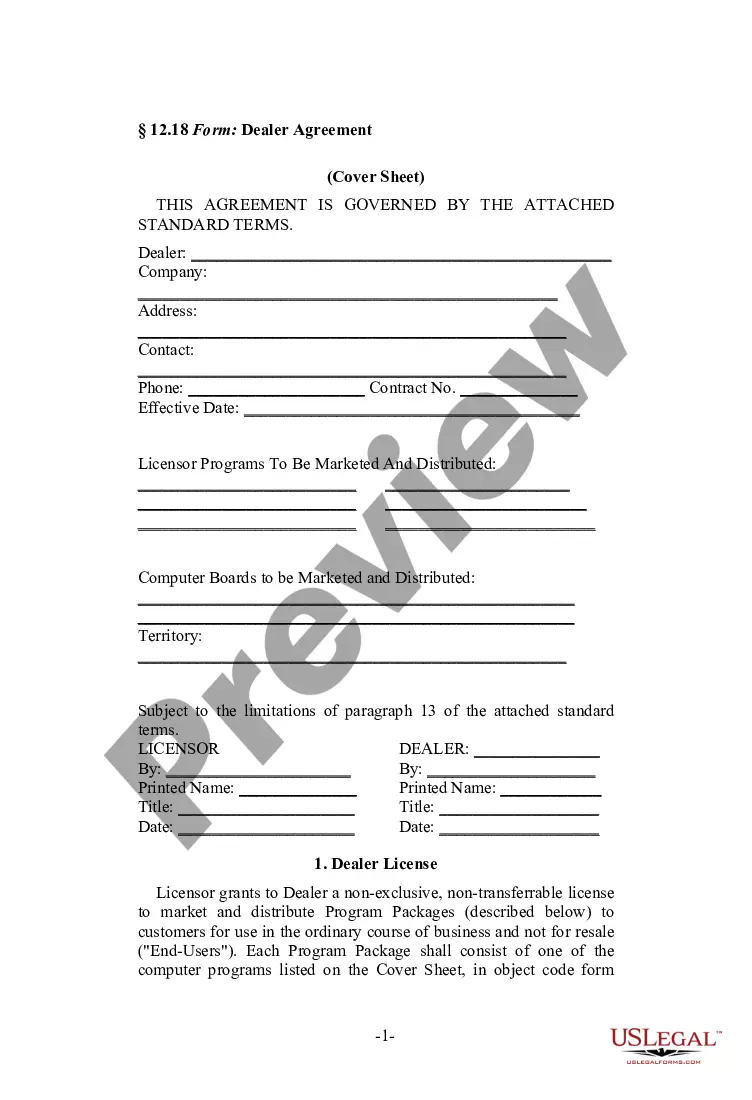

Tennessee Software Installation Agreement between Seller and Independent Contractor

