Tennessee Information Sheet - When are Entertainment Expenses Deductible and Reimbursable

Description

How to fill out Information Sheet - When Are Entertainment Expenses Deductible And Reimbursable?

US Legal Forms - one of the largest repositories of legal templates in the United States - provides a selection of legal document samples that you can download or print.

By utilizing the website, you will discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest editions of documents like the Tennessee Information Sheet - When are Entertainment Expenses Deductible and Reimbursable in just a few minutes.

If you have a subscription, Log In and download the Tennessee Information Sheet - When are Entertainment Expenses Deductible and Reimbursable from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved forms in the My documents section of your account.

Make modifications. Fill out, alter, print, and sign the saved Tennessee Information Sheet - When are Entertainment Expenses Deductible and Reimbursable.

Each template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another version, simply navigate to the My documents section and click on the form you desire. Access the Tennessee Information Sheet - When are Entertainment Expenses Deductible and Reimbursable with US Legal Forms, one of the most extensive collections of legal document samples. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

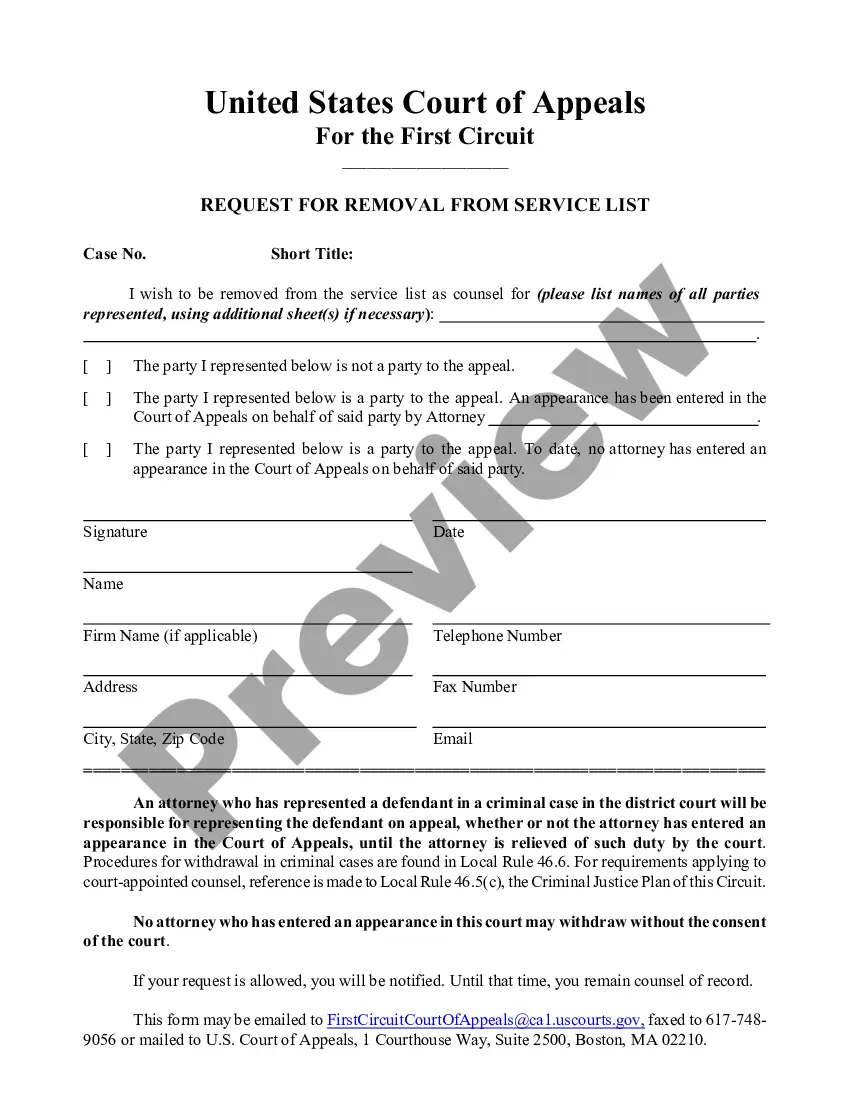

- Ensure you have selected the correct form for your city/county. Click on the Preview button to view the form’s details. Read the form description to confirm you've picked the right form.

