Tennessee Employment of Executive with Stock Options and Rights in Discoveries

Description

How to fill out Employment Of Executive With Stock Options And Rights In Discoveries?

Selecting the finest authentic document template can be challenging. Naturally, there are numerous templates available online, but how can you find the genuine form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Tennessee Employment of Executive with Stock Options and Rights in Discoveries, useful for both business and personal purposes.

All forms are verified by experts and comply with federal and state regulations.

US Legal Forms is the largest repository of legal documents, where you can find various document templates. Use this service to download professionally crafted papers that comply with state requirements.

- If you are already registered, sign in to your account and click the Download button to obtain the Tennessee Employment of Executive with Stock Options and Rights in Discoveries.

- Use your account to review the legal forms you have previously purchased.

- Go to the My documents section of your account and download another copy of the document you require.

- If you are a first-time user of US Legal Forms, here are simple guidelines for you to follow.

- First, ensure you have selected the correct form for your locality/region.

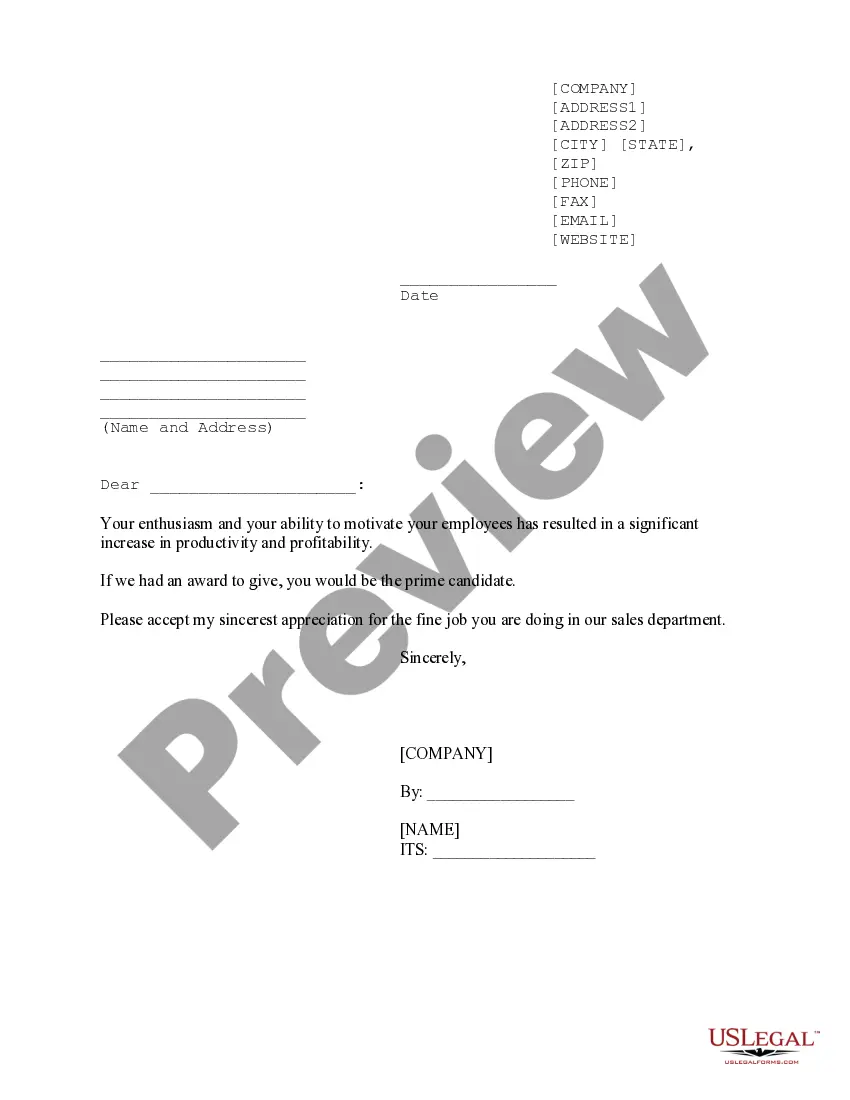

- You can review the form using the Preview button and read the form description to confirm it is suitable for your needs.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- When you are confident that the form is right, click the Get now button to obtain the form.

- Select your preferred pricing plan and enter the necessary details.

- Create your account and complete the payment for your order using your PayPal account or credit card.

- Choose the format and download the legal document template to your device.

- Complete, edit, print, and sign the acquired Tennessee Employment of Executive with Stock Options and Rights in Discoveries.

Form popularity

FAQ

You Could Make a Lot of Money with Stock Options (But There's No Guarantee) Think of a start-up company that gives you 100,000 company stock options with a strike price of $1 per share. At issue, they probably won't be worth much.

Grant date, which is the date on which employees are granted the options. Vesting schedule, which is the time table under which the employees gain full control over the options. This can vary by company. The options may vest all at once or gradually over time, say 20% per year over a five-year period.

If you have been given stock options as part of your employee compensation package, you will likely be able to cash these out when you see fit unless certain rules have been put into place by your employer detailing regulations for the sale.

It may sound complicated, but accepting your stock grant should be a no-brainer for anyone who's starting at a new company. It's low-risk and can provide measurable benefits down the road. To get started on the ins and outs of stock options, check out part 1 of our series Equity 101: Startup Employee Stock Options.

Stock option grants are how your company awards stock options. This document usually includes details like the type of stock options you get, how many shares you get, your strike price, and your vesting schedule (we'll get to this in the vesting section).

Stock options are a benefit often associated with startup companies, which may issue them in order to reward early employees when and if the company goes public. They are awarded by some fast-growing companies as an incentive for employees to work towards growing the value of the company's shares.

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

ESOP (Employee stock option plan) is an employee benefit plan offering employees the ownership interest in the organization. It is similar to a profit sharing plan. Under these plans the company, who is an employer , offers its stocks at negligible or low prices.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

What is a Stock Grant? Stock grants are equipped to keep a company's employees working for a specific set period. A stock grant is also known as an employee grant. An example of this would be a company granting a new employee 50 shares of shock that are vested over a period of two years.