The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

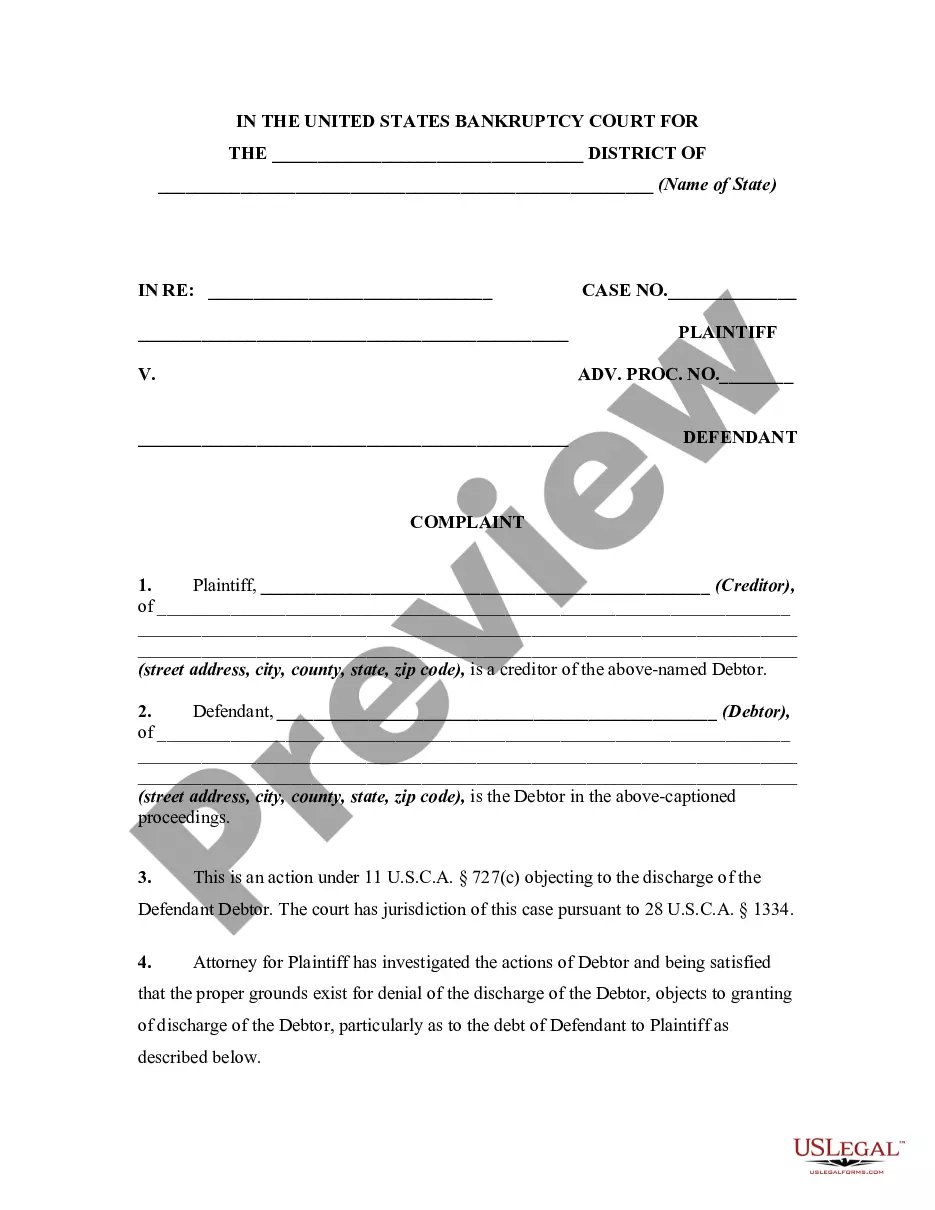

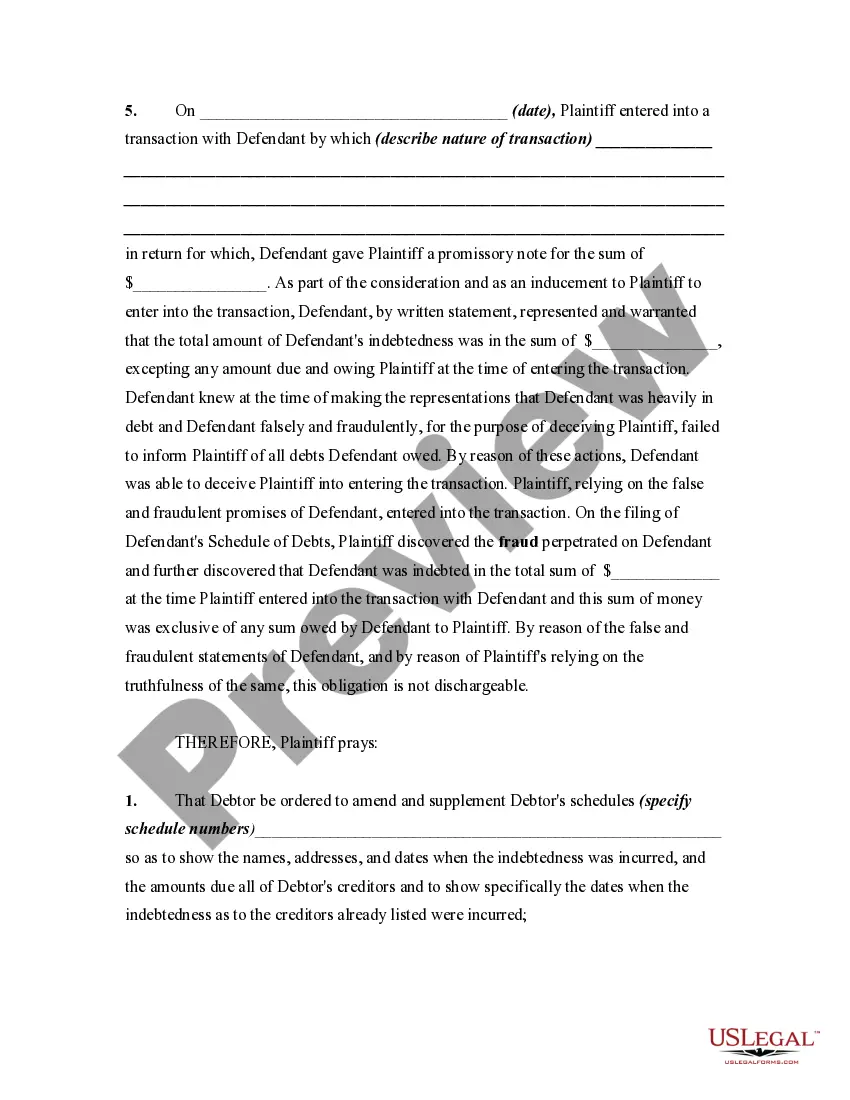

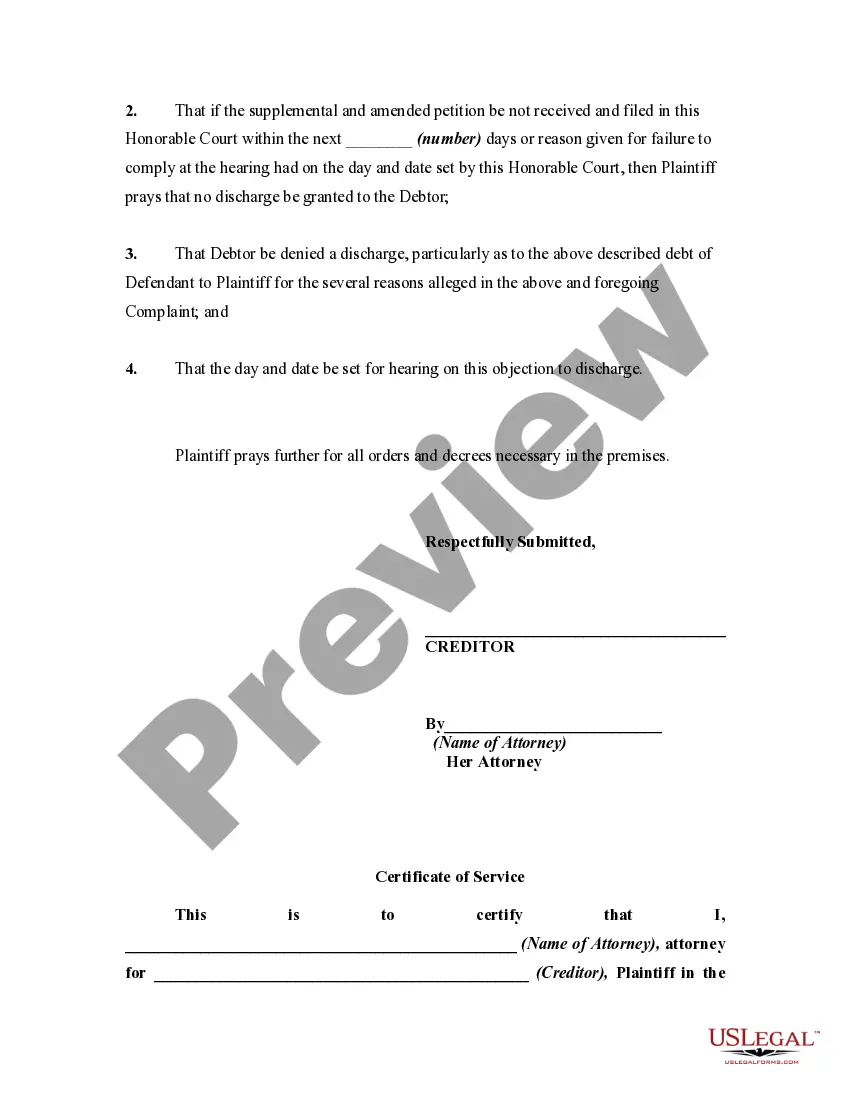

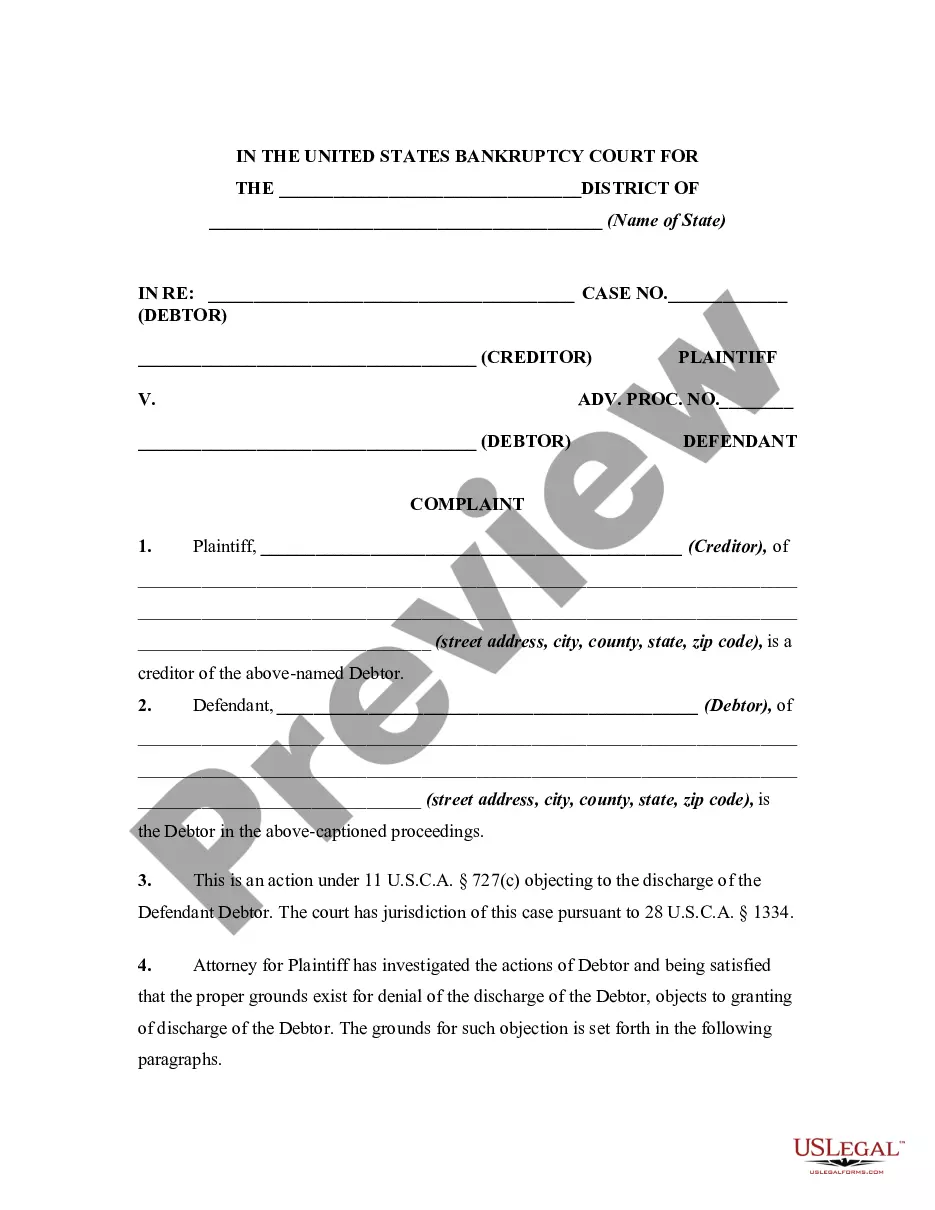

Tennessee Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding Debtor's Financial Condition

Description

How to fill out Complaint Objecting To Discharge By Bankruptcy Court On The Grounds That Transaction Was Induced By Fraud Regarding Debtor's Financial Condition?

It is possible to spend several hours online searching for the legitimate file web template that meets the state and federal needs you will need. US Legal Forms supplies 1000s of legitimate types which can be examined by experts. It is simple to download or produce the Tennessee Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding from my support.

If you already possess a US Legal Forms accounts, you may log in and click the Acquire option. Afterward, you may complete, modify, produce, or indication the Tennessee Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding. Each and every legitimate file web template you acquire is your own eternally. To get another duplicate for any obtained kind, check out the My Forms tab and click the corresponding option.

If you work with the US Legal Forms web site for the first time, keep to the easy instructions under:

- Very first, be sure that you have selected the proper file web template to the county/town of your choosing. See the kind outline to make sure you have selected the right kind. If readily available, use the Review option to appear through the file web template at the same time.

- If you would like discover another variation from the kind, use the Research area to get the web template that meets your needs and needs.

- When you have found the web template you want, click Purchase now to proceed.

- Find the costs program you want, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You should use your Visa or Mastercard or PayPal accounts to cover the legitimate kind.

- Find the format from the file and download it to the system.

- Make changes to the file if necessary. It is possible to complete, modify and indication and produce Tennessee Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding.

Acquire and produce 1000s of file web templates using the US Legal Forms site, that provides the biggest assortment of legitimate types. Use specialist and status-particular web templates to deal with your company or personal demands.

Form popularity

FAQ

Conditions for Denial of Discharge You've hidden, destroyed, or failed to keep adequate records of your assets and financial affairs. You lied or tried to defraud the court or your creditors. You failed to explain any loss of assets. You refused to obey a lawful order of the court.

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

A debtor may apply to the Court to challenge (oppose) a bankruptcy notice before the time for compliance with the notice has finished. The debtor can apply to challenge a bankruptcy notice if: there is a defect in the bankruptcy notice. the debt on which the bankruptcy notice is based does not exist.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

In a decision handed down on February 22, 2023, Bartenwerfer v. Buckley, the United States Supreme Court ruled that the bankruptcy process cannot be used to discharge debts incurred through fraud, even when the debtor was not the individual that defrauded creditors.

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

A trustee's or creditor's objection to the debtor being released from personal liability for certain dischargeable debts. Common reasons include allegations that the debt to be discharged was incurred by false pretenses or that debt arose because of the debtor's fraud while acting as a fiduciary.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

A creditor will usually object to the discharge of its particular debt when fraud or an intentional wrongful act occurs before the bankruptcy case. For instance, examples of nondischargeable debts, if proven, could include: The costs and damages caused by intentional and spiteful conduct.