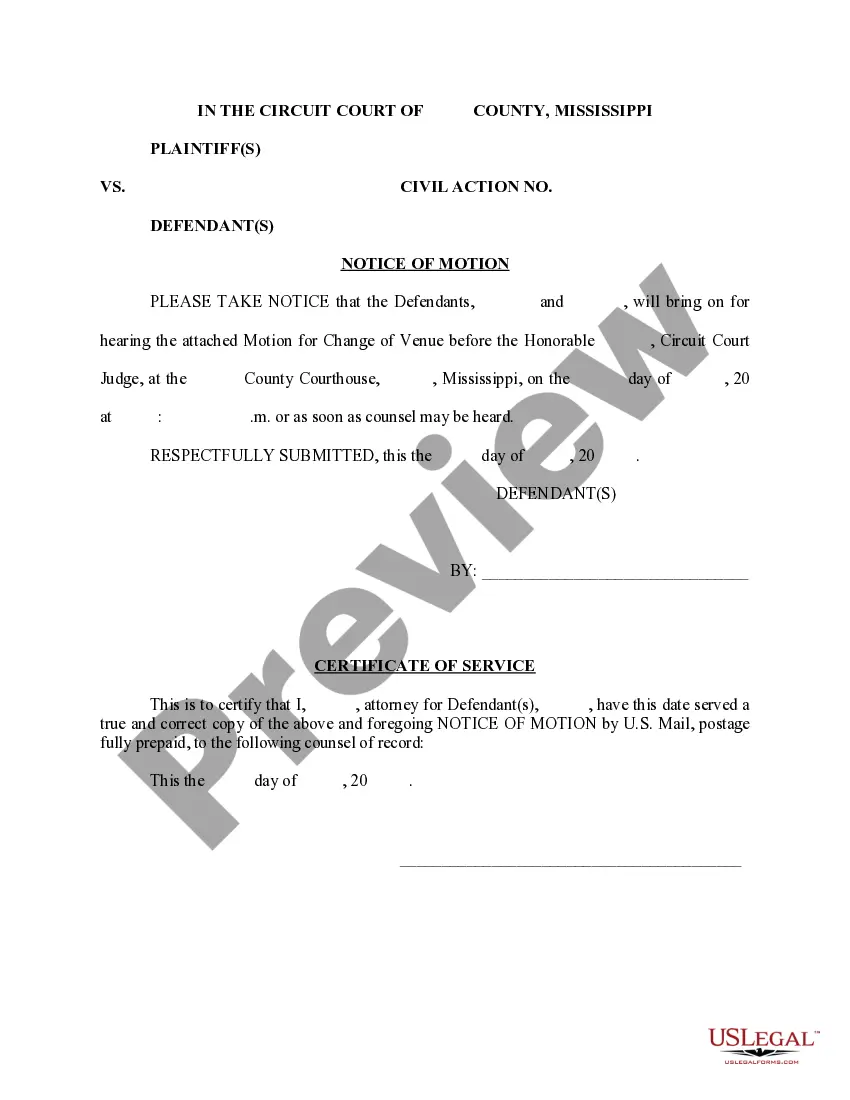

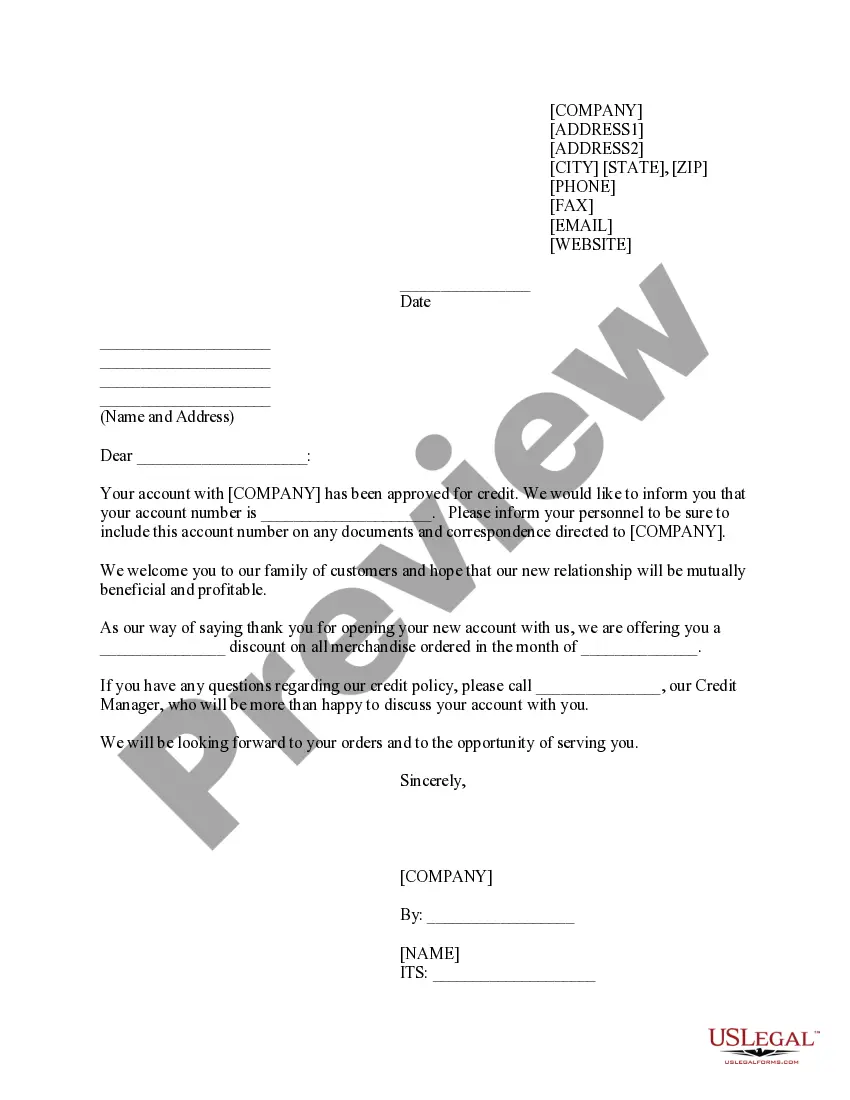

- Very first, be sure that you have selected the best document web template to the region/city of your liking. Browse the develop description to make sure you have chosen the right develop. If offered, use the Preview switch to look throughout the document web template too.

- If you want to discover yet another version of your develop, use the Search discipline to get the web template that fits your needs and needs.

- Once you have found the web template you desire, simply click Purchase now to move forward.

- Find the rates program you desire, type your credentials, and register for your account on US Legal Forms.

- Full the deal. You can utilize your credit card or PayPal profile to purchase the legitimate develop.

- Find the file format of your document and obtain it for your system.

- Make adjustments for your document if possible. You can comprehensive, revise and indication and produce Tennessee License Agreement regarding the inclusion of software product as a component.

Acquire and produce 1000s of document templates making use of the US Legal Forms web site, that offers the biggest variety of legitimate kinds. Use expert and status-certain templates to deal with your organization or specific needs.

Form popularity

FAQ

In Tennessee, services that are generally not subjected to either sales or use taxes include data processing, information services, and management consulting services. Businesses that offer management consulting or management services are required to pay a local gross receipts tax.