Description

An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

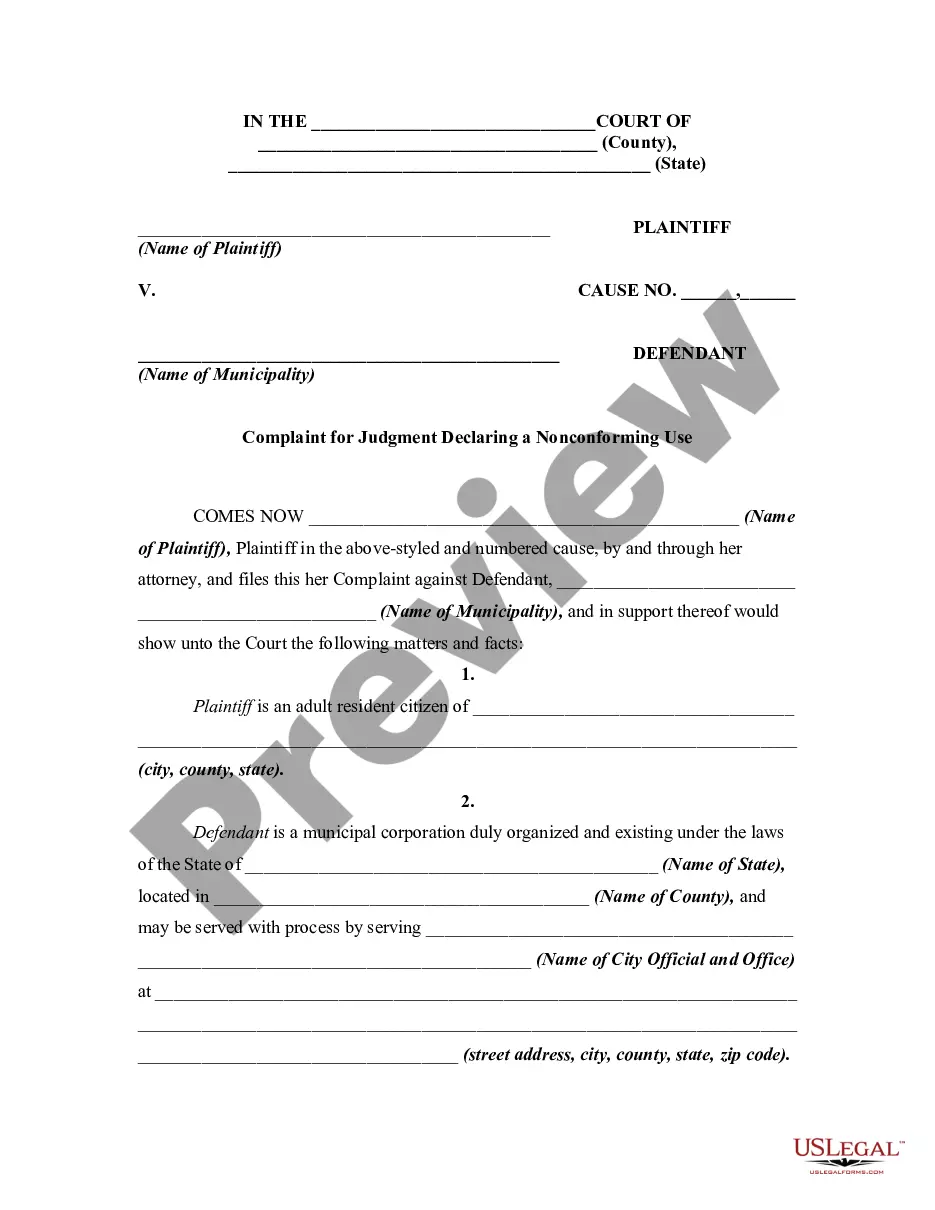

How to fill out Software Installation Agreement Between Seller And Independent Contractor?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a vast array of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can find the most recent versions of documents such as the Tennessee Software Installation Agreement between Seller and Independent Contractor within seconds.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred pricing plan and provide your details to register for an account.

- If you have a monthly subscription, Log In to obtain the Tennessee Software Installation Agreement between Seller and Independent Contractor from your US Legal Forms library.

- The Download button will appear on every document you view.

- You can access all previously obtained forms from the My documents tab in your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct document for your region/county. Click on the Review button to verify the document's contents.

- Read the document summary to confirm that you have chosen the appropriate form.

Form popularity

FAQ

Labor is generally not taxed in Tennessee unless it directly relates to the sale of a tangible product or involves taxable services. It is important to differentiate between different types of labor when creating contracts. When entering into a Tennessee Software Installation Agreement between Seller and Independent Contractor, both parties should understand if any labor costs need to be taxed. This awareness can help streamline your business transactions and foster clear communication.

Installation services in Tennessee may be taxable, especially if they are part of the sale of tangible personal property. If you provide installation as part of a product sale, your Tennessee Software Installation Agreement between Seller and Independent Contractor should address the tax implications clearly. Clarity in the agreement helps to avoid any misunderstandings about tax liabilities down the line.

Certain items are exempt from sales tax in Tennessee, including some food products, prescription medications, and sales to certain non-profit organizations. Additionally, services that do not involve tangible goods, such as consulting or some educational services, may also be exempt. If your Tennessee Software Installation Agreement between Seller and Independent Contractor includes tasks that fall under these exemptions, it can save costs for both parties. Make sure to check the latest tax regulations for any updates.

In Tennessee, labor is generally not subject to sales tax unless it directly relates to the sale of tangible personal property. However, when it comes to installation services associated with a sale, these services may incur sales tax. If you're drafting a Tennessee Software Installation Agreement between Seller and Independent Contractor, ensure that you clarify whether the installation involves taxable labor. Understanding tax implications can protect both parties' interests.

Tennessee business tax began on July 1, 1967. This tax is designed to support state services and infrastructure. If you are entering into a Tennessee Software Installation Agreement between Seller and Independent Contractor, it’s essential to understand this tax, as it may impact your contractual obligations. Familiarity with tax regulations can enhance your business operations.

The independent contractor agreement in Tennessee outlines the working relationship between a contractor and a client. It delineates responsibilities, payment terms, and other important details of the engagement. If you’re entering into a Tennessee Software Installation Agreement between Seller and Independent Contractor, this agreement serves as a crucial foundation for your business relationship.

Yes, software maintenance is generally taxable in Tennessee. If you provide software maintenance services as an independent contractor, you may need to account for sales tax. When creating your Tennessee Software Installation Agreement between Seller and Independent Contractor, ensure these tax obligations are explicitly stated to maintain compliance.

Maintenance contracts are typically subject to sales tax in Tennessee. This means if you’re providing ongoing support through a maintenance agreement, those services may incur taxes. When considering a Tennessee Software Installation Agreement between Seller and Independent Contractor, always include tax considerations in your contract to avoid unexpected liabilities.

In Tennessee, software as a service (SaaS) is generally considered taxable. However, this can depend on the nature of the service and how it is delivered. If you have a Tennessee Software Installation Agreement between Seller and Independent Contractor, it’s essential to assess the specifics to determine tax obligations accurately.

Software maintenance costs can be tax-deductible if they are directly related to your business operations. This deduction can benefit independent contractors who rely on software for their services. When you draft a Tennessee Software Installation Agreement between Seller and Independent Contractor, consider including provisions for software maintenance to maximize your tax benefits.