District of Columbia Goals, Values, and Beliefs Policy

Description

How to fill out Goals, Values, And Beliefs Policy?

Are you in a scenario where you require documentation for business or personal reasons nearly every workday.

There are numerous legal form templates available online, but finding reliable ones isn't easy.

US Legal Forms provides a vast array of template forms, including the District of Columbia Goals, Values, and Beliefs Policy, which can be tailored to comply with state and federal regulations.

Choose an easy file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download a duplicate of the District of Columbia Goals, Values, and Beliefs Policy anytime, if needed. Simply select the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the District of Columbia Goals, Values, and Beliefs Policy template.

- If you don't have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it's for the correct city/state.

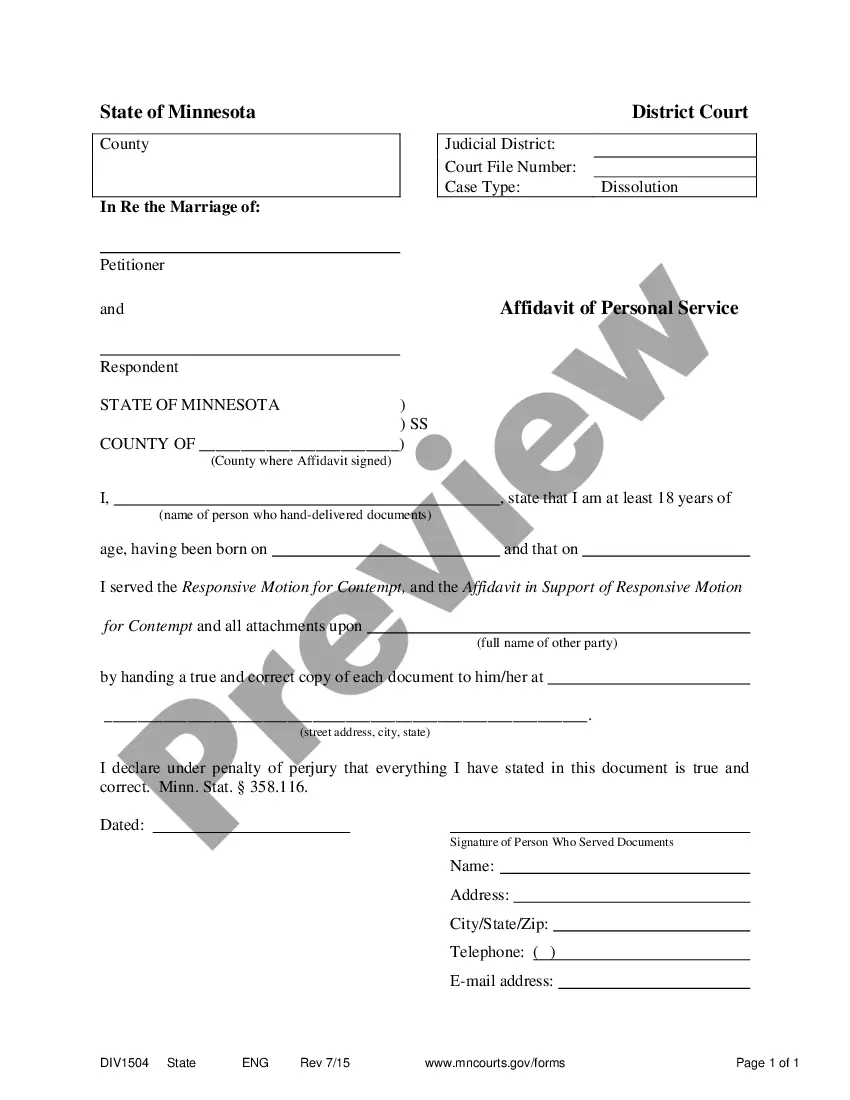

- Utilize the Preview option to review the document.

- Read the description to confirm that you've selected the appropriate form.

- If the form isn't what you are looking for, use the Search field to find the form that meets your needs and specifications.

- Once you locate the correct form, click Buy Now.

- Select the pricing plan you prefer, provide the necessary details to create your account, and complete your purchase using your PayPal or Visa/MasterCard.

Form popularity

FAQ

Yes, you can e-file a DC tax return, including those using forms like the D-30. Electronic filing not only speeds up the process but also helps maintain compliance with the District of Columbia Goals, Values, and Beliefs Policy. Look for online tax services that offer e-filing options for a seamless experience.

The DC D-30 filing requirement mandates that individuals who meet specific income thresholds file their income tax returns with the District of Columbia. This form is essential for maintaining compliance with the District of Columbia Goals, Values, and Beliefs Policy. Make sure to track your income accurately to determine if you need to file this form.

DC Form D-30 is primarily designed for individual income tax returns, while DC Form D-65 is intended for partnerships. When considering the District of Columbia Goals, Values, and Beliefs Policy, it's important to select the correct form that aligns with your filing status. Be sure to review the requirements for each to ensure accurate filing and compliance.

When writing Washington, D.C. in a paper, make sure to use the full term 'Washington, District of Columbia' on first reference. Subsequently, you can use the abbreviation 'D.C.' This approach ensures clarity and aligns with the standards set by the District of Columbia Goals, Values, and Beliefs Policy.