The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

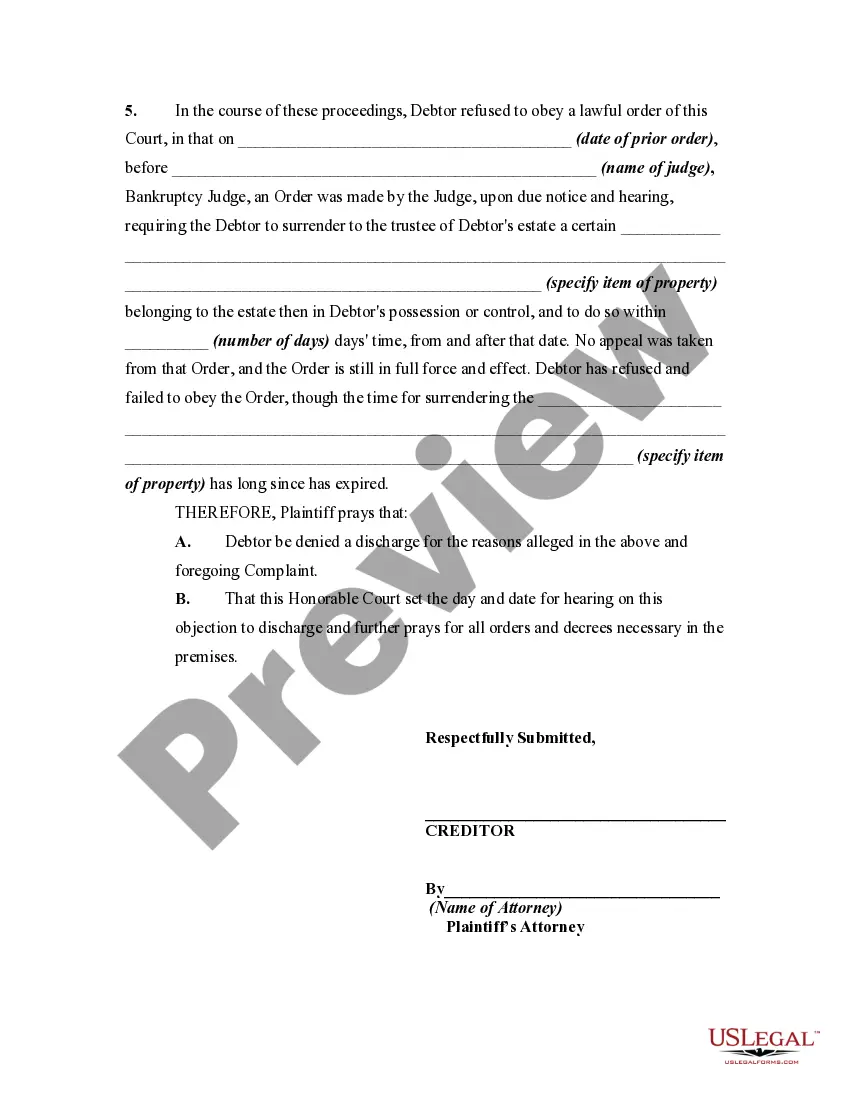

Tennessee Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court

Description

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Proceedings For Refusal By Debtor To Obey A Lawful Order Of The Court?

If you have to complete, acquire, or print out lawful record layouts, use US Legal Forms, the greatest collection of lawful forms, which can be found on-line. Utilize the site`s simple and easy practical look for to find the documents you need. Various layouts for company and individual reasons are categorized by types and claims, or keywords and phrases. Use US Legal Forms to find the Tennessee Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the in just a few clicks.

When you are currently a US Legal Forms client, log in for your profile and click the Obtain option to have the Tennessee Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the. Also you can accessibility forms you earlier downloaded within the My Forms tab of your own profile.

If you are using US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form to the right area/nation.

- Step 2. Make use of the Preview option to look over the form`s content. Don`t neglect to read through the information.

- Step 3. When you are not satisfied with the develop, utilize the Look for industry at the top of the display screen to discover other types in the lawful develop template.

- Step 4. Upon having identified the form you need, go through the Purchase now option. Select the prices plan you choose and include your accreditations to sign up for the profile.

- Step 5. Approach the purchase. You may use your credit card or PayPal profile to finish the purchase.

- Step 6. Select the file format in the lawful develop and acquire it on your system.

- Step 7. Complete, edit and print out or indication the Tennessee Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the.

Each lawful record template you purchase is yours for a long time. You possess acces to each and every develop you downloaded within your acccount. Click the My Forms area and choose a develop to print out or acquire once again.

Remain competitive and acquire, and print out the Tennessee Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the with US Legal Forms. There are millions of skilled and state-distinct forms you may use for the company or individual demands.

Form popularity

FAQ

Another exception to Discharge is for fraud while acting in a fiduciary capacity, embezzlement, or larceny. Domestic obligations are not dischargeable in Bankruptcy. Damages resulting from the willful and malicious injury by the debtor of another person or his property, are also not dischargeable in Bankruptcy.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

The debtor knowingly made a false oath or account, presented a false claim, etc. Failure to comply with a bankruptcy court order.

If you had a Chapter 7 that resulted in discharge of your debts, you must wait at least eight years from the date you filed it before filing Chapter 7 bankruptcy again. While Chapter 7 is typically the quickest form of debt relief, the eight-year period to refile is the longest waiting time between cases.

Section 523 complaints focus on specific debts to a single creditor. A Section 727 complaint may be filed if the creditor or bankruptcy trustee believes that the debtor has not met the requirements for a discharge under Section 727. Section 727 complaints address the discharge of a debtor's entire debt obligations.

An objection to discharge is a notice lodged with the Official Receiver by a trustee to induce a bankrupt to comply with their obligations. An objection will extend the period of bankruptcy so automatic discharge will not occur three years and one day after the bankrupt filed a statement of affairs.