Tennessee Repossession Services Agreement for Automobiles

Description

How to fill out Repossession Services Agreement For Automobiles?

Are you presently inside a place where you need to have documents for both business or person reasons just about every day time? There are a variety of lawful papers templates available on the net, but finding types you can rely on isn`t straightforward. US Legal Forms delivers thousands of form templates, such as the Tennessee Repossession Services Agreement for Automobiles, that happen to be created to meet state and federal needs.

In case you are previously acquainted with US Legal Forms internet site and possess a merchant account, simply log in. Next, you are able to download the Tennessee Repossession Services Agreement for Automobiles design.

If you do not come with an account and need to begin to use US Legal Forms, abide by these steps:

- Obtain the form you need and make sure it is to the right area/area.

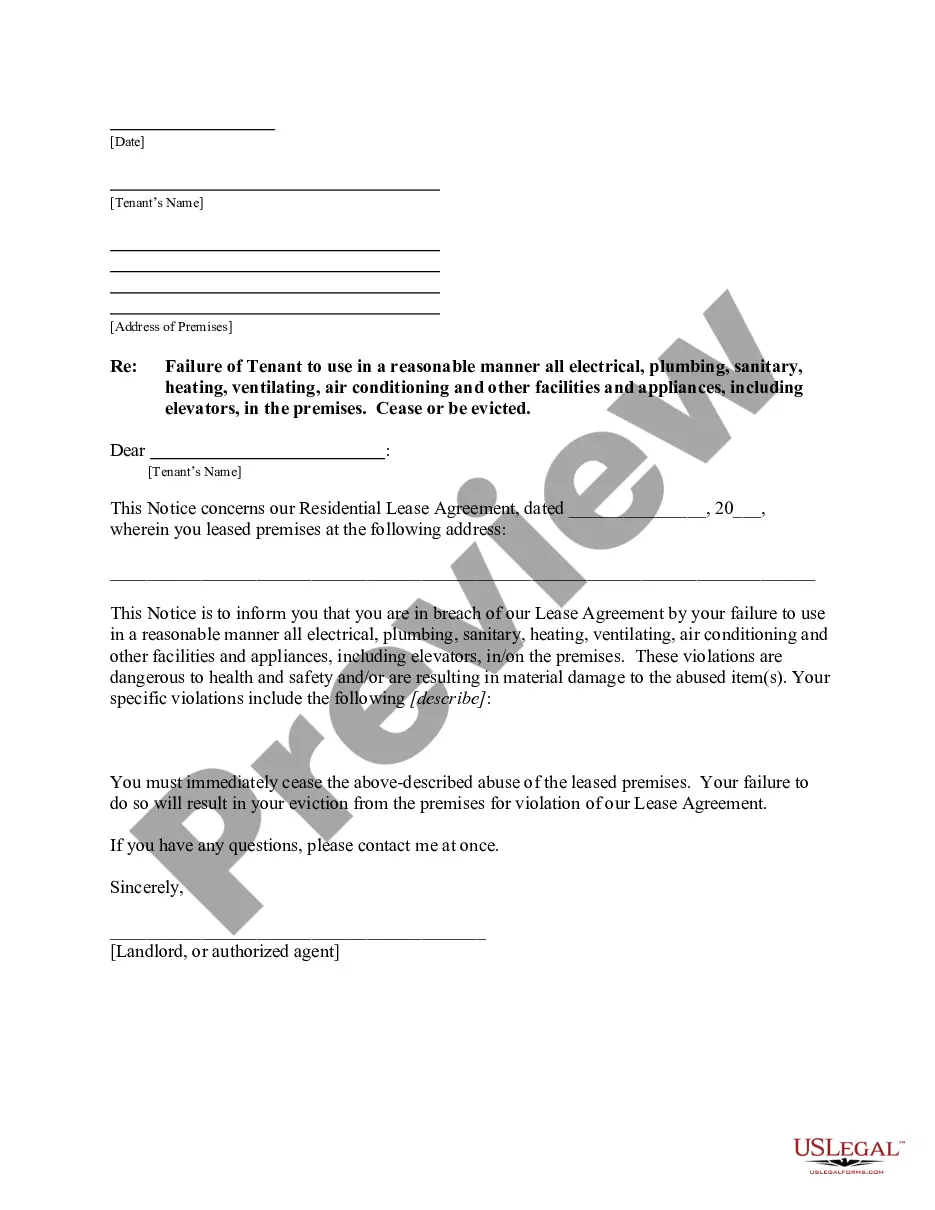

- Use the Review key to examine the form.

- See the explanation to actually have chosen the right form.

- In case the form isn`t what you`re trying to find, use the Search industry to get the form that suits you and needs.

- Whenever you discover the right form, simply click Acquire now.

- Select the costs strategy you want, submit the specified information and facts to create your account, and pay for the order making use of your PayPal or credit card.

- Pick a practical file format and download your copy.

Locate all the papers templates you may have bought in the My Forms food selection. You can obtain a further copy of Tennessee Repossession Services Agreement for Automobiles whenever, if needed. Just click the required form to download or print the papers design.

Use US Legal Forms, probably the most comprehensive selection of lawful varieties, in order to save time as well as steer clear of blunders. The assistance delivers expertly created lawful papers templates that can be used for a variety of reasons. Generate a merchant account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

The only way that a vehicle can be repossessed in the absence of the Sheriff of the Court and an original court order, is if the owner signs a voluntary termination notice, said Steyn.

Can I Get My Car Back After a Repossession in Tennessee? The Tennessee code says you can get the car back after repossession if you redeem it before it's sold. Under Tennessee law, you have to pay the full amount due on the loan to redeem the vehicle, not just the past-due amount.

Example Repossessed because of previous owner's debt A few months later, the car is repossessed by the company who sold it to the previous owner, who owed money on it and had not been making payments.

Repossession happens when your lender or leasing company takes your car away because you've missed payments on your loanand it can occur without warning if you've defaulted on your auto loan.

If your car or other property is repossessed, you might still owe the lender money on the contract. The amount you owe is called the "deficiency" or "deficiency balance."

Under Tennessee law, lenders are not required to have a court order or notify you when repossessing your vehicle. They have the right to repossess your car at any time if you are behind on payments. However, lenders are not allowed to repossess a vehicle if doing so breaches the peace.

Repossession is used to help lenders ensure that their debt is paid or as close to paid as is possible.

You can "redeem" the property by offering the creditor the entire unpaid balance on the debt plus expenses reasonably caused by the repossession. You must do this before the creditor has disposed of or sold the property. Usually you cannot redeem just by paying the amount in arrears unless the creditor approves it.

What is Repossession? The contractual right of repossession is a process where a creditor can legally take possession of a specific asset or property if a debtor fails to meet their obligations on a contract. This right of repossession exists in many different sorts of agreements and transactions.