Tennessee Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Finding the right legitimate papers format can be quite a have difficulties. Obviously, there are a lot of web templates available on the Internet, but how can you obtain the legitimate kind you will need? Utilize the US Legal Forms site. The service delivers a huge number of web templates, such as the Tennessee Unrestricted Charitable Contribution of Cash, that you can use for business and personal requirements. All of the forms are checked out by specialists and meet up with state and federal demands.

In case you are presently authorized, log in for your account and click on the Acquire option to obtain the Tennessee Unrestricted Charitable Contribution of Cash. Make use of your account to appear throughout the legitimate forms you have ordered formerly. Visit the My Forms tab of your respective account and have an additional duplicate of the papers you will need.

In case you are a fresh customer of US Legal Forms, allow me to share simple guidelines that you can comply with:

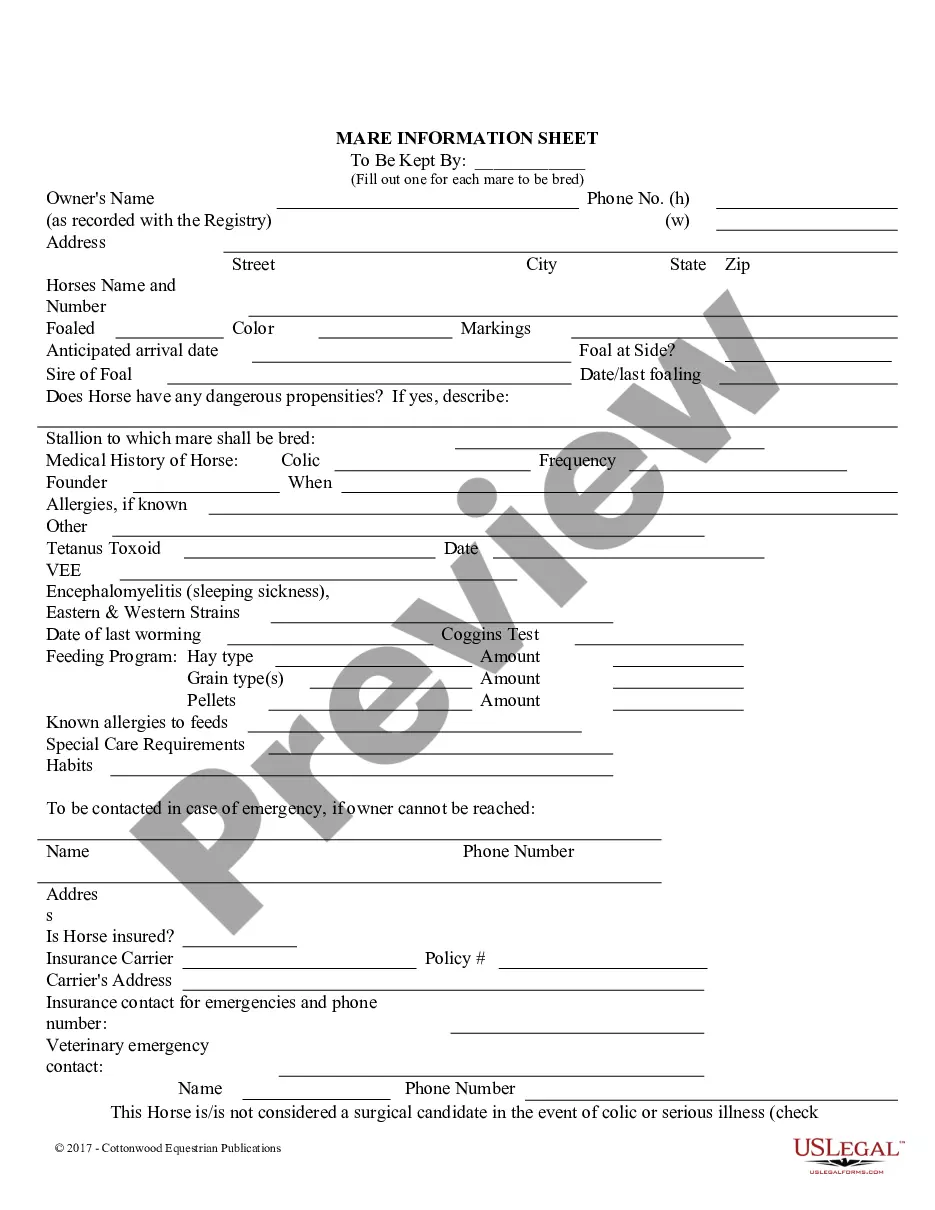

- Initially, make sure you have selected the correct kind for the area/area. You can check out the form using the Preview option and read the form description to ensure it is the right one for you.

- In the event the kind fails to meet up with your needs, use the Seach discipline to discover the right kind.

- When you are certain the form is suitable, click the Buy now option to obtain the kind.

- Choose the pricing program you need and type in the required info. Create your account and pay for the transaction utilizing your PayPal account or bank card.

- Select the submit formatting and acquire the legitimate papers format for your system.

- Comprehensive, edit and printing and sign the acquired Tennessee Unrestricted Charitable Contribution of Cash.

US Legal Forms may be the most significant catalogue of legitimate forms that you can find different papers web templates. Utilize the company to acquire appropriately-produced papers that comply with status demands.

Form popularity

FAQ

Non-cash items are furniture, clothing, home appliances, sporting goods, artwork and any item you contribute other than cash, checks, or by credit card. Generally, you can deduct your cash contributions and the Fair Market Value (FMV) of most property you donate to a qualified charitable organization. Non-Cash Charitable Contributions - AZ Money Guy azmoneyguy.com ? non-cash-charitable-contributi... azmoneyguy.com ? non-cash-charitable-contributi...

No, if you take the standard deduction you do not need to itemize your donation deduction. However, if you want your deductible charitable contributions you must itemize your donation deduction on Form 1040, Schedule A: Itemized Deductions.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Charitable Contribution Deductions | Internal Revenue Service irs.gov ? charitable-organizations ? charitabl... irs.gov ? charitable-organizations ? charitabl...

For tax years beginning in 2021, an individual who does not itemize deductions may claim a deduction in calculating taxable income (and not as an above-the-line deduction in calculating AGI) of up to $300 ($600 in the case of a joint return) for charitable contributions in cash. Percentage Limit on Charitable Deductions for Individuals - Topics cch.com ? topic ? percentage-limit... cch.com ? topic ? percentage-limit...

The new threshold is 60 percent of AGI for cash contributions held for over a year, and 30 percent of AGI for non-cash assets. The good news is that the standard deduction is now higher to account for inflation, rising to $12,950 for people who file individually and $25,900 for married couples who file joint returns.

The gift makes up a large percentage of your income. Your deduction for charitable contributions is generally limited to 60% of your AGI. For tax years 2020 and 2021, you can deduct cash contributions in full up to 100% of your AGI to qualified charities. There are limits for non-cash contributions.

For contributions of non-cash assets held more than one year, the limit is 30% of your adjusted gross income (AGI). Your deduction limit will be 60% of your AGI for cash gifts. Charitable Donations: The Basics of Giving | Charles Schwab schwab.com ? learn ? story ? charitable-don... schwab.com ? learn ? story ? charitable-don...

Gifts to a non-qualified charity or nonprofit are not deductible. To qualify, a group must register with the IRS under section 501(c)(3) or, in some cases, section 501(c)(4). A pledged or promised donation is not deductible, only money that is actually given.