A Rhode Island Certificate of Cancellation of Registration of a Limited Partnership (Foreign LP) is a document issued by the Rhode Island Division of Taxation that cancels the registration of a foreign limited partnership with the State of Rhode Island. The Certificate of Cancellation is effective on the date it is filed with the Division of Taxation, and it terminates the registration of the Foreign LP in Rhode Island. The Certificate must be signed by the general partner of the Foreign LP, or their authorized agent, and must include the LP's name, registration number, state of origin, and the reason for cancellation. There are two types of Rhode Island Certificate of Cancellation of Registration of a Foreign LP: the Non-Dissolution Cancellation and the Dissolution Cancellation. The Non-Dissolution Cancellation is used to cancel the registration of a Foreign LP that is not dissolving. The Dissolution Cancellation is used to cancel the registration of a Foreign LP that is dissolving. Both types of Certificates require the LP to provide evidence that all taxes and fees due to the State of Rhode Island have been paid.

Rhode Island Certificate of Cancellation of Registration of A Limited Partnership (Foreign LP)

Description

How to fill out Rhode Island Certificate Of Cancellation Of Registration Of A Limited Partnership (Foreign LP)?

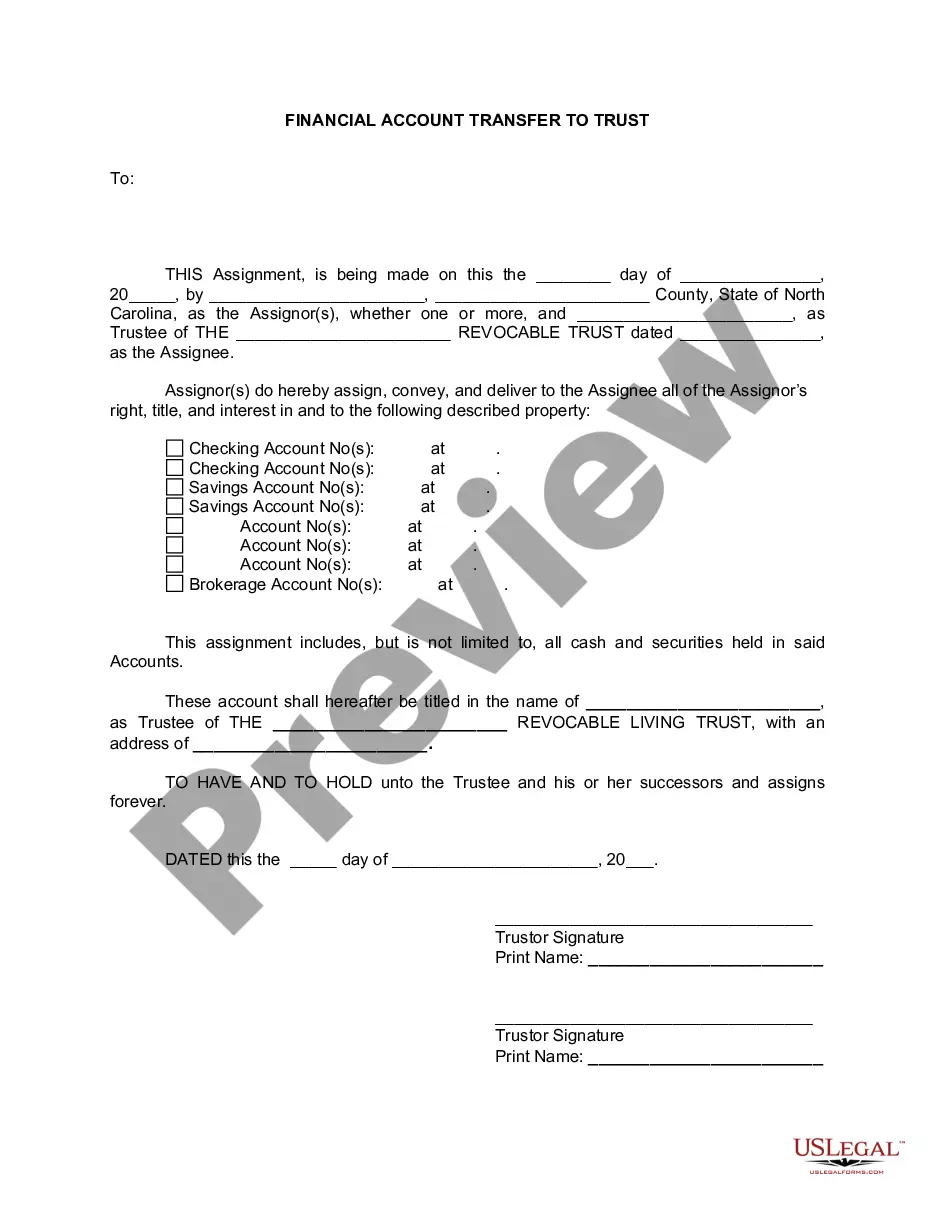

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state regulations and are checked by our specialists. So if you need to fill out Rhode Island Certificate of Cancellation of Registration of A Limited Partnership (Foreign LP), our service is the best place to download it.

Obtaining your Rhode Island Certificate of Cancellation of Registration of A Limited Partnership (Foreign LP) from our service is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they locate the correct template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance check. You should attentively review the content of the form you want and ensure whether it suits your needs and meets your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now once you see the one you want.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Rhode Island Certificate of Cancellation of Registration of A Limited Partnership (Foreign LP) and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

You must cancel your sales and use tax permit by doing the following: File your monthly or quarterly return and check the "Yes" box following the question, "Are you out of business now?" Enter the last business date in the block provided. Also, write the word FINAL prominently across the top of the return.

The Rhode Island Division of Taxation office is open to the public a.m. to p.m. business days. To learn more, see the agency's website: .tax.ri.gov , or call (401) 574?8829.

Rhode Island ? like the federal government and many states ? has a pay-as-you-earn income tax system. Under that system, employers are required to withhold a portion of their employees' wages and to periodically turn over those withheld funds to the RI Division of Taxation.

Employers pay between 1.1% to 9.7% on the first $28,600 in wages paid to each employee in a calendar year. If you're a new employer (congratulations, by the way!), you pay 1.09% (which is a decrease from 1.19% from 2022).

Call: 410-260-7980 or 1-800-638-2937 Provide: Name, telephone number, Federal Employer Identification Number (FEIN), Central Registration Number (CRN), reason for closing account, and closing date. Online through the MDES Online System.

To close your business in Rhode Island, you must satisfy all filing obligations with both the RI Division of Taxation and the RI Department of State. To dissolve your business, it must be active and up to date with all filings with the RI Department of State. To verify your status, email corporations@sos.ri.gov.

To close your business in Rhode Island, you must satisfy all filing obligations with both the RI Division of Taxation and the RI Department of State. To dissolve your business, it must be active and up to date with all filings with the RI Department of State. To verify your status, email corporations@sos.ri.gov.

Rhode Island doesn't require you to fill out a reinstatement application to get back into business. Instead, you'll need to submit the following to the Rhode Island Department of State: a Letter of Good Standing from the Rhode Island Division of Taxation. any missed annual reports and amendments.