Tennessee Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

Are you currently in a position where you require documents for business or personal reasons almost constantly.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the Tennessee Contract for Sale of Goods on Consignment, designed to comply with federal and state regulations.

Once you find the suitable form, click Get now.

Select the pricing plan you want, enter the necessary information to create your account, and complete the purchase with your PayPal or Visa or Mastercard. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Tennessee Contract for Sale of Goods on Consignment at any time. Just select the required form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Contract for Sale of Goods on Consignment template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/county.

- Use the Review button to examine the form.

- Read the description to confirm that you have chosen the right form.

- If the form does not match your needs, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

A consignment sale works by allowing the consignee to sell goods on behalf of the consignor, who retains ownership until the sale occurs. The consignee displays the goods and earns a commission from the sales revenue. Engaging in a Tennessee Contract for Sale of Goods on Consignment ensures both parties understand their roles and provides an efficient process for sales and profit distribution.

The common law of consignment governs the rights and responsibilities of the parties involved in a consignment agreement. It establishes how goods are to be handled, how profits are to be shared, and the legal implications if one party fails to meet their obligations. Using a Tennessee Contract for Sale of Goods on Consignment can be advantageous as it incorporates these common law principles while also addressing state-specific requirements.

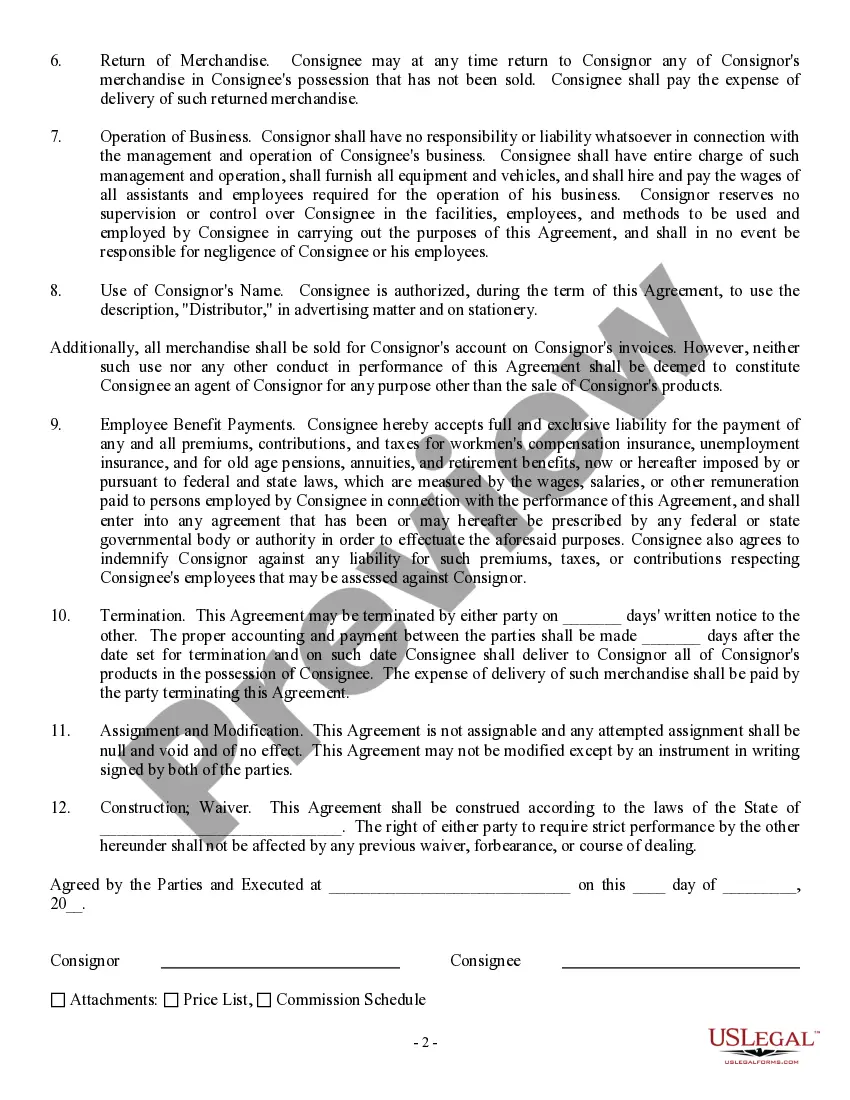

A typical consignment agreement outlines the terms between a consignor, who provides goods, and a consignee, who sells those goods on behalf of the consignor. This agreement ensures that the consignor retains ownership of the goods until they are sold, establishing a clear understanding of responsibilities and profits. Utilizing a Tennessee Contract for Sale of Goods on Consignment provides a detailed framework to protect both parties involved.

Certain vendors, such as corporations and tax-exempt organizations, often qualify for exemptions from 1099 reporting. Additionally, payments related to merchandise purchases generally do not require 1099 forms. For clarity and guidance on these exemptions, referring to a well-crafted Tennessee Contract for Sale of Goods on Consignment is advisable.

You typically do not receive a 1099 for selling goods unless the sale exceeds $600 and involves a business relationship with a buyer. If you conduct sales through consignment, a Tennessee Contract for Sale of Goods on Consignment can help clarify any tax obligations. Keeping accurate records will help you stay informed about any potential 1099 requirements.

You do not typically issue a 1099 for merchandise sold, as it is considered a part of regular business transactions. However, if your consignment sales involve independent contractors, you might need to consider issuing a 1099 if the payment exceeds $600. Referencing a Tennessee Contract for Sale of Goods on Consignment can assist in determining your tax responsibilities.

Generally, you do not need to send 1099s to corporations or tax-exempt organizations. Additionally, payments made to vendors for merchandise typically do not require 1099 forms. Understanding who is exempt is crucial, and a Tennessee Contract for Sale of Goods on Consignment can help clarify these obligations.

If you operate a business and your consignment sales exceed $600 in a calendar year, you are required to issue a 1099 to the seller. The Tennessee Contract for Sale of Goods on Consignment outlines these financial aspects, helping you stay compliant. It's wise to consult a tax advisor for further guidance specific to your situation.

A fair split for consignment sales often ranges between 60/40 and 50/50, depending on various factors, including the nature of the goods and the agreement terms. The Tennessee Contract for Sale of Goods on Consignment can help define this split clearly. Establishing a mutual agreement ensures transparency and fairness for both parties involved.

In a typical consignment arrangement, the consignor supplies goods to the consignee, who sells them on behalf of the consignor. The consignee earns a percentage of the sales revenue, while the consignor retains ownership until the goods are sold. This structure allows sellers to maximize their product exposure without risking upfront costs or unsold inventory, making it a popular choice in the Tennessee market.