Tennessee Irrevocable Trust Agreement Setting up Special Needs Trust for Benefit of Multiple Children

Description

How to fill out Irrevocable Trust Agreement Setting Up Special Needs Trust For Benefit Of Multiple Children?

You can invest hours online searching for the legal document template that meets the state and federal criteria you need.

US Legal Forms offers thousands of legal documents that are evaluated by experts.

You can easily acquire or print the Tennessee Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children from the service.

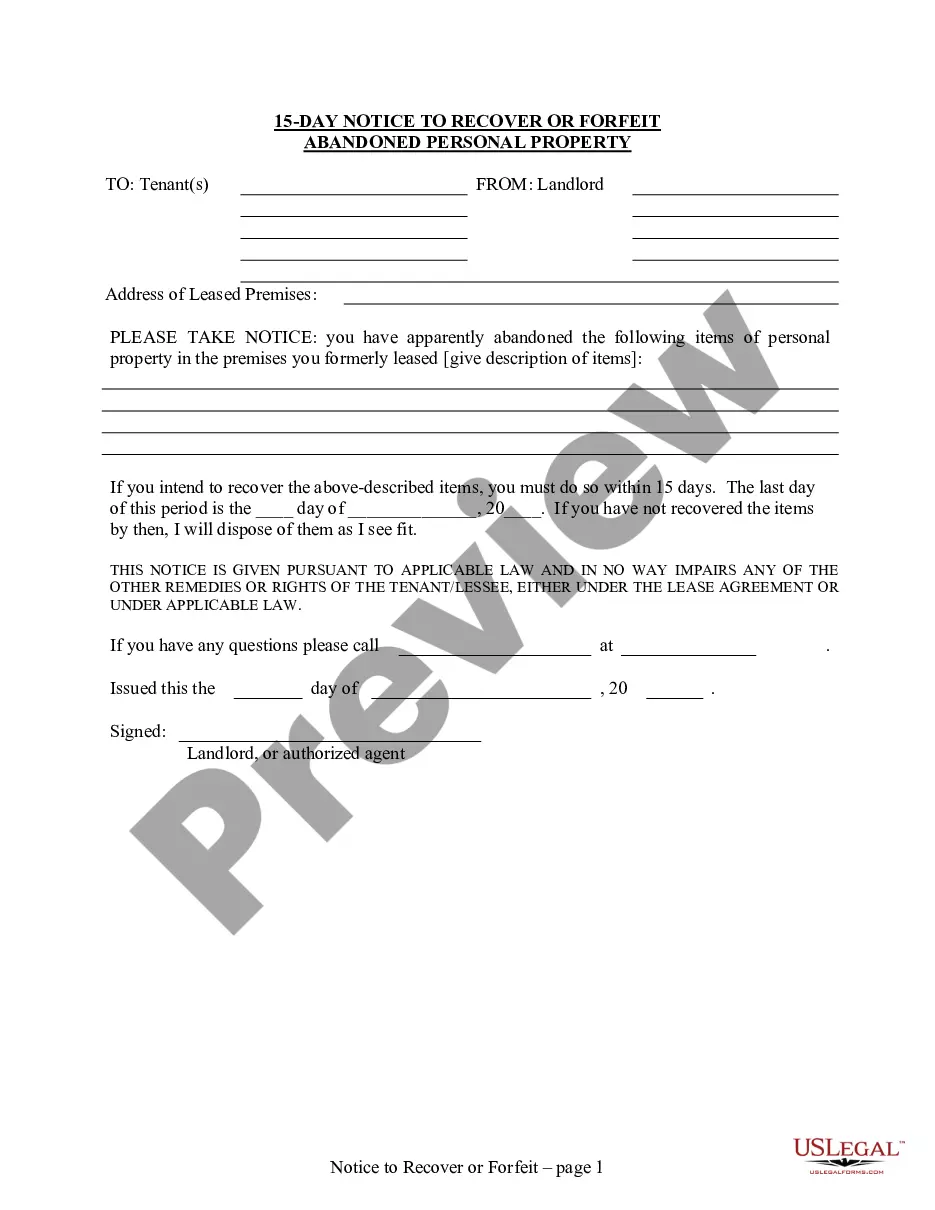

If available, use the Review button to preview the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Next, you can fill out, modify, print, or sign the Tennessee Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children.

- Every legal document template you download is yours permanently.

- To obtain an additional copy of a purchased form, go to the My documents section and click the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, make sure you have selected the correct document template for the state/city of your choice.

- Review the form description to ensure you have chosen the right template.

Form popularity

FAQ

Primary Beneficiary vs.A living trust can have both primary beneficiaries and contingent beneficiaries. This is true both for a single-grantor trust and a joint living trust, a common option for spouses as it allows for multiple grantors.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

Yes, there is no limit to the number of POD beneficiaries allowed on an account. Each POD beneficiary will receive an equal share of the assets in an account at the time of the passing of the last owner on the account. For example, if there are 4 POD beneficiaries, each will receive 25% of the funds.

Special Needs Trusts are a useful tool and a long-term plan for savings; however, they are not always a good fit for everyone. Alternatives to opening a trust include spending down the funds, prepayment of living expenses, and ABLE Accounts.

Trusts can have more than one beneficiary and they commonly do. In cases of multiple beneficiaries, the beneficiaries may hold concurrent interests or successive interests.

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

All these elements are important to address and start preparing the trust.Estimate the Funds Required For Special Needs Care. One of the major considerations while setting up a trust us to identify the fund's trust will require.Preparing the Trust Deed.Registering the Trust Deed.

A primary beneficiary is an individual or organization who is first in line to receive benefits in a will, trust, retirement account, life insurance policy, or annuity upon the account or trust holder's death. An individual can name multiple primary beneficiaries and stipulate how distributions would be allocated.

The term special needs trust refers to the purpose of the trust to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name supplemental needs trust addresses the shortfalls of our public benefits programs.