Tennessee Mileage Reimbursement Form

Description

How to fill out Mileage Reimbursement Form?

If you want to gather, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account.

Complete and download, and print the Tennessee Mileage Reimbursement Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to locate the Tennessee Mileage Reimbursement Form with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and then click the Download button to obtain the Tennessee Mileage Reimbursement Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

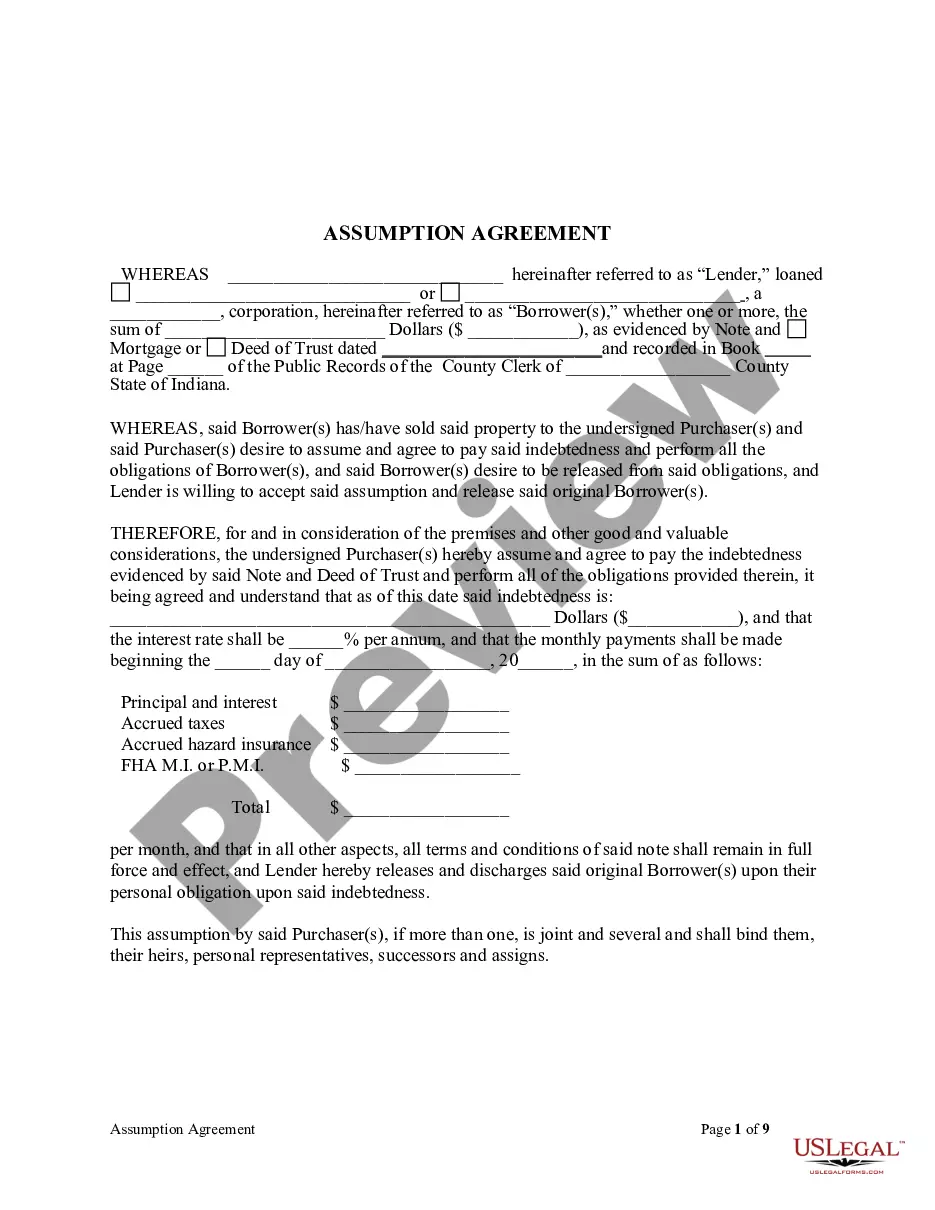

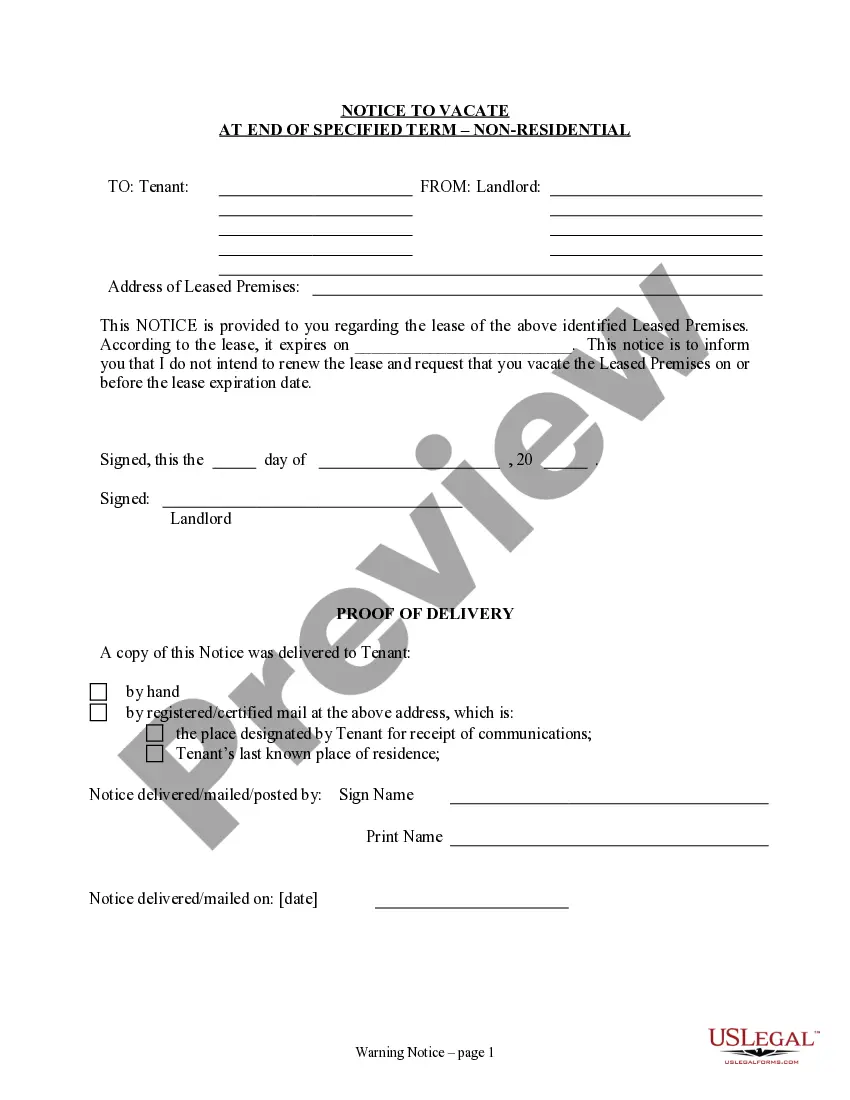

- Step 2. Use the Preview option to review the content of the form. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal format.

- Step 4. Once you find the form you want, click the Purchase now button. Choose the payment method you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify and print or sign the Tennessee Mileage Reimbursement Form.

Form popularity

FAQ

There is no law that says employers have to offer mileage reimbursement. Many do because it's a smart way to attract and retain employees.

Most states have some kind of mileage reimbursement law and Tennessee is no exception. This law is designed so that employers cannot take advantage of their employees when he or she must use their own car for work.

You can pay for actual costs or the IRS standard mileage rate. All reports must show detailed mileage and business purpose for each trip. For the standard mileage rate, use the IRS mileage rate for the year and multiply it by the actual business miles for the employee for the month.

To cover employee vehicle costs incurred as part of the job, an employer pays a cents-per-mile rate to employees. The standard mileage rate for 2022 is 58.5 cents per mile, as set by the IRS. You multiply this rate by the number of miles you drive over a payment period, and the result is your mileage reimbursement.

Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile for business miles driven, down 1.5 cents from the 2020 rate. 16 cents per mile driven for medical or moving purposes, down 1 cent from the 2020 rate.

For those municipalities that reimburse employees for business use based on the state of Tennessee mileage rate, the current rate effective August 1, 2018, is 47 cents per mile.

The standard mileage rate in 2020 for the use of a personal vehicle for business purposes is 57.5 cents per mile driven. That's down 0.5 cents from 58 cents per mile in 2019.

Effective January 2, 2022, that rate increased from $0.47 per mile to $0.585 per mile. The mileage reimbursement rates have changed over time.

The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. The notice also provides the standard mileage rate for use of an automobile for purposes of obtaining medical care under Sec. 213. This rate will be 18 cents per mile, up 2 cents from 2021.

The Fair Labor Standards Act (FLSA) kickback rule says if an employee's driving expenses cause them to earn less than minimum wage, the employer must reimburse them.