Tennessee Approval of amendment to the corporation's restated articles of incorporation with exhibits

Description

How to fill out Approval Of Amendment To The Corporation's Restated Articles Of Incorporation With Exhibits?

Finding the right legal file template might be a struggle. Needless to say, there are a lot of templates accessible on the Internet, but how will you find the legal develop you require? Utilize the US Legal Forms internet site. The support delivers a large number of templates, for example the Tennessee Approval of amendment to the corporation's restated articles of incorporation with exhibits, that can be used for organization and personal needs. All the types are inspected by pros and meet up with state and federal specifications.

Should you be already listed, log in for your account and then click the Down load switch to have the Tennessee Approval of amendment to the corporation's restated articles of incorporation with exhibits. Utilize your account to look through the legal types you may have bought earlier. Check out the My Forms tab of your own account and obtain an additional copy in the file you require.

Should you be a whole new consumer of US Legal Forms, listed here are straightforward recommendations so that you can adhere to:

- Very first, make sure you have selected the proper develop to your area/region. It is possible to look through the shape utilizing the Review switch and study the shape information to make certain it will be the best for you.

- In case the develop will not meet up with your preferences, utilize the Seach field to get the appropriate develop.

- When you are positive that the shape would work, click on the Get now switch to have the develop.

- Choose the costs program you would like and enter the needed information and facts. Design your account and buy the transaction making use of your PayPal account or bank card.

- Select the document formatting and obtain the legal file template for your gadget.

- Total, revise and produce and signal the obtained Tennessee Approval of amendment to the corporation's restated articles of incorporation with exhibits.

US Legal Forms is the greatest catalogue of legal types in which you will find numerous file templates. Utilize the company to obtain expertly-manufactured documents that adhere to condition specifications.

Form popularity

FAQ

Businesses that are incorporated in another state will typically apply for a Tennessee certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.

If you're looking for a copy of an Articles of Organization that you already filed for your LLC, you can get one for $20. The request for copies must be sent via mail to the Secretary of State. Download the Request for Copy of Documents Form (Form SS-4461) from the Tennessee Secretary of State.

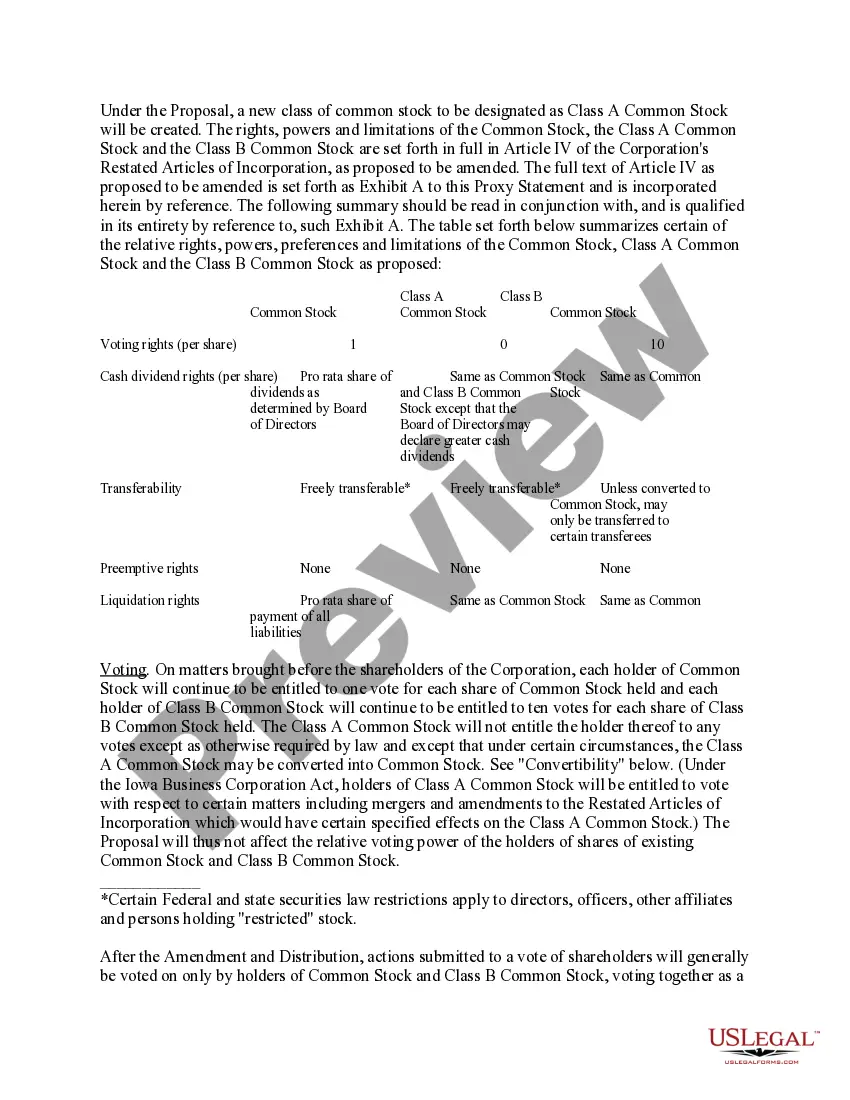

Changing articles of incorporation often means changing things like agent names, the businesses operating name, addresses, and stock information.

File an original form SS-4247, Articles of Amendment to Articles of Organization (LLC) with the Tennessee Department of State, Division of Business Services (DBS). The DBS amendment form is in your online account when you sign up for registered agent service and is available on the DBS website.

To amend your Tennessee corporation's charter, file one original form SS-4421, Articles of Amendment to the Charter (For Profit) with the Tennessee Department of State, Division of Business Services (DBS).