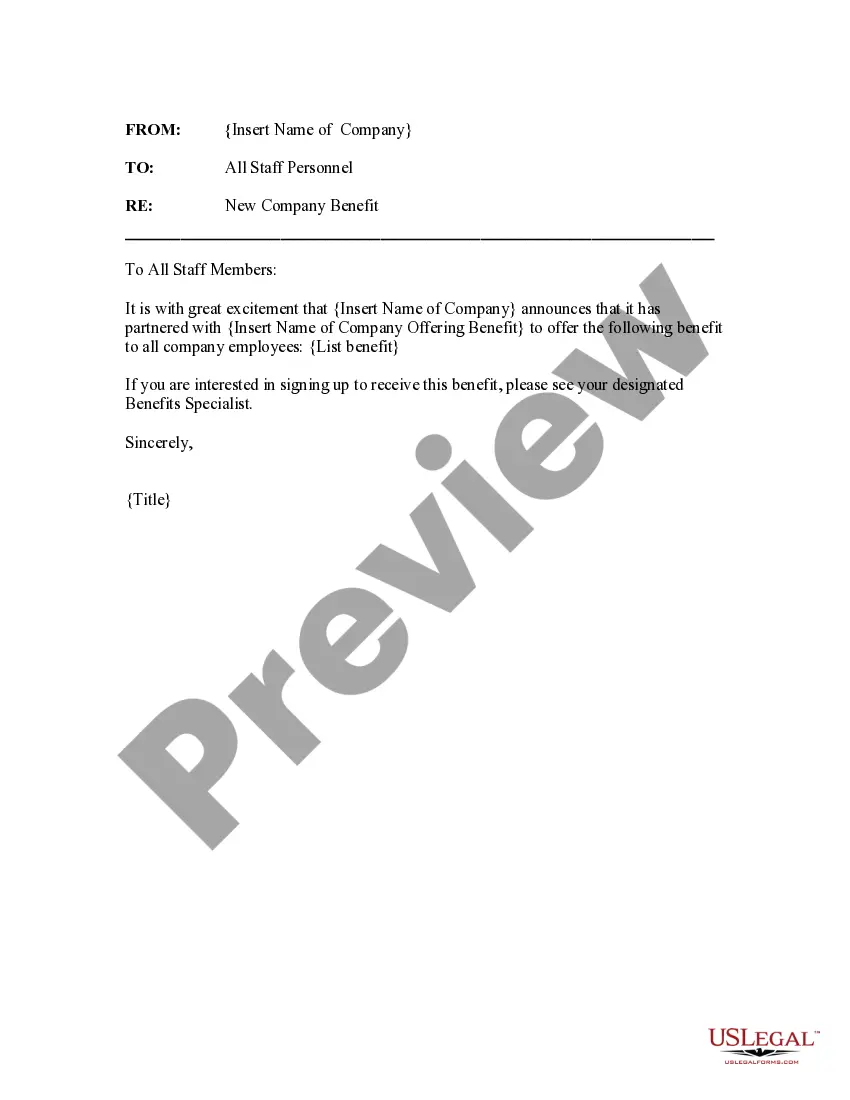

Tennessee New Company Benefit Notice

Description

How to fill out New Company Benefit Notice?

Have you ever found yourself in a scenario where you consistently require documents for either corporate or personal purposes.

There are numerous authentic document templates available online, yet locating ones you can rely on isn't easy.

