Tennessee Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

Are you in a situation where you require documentation for various company or personal reasons almost daily.

There are numerous legal document templates available online, but finding ones you can trust isn’t straightforward.

US Legal Forms offers a vast array of form templates, including the Tennessee Charitable Remainder Inter Vivos Unitrust Agreement, tailored to fulfill federal and state regulations.

Once you locate the appropriate form, click Purchase now.

Choose the pricing plan you want, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Tennessee Charitable Remainder Inter Vivos Unitrust Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

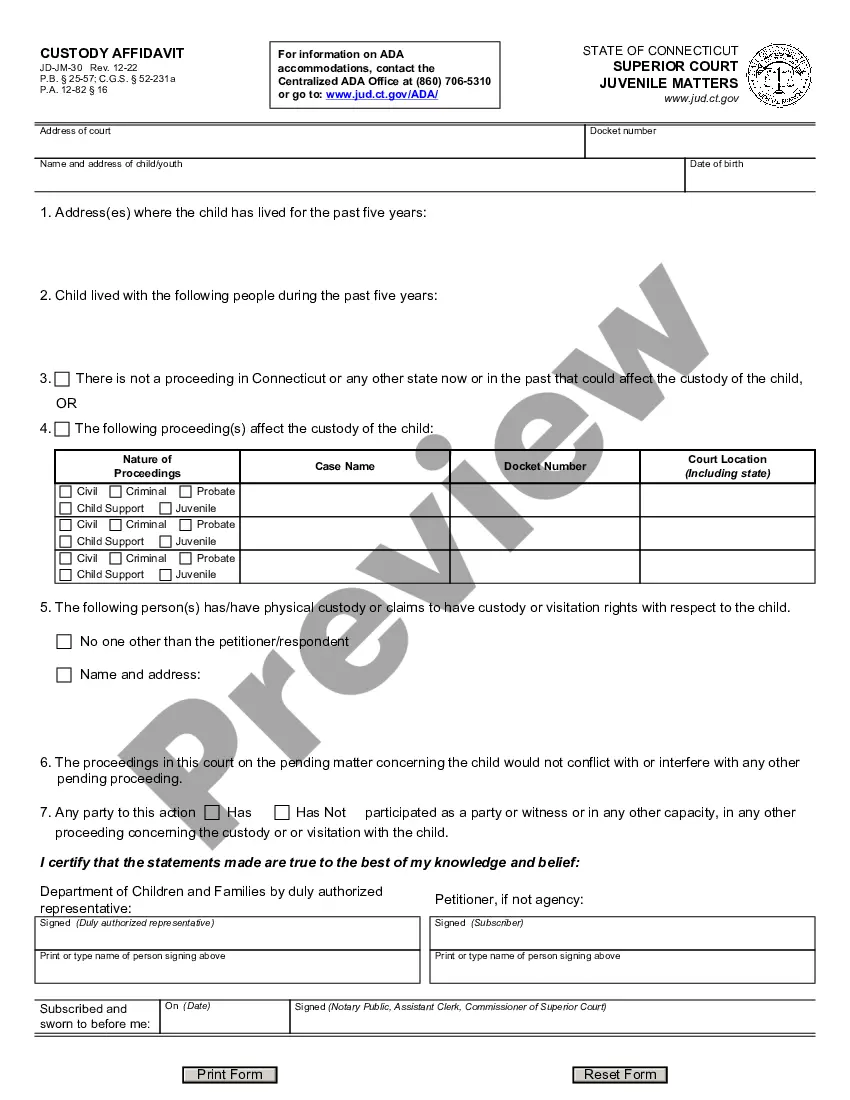

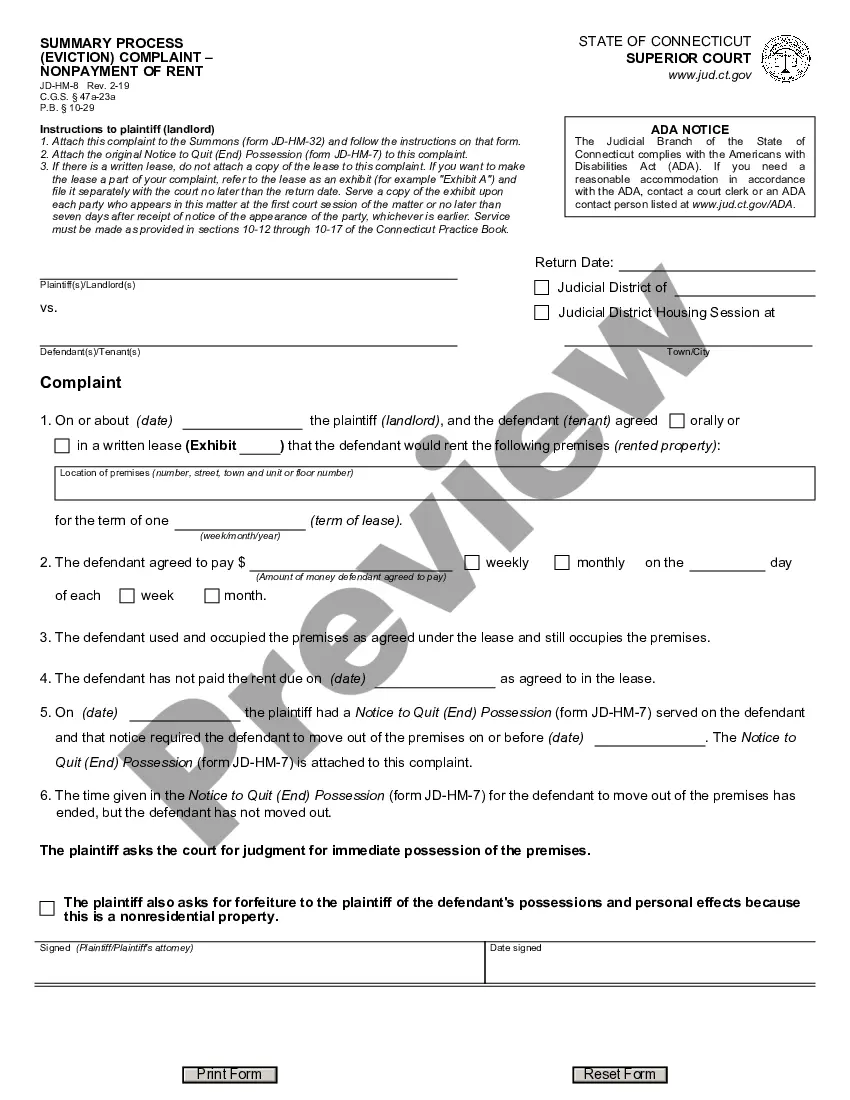

- Utilize the Review feature to inspect the form.

- Read the details to confirm you have selected the accurate form.

- If the form doesn’t meet your needs, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

Starting a Charitable Remainder Trust (CRT) begins similarly to setting up a CRUT, as you will need a trust document that specifies the terms. Choose your charitable beneficiaries and determine the payout structure—fixed or variable. Platforms like US Legal Forms can assist you in creating a legally sound agreement that aligns with your philanthropic goals.

The 5% rule for a Tennessee Charitable Remainder Inter Vivos Unitrust Agreement refers to the minimum percentage payout required. This rule ensures that trusts provide a consistent income to beneficiaries while still fulfilling charitable purposes. Adhering to this guideline can help maintain the trust's tax-exempt status while benefitting all parties involved.

The primary difference between a CRUT and a CRT lies in their payout structures. A Charitable Remainder Unitrust (CRUT) pays a percentage of the trust's value, which can fluctuate, while a Charitable Remainder Trust (CRT) pays a fixed amount. Understanding these differences can help you choose the right approach for your charitable giving plans.

Setting up a Tennessee Charitable Remainder Inter Vivos Unitrust Agreement involves several steps, starting with defining your charitable goals. Next, create the trust document, specifying the trust terms and the beneficiaries. Engaging with professionals from platforms like US Legal Forms can simplify this process, helping you navigate the legal requirements effectively.

Establishing a Tennessee Charitable Remainder Inter Vivos Unitrust Agreement begins with drafting the trust document, which outlines the terms and conditions. You will need to identify the trust's income beneficiaries and decide on the percentage payout. It's advisable to work with a legal or financial advisor familiar with charitable trusts to ensure compliance with state and federal laws.

The payout from a Tennessee Charitable Remainder Inter Vivos Unitrust Agreement is typically based on a fixed percentage of the trust's annual value. This percentage usually ranges from 5% to 7%. Payouts are made to the income beneficiaries for a specified period, which can enhance financial stability while supporting charitable causes.

To set up a charitable remainder trust, you need to draft a trust document that outlines the terms, beneficiaries, and payout structure. You may want to consult with a legal expert familiar with a Tennessee Charitable Remainder Inter Vivos Unitrust Agreement to ensure compliance with state laws. Platforms like USLegalForms can provide the resources and support needed to simplify this process.

The unitrust amount is calculated based on the current market value of the assets in the trust. Each year, the trust’s value is assessed, and the predetermined percentage payout is applied. This method ensures that the income received can increase or decrease over time, which is a significant feature of a Tennessee Charitable Remainder Inter Vivos Unitrust Agreement.

A charitable remainder unitrust works by allowing donors to contribute assets, which then generate income over a specified period. This income is distributed to the beneficiaries based on a fixed percentage of the trust’s value, recalculated each year. By setting up a Tennessee Charitable Remainder Inter Vivos Unitrust Agreement, you can enjoy tax benefits while supporting charitable causes you care about.

The payout rate varies depending on the type and terms of the trust. Generally, it can range from 5% to 7% of the trust's value, chosen based on the donor's financial goals. In a Tennessee Charitable Remainder Inter Vivos Unitrust Agreement, the payout is recalculated annually, ensuring that the donor benefits from both income and potential tax advantages.