Florida Private Client General Asset Management Agreement

Description

How to fill out Private Client General Asset Management Agreement?

Are you at present in a position where you require documents for occasions when a business or individual frequently employs them? There is a wide array of legal document templates accessible on the internet, but discovering ones you can rely on can be challenging.

US Legal Forms provides thousands of template options, such as the Florida Private Client General Asset Management Agreement, which can be tailored to meet state and federal requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Florida Private Client General Asset Management Agreement template.

- Locate the document you need and confirm it is for the correct city/state.

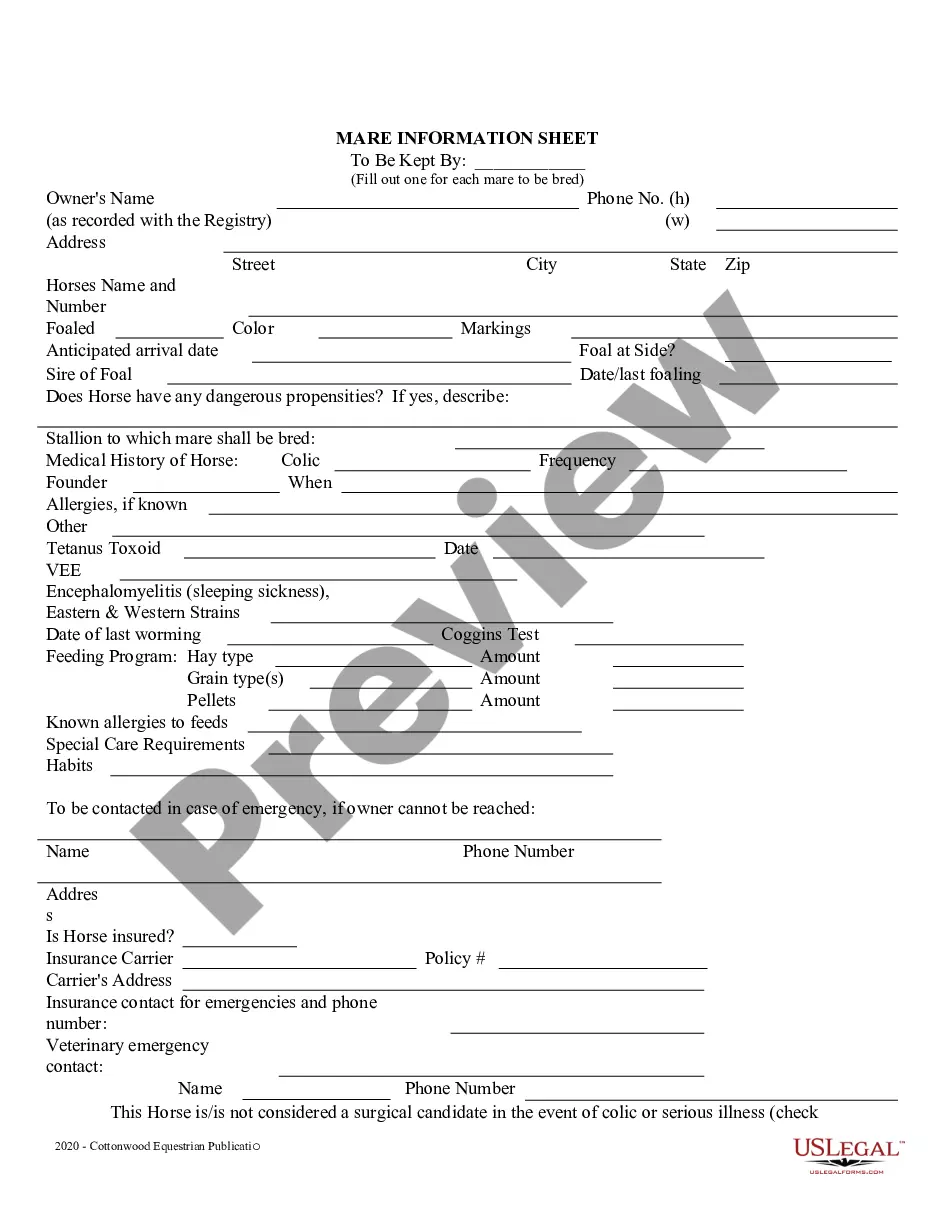

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the appropriate document.

- If the form does not meet your needs, take advantage of the Search feature to find the document that fits your requirements.

- Once you find the suitable form, click Purchase now.

- Choose the payment plan you require, complete the necessary information to create your account, and make your purchase using PayPal or a credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Registering as a Registered Investment Adviser (RIA) in Florida involves several key steps. You need to complete Form ADV, which outlines your business practices and fees, and then file it with the Florida Division of Securities. After your application is submitted, you may also need to meet specific criteria related to your services, such as those provided under the Florida Private Client General Asset Management Agreement. Uslegalforms offers tools and templates to simplify the registration process for you.

Any individual who provides investment advice or makes securities recommendations in Florida must register as an investment adviser representative. This includes those involved in managing client assets under agreements like the Florida Private Client General Asset Management Agreement. Registration ensures compliance with state laws, protecting both the adviser and the client. Consider using uslegalforms to streamline your registration process and access necessary resources.

Certain professionals may be exempt from registration as investment adviser representatives in Florida. Typically, individuals who work for a registered investment adviser and do not engage in client-facing activities might qualify for this exemption. If your role involves providing advice related to a Florida Private Client General Asset Management Agreement, it’s crucial to verify your registration status. Consulting a legal expert can also clarify your obligations.

In Florida, obtaining a Series 66 license is often required for individuals who wish to act as both securities agents and investment adviser representatives. If you plan to offer services related to the Florida Private Client General Asset Management Agreement, this license is essential. It ensures that you understand state regulations and can provide informed advice to clients. Always check with the Florida Division of Securities for the most current requirements.

In a property management agreement, certain items may be excluded, such as detailed maintenance procedures or excessive legal jargon. Instead, focus on fundamental elements like rental terms and responsibilities of both parties. By prioritizing clarity and simplicity, you can create a user-friendly Florida Private Client General Asset Management Agreement that addresses key points without unnecessary complexity. Utilizing tools from US Legal Forms can help ensure your agreement meets legal standards while remaining concise.

To become an asset manager, you typically need to obtain licenses such as the Series 65 or Series 66, which allow you to act as an investment advisor. Additional qualifications may be required based on the specific services you provide. Understanding the requirements for the Florida Private Client General Asset Management Agreement is essential to ensure compliance and enhance your practice.

A private asset management company provides personalized investment management services to individuals and families. These firms often create tailored portfolios based on client goals, risk tolerance, and financial circumstances. When entering into a Florida Private Client General Asset Management Agreement, clients benefit from a bespoke service that addresses their unique needs.

Qualifications for asset management typically include a bachelor's degree in finance or economics and relevant industry experience. Furthermore, possessing licenses such as the Series 65 can enhance your qualifications. The Florida Private Client General Asset Management Agreement frequently requires practitioners to demonstrate both academic and practical know-how to instill client confidence.

Certifications can vary, but most asset managers seek credentials like the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP). These certifications validate your expertise in managing client assets effectively. When engaging in a Florida Private Client General Asset Management Agreement, possessing these certifications can significantly enhance your credibility and overall effectiveness.

Getting an asset management license involves researching your state's requirements, completing necessary education, and passing the exams administered by regulatory authorities. Additionally, you should gather relevant experience in finance and investment management. Utilizing tools and resources from platforms like uslegalforms can help you prepare the right documentation for your Florida Private Client General Asset Management Agreement.