Tennessee Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator

Description

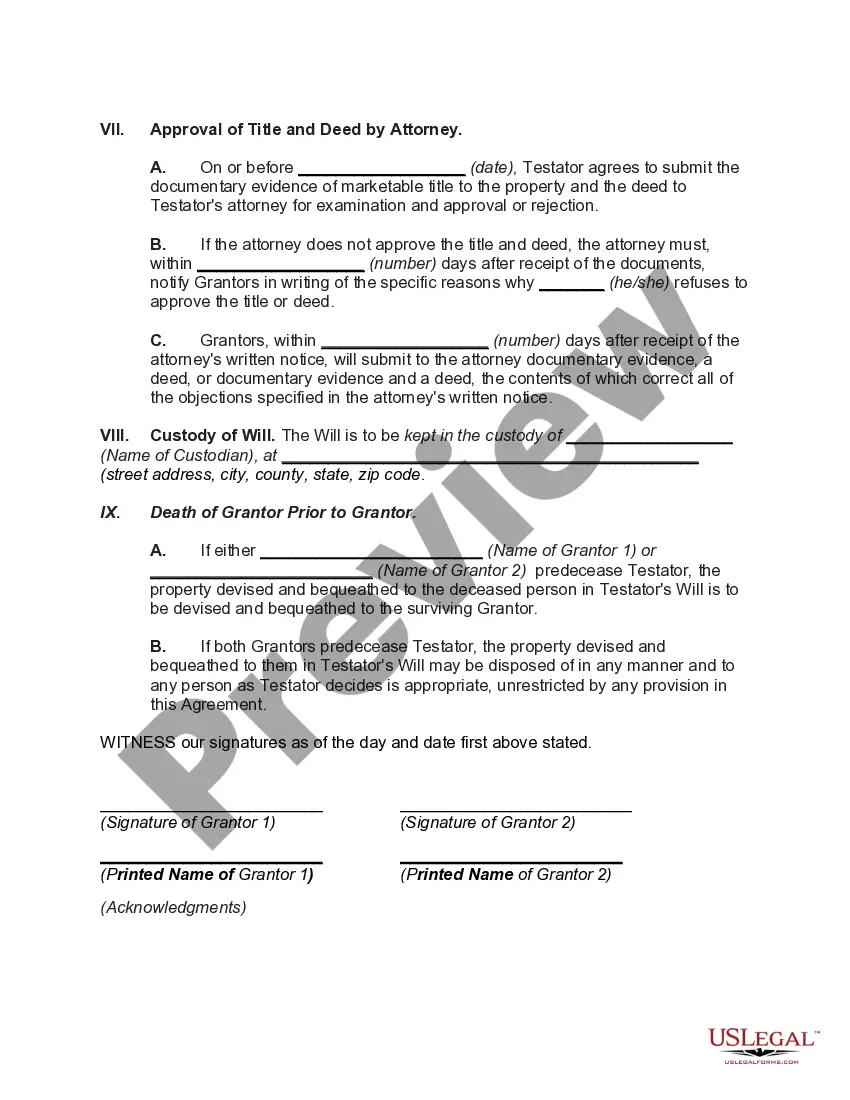

How to fill out Agreement To Devise Or Bequeath Property To Grantors Who Convey Property To Testator?

You can spend hours online searching for the legal document template that meets your state and federal requirements.

US Legal Forms offers a vast array of legal documents that can be reviewed by experts.

You can easily download or print the Tennessee Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator through my services.

If available, make use of the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Tennessee Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator.

- Each legal document template you acquire is yours forever.

- To obtain another copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your chosen region.

- Check the form description to confirm that you have selected the right form.

Form popularity

FAQ

To transfer property after the passing of a parent with a will in Tennessee, the will must first be probated in the local court. The executor named in the will will manage the process of transferring ownership. Utilizing a Tennessee Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator may streamline obtaining approvals from beneficiaries, simplifying the transfer.

"Transfer on Death Deed Form" - TennesseeA Beneficiary Deed of this kind will let you indicate one or more individuals who will automatically obtain rights to your property after your death without probate.

In terms of filing for probate, if the estate is small and has a value of $50,000 or less, a small estate affidavit can be filed 45 days after the death of the property owner.

Yes, probate is a requirement for estates in Tennessee. This is the method used to distribute the assets to the heirs and ensure the will is followed. In some cases, it is possible to avoid probate, especially if you utilize estate planning.

The executor has 60 days to start the process by submitting an inventory of the estate's assets, notifying heirs and creditors and asking the state's tax authorities and the Medicaid agency, TennCare, for a release of any claims.

However, in the case of death of a spouse, the property can only be transferred in two ways. One is through partition deed or settlement deed in case no will or testament is created by the deceased spouse. And second is through the will deed executed by the person before his/her last death.

What is the difference between these two phrases? Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

If a person dies intestate without any children, the spouse recovers the entire estate. If the person left a spouse and children, the surviving spouse will receive either one-third of the entire estate or a child's share of the estate, whichever is greater.

Tennessee does not allow real estate to be transferred with transfer-on-death deeds.

If you die intestate and you do not have either a spouse or descendants, the State of Tennessee dictates that the subsequent relative to inherit your estate is any surviving parents. If your parents survive you, your estate is distributed to them in equal parts.