Tennessee Dividend Equivalent Shares

Description

How to fill out Dividend Equivalent Shares?

Are you currently in a situation that you need files for both organization or specific functions almost every time? There are tons of legitimate document layouts available online, but discovering kinds you can depend on isn`t easy. US Legal Forms gives a huge number of develop layouts, just like the Tennessee Dividend Equivalent Shares, that happen to be published to meet state and federal needs.

Should you be already knowledgeable about US Legal Forms web site and possess a merchant account, basically log in. Next, you may obtain the Tennessee Dividend Equivalent Shares template.

Should you not provide an account and wish to begin using US Legal Forms, adopt these measures:

- Discover the develop you need and ensure it is to the correct area/county.

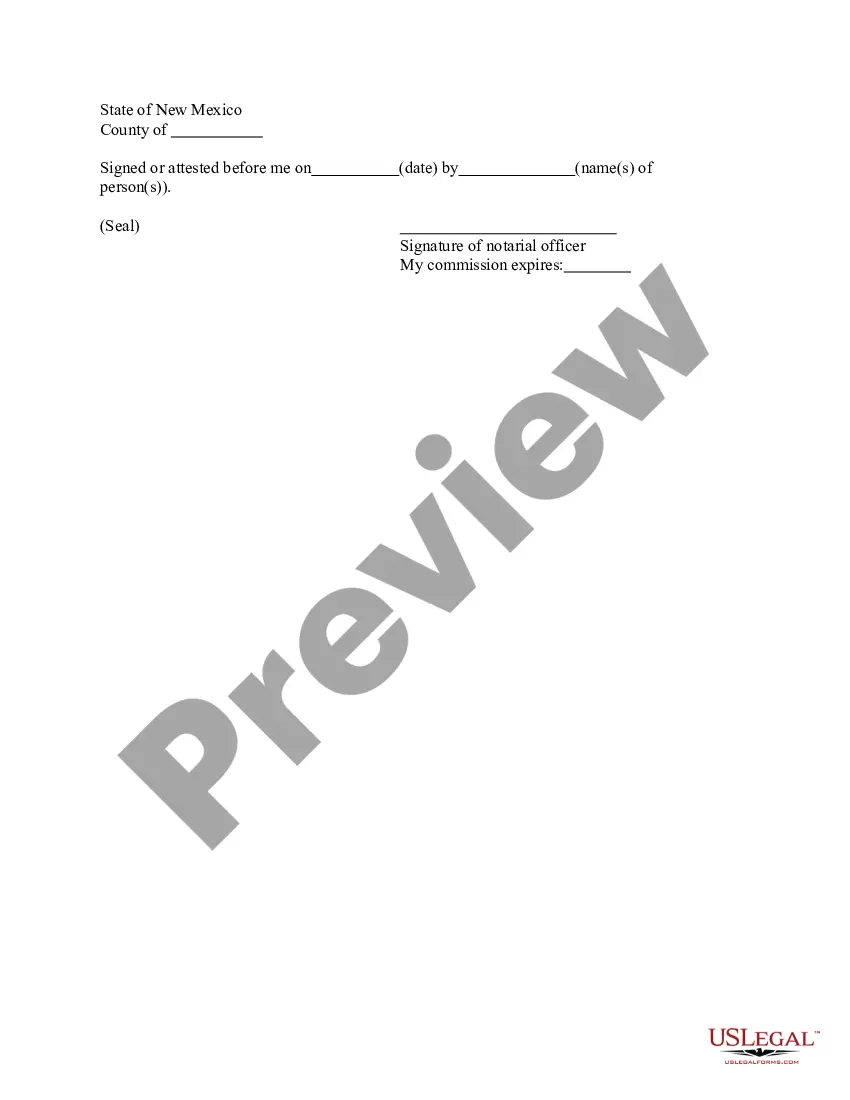

- Use the Preview key to review the form.

- Look at the explanation to ensure that you have selected the right develop.

- In case the develop isn`t what you`re looking for, make use of the Search area to find the develop that fits your needs and needs.

- When you obtain the correct develop, just click Buy now.

- Choose the prices strategy you want, complete the specified details to create your money, and purchase your order making use of your PayPal or bank card.

- Select a practical paper structure and obtain your backup.

Get every one of the document layouts you possess bought in the My Forms food selection. You can get a additional backup of Tennessee Dividend Equivalent Shares anytime, if possible. Just click on the needed develop to obtain or print the document template.

Use US Legal Forms, the most substantial collection of legitimate types, in order to save time as well as avoid faults. The services gives skillfully created legitimate document layouts that you can use for an array of functions. Generate a merchant account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

As of January 1, 2021 the Hall income tax no longer exists and the state does not levy a personal income tax of any form on individuals.

Key Takeaways. Qualified dividends must meet special requirements issued by the IRS. The maximum tax rate for qualified dividends is 20%, with a few exceptions for real estate, art, or small business stock. Ordinary dividends are taxed at income tax rates, which as of the 2023 tax year, maxes out at 37%.

Franchise tax 0.25% of the greater net worth or real tangible property in Tennessee.

Tennessee joined the ranks of no-income-tax. states in 2022 with the phaseout of the Hall Tax on interest and dividend income.

Tennessee does not have an individual income tax. Tennessee has a flat 6.50 percent corporate income tax rate and levies a gross receipts tax. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent.

Tennessee is a tax-friendly state for retirees. Tennessee does not levy a state income tax on earned income including wages, salaries. This also includes retirement incomes such as public and private pensions, Social Security, 401(k) distributions, and withdrawals from retirement accounts, all of which are not taxed.

The minimum combined 2023 sales tax rate for Memphis, Tennessee is 9.75%. This is the total of state, county and city sales tax rates. The Tennessee sales tax rate is currently 7%. The County sales tax rate is 2.25%.

What's the Tennessee Income Tax Rate? There is no income tax on wages in this state, making it one of the states with the lowest taxes. Therefore, the Tennessee income tax rate is 0%. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends.

Tennessee joined the ranks of no-income-tax. states in 2022 with the phaseout of the Hall Tax on interest and dividend income.

It was enacted in 1929 and was originally called the Hall income tax for the senator who sponsored the legislation. The Hall Income tax was repealed for tax periods that begin on January 1, 2021, or later. Please do not file a return for any tax year that begins on or after January 1, 2021.