Tennessee Certificate of Incorporation for a Franchise Advertising Cooperative

Description

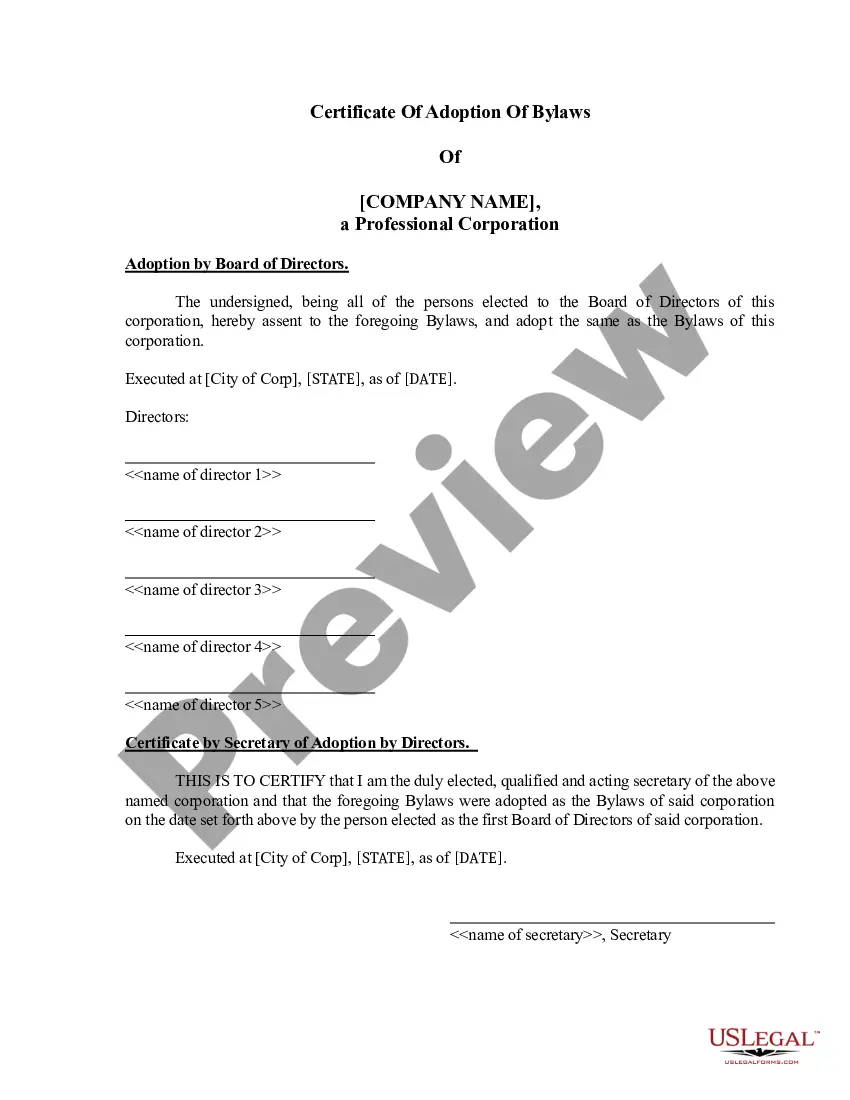

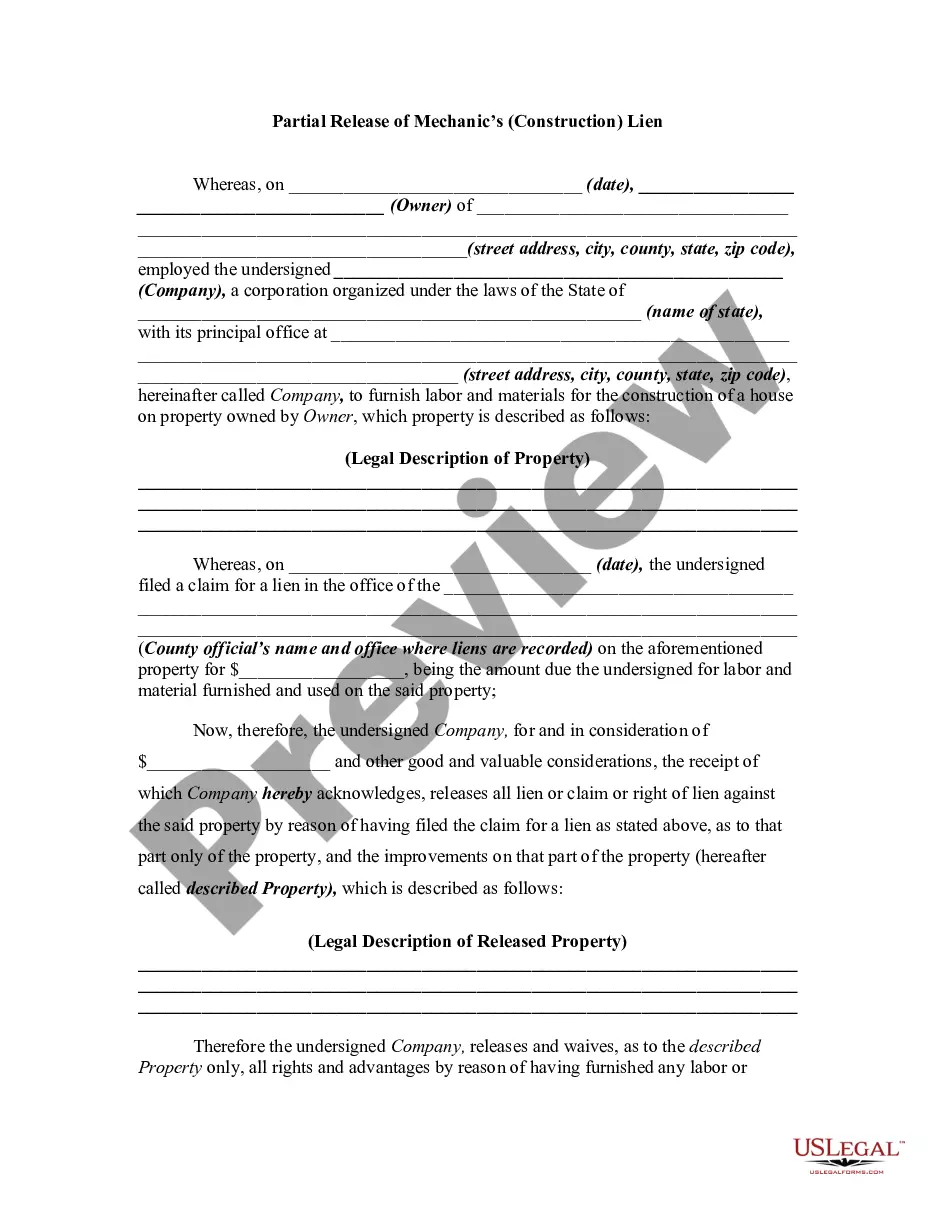

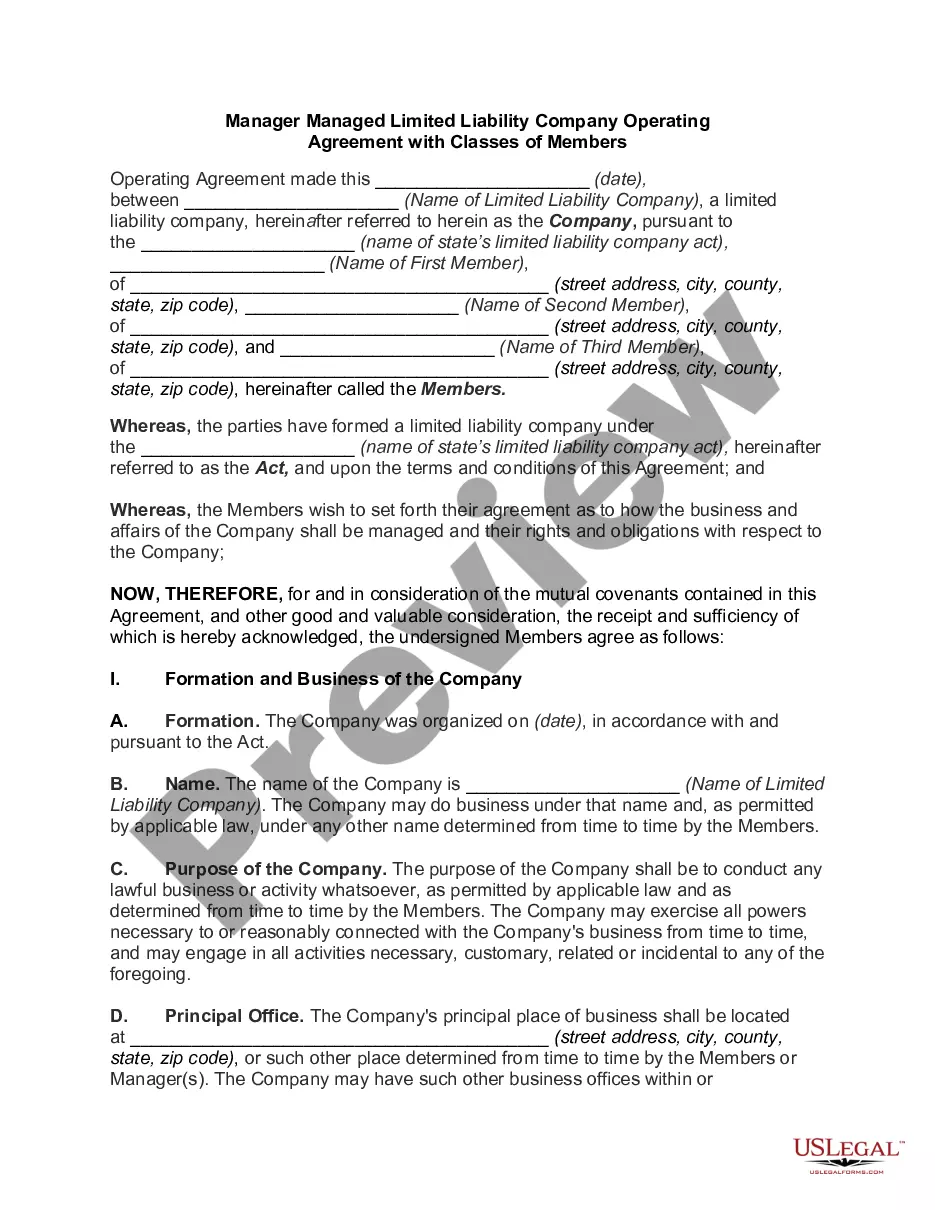

How to fill out Certificate Of Incorporation For A Franchise Advertising Cooperative?

