Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

How to fill out Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

Have you ever found yourself in a situation where you require documents for either organizational or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding versions you can rely on is challenging.

US Legal Forms offers thousands of form templates, including the Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, which is designed to meet state and federal requirements.

Choose the pricing plan that suits you, fill in the necessary details to create your account, and complete your order using PayPal or Visa or Mastercard.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is suitable for the correct city/state.

- Use the Preview button to review the form.

- Check the description to ensure you have selected the correct document.

- If the form is not what you are looking for, use the Search field to find the one that fits your requirements.

- Once you find the right form, click Purchase now.

Form popularity

FAQ

Being independent of contract means that an individual operates without being under the direct supervision of another party. This autonomy allows contractors to manage their work and business practices. For those entering a Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, understanding this independence ensures that they can deliver medical services without the constraints of traditional employment.

An independent contractor can take on various roles, and a commonly recognized example is a freelance writer or graphic designer. These professionals provide services to clients without being directly employed by them. In the context of a Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, a physician may enter into such an agreement to provide services while maintaining independence from a corporate entity.

Yes, as an independent contractor in Tennessee, you typically need to obtain a business license depending on your specific activities. This requirement ensures that you comply with local regulations and helps protect your professional liability. The Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation outlines responsibilities, and acquiring the appropriate licenses is integral to a successful contract.

In Tennessee, contracting without a proper license can lead to significant penalties. Violators may face fines, legal repercussions, and even restrictions on future contracting opportunities. Specifically, engaging in activities under a Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation without the necessary licensing can complicate your practice and lead to disciplinary action.

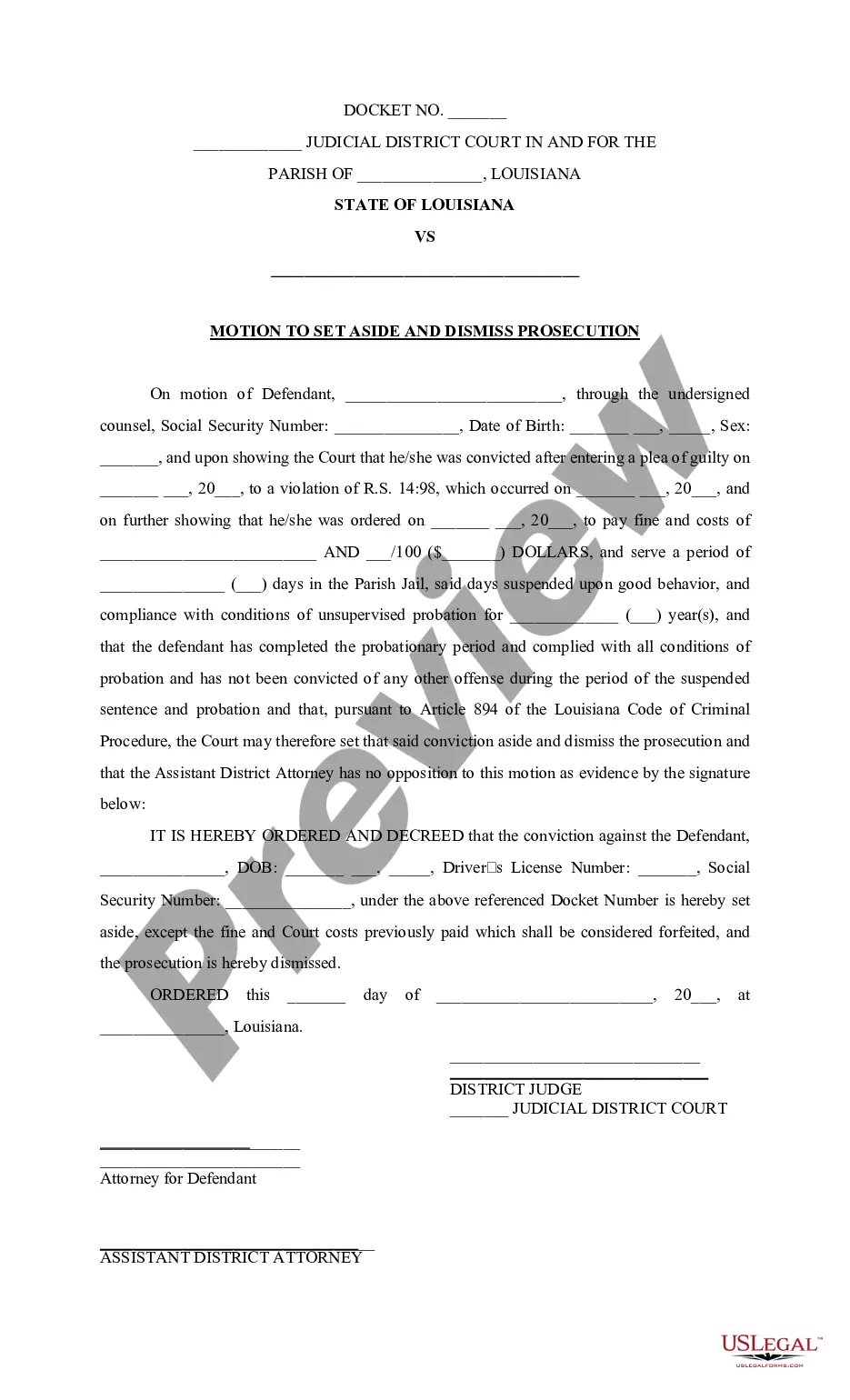

The independent contractor agreement in Tennessee is a legal document that outlines the terms under which a physician operates as an independent contractor. It specifies the relationship between the contractor and the professional corporation, covering aspects like services, fees, and obligations. Utilizing the Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation promotes compliance and provides protection for both parties involved in the agreement.

The healthcare industry has seen a rise in independent contractors, particularly among physicians and specialists. This sector benefits from the flexibility that independent contracting offers, allowing more control over work hours and patient care. The Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation facilitates smooth operations in such arrangements, ensuring clarity in professional relationships.

Most doctors work in hospitals and healthcare systems, though many also operate private practices, community clinics, or urgent care centers. This variation in work environments allows physicians to cater to diverse patient needs. The Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can be essential for those who operate outside these traditional settings, allowing them to formalize their business relationships.

To write an effective independent contractor agreement, begin with clear definitions of the parties involved, focusing especially on responsibilities and services offered. It's essential to include payment terms, confidentiality clauses, and termination conditions. The Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation template can serve as a helpful guide in ensuring compliance with legal standards and protecting both parties’ interests.

Currently, a majority of doctors are employed by hospitals or healthcare systems, with approximately 70% working as employees. However, many physicians still choose to work as independent contractors, particularly those who prefer the flexibility and autonomy associated with the Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. This arrangement enables them to manage their practices on their own terms.

Around 30% of US doctors operate in private practice. This percentage represents a significant portion of the medical workforce that prefers independence to corporate healthcare settings. The Tennessee Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation plays a vital role in these arrangements, allowing physicians to maintain control over their practice and financial decisions.