- If the form does not meet your needs, use the Search area at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then select the pricing plan you prefer and provide your details to sign up for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

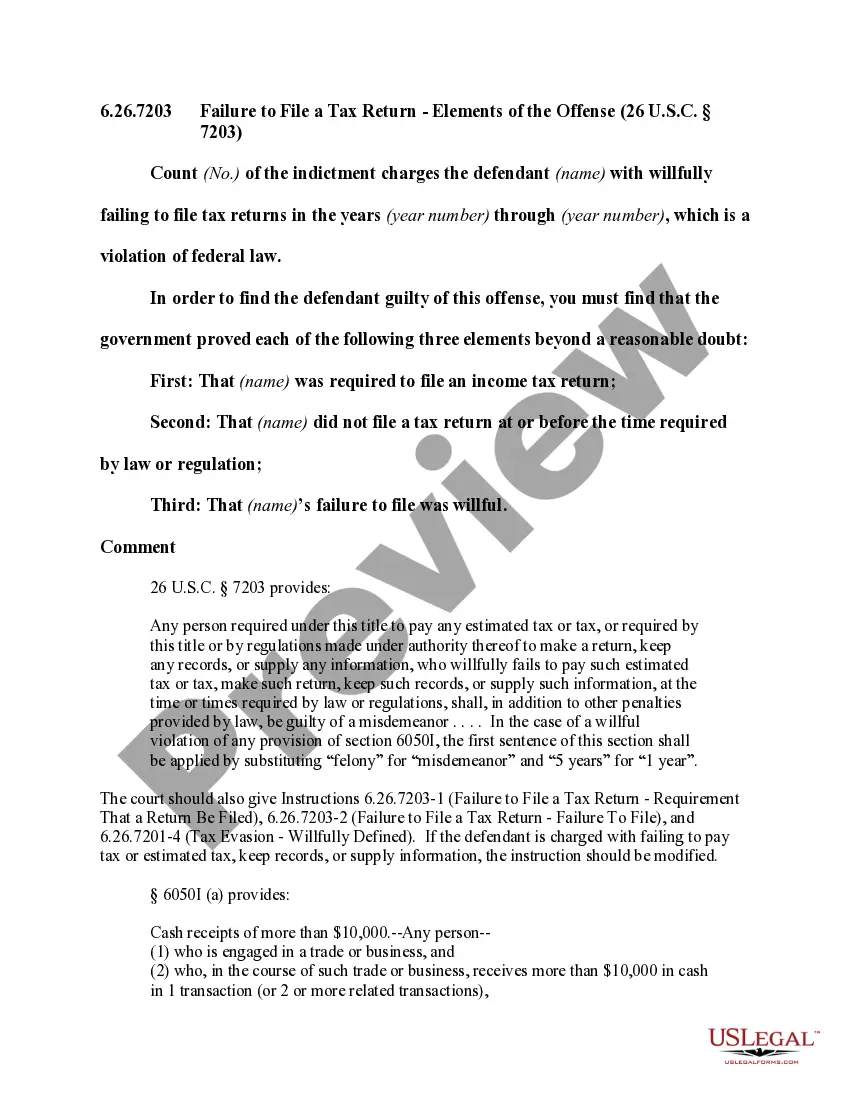

Businesses will be permitted to fully deduct business meals that would normally be 50% deductible. Although this change will not affect your 2020 tax return, the savings will offer a 100% deduction in 2021 and 2022 for food and beverages provided by a restaurant.

Entertaining clients (concert tickets, golf games, etc.) Wondering how this breaks down? If you're dining out with a client at a restaurant, you can consider that meal 100% tax-deductible. However, if you're entertaining that same client in-office with snacks purchased at a grocery store, the meal is 50% deductible.

Entertainment expenses include the cost of entertaining customers or employees at social and sports events, restaurant meals and theater tickets, among other things. You may deduct business entertainment expenses subject to certain conditions.

The new tax act establishes additional limitations on the deductibility of certain business meals and entertainment expenses. Under the act, entertainment expenses incurred or paid after Dec. 31, 2017 are nondeductible unless they fall under the specific exceptions in Code Section 274(e).

2022 meals and entertainment deduction As part of the Consolidated Appropriations Act signed into law on December 27, 2020, the deductibility of meals is changing. Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. Entertaining clients (concert tickets, golf games, etc.)

24, 2020). The proposed regulations were based, in turn, on Notice 2018-76, published in October 2018. Sec. 274(a)(1)(A) generally disallows a deduction for any activity of a type generally considered entertainment, amusement, or recreation.

Businesses will be permitted to fully deduct business meals that would normally be 50% deductible. Although this change will not affect your 2020 tax return, the savings will offer a 100% deduction in 2021 and 2022 for food and beverages provided by a restaurant.

Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible. However, team-building activities for employees are deductible.

The deduction for unreimbursed non-entertainment-related business meals is generally subject to a 50% limitation. You generally can't deduct meal expenses unless you (or your employee) are present at the furnishing of the food or beverages and such expense is not lavish or extravagant under the circumstances.

Anything considered to constitute entertainment, amusement, or recreation is nondeductible, including the cost of facilities used in connection with these activities. This is unchanged from 2018 tax reform.