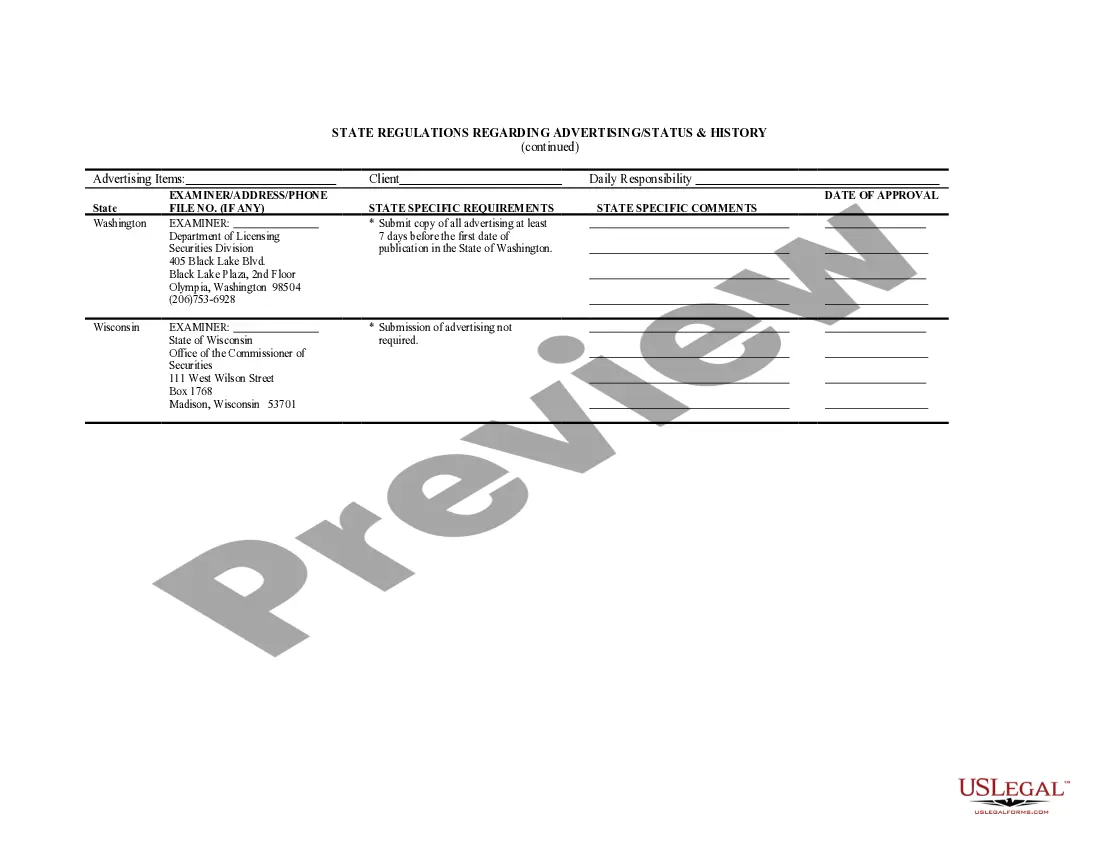

Tennessee State Regulations Regarding Advertising - Status and History

Description

How to fill out State Regulations Regarding Advertising - Status And History?

Choosing the right authorized record format can be quite a have difficulties. Obviously, there are tons of layouts available on the Internet, but how can you obtain the authorized type you require? Take advantage of the US Legal Forms web site. The services gives a large number of layouts, including the Tennessee State Regulations Regarding Advertising - Status and History, that can be used for organization and private requires. Each of the varieties are inspected by pros and meet state and federal requirements.

Should you be previously authorized, log in to your account and click on the Obtain option to find the Tennessee State Regulations Regarding Advertising - Status and History. Use your account to look from the authorized varieties you have purchased in the past. Go to the My Forms tab of the account and get one more duplicate of the record you require.

Should you be a new end user of US Legal Forms, listed below are easy directions that you should follow:

- First, be sure you have chosen the appropriate type for your personal metropolis/area. You may look through the form utilizing the Preview option and look at the form information to guarantee it will be the right one for you.

- If the type is not going to meet your needs, take advantage of the Seach area to discover the correct type.

- Once you are sure that the form would work, select the Acquire now option to find the type.

- Opt for the costs plan you desire and enter the needed information and facts. Create your account and pay money for the order utilizing your PayPal account or bank card.

- Opt for the data file structure and acquire the authorized record format to your device.

- Full, change and print out and indicator the attained Tennessee State Regulations Regarding Advertising - Status and History.

US Legal Forms is the most significant collection of authorized varieties for which you will find different record layouts. Take advantage of the service to acquire skillfully-made paperwork that follow status requirements.

Form popularity

FAQ

Almost every business operating in Tennessee must register for the Tennessee Business Tax. The Tennessee Department of Revenue's Registration and Licensing page will guide you through the process. The registration fee is $15. All new businesses must register using TNTAP.

Title 1260 - Real Estate Commission. Chapter 1260-01 - Licensing.

Exempt services generally include, but are not limited to: doctors, dentists, veterinarians, attorneys, accountants, schools, religious organizations, nonprofit membership organizations, insurance agents, loan companies, security exchanges, and public utilities.

Obtain a Business License Minimum activity license: Between $3,000 and $100,000* in gross sales. A business tax account and filing are not required with a minimum activity license. A business will renew directly with their local county clerk's office. Standard business license: More than $100,000* in gross sales.

Almost every business operating in Tennessee must register for the Tennessee Business Tax. The Tennessee Department of Revenue's Registration and Licensing page will guide you through the process. The registration fee is $15. All new businesses must register using TNTAP.

Businesses with gross receipts of $100,000 or greater will need to renew their license annually with the State of Tennessee Department of Revenue.