Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution

Description

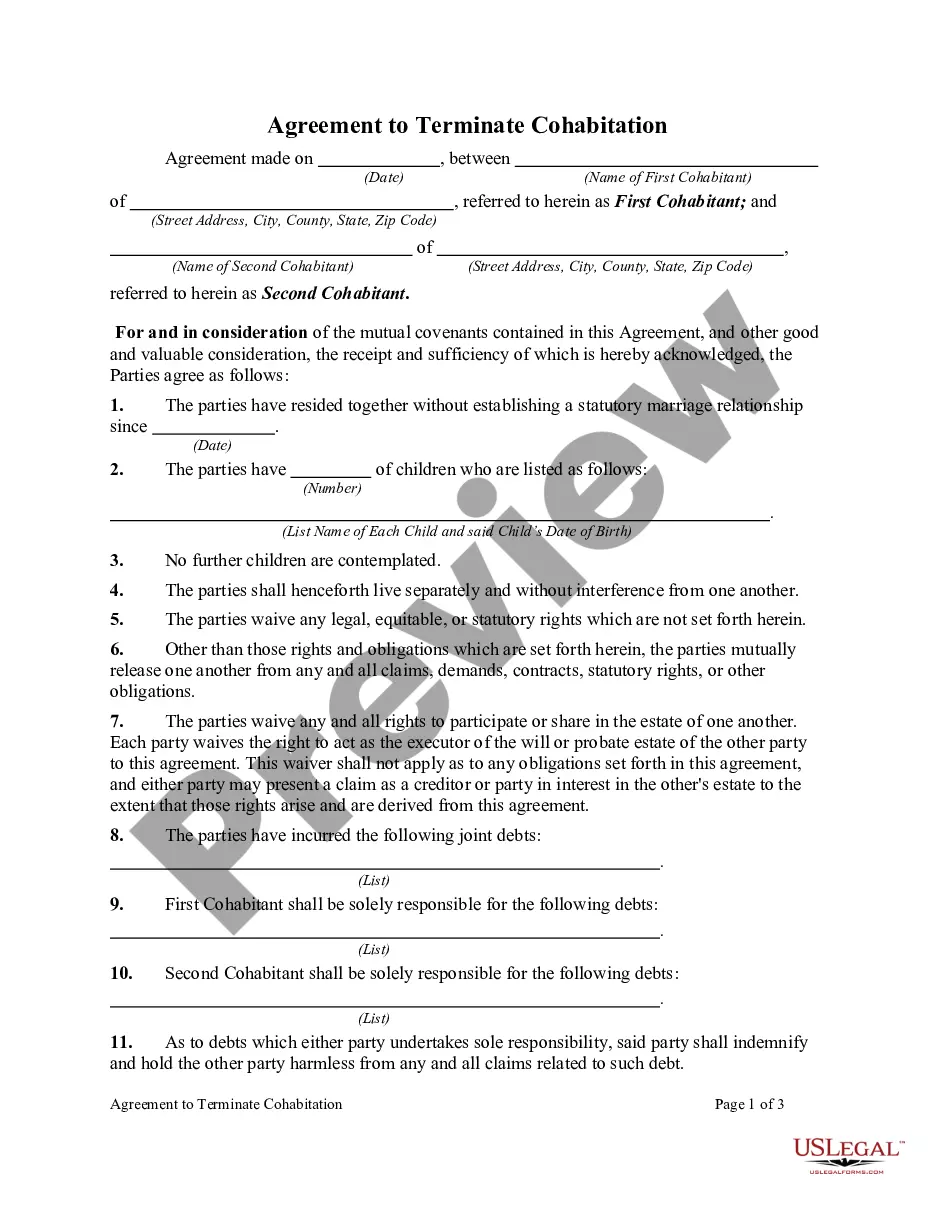

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

You have the opportunity to dedicate hours online searching for the permitted document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that can be assessed by experts.

You can download or print the Tennessee Limited Endowment to Educational, Religious, or Charitable Institution from my service.

Check the form description to confirm you have selected the right form. If available, use the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you may complete, modify, print, or sign the Tennessee Limited Endowment to Educational, Religious, or Charitable Institution.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click on the associated button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city you choose.

Form popularity

FAQ

Obtaining a tax-exempt certificate in Tennessee involves applying to the state for recognition as a nonprofit organization. Once recognized, your organization can claim tax-exempt status, beneficial for entities such as a Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution. Proper documentation and adherence to guidelines are essential to secure and maintain this valuable asset.

Yes, 50/50 raffles are legal in Tennessee, provided they meet certain regulatory requirements. Organizations, particularly those classified as a Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution, must comply with local laws governing such fundraising methods. These regulations help ensure that the raffles are conducted fairly and transparently, ultimately benefiting your charity's goals.

To become exempt from property taxes in Tennessee, your organization must apply for a property tax exemption through the local tax assessor's office. Eligibility often requires your organization to be recognized as a Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution. Proper documentation and evidence of your organization’s charitable activities will be essential to support your application.

In Tennessee, certain entities can avoid sales tax by applying for an exemption. Non-profit organizations that qualify as a Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution may be eligible for this exemption, enabling them to conduct mission-driven activities without the burden of sales tax. It's important to ensure that your organization meets all eligibility criteria outlined by the state.

The Charitable Solicitations Act in Tennessee regulates how organizations can solicit donations from the public. This law is designed to prevent fraud and ensure that charities operate transparently. By complying with this act, organizations can strengthen their position as a Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution, building credibility and trust within the community.

To become tax exempt in Tennessee, organizations must apply for 501(c)(3) status with the IRS. This designation allows your organization to operate as a Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution and receive tax exemptions on federal and state levels. Additionally, you’ll need to provide certain documents and comply with specific state regulations to maintain your exemption status.

Soliciting for charity refers to asking for donations to support a charitable cause. In Tennessee, this practice is governed by the Charitable Solicitations Act, which ensures transparency and accountability in fundraising efforts. Understanding these regulations is crucial for organizations looking to establish a Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution, as it helps build trust with potential donors.

In Tennessee, a non-profit organization must have a minimum of three board members. This requirement ensures that the organization has sufficient oversight and diverse perspectives. When establishing a Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution, having an active and engaged board is essential. This board will help guide the organization's mission and ensure compliance with state regulations and best practices.

The law governing nonprofit corporations in Tennessee is outlined in the Tennessee Nonprofit Corporation Act. This legislation provides guidelines on formation, governance, and dissolution of nonprofit entities. Understanding these laws is crucial for compliance, especially for organizations focused on the Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution, ensuring they meet legal and operational standards.

Yes, churches are generally tax exempt in Tennessee. This status allows them to operate without the burden of state sales tax, which can enhance their ability to serve the community. The tax exemption aligns with the principles of the Tennessee Restricted Endowment to Educational, Religious, or Charitable Institution, promoting financial support for religious entities.