What's tax-free? General apparel that costs $100 or less per item, such as shirts, pants, socks, shoes, etc. School and art supplies that cost $100 or less per item, such as binders, backpacks, crayons, paper, pens, pencils and etc. ... Computers for personal use with a purchase price of $1,500 or less.

Tangible products are taxable in Tennessee, with a few exceptions. These exceptions include, medical supplies, and packaging. Food is taxed at 4%, instead of the state rate of 7%. In 2021, Tennessee honored a sales tax holiday three different times throughout the year, with more planned for 2022.

In the United States, almost all states tax "tangible individual property" but exempt non-luxury "necessities": groceries, prescriptions, prosthetics, agriculture supplies, and sometimes clothes?the exemptions vary between states. Most states charge sales tax for women's pads and tampons.

Software licensing terms and conditions usually include fair use of the software, the limitations of liability, warranties and disclaimers. They also specify protections if the software or its use infringes on the intellectual property rights of others. Software licenses typically are proprietary, free or open source.

Tenn. Code Ann. § 67-6-202(a) (2007) imposes an additional state tax at the rate of 2.75 percent on the amount over $1,600, but less than or equal to $3,200, on the sale or use of any single article of tangible personal property (the ?state single article sales tax?). 1.

Tax Exempt Items Food for human consumption. Manufacturing machinery. Raw materials for manufacturing. Utilities and fuel used in manufacturing. Medical devices and services.

Tax-exempt goods Some goods are exempt from sales tax under Tennessee law. Examples include some industrial machinery, agricultural equipment, fuel, and medical supplies.