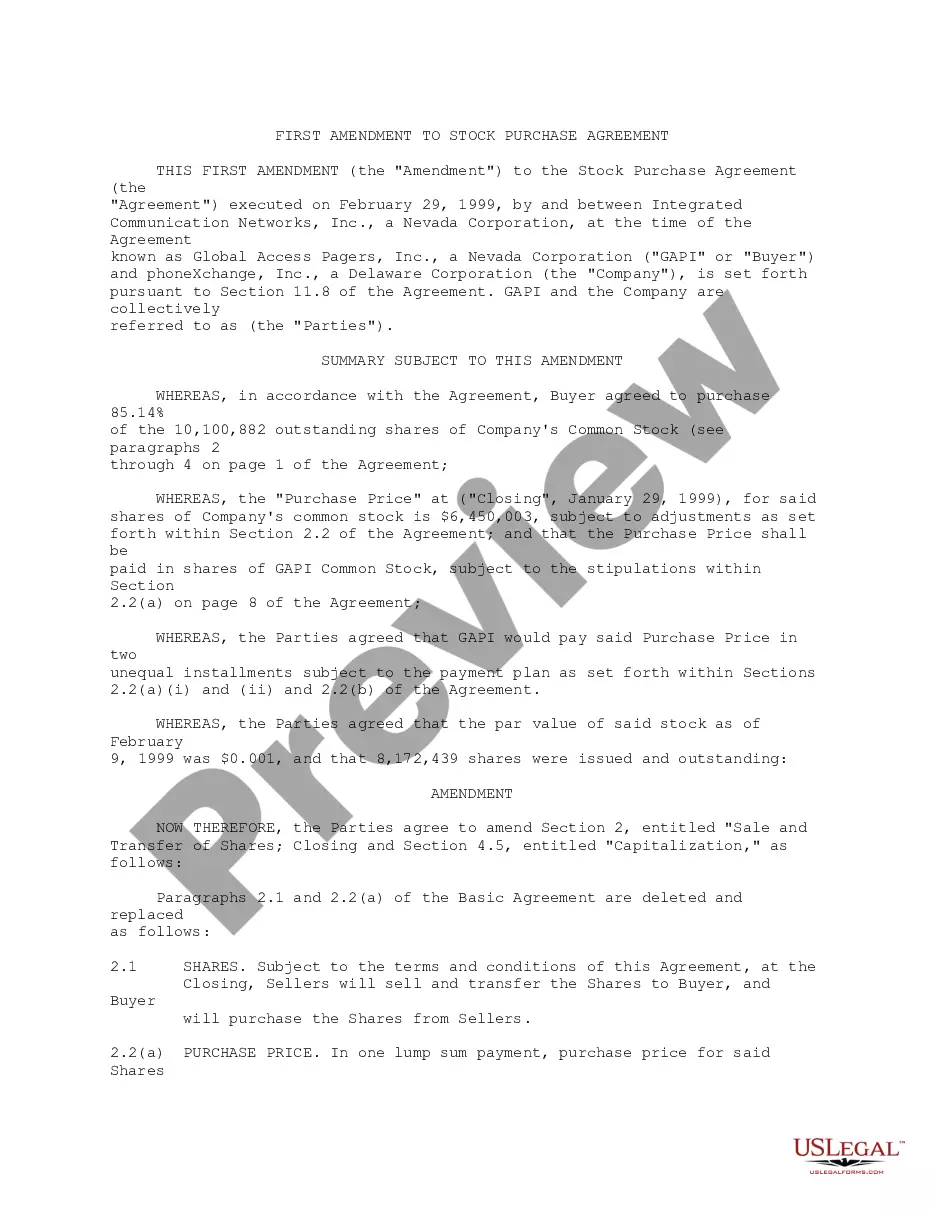

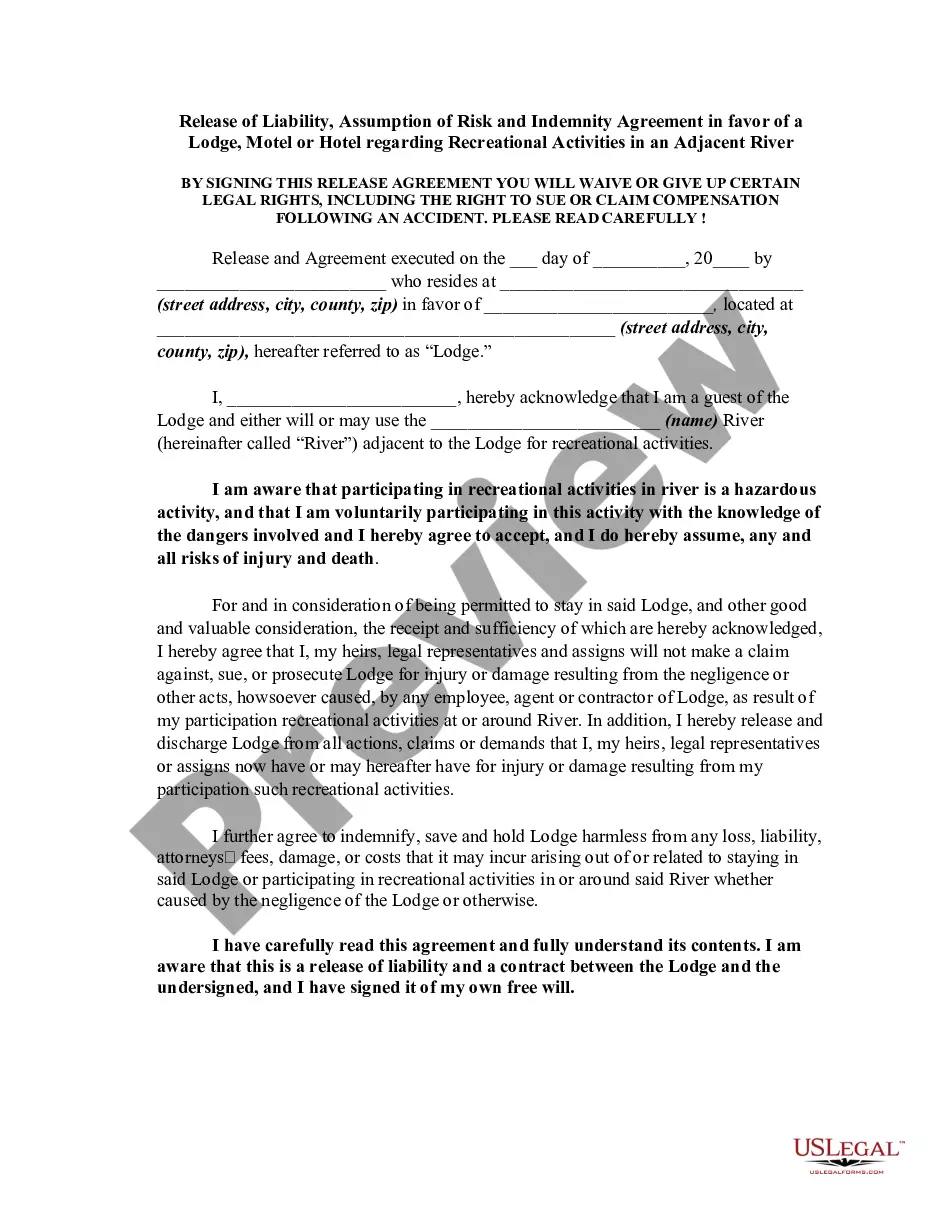

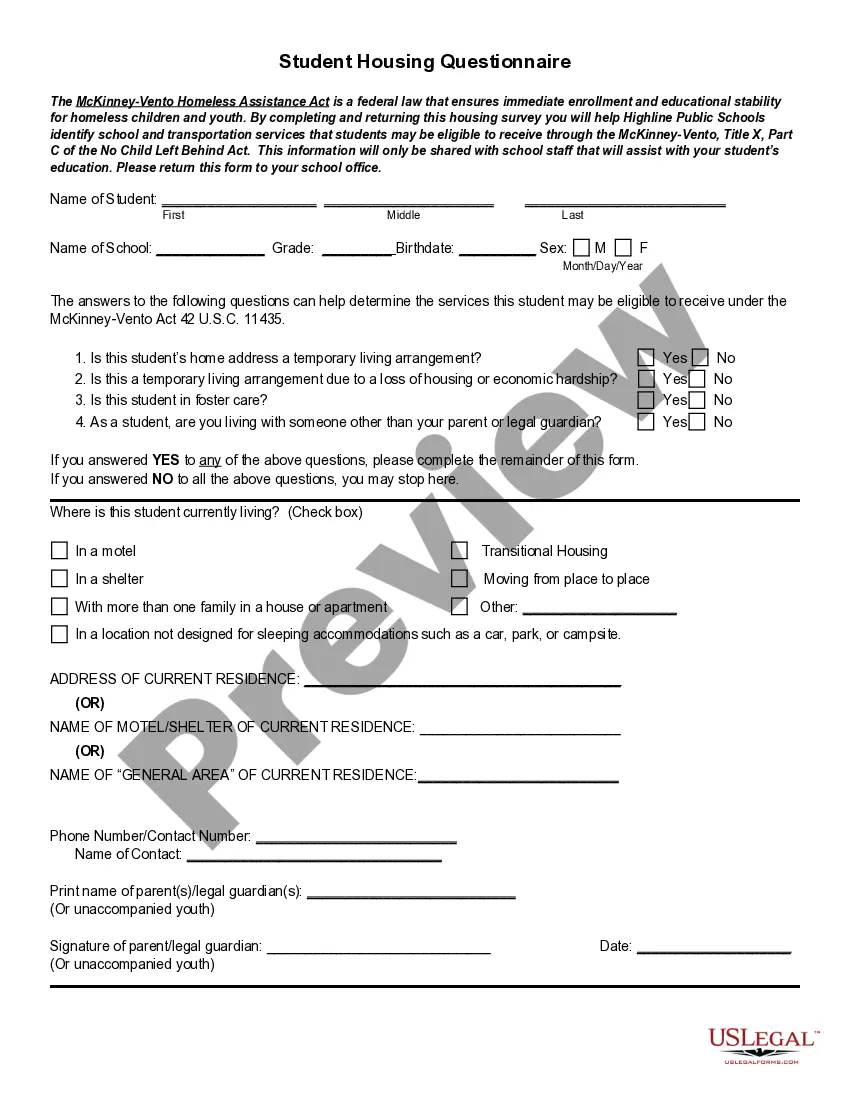

If you need to comprehensive, obtain, or produce authorized papers layouts, use US Legal Forms, the biggest assortment of authorized types, that can be found on the Internet. Utilize the site`s basic and convenient research to discover the paperwork you need. A variety of layouts for enterprise and individual uses are categorized by categories and suggests, or search phrases. Use US Legal Forms to discover the Tennessee Certificate of Incorporation for a Franchise Advertising Cooperative in just a number of click throughs.

If you are previously a US Legal Forms customer, log in in your profile and click on the Download key to find the Tennessee Certificate of Incorporation for a Franchise Advertising Cooperative. You can also gain access to types you earlier saved inside the My Forms tab of your own profile.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for the proper city/nation.

- Step 2. Take advantage of the Review choice to examine the form`s information. Don`t neglect to see the outline.

- Step 3. If you are not satisfied together with the kind, make use of the Research discipline on top of the monitor to get other versions of your authorized kind web template.

- Step 4. After you have discovered the shape you need, select the Purchase now key. Opt for the pricing program you like and include your qualifications to sign up for an profile.

- Step 5. Approach the deal. You can utilize your Мisa or Ьastercard or PayPal profile to accomplish the deal.

- Step 6. Select the file format of your authorized kind and obtain it on the product.

- Step 7. Total, modify and produce or indication the Tennessee Certificate of Incorporation for a Franchise Advertising Cooperative.

Every authorized papers web template you purchase is your own permanently. You may have acces to every kind you saved within your acccount. Go through the My Forms section and pick a kind to produce or obtain once more.

Be competitive and obtain, and produce the Tennessee Certificate of Incorporation for a Franchise Advertising Cooperative with US Legal Forms. There are millions of skilled and condition-distinct types you can utilize for the enterprise or individual needs.

Form popularity

FAQ

Pay while logged into TNTAP: Log into TNTAP. Select your FAE Account and Period, then select the ?Make a Payment? link in the ?I Want To? section. Choose ACH Debit or Credit Card, and then fill in the information requested. Once completed, click the ?Submit? button.

An obligated member entity (OME) entails unlimited liability protections and exemption from state taxes. Tennessee levies excises and franchise taxes on all legal entities, unless a company can gain exemption.

Tennessee does not tax individual's earned income, so you are not required to file a Tennessee tax return. Since the Hall Tax in Tennessee has ended. Starting with Tax Year 2021 Tennessee will be among the states with no individual income.

Franchise tax 0.25% of the greater net worth or real tangible property in Tennessee.

With a few exceptions, all businesses that sell goods or services must pay the state business tax. This includes businesses with a physical location in the state as well as out-of-state businesses performing certain activities in the state.

Franchise & Excise Tax - Excise Tax All persons, except those with nonprofit status or otherwise exempt, are subject to a 6.5% corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal year.

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

There are some exemptions to filing franchise and excise tax. For example, certain limited liability companies, limited partnerships and limited liability partnerships whose activities are at least 66% farming or holding personal residences where one or more of its partners or members reside are exempt.