Letter re: sale of assets - Asset Purchase Transaction. The purpose of this letter is to outline the manner in which Buye, purposes to purchase certain assets of Selller. Buyer and Seller recognize that the transaction will require further documentation and approvals, including the preparation and approval of a formal agreement setting for the terms and conditions of the proposed purchase in more detail the "Purchase Agreement"); but buyer and Seller execute this letter to evidence their intention to proceed in mutual good faith.

Tennessee Letter regarding sale of assets - Asset Purchase Transaction

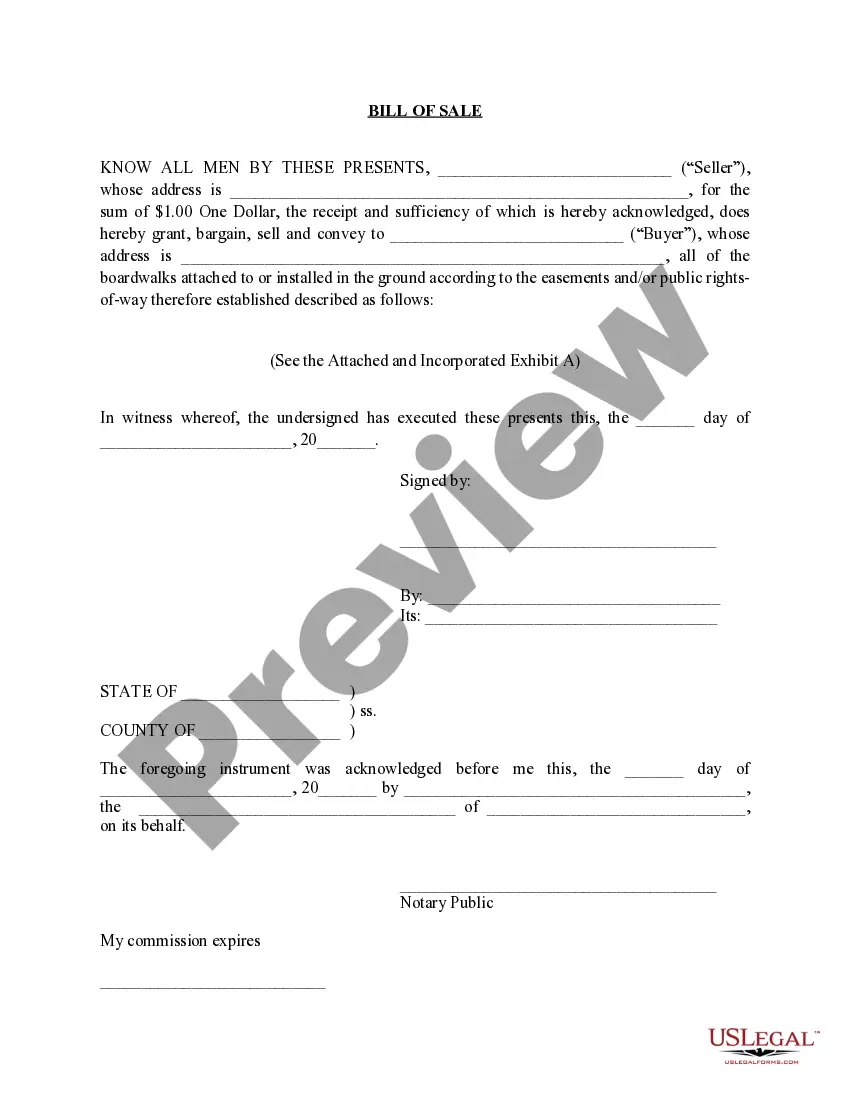

Description

How to fill out Letter Regarding Sale Of Assets - Asset Purchase Transaction?

If you require to aggregate, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents, available online.

Make use of the site's straightforward and user-friendly search to locate the documents you need.

Different templates for both business and personal uses are categorized by types and states, or keywords.

Step 4. Once you have found the form you desire, click the Get now button. Choose the pricing plan that suits you and provide your details to register for an account.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the transaction.

- Employ US Legal Forms to retrieve the Tennessee Letter concerning the sale of assets - Asset Purchase Transaction in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Tennessee Letter regarding sale of assets - Asset Purchase Transaction.

- You can also access documents you have previously acquired from the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, follow the guidelines below.

- Step 1. Confirm you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the contents of the form. Remember to review the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

Asset acquisitions are accounted for by allocating the cost of the acquisition to the individual assets acquired and liabilities assumed on a relative fair value basis. Goodwill is not recognized in an asset acquisition.

In an asset sale the target's contracts are transferred to the buyer by means of assigning the contracts to the buyer. The default rule is generally that a party to a contract has the right to assign the agreement to a third party (although the assigning party remains liable to the counter-party under the agreement).

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

Asset Sale ChecklistList of Assumed Contracts.List of Liabilities Assumed.Promissory Note.Security Agreement.Escrow Agreement.Disclosure of Claims, Liens, and Security Interests.List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names.Disclosure of Licenses and Permits.More items...?

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.