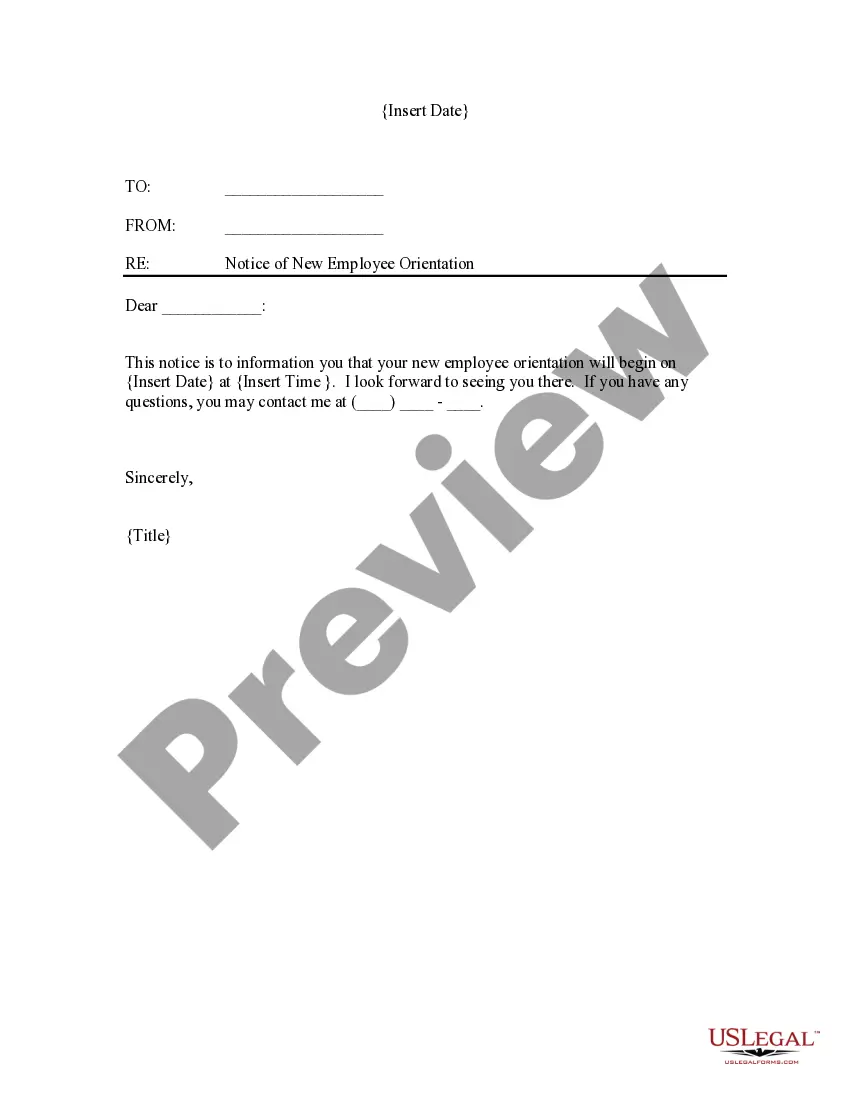

US Legal Forms provides a vast selection of template forms, such as the Tennessee New Company Benefit Notice, designed to comply with federal and state regulations.

Once you locate the appropriate form, click Buy now.

Select your desired pricing plan, provide the required details to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Tennessee New Company Benefit Notice template.

- If you don't have an account and wish to start utilizing US Legal Forms, follow these steps.

- Acquire the form you need and confirm it aligns with the correct state/region.

- Use the Review button to verify the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Lookup field to find the form that fits your requirements and specifications.

Form popularity

FAQ

Worker Adjustment and Retraining Notification Act (WARN) (29 USC 2100 et. seq.) - Protects workers, their families and communities by requiring most employers with 100 or more employees to provide notification 60 calendar days in advance of plant closings and mass layoffs.

Notify Us of the Layoff Federal law, known as the Worker Adjustment and Retraining Notification Act or WARN Act, offers protection to workers, their families and communities by requiring employers to provide notice 60 days in advance of plant closings, mass layoffs and/or sale of a business.

Top 10 Things To Do When Hiring A New EmployeeGet the employee set up on payroll & other company systems.Complete new hire paperwork.Get their desk and phone setup.Run a background check.Schedule an employee orientation.Schedule employee training.Host a team welcome for the new hire.Set employee goals.More items...?

Rule 0800-09-01-. 02 of the Rules and Regulations of the Tennessee Employment Security Law, requires all employers to furnish each separated employee with a Separation Notice, LB-0489, within 24 hours of the employee's separation from employment.

Visit to register for online reporting. Electronic Reporting: Employers can export their new hire information from their payroll or human resources software into a file that meets our layout specifications.

Tennessee has its own mini-WARN Act that differs from the federal act. Are You a Covered Employer? If you have 100 or more employees (not counting employees who have worked less than 6 months in the last 12 months, and not counting employees who work an average of less than 20 hours a week), you are a covered employer.

Workers in Tennessee are protected by the Federal WARN Act, which requires certain employers to give 60 days' notice before a mass layoff or plant closing. Additionally, Tennessee state law imposes certain requirements on employers operating inside the state that differ slightly from the federal law.

A mass layoff occurs under the WARN Act when: at least 50 employees are laid off during a 30-day period, if the laid-off employees made up at least one third of the workforce; 500 employees are laid off during a 30-day period, no matter how large the workforce; or.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.