The Tennessee Wage Statement Form (Form C-100) is a document required by the Tennessee Department of Labor and Workforce Development to be issued to employees in the state of Tennessee each time they are paid. The form is used to document the wages earned and deductions taken from each employee’s paycheck. It also serves as a record of an employee’s earnings for tax purposes. There are two types of Tennessee Wage Statement Forms: Form C-100A, provided for employees paid on an hourly rate, and Form C-100B, provided for employees paid on a salary or commission basis. Both forms include information such as the employee’s name, hours worked, pay rate, gross wages, deductions, net wages, and other pertinent information. Employers are required to keep copies of the forms on file for at least four years.

Tennessee Wage Statement Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee Wage Statement Form?

If you’re looking for a way to appropriately complete the Tennessee Wage Statement Form without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business situation. Every piece of documentation you find on our online service is drafted in accordance with federal and state regulations, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to get the ready-to-use Tennessee Wage Statement Form:

- Make sure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Tennessee Wage Statement Form and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

The impairment rating is then multiplied by 450 to determine how long your benefits will be paid (this is called the ?compensation period?). The compensation period is then multiplied by 66 2/3% of the average weekly wages you received pre-injury (subject to the state maximum).

The impairment rating is a percentage that represents the extent of a whole person impairment of the employee, based on the organ or body function affected by a covered illness or illnesses.

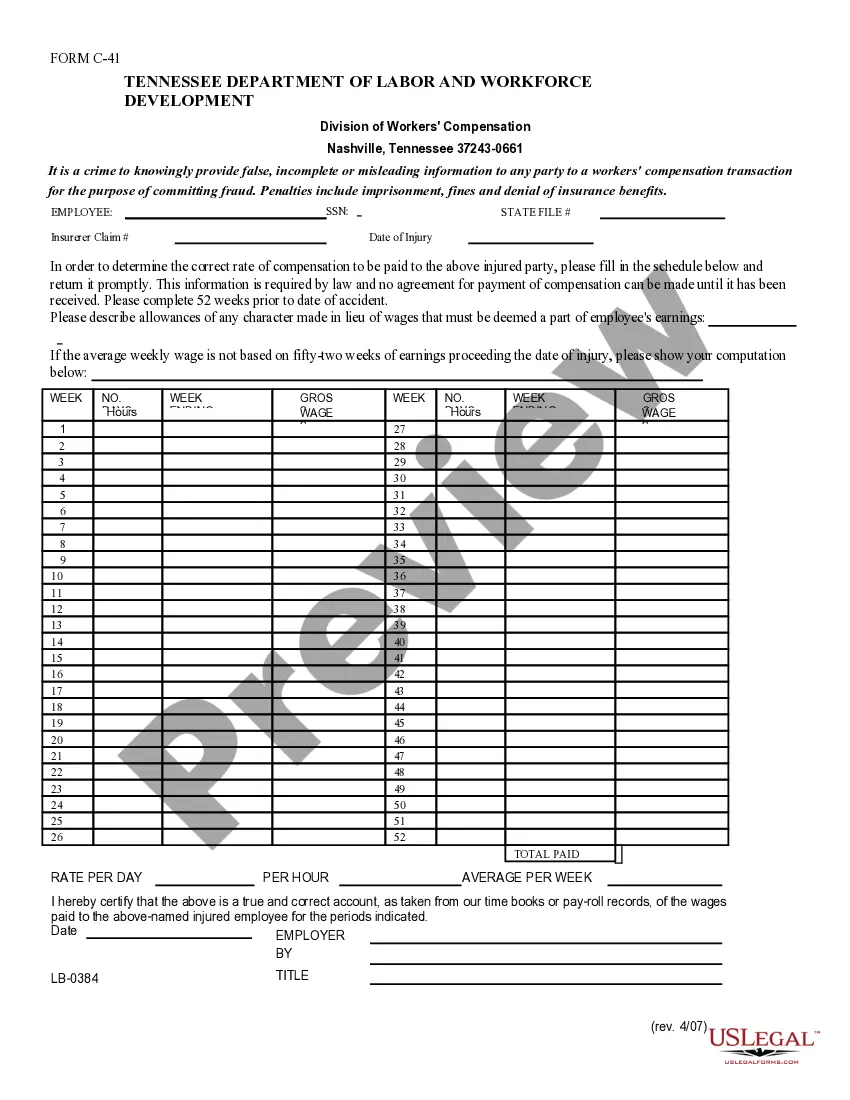

Form C-41 Wage Statement. This form enables EMPLOYERS to calculate the correct compensation due to an injured employee. Please complete the form and submit to EMPLOYERS within 5 days after your knowledge of any accident that has caused your employee to be disabled for more than 7 calendar days.

A worker with a 0 percent impairment rating is considered to have no impairment at all. Therefore, such a worker is expected to continue with their daily tasks as they would before the injury.

An impairment rating is a measure of the level of impairment, so the worker, employer, and insurance company can all understand the severity of the injury. They may determine that you are partially or totally disabled because of your workplace injury.

As a general rule, an impairment rating of over 20% will mean that the worker is unable to ever return to work. Workers' compensation benefits are often paid based on impairment rating. For example, for every impairment rating from 1-10%, the employee will be entitled to two weeks of benefits per percentage point.

Class 2: Mild impairment: Able to live independently, looks after self adequately, although may look unkempt occasionally, sometimes misses a meal or relies on take-away food.

After a person has reached MMI, they may still need ongoing medical care for pain management or complications of the injury, but the medical treatment is not expected to improve the condition. No matter where you are in your recovery, it's important to speak to a personal injury trial attorney as soon as possible.