Tennessee ACCOUNTING — Sworn Statement In Lieu of Final Accounting (Probate) is a document used to provide an accounting of a deceased person’s estate. This statement is prepared by the executor or administrator of the estate and is used to demonstrate to the court that all assets and liabilities of the estate have been accounted for. The statement provides a detailed accounting of all assets including cash, real estate, stocks, bonds, and other investments held by the decedent, as well as all liabilities and debts owed by the estate. The statement also includes a summary of the total value of the estate, which is used to calculate the estate tax liability. Depending on the type of estate, there may be different types of Tennessee ACCOUNTING — Sworn Statement In Lieu of Final Accounting (Probate) such as an Inventory and Appeasement Statement, a Personal Property Statement, and a Real Estate Statement.

Tennessee ACCOUNTING - Sworn Statement In Lieu of Final Accounting (Probate)

Description

How to fill out Tennessee ACCOUNTING - Sworn Statement In Lieu Of Final Accounting (Probate)?

If you’re searching for a way to appropriately prepare the Tennessee ACCOUNTING - Sworn Statement In Lieu of Final Accounting (Probate) without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every private and business scenario. Every piece of paperwork you find on our web service is designed in accordance with federal and state laws, so you can be certain that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use Tennessee ACCOUNTING - Sworn Statement In Lieu of Final Accounting (Probate):

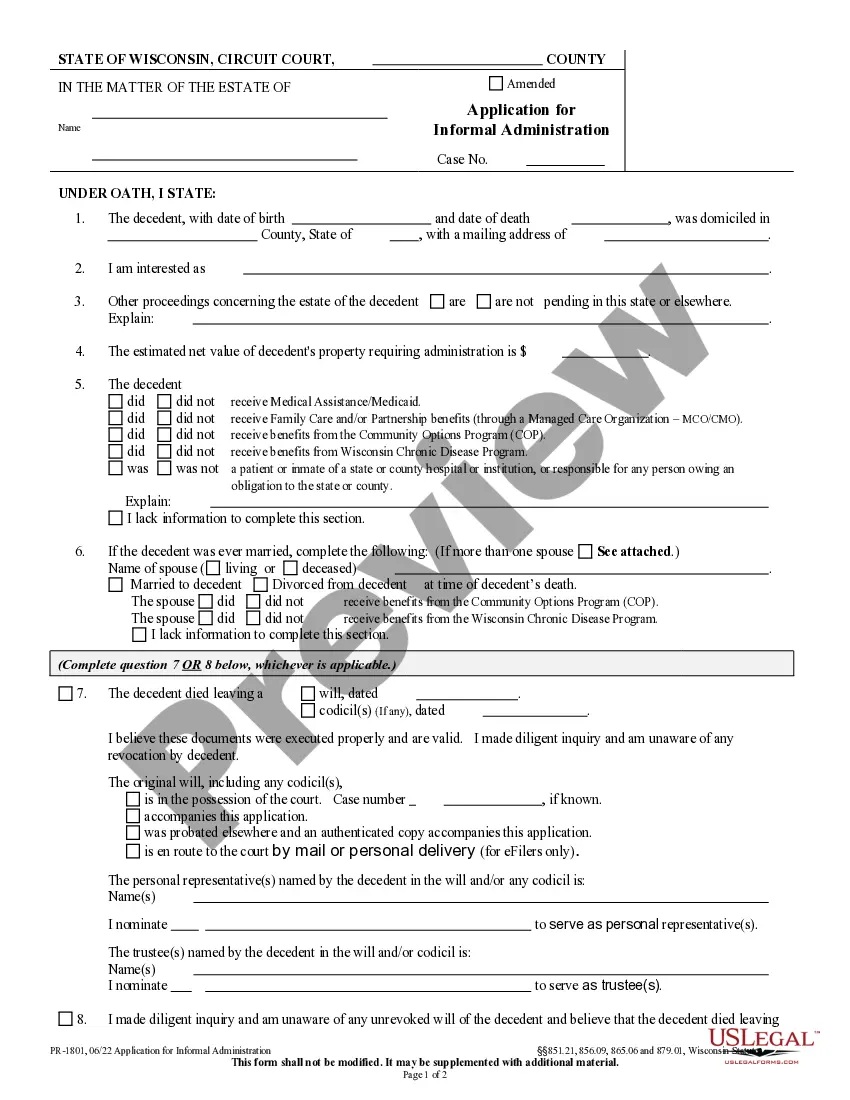

- Ensure the document you see on the page complies with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and select your state from the list to locate another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your Tennessee ACCOUNTING - Sworn Statement In Lieu of Final Accounting (Probate) and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Accountings ? Statement in Lieu of Accounting. Within fifteen (15) months from the date of qualification, the personal representative shall make an accounting with the clerk of the court exercising probate jurisdiction in the county of the estate.

Assignment of Homestead. The homestead in lands of a decedent, inuring to the benefit of a surviving spouse or minor children, shall be assigned and set apart in the manner provided in this part.

In Tennessee, if no estate is opened, a creditor has 12 months after someone dies to file a claim against the estate of the deceased person. However, that deadline is shortened to 4 months or less if an estate is opened.

Solemn form probate is advised when a Will may be contested or challenged or for special circumstances as recommended by an attorney. It entails notifying all interested parties up front and inviting them to contest the Will; if they fail to do so, they are not permitted to file a contest later on in the process.

Section 30-2-306 - Notice to creditors of qualification of personal representative (a) Except as provided in subsection (e), it is the duty of the clerk of the court in which an estate is being administered, within thirty (30) days after the issuance of letters testamentary or of administration, to give, in the name of

Yes, probate is a requirement for estates in Tennessee. This is the method used to distribute the assets to the heirs and ensure the will is followed.

30-2-314 - Exceptions to claim Trial by circuit court where jury demanded Concurrent jurisdiction. 30-2-314. Exceptions to claim Trial by circuit court where jury demanded Concurrent jurisdiction. (2) The expiration of the exception period.

When the will of the deceased excuses the requirement for making and filing an inventory of the estate, or when excused by all of the residuary distributees or legatees, no inventory shall be required of a solvent estate, unless demanded by any residuary distributee or legatee of